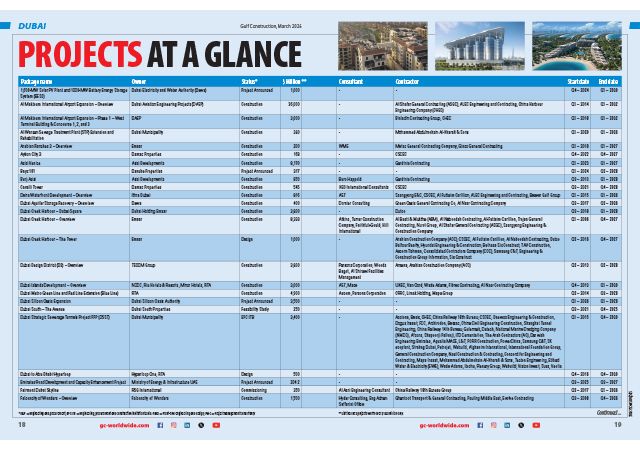

There