Buoyed by record oil prices and healthy real economic growth, Saudi Arabia, the region’s largest market, is embarking on mega projects at a scale that has never before been witnessed in the kingdom’s history.

One of the fastest growing economies in the region, the kingdom – which recorded real economic growth at 6.1 per cent in 2005 and 4.3 per cent in 2006 – boasts of a better domestic geo-political environment, acceleration of reforms, membership of the World Trade Organization (WTO), growth of foreign assets of Saudi Arabia Monetary Authority (Sama), increased liquidity in the market, strong private sector growth and high corporate earnings.

With oil expected to continue to play a major role in the kingdom’s revenue, government officials have set a vision for the year 2025 where the economy will be a diversified, private-sector driven, providing rewarding job opportunities, quality education, healthcare facilities and necessary skills to ensure positive growth momentum. Saudi Arabia is focusing on development of an attractive investment environment. In recent years, the country has reduced corporate tax on foreign-owned firms from 45 per cent to 20 per cent thereby causing an increase in foreign direct investment (FDI) inflows from $183 million in 2000 to $18.29 billion in 2006. Saudi Arabia has also benefited from accession to the WTO three years ago and is looking forward to be among the top 10 competitive nations in the world for inward investment by 2010 “10x10 Strategy”.

The authorities are also looking to attract $300 billion of investments in energy-intensive industries over the next 13 years. A further $100 billion of investments is also being sought for knowledge-based industries and a similar amount for transportation ventures. A variety of industrial projects, transport developments, building of six new cities, liberalisation initiatives as well as oil and gas ventures are certain to increase the level of investment desired by the country.

Amongst the strongest drivers of investment demand in Saudi Arabia are capacity expansions currently undertaken by commodity exporters, mainly Saudi Aramco and Saudi Basic Industries Corporation (Sabic), a sizable chunk of which will be completed by 2010.

In a move that will help it become less reliant on oil, Saudi Arabia has been investing heavily in its manufacturing sector and also training its local population. The kingdom is also pushing ahead with a number of industrial cities which are expected to attract investment, develop a much broader economy and provide the job opportunities the kingdom’s young population requires.

A dozen industrial estates have been built throughout the kingdom accommodating more than 1,600 industrial units. The number of manufacturing and industrial enterprises in the kingdom now total more than 3,800. A national industrial cluster development programme has recently been established to expand the industrial base. The strategy aims to stimulate metals processing, automotive assembly as well as production of construction materials, packaging and consumer goods, electrical and electronics goods and packaging which could attract foreign investment.

Transport and communications are benefiting particularly from deregulation and should experience growth of more than nine per cent a year until the end of 2010. Construction is also a big winner as result of the $300 billion worth of projects under way. Prospects are also strong for private independent water and power investors.

Gross domestic product

Oil plays a major role in the economic performance of Saudi Arabia, exposing it to external shocks stemming from changes in international oil prices. The kingdom is the world’s largest crude oil producer and has a share of 11 per cent in the world oil supply. Its oil reserves are estimated to account for around 22 per cent of global reserves and 55 per cent of GCC reserves while it has 252 trillion cu ft of natural gas reserves, accounting 16 per cent of the GCC total gas reserves.

Saudi Arabia’s nominal gross domestic product (GDP) grew by 10.6 per cent (SR1.3 trillion) in 2006 against 26 per cent in 2005 (SR1.18 trillion) and real GDP rose by 4.3 per cent (SR798.9 billion) in 2006 as against 6.1 per cent (SR766 billion) in 2005 (Table 1). Economic activity remained robust owing to the government’s investment drive – a key precept of the reform programme. The expansionary fiscal position continued to support domestic economic activity, as did the continuation of the government’s reform and investment programme.

The country’s mining and quarrying sector accounted for more than 50 per cent of total nominal GDP in 2006. Government services ranked second in terms of contribution to nominal GDP amounting to 14 per cent, while the finance, insurance, real estate and business services followed at eight per cent of GDP.

Nominal and real GDP growth accelerated from 2002 to 2006, and exhibited a compound annual growth rate (CAGR) of 17 per cent and six per cent respectively.

In terms of sectoral contribution to the nominal GDP, crude petroleum and natural gas sector continued to dominate the GDP as it reported a CAGR of 29 per cent during 2002-06. The country has benefited from high oil prices in the last couple of years. The contribution of crude petroleum and natural gas sector as the proportion of the total nominal GDP increased from 33 per cent in 2002 to 50 per cent in 2006.

Although the government is making efforts to reduce the dependence of oil by promoting and facilitating investment in the non-oil sector, the oil sector’s domination in GDP continued to grow due to the high prices that prevailed during the period.

In the manufacturing sector, refining witnessed strong growth as new downstream projects helped the refining industry to grow at a CAGR of 21 per cent during 2002-06 whereas the manufacturing sector recorded a CAGR of 14 per cent.

Construction activities exhibited healthy growth as a CAGR of 7.2 per cent was posted by the sector during 2002-06 and its contribution to the nominal GDP stood at 4.5 per cent. The sector is well supported by a number of projects entering the implementation stage. These include petrochemical and infrastructure projects, as well as the King Abdullah Economic City (KAEC) in Rabigh near Jeddah, and will involve the development of new residential, industrial and services facilities in the kingdom.

Total planned investment in the construction sector over the next five years is estimated to cross SR1.31 trillion ($350 billion), a sum which will keep the sector booming. Apart from that a new mortgage law is due to be passed this year which will provide further impetus to the construction sector.

For 2007, it is estimated that nominal GDP would grow 8.1 per cent to SR1,414 billion ($377 billion) while the real growth is expected at 3.5 per cent to SR827 billion ($220.5 billion). The kingdom has drawn Vision 2025 which is supported by three pillars. The first pillar defines the direction and goal of the long-term strategy, the second constitutes the methods of achieving the set policies and the third constitutes the follow-up and implementation mechanism to achieve the long-term strategy.

Budget 2008

Saudi Arabia’s 2008 national budget projected the revenues at SR450 billion and expenditure at SR410 billion resulting in the surplus of SR40 billion. The 2008 budget is a continuation of the government focus on optimising the available resources and giving priority to social infrastructure and services especially in education, health, social affairs, municipal services, water and sewage, and roads. Moreover, the budget puts special emphasis on projects related to research and development and e-government in addition to capital expenditures that will create more job opportunities and enhance economic activities, and boost economic growth.

Bank credit

Expansionary bank credit is considered an essential tool in pushing forward economic growth.

Therefore, it is of significant importance to gauge the performance of the real estate and construction sector through credit provided by commercial banks to them. Credit provided by commercial banks is divided into 11 categories (Table 2). The largest shares were for miscellaneous and commerce categories that averaged more than 50 per cent of total credit over the period 2001 -06. However, it is important to note that miscellaneous credit category includes consumer and credit card loans that is an indication for real estate financing. Credit to manufacturing and building and construction categories followed to average 9.4 per cent and 8.2 per cent respectively over the same period.

Previously, credit facilities to the building and construction sector remained flat for the period 1998-2001, but started picking up dramatically since 2002. Owing to improved liquidity, Saudi commercial banks expanded their credit portfolios drastically especially in the last three years. As per latest available data from Sama, credit to building and construction reported the highest growth rates of 38 per cent, 19 per cent and 18 per cent registered during 2005, 2006 and the third quarter of last year respectively (Figure A). In line with the accommodative financing schemes provided by commercial banks in 2005, the building and construction sector registered SR31.7 billion in credit facilities.

High oil prices, which led liquidity in the system, has allowed commercial banks to continue their exposure to the building and construction sector, providing SR44.8 billion in new loans during the third quarter of last year. Looking forward, high oil prices as well as the improved domestic economic climate should generate additional demand for fresh loans in a number of sectors, including the construction sector.

On the consumer level, commercial banks have been key players in pushing along activity in the real estate market by providing real estate financing loans to small-to-medium investors at an accelerated pace. As a result, consumer loans for real estate financing reported a high CAGR of 33 per cent over the period 2001-06 as real estate financing loans picked up from SR3.3 billion in 2001 to SR13.7 billion by the end of 2006.

The increased consumer appetite for credit during 2007, especially to the real estate financing segment, resulted in SR15 billion being channelled to real estate activity by mid-2007, expanding by 9.5 per cent over 2006.

Looking forward, the growing population and high liquidity should continue the increased interest in consumer loan products. Moreover, commercial banks are expected to take up additional exposure in both the real estate and construction sectors, particularly with the introduction of the mortgage law and increased government expenditure on projects.

The real estate sector

Historically, the real estate sector has played a key role in the Saudi Arabian economy. Its many links with a number of other sectors in the economy has rendered it crucial to the development of the economy. Saudi Arabia’s land area is nearly 2.25 million sq m, or nearly 80 per cent of the land mass in the Arabian peninsula. Further, Saudi Arabia’s population density, which has been calculated to be nearly nine individuals per sq m, is considered one of the lowest by international standards. Underlying the surge in the real estate market are a number of factors. To understand the outlook for the sector, one must understand and analyse the factors and variables which are driving the market.

Population

The GCC region has experienced one of the highest population growth rates in the world in the last two decades primarily due to labour force migration.

This accompanied with high fertility rates, decline in infant mortality and increase in life expectancy has led to a dramatic increase in the number of people in the working age group of 15 to 65 years. Also, there is a significant proportion of the population under 15 years which is ready to join the working force within the next decade.

Saudi Arabia’s population reached 23.68 million by the end of 2006 up from 23.11 million recorded in the previous year, according to Central Department of Statistics, Ministry of Planning. The proportion of Saudi nationals in the population has remained more or less the same – around 73 per cent – in the last few years.

According to the most up-to-date data from the 2005 census, about 26 per cent of the total population lives in the Makkah Province in the western region of Hejaz. This area includes the Red Sea port of Jeddah as well as the holy city of Makkah. A further 23 per cent live in the Riyadh governorate in the central region of the Nejd, which includes the kingdom’s capital, Riyadh. The oil-rich Eastern Province has 14 per cent, concentrated in the cities of Dammam, Al Khobar and Dhahran. This means that the three administrative units of Riyadh, Makkah and Eastern Province together have 63 per cent of the total population.

Generally, Saudi Arabia is witnessing and escalating demand from young middle-income Saudis. Thus, if the kingdom is to meet such demand it will need to build 1.5 million new homes by 2015 and it will be up to the financial institutions (both governmental and private sector) to provide the finance that makes this huge expansion possible. The financial sector (whether banks or financing companies) will play a major role through introducing innovative financial solutions which will on the one hand enable developers to build these homes and, on the other hand, to ensure residents financial ability to afford buying them.

Financing & REDF

A major contributor to the well-being of the real estate market is the availability of sufficient financing mechanisms to quench the thirst of the increased demand for funds. With local banks having expanded their credit portfolios at a CAGR of 21.5 per cent over 2001 to 06, coupled with abundant liquidity in the local economy, it is expected that building and construction facilities as well as real estate financing loans are likely to increase. This would also be a result of the estimated growth in the population, increasing demand for housing and the current housing shortages.

Traditionally, commercial banks and specialised institutions were the main players providing means of finance in Saudi Arabia.

Moreover, within specialised credit institutions, the Real Estate Development Fund (REDF) is the sole agency that offers real estate soft loans. REDF continued to account for more than 60 per cent of total outstanding loans over the period 2001-06. However, its share has been increasing over the years to account for a majority (64.2 per cent) of total outstanding loans by the end of 2006. The next largest share is the Public Investment Fund with outstanding loans of 16.1 per cent of the total (Figure B).

Government financing in the form of facilities provided by the REDF has helped support the increased activity in both the real estate and construction sectors. Since its inception in 1974 and up to the end of 2006, REDF has financed over 613,000 housing units at cumulative disbursements exceeding SR71 billion through interest-free, easy-term loans to Saudis. Generally, the fund is designed to be self-sustaining and relies on the regular repayment of loan instalments. However, the resources of the fund have not met the increasing demand for loans in recent years, and the gap between the number of applications submitted and loans given widened.

By the end of 2004 around 30 per cent of outstanding loans were delinquent and the fund was running low on capital. This resulted in the number of loans on offer being considerably reduced and there was a need for government intervention. As a result the fund received a further SR9 billion from Sama. Another injection of the same amount was made in 2006 as the situation became more pressing. Currently, REDF’s capital base stands at SR92 billion.

On the performance front, the year 2004 witnessed a drop in total disbursements and net lending to their lowest levels over the period 2001-06. Total disbursements declined significantly by 21.6 per cent reaching SR1.77 billion in 2004. Similarly, net lending stood at negative SR324 million. Moving ahead, government interventions assisted the fund’s performance significantly. Disbursements reached a peak of SR3.97 billion by the end of 2006 reporting the highest annual growth rate of 57.6 per cent. Net lending, on the other hand, reversed its declining trend for the last two years to reach a new landmark of SR2.18 billion.

Mortgage law & financing

Saudi Arabia’s housing market is set to boom as the kingdom gears up to introduce the long-awaited mortgage financing law. The new law is likely to be enacted during the course of 2008 as according to the Minister of Finance, a draft law is in place that was expected to be enacted during 2007. In anticipation of the long-awaited law, a number of banks have started offering Shariah-compliant home financing credit with tenors extending up to 25 years.

According to market sources, the size of outstanding housing credit is likely to rise from SR4 billion during 2007 to SR46 billion by the end of this decade, assuming a gradual rise in the share of new residential units purchased through housing loans from 10 per cent to 55 per cent by 2010.

Traditionally, commercial banks and specialised institutions such as REDF were the main players providing a means of finance in Saudi Arabia. However, private sector financing companies such as Real Estate Financing Company, National Installment Company and Ta’jeer Company are now emerging in this sector.

On the financial innovation front, Saudi banks and financing companies are now expanding their housing loan programmes to help people buy and own their houses and real estate using innovative Shariah-compliant financial schemes. Saudi British Bank (SABB) has introduced its Manazel home ownership (HOL) Scheme. Similarly, Riyadh Bank highlighted its land purchase murabaha finance (LPMF) and murabaha home finance (MHF) programmes in compliance with Islamic Shariah. Finally, Riyadh-based Dar Al Arkan Real Estate Development Company, one of the largest real estate developers in the kingdom, set up a mortgage finance joint venture in April 2007 with the Kingdom Installment Company (KIC), Arab National Bank (ANB) and the International Finance Corporation (IFC) – the private sector financing arm of the World Bank Group. The SR2 billion capitalised company is the first housing finance company to be licensed by Sama. It will help Saudi citizens to purchase suitable houses by providing them with Shariah-compliant financial tools.

Credit and finance companies of this nature are expected to increase in the near future, thereby supplying investors and participants with the necessary means to take part in the thriving local real estate market. To further boost the availability of real estate financing, the Shura Council Committee on Public Services has put in a plan allowing foreign banks operating in the kingdom to participate in the financing of housing projects. This would increase available funds for housing, helping alleviate the housing shortage and drive market activity further.

Private sector role

In the past, construction booms in Saudi Arabia were mainly tied to increased government outlays for construction. However, this time around, there is a change in the leading role. With the backing of government regulations, private sector developers are rushing to attain a piece of the growing market by erecting multi-billion-dollar properties across the kingdom, ranging from apartment towers, office buildings, commercial centres, hotels and economic cities.

As per the Eighth Development Plan (2005 – 2009), one million units are planned to be completed, of which the private sector is estimated to self-finance the construction of 800,000 units. The government has encouraged banks and other financial institutions to provide housing loans and the tide has turned in the favour of the private sector to play an increasingly crucial role in driving the market forward.

Growth drives regulation

Real estate is a loosely regulated sector, not just in Saudi Arabia, but in the GCC as a whole, with land in most of the countries belonging to the state and locals by way of grant, freehold or a long-term lease. Regulations allowing locals and local companies to own land is in place in most of the GCC countries. However outsiders (non-GCC) – individuals and foreign companies-still cannot own land in most of the GCC countries. All the real estate markets of the GCC countries are now open for investment by the GCC nationals or companies owned 100 per cent by GCC nationals. This is also driving the market as these countries go ahead to implement and promulgate the relevant legislation in their countries. Large projects are already coming up in the region, where GCC nationals are buying real estate in wholesale.

In Saudi Arabia, the rapid growth of the real estate sector and emerging market opportunity has prompted the government to take measures in organising, regulating and systemising activity within the sector. Pushing forward regulations within the industry would further fuel investments, with a regulatory framework providing opportunities not just to large players, but also to the small to medium-sized investors. Market participants have already commended government efforts in supporting development of properties for housing purposes through the relaxation of rules, regulations and procedures in issuing licenses. A gradual relaxation in regulations for multi-storey buildings has also helped stimulate further activity. Finally, the introduction of the new mortgage law in Saudi would also boost the market further along.

The Seventh & Eighth Plans

Saudi Arabia’s housing sector is expected to grow at an annual rate of 6.3 per cent throughout the Eighth Development Plan (Eighth DP) covering 2005 to 2009, while in the next 20 years, the Saudi population’s growth rate is expected to be 2.5 per cent. This would initially imply that the housing sector’s growth rate is adequate to cover the growing demand for housing in the kingdom.

However, the Saudi demographic structure is characterised by a very young segment (that is below 25 years of age) constituting more than 50 per cent of the total population. This unique characteristic has a direct impact on the “rate of formation of new families” and is the driving force behind the rapid increase in the demand for new housing.

The number of completed and ongoing housing units during the Seventh Development Plan from 1420-21 to 1424-25 (2000-2004) reached about 300,000 units, bringing the cumulative total number of housing units completed by the end of 1424-25 (2004) to about 3.99 million units. Table 3 shows the number of housing units constructed by the Deputy Ministry for Housing Affairs, some other government agencies and the private sector, through self-finance and finance by the REDF.

Due to the rapid growth rate of new families, the Eighth Development Plan expects demand for housing to increase by an additional 1 million units. This represents an annual average increase of 200,000 units and implies that the cumulative number of housing units in the kingdom will reach almost 5 million by 2009.

It is very clear from Table 3 that it is the private sector that has played a very important role in providing housing units, both in terms of construction and financing of the units. The sector constructed approximately 3.72 million housing units (93.1 per cent of the total) of the total cumulative number of housing completed in the kingdom at the end of 1424-25 (2004), of which 610,000 were financed by REDF.

It is expected that the demand for housing units (Table 4) during the Eighth Development Plan will be met through private sector investments in addition to the REDF loans.

The forecast growth targets of the housing sector in the Eighth Development Plan are as follows:

• To construct about 1 million housing units over the plan period, that means approximately 200,000 units to be built each year;

• To provide 75,000 REDF loans with a total value of SR22.5 billion for constructing 90,000 housing units (18,000 units per year) in the various provinces of the kingdom;

• The private sector would finance (self-finance) the construction of the remaining part of the estimated demand during the Eighth Plan, that is 800,000 housing units at the rate of 160,000 units per year; and

• To provide about 280 million sq m of residential land to meet the demand for housing during the Eighth Plan, an average of 56 million sq m each year.

Industry structure & performance

By type, Saudi’s real estate market is divided into housing and residential market, virgin land, and commercial markets.

The housing market comprise of apartments, villas, traditional houses and compounds. In addition there is agriculture and industrial properties (land and built-up units). Commercial property is further broken down into office space and retail space. Industrial estates have been developed to house industrial units in various regions of Saudi Arabia. More space is being added in each of these estates while new estates are planned as well. On the other hand, geographically, the urban real estate market is divided into three regional centres, namely, Riyadh in the central area, Western area (Jeddah, Makkah and Madinah) and the Eastern area (Al Khobar and Dammam).

Introduction to the structure of the real estate market in Saudi Arabia is incomplete without an introduction of the key government body in Saudi Arabia, the Ministry for Housing. The ministry specialises in the planning, design and execution of government housing projects for citizens in all areas of the kingdom.

It has executed 13 housing projects in nine of the kingdom’s cities, which include Riyadh, Jeddah, Dammam, Al Khobar, Buraidah, Madinah, Makkah, Al Ahsa and Al Qatif.

The projects include multi-storey apartments and villas. The latter will have provisions for an additional floor, if necessary.

All projects offer general services that include: roads, parking areas, children’s playgrounds, electrical and telephone networks, and sewage plants. Further, these projects were handed over to the REDF for distribution to deserving citizens.

Since 2004, Saudi Arabia’s real estate industry has undergone a dramatic growth. The market was estimated to have ballooned to more than SR1 trillion in value during 2004. Similarly, the sector continued its growth until 2007. According to data from Mazaya real estate, total real estate investments more than doubled during the year 2007 reporting 115.9 per cent annual growth. Total investments stood at SR100.4 billion by the end of 2007 as compared with SR46.5 billion during 2006. Such a surge was backed by increased prices as well as increased demand and activity within the sector. Looking forward, the sector will continue its journey to the north as market players’ estimate increased investment expenditures within the Saudi economy to reach SR1.3 trillion by the end of 2012. This figure includes both public and private investments in mega projects in the fields of energy, utilities, infrastructure, as well as investments in economic zones.

Construction activity & permits

Generally, construction activity was brisk starting 2000 and up to 2007, as reflected in the increased investments and projects especially within the residential segment. Moreover, government regulations and initiatives allowing foreign ownership, low to medium interest rates and high levels of liquidity coupled with rising demand due to expanding population along with the influx of expatriates have further fuelled the demand for real estate. This has led to rising construction activity in the recent past.

Building permits – an indicator of construction activity in the economy – reported 11.1 per cent CAGR over the period 2000 to 2005. This was a direct result of the huge increase in total building permits issued during 2005 reaching a peak of 55,369 permits, which eventually came down to 53,856 in 2006. For 2007, initial data from the Ministry of Municipal and Rural Affairs indicates a sharp 32.8 per cent decline in issued permits to 36,214, almost the same level as 2003. The decline could be reported mainly to the large bases of 2005 and 2006.

Generally, analysing building permits data by type revealed that residential permits continued to account for almost 90 per cent of issued permits from 2000 to 2007 (Table 5).

Commercial and industrial permits followed, accounting for six per cent on average over the same period. However, it is important to note that the share of commercial and industrial permits as well as other permits has been increasing over the years.

As compared with 5.5 per cent and 2.5 per cent of total permits in 2000, commercial and industrial permits and other permits accounted for 6.7 per cent and 5.3 per cent respectively by the end of 2007. This growth, however, has been at the expense of residential segment, whose share nosedived from a high of 92 per cent to 88.1 per cent during the same period.

For building permits by administrative area (Figure C), generally three areas accounted for more than 60 per cent of total issued permits over the years, namely; Riyadh, Makkah, and Eastern region. By the end of 2007 they accounted for 34.1 per cent, 18.9 per cent and 12.5 per cent respectively. This is mainly attributed to the increased activity and investments in these regions.

Moreover, the increased migration from rural to urban areas has contributed significantly to changing the demographic map for Saudi Arabia over the last period. This can be gauged by the population distribution by administrative area as well as new residential permits issued mainly in Riyadh and Makkah areas.

According to data from the Ministry of Municipal and Rural Affairs, the period 2000 to 2007 witnessed an increase in the share of issued permits in Riyadh from 24.3 per cent to 34.1 per cent. Similarly, permits issued in Makkah has witnessed an increase from 15.5 to 18.9 per cent over the same period. Such increases have corresponded to the declining shares of permits issued in Aseer, the Eastern region, Madinah, Qassim and Tabuk.

Demand-supply scenario

Generally, the Saudi real estate market is demand driven rather than speculative in most of its segments. However, as could be seen from construction and building permits data, the housing and residential segment accounts for the lion’s share in real estate activity.

The residential market is suffering supply shortage especially for affordable low and middle income housing class.

This increased demand and short supply scenario has driven housing prices high in recent years.

The commercial segment has also been facing a period of increased demand surpassing supply for both retail and office space. This has been attributed to the increased business and investment activity brought about by a high population growth rates and increased per-capita income.

On the supply side, new residential areas are sprouting up across Saudi Arabia with property prices in developed areas touching record levels.

Similarly, the investment segment is seeing the addition of several new buildings, catering to an increasing demand within the expatriate population.

The commercial segment is also witnessing a boom in activity, with developers busy erecting modern office buildings in Riyadh. In addition, several additional commercial and entertainment complexes have been found to dot the country’s landscape. Even the tourism industry is undergoing a boom.

The year 2007 witnessed an impressive performance for real estate activity especially in terms of volume. According to Mazaya’s real estate index, volumes of real estate deals concluded reported a new record level of 114 million sq m, up from 50.6 million sq m recorded for 2006. Similarly, total invested liquidity in the sector amounted to SR100.4 billion by the end of 2007 as compared with SR46.5 billion reported for 2006.

As per data from Mazaya (Table 6), the residential segment accounted for 66 per cent of total value of Saudi real estate sector by the end of 2007.

In terms of volume the segment reported a whopping 425 per cent growth over 2006.

However, the increased volume affected average price per sq m negatively, which retreated by 24.7 per cent. According to Mazaya “the decline was a result of increased supply of new lands away from city centres, characterised by moderate rates compared to those prevailing in major cities that entered the market, emphasising that the demand is increasing”. Thus by the end of the year, the average monthly price per sq m stood at SR623 while the highest average price was SR814 and the lowest price was SR431.

Lands for commercial and investment activities accounted for 27 per cent of real estate activity during 2007. Similar to the residential segment, commercial and investment lands witnessed a huge 217 per cent growth in volume of deals concluded.

The average monthly value of deals grew to SR2.23 billion up from SR630 million. Average price per sq m continued to pick up by 13.2 per cent reaching SR14,700 per sq m as a result of the increased demand.

The highest average monthly price stood at SR16,300 per sq m.

Finally, office complexes accounted for the remaining seven per cent of total real estate activity. Fuelled by an increasing demand, the segment witnessed a 394 per cent increase in volume of deals concluded.

As a result the average price per sq m declined by 24.6 per cent from SR20,300 per sq m in 2006 touching SR15,300 per sq m by the end of 2007.

However, it is important to note that despite this decline in average price per sq m, prices in the kingdom have remained among the highest in the Gulf.

Affordable housing

According to data from the Ministry of Economy and Planning, by the end of the Seventh DP, accumulated unmet housing demand stood at 270,000 units.

On the flip side, vacant housing units were as high as 12 per cent to 15 per cent of total available housing units.

This indicated that available supply is beyond the purchasing power of large segments of the population. That is one of the major challenges to be addressed by the eighth DP. The new mortgage law will play a major role in supporting Saudis’ to finance their housing purchases.

Generally, population demographics, economic and social factors are the most important determinants that will depict housing demand over years. Thus, the next few years will continue to experience increasing demand from both Saudis and expatriates.

On one hand, economic expansion and increased investment opportunities in the country will continue to encourage the influx of expatriates in larger numbers, consequently demand will continue to pick up.

On the other hand, the population in the kingdom is forecast to continue growing at an average annual rate of 2.5 per cent as per the Ministry of Economy and Planning. Such a high growth rate will result in a total population of 25.66 million by the end of 2009. Moreover, average household size plays another major role in increasing demand. The average household size is estimated to decline from 5.5 to 5.2 persons over 2005 to 2009. Such a decline in household size will be mirrored by a proportionate increase in demand for housing. In addition, up to the end of 2009, a larger percentage of the population will be reaching a marriagable age pushing further the demand for more housing units.

Based on these assumptions, the Eighth DP estimated future housing demand to stand at 1 million units over the period 2005 to 2009.

In addition, plans to satisfy such a demand would require sufficient land at an annual average of 5,600 hectares as well as investments of SR500 billion.

It is expected that Riyadh and Makkah will continue to account for almost half the estimated demand (46 per cent of total estimated demand), mainly because of demographics. Closely following are the markets of Eastern Province and Madinah accounting for 16.5 per cent and 5.9 per cent of total demand, respectively.

While the population remains one of the major factors for an increased demand in the markets of Riyadh, Makkah, Madinah and Eastern Province, factors such as an increased investment in business, tourism and commercial ventures, combined with the fact that these markets are set to receive a lion’s share of almost all development plans as well as upcoming projects, whether residential or commercial, have shot fuelled demand to new highs.

Riyadh

Statistics also reveal that the demand is expected to continue for a while now. For instance, the population of Riyadh, which has shown an annual growth rate of more than eight per cent, is expected to cross the 10 million mark by 2020. As per a study prepared by the High Commission for Riyadh Development, new family growth rates are expected to be between seven to 13 per cent.

Correspondingly, housing demand is estimated to stand at 220,000 units. Add to this the migration from other areas is expected to boost the capital’s population to make it the first mega-city in the Gulf region within a decade.

This is one of the reasons that construction activity at Riyadh is on the rise, with the city boundaries quickly expanding in all directions, especially to the north. But activity has not been exclusive to the outskirts of the city, as downtown Riyadh has experienced a new boom in the recent past.

Jeddah

Similarly, Jeddah is undergoing its own real estate boom, with real estate investments in the city ballooning. All segments of the real estate market have been benefiting from the extensive development that is reshaping the city.

The city’s corniche has witnessed the mushrooming of several projects. The eastern parts of Jeddah have also seen a sky rocketing of prices with the municipality granting permission for the construction of taller buildings in the area.

The new regulations are expected to fuel a new wave of construction activities that include high-rise developments as developers seek to maximise returns on investments by increasing total built-up space.

Some of the projects that are expected to redefine the skyline of the city include the Al Nakheel project, which is strategically positioned in the heart of Jeddah within the central business district. The project is set to benefit from the proximity to some of the key road schemes in Jeddah, giving easy and convenient access from all routes including the Al Saben District, Abdullah Al Suleiman, and Crown Prince Avenue. Al Nakheel is currently in its early stages of development with work on the infrastructure facilities under way.

Makkah

The cities of Makkah and Madinah have also benefitted from the real estate boom largely because of the new regulations that have relaxed visa laws for pilgrimages.

With forecasts pointing to an expanding number of visitors to the cities, the government has activated the private sector to expand the infrastructure and provide accommodation, transport and recreational activities that will help meet the demand.

In tandem with the interest shown by the government, the private sector has, on its part, announced several projects within the cities, causing a sharp rise in real estate demand. This has seen the sprouting of several mega-projects.

The Abraj Al Bait, one of the mega developments in Makkah, is expected to accommodate 65,000 people, once complete. The project will include the 485-m-tall Al Bait Towers.

Construction of the building is already under way and should be completed before 2009. The project includes six residential towers with 864 units offering a total built-up area of 302,000 sq m, a 60-storey five-star hotel with 2,000 keys, a convention centre for 1,500 persons, prayer hall for 3,800 persons, four-storey parking for 780 cars and 10 buses and two heliports.

The Zamzam tower is the first Shariah-compliant timeshare scheme in the kingdom. The 31-storey tower project will include 1,240 residential units and leisure and retail facilities covering 91,326 sq m. Located within 100 m of the Holy Haram, the tower is one of five within the estimated SR6 billion Al Bait towers complex.

The SR10 billion Jabal Omar scheme, being built over 230,000 sq m, involves the construction of six five-star hotels, seven 35-storey residential towers and a four-level retail concourse.

Another project, the SR3 billion Jabal Khandama, will have a total built-up area of 970,000 sq m and include hotels, apartment buildings and villas, for 50,000 persons, to be rented to pilgrims during Ramadan and Hajj.

The project will offer a complete residential district overlooking the Holy Haram in Makkah and will consist of several hotels of three, four and five-star ratings, residential towers and commercial areas.

Madinah

Real estate in Madinah has also witnessed tremendous growth in terms of investments and prices. Property prices and rentals have gone up dramatically near the Al Enabeya area east of the Prophet’s Mosque, where development work is under way.

Looking forward, a further spate of developments, is expected to drive prices and activity to higher levels.

Eastern Province

The Eastern Province has also emerged as a magnet for real estate development. Numerous real estate projects are being initiated in the region, ranging from seafront resorts, apartment complexes, residential communities and hotels.

The attractiveness of the area stems from its 85-km stretch of land which lies on the Arabian Gulf. But the demand for such developments can be attributed to the region’s growing role as an industrial hub for the kingdom, where the oil giant Aramco has its headquarters.

Estates & economic cities

Apart from these developments, the government has done a commendable job in making Saudi Arabia a key destination for companies intending to set up their industrial units.

This includes providing industries with investment benefits, setting up world-class infrastructure and making the entry in the industrial sector lucrative for foreign as well as private investors. Major milestones in government effort to woo industrial investments have been industrial estates and economic cities.

In industrial estate, the Ministry of Industry and Electricity is supervising a number of such developments in the various regions of Saudi Arabia.

The total area of the industrial properties which have been developed as of end 2006 exceeded 1.59 billion sq m (Table 7).

Generally, Riyadh, Jeddah, Dammam and Madinah had the largest areas in terms of industrial estates accounting for 99.5 per cent of total developed area. However, major activity continued to be within Riyadh that alone accounted for 96.7 per cent of total developed area, or 1.54 billion sq m.

The total number of plants stood at 1,945 by the end of 2006. The three provinces of Riyadh, Jeddah and Dammam accounted for 40.9 per cent, 29.1 per cent and 21.9 per cent of total plants respectively.

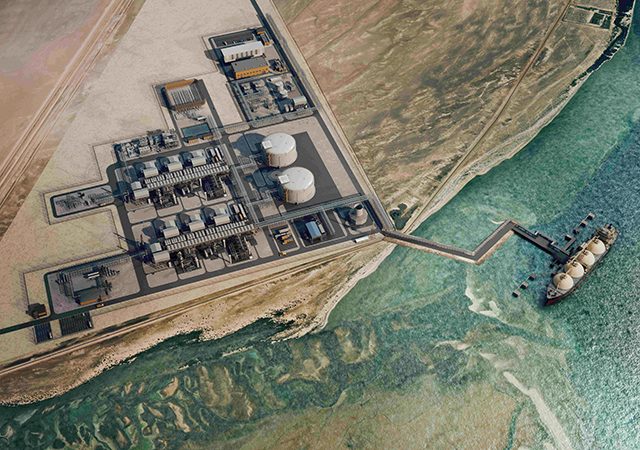

Currently the Saudi Industrial Estates Authority is developing a number of new industrial estates in the various regions of the kingdom. This includes the development of Sudair Industrial Estate Phase One with a total area of 10 million sq m on a BOT (build, operate and transfer) basis. Similarly, the Second Industrial Estate in Jeddah is being developed on a total area of 3.5 million sq m on a BOT basis, while Jizan Industrial Estate is being developed on a total area of 2 million sq m. Finally, it is important to note that the two main industrial estates of Jubail and Yanbu were developed by their Royal Commission rather than the Saudi Industrial Estates Authority. Both industrial estates have a total area of 1,000 sq km and 185 sq km respectively.

In total, both estates comprise 317 plants with 122,000 job opportunities. During 2006, around 51 industrial projects were developed in the two industrial estates involving investments of SR2.95 billion. Looking forward, the two main industrial estates are expected to develop 125 new industrial projects at an investment cost of SR14 billion.

This huge addition in industrial estates is in anticipation of rising industrial and business activity in the kingdom due to the change ushered in by the New Investment Law of 2000 and the Real Estate Ownership Laws for non-Saudis.

All this collectively has given rise to a sense of optimism, both in the growing business opportunities in the region and the kingdom. In addition, the kingdom’s ambitious plan to dramatically raise investment competitiveness under its “10 by 10” programme to put Saudi Arabia among the world’s Top 10 globally-competitive investment destinations by 2010 can be best seen in its economic cities (Table 8).

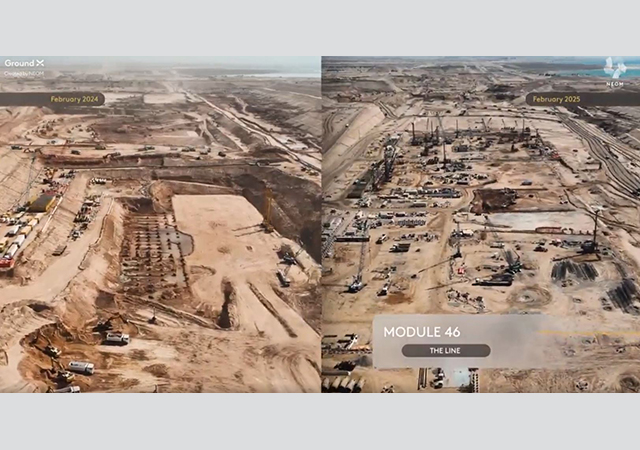

Plans for the first economic city were launched in 2005 and since then three more such cities have been launched. These projects are expected to feature major residential and commercial real estate developments.

Around 1.5 million people are expected to be accommodated in the medium term and three times as many by 2020. These cities (King Abdullah Economic City, Knowledge Economic City, Prince Abdulaziz Bin Mousaed Economic City and Jizan Economic City) will drive investment, which will increasingly be a driver of economic growth.

The estimated investments for these four economic cities are $69 billion. Moreover, a study is under way to establish two more economic cities, one in Tabuk and another in the kingdom’s Eastern region.

Cement sector

Construction has often been a major driver of growth, reflecting both the demographically-driven need for housing, and efforts to build a modern infrastructure. The performance of the sector is closely related to the ups and downs of oil revenue and government spending.

In recent years, construction has accounted for about nine per cent of non-oil GDP. A renewed construction boom is currently under way in line with the surge in public and public-sponsored investments. These include schools, hospitals, roads, railways, power and water plants, oilfield and industrial facilities, the expansion of the industrial cities of Jubail and Yanbu, the creation of a new financial district in Riyadh and the start of work on the ambitious new economic cities.

The current construction boom has caused the cement market to tighten. In early 2007 the government intervened to prevent excessive price increases. Saudi Arabia has huge limestone deposits in the country which provide the much needed raw material for the industry. Another advantage is low energy costs due to large natural gas reserves.

Currently there are eight listed cement companies operational in Saudi Arabia, which are:

• Qassim Cement Company;

• Yanbu Cement Company;

• Arabian Cement Company;

• Yamama Cement Company;

• Saudi Cement Company;

• Tabuk Cement Company;

• Eastern Province Cement Company; and

• Southern Province Cement Company.

In addition, two new companies are being set up, namely Riyadh Cement Company and Khait Cement Company. Currently, Yamama Cement is leading in terms of capacity with a 20 per cent market share of amounting to 6 million tonnes per year (mtpy) followed by Yanbu Cement at 4.8 mtpy and Saudi Cement at 4.7 mtpy (Table 9). During 2007, cement production rose to 30.29 million tonnes as compared to 27.05 million tonnes in 2006 (Table 10).

Saudi Cement achieved the highest production numbers, notching 5.27 million tonnes in 2007 as compared to 5.0 million tonnes in 2006. Yamama Cement was the second largest producer, producing 4.65 million tonnes in 2007, as compared to 3.84 million in 2006. Yanbu Cement remained a close competitor producing 4.62 million tonnes of cement in 2007 compared to 3.52 million tonnes in 2006. Southern Cement which stood second in 2006 in terms of production, came in fourth last year producing 4.61 million tonnes as against 4.60 million tonnes in 2006.

Overall sales volume rose by 13 per cent to 30.33 million tonnes in 2007 against 26.92 million tonnes in 2006. Domestic deliveries stood at 26.8 million tonne in 2007 as compared to 24.74 million tonnes in 2006, rest being taken by the exports.

In terms of sales, Saudi Cement topped the charts with deliveries of 5.3 million tonnes against 4.97 million tonnes in 2006. Yanbu Cement, was the second with sale of 4.65 million tonnes in 2007 as against 3.49 million tonnes in 2006. Yamama Cement and Yanbu Cement followed the second position holder closely by delivering 4.62 million tonnes and 4.60 million tonnes, respectively.

The aggregate profit of listed cement companies in Saudi Arabia reached SR4.49 billion in 2007 as against SR3.68 billion in 2006, up 22 per cent. The highest growth was registered in Qassim Cement which reported 71 per cent growth in net profit in 2007 which can be attributed to increased production as it ramped up its capacity during the year.

In value terms, Yamama Cement earned the most at SR730 million as against SR601 million in 2006, growth of 21 per cent. With the increase in production due to the capacity increases planned in next couple of years, profits of cement companies are expected to show good growth (Table 11).

The new initiatives such as economic cities are also expected to provide incentive to increase capacity which will translate to increased revenues and profits.

Conclusion

The Saudi real estate sector is witnessing a phase of rapid growth that will continue for the next years, largely because it remains a market driven by demand fundamentals where demand surpasses supply for almost all segments.

With demand expected to continue for the coming years, this is likely to have a direct impact on the prices and rentals market.

However, it is important to note that, such undersupply scenario underlies a major challenge especially for the affordable low income housing segment, which is expected to continue for the short to medium term until new supply is delivered.

Supporting such a scenario will be demographic fundamentals combined with the strong performance of the overall economy that will sustain the growth in the real estate sector.

A major solution for such challenge would be the introduction of mortgage products that are expected to add impetus to the growing sector. On the other hand, both retail and office segments will continue their increased demand scenario, largely owing to the increasing population as well as the growing demand for a higher standard of living and consequently the increased demand for leisure and commercial needs.

Similarly, office demand will continue to witness an increasing demand due to the increased number of newly established companies and the expansion of existing ones. Such trend is expected to continue as a result of opening of the Saudi economy and new investment laws attracting more foreign investments in the kingdom.

Finally, to sum up, the factors supporting buoyant activities in the real estate sector are:

• On-going booming economy and higher GDP growth rates along with a higher per capita income and standard of living;

• Expansionary fiscal policy by the government;

• On-going mega projects including energy and utilities projects, infrastructure, real estate, and new economic zones;

• On-going development and diversification plans for the Saudi economy away from oil sector, with specific attention to industrial and economic cities;

• Increased annual population growth rates estimated at 2.5 per cent in addition to the increased influx of expatriates;

• Increasing numbers of pilgrims estimated at six per cent per year up to the end of 2009, thus supporting real estate and construction activities in the two holy cities;

• Increased private sector role in almost all aspects of the economy and especially in real estate and construction activities on BOT basis;

• Availability of funds and new financing schemes for real estate sector namely; the new mortgage law; and

• A sector that is driven by demand fundamentals thus pushing activity in the sector with estimated demand of at least one million units up to the end of 2009.

All these factors broadly highlight the drivers for the real estate market in Saudi Arabia and their likely impact in the future as well.

Thus, similar to other GCC countries, real estate activity in the kingdom will remain buoyant for the coming years with sustained growth in demand surpassing supply for almost all segments of the sector.

Vision 2025

• Doubling per capita GDP from its current level of SR43,300 at the beginning of 2005 to SR98,500 in 2025.

• Commensurate increase in the quality of life of citizens.

• Increase in per capita income of Saudi citizens is to be accompanied by a matching increase in their standard of living.

• Economic growth could be fuelled by boosting investments in both the public and private sectors.

• Economy is expected to grow at an average annual rate of 9.3 per cent during the strategy period.

Budget allocation 2008

• Education and manpower development: Total expenditure amounts to SR105 billion including technical and vocational training. These include King Abdullah Project for Education Development amounting to SR9 billion. New projects include 2,074 new schools (in addition to 4,352 schools currently under construction) and rehabilitation of 2,000 existing school buildings.

• Health and social affairs: Total expenditure amounts to SR44.4 billion. New projects include over 250 primary care centres, eight hospitals with a capacity of 1,900 beds, expansion and development of existing health facilities, and furnishing newly-completed hospitals. Meanwhile, there are 79 hospitals under construction which will add 9,850 beds.

• Municipality services: Total expenditure amounts to SR17 billion. New projects include intercity roads, intersection and bridges, streetlighting, and cleaning-related projects.

• Transportation and telecommunication: Total expenditure amounts to SR16.4 billion. New projects include roads totalling 7,300 km to be added to 24,000 km of roads currently under construction, ports, airports, and railroads development, and new postal services. The existing paved road network stands now at 54,000 km.

• Water, agriculture, and infrastructure sector: Total expenditure amounts to SR28.5 billion of which projects for water, sewage, and desalination will amount to SR13.3 billion. In addition, the budget includes appropriation for the two industrial cities of Jubail and Yanbu, and other industrial and agricultural projects amounting to SR7.6 billion.

• Specialised credit development institutions and government financing programmes: (1) SR25 billion to be allocated to the Real Estate Development Fund over five years. (2) Loans disbursed by Real Estate Development Fund, Saudi Industrial Development Fund, Saudi Credit and Saving Bank, and Agricultural Bank since their inception amounted to SR224.7 billion. SR16.2 billion is expected to be disbursed in 2008 including credits to build hotels, schools, universities, and hospitals. Private higher education scholarship program will continue in 2008. The Saudi Export Programme managed by the Saudi Fund for Development financed SR6.9 billion.

Saudi Arabia Economic highlights 2007

• Saudi Arabia was to float tenders inviting foreign capital for a variety of projects in the infrastructure and oil and gas sector to the tune of $50 billion. The investment structure by sector would include private sector investments $30.6 billion, investment in oil and gas sector $7.4 billion and investments in government sector $12 billion.

• Saudi Arabia was to invest $70 billion to expand its crude oil and natural gas production, and $25 billion to increase its refining production capacity. The move is said to boost the kingdom’s upstream output capacity from 11.3 million barrels per day (bpd) to 12.5 mbpd by 2009 and downstream refining capacity by almost 50 per cent to six mbpd.

• The Saudi Arabian General Investment Authority (Sagia), Rakisa Holding and General Electric (GE) have joined hands to work out a three-phase investment cooperation plan to develop Hail Economic City, with Rakisa as the main developer. The first phase presents a three-level scheme in which a total of SR6.4 billion will be invested in infrastructure and SR30 billion in business projects within seven years. It will generate more than 30,000 employment opportunities. In the second phase, another SR9.8 billion will be invested in infrastructure and SR48 billion in the other sectors to create 66,000 jobs. The third phase will witness a SR13.7 billion infrastructure investment coupled with a SR67 billion investment in other sectors, catalysing an expected 119,000 new jobs in the country.

• The first three projects to be implemented at the two new industrial cities in Jubail and Yanbu was said to involve a capital investment of SR45.35 billion, land allocations for which was carried out by a Royal Commission. One of the projects is a SR24 billion, 400,000 bpd, oil refinery on a five million sq m of land in Jubail II, developed by a joint venture of Aramco and French oil major Total.

• Saudi Arabia will add 100 trillion cu ft (tncf) of gas to its reserves over the next 10 years as it seeks to meet surging demand from industry and power plants. The kingdom plans to drill 186 gas exploration wells over the same period to boost its stocks in an effort to meet surging demand that’s expected to grow by 40 per cent up to 2012.

• Saudi Arabia needs SR190 billion ($50.6 billion) in investment to meet its electricity requirements until the year 2015, according to the Saudi Electricity Company. The report saw a seven per cent annual growth in power demand in the coming five years.

• Contracts worth SR3.6 billion have been awarded to establish 1,010 model health centres in different parts of the kingdom. Plans also include the setting up of 2,000 model health centres within a timeframe. The projects also included 440 health centres, at a cost of SR1.6 billion, and two psychiatric hospitals in Dammam and Abha with 300 and 200 beds respectively.

• The total size of outstanding housing credit in Saudi Arabia is likely to rise from SR4 billion in 2007 to about SR46 billion by the end of the decade, according to an estimate.

• The General Authority of Civil Aviation is planning to construct a new airport in Al-Qunfuda as part of its plan to construct new airports to serve remote Governorates. The plan will include the construction of four other airports in different areas.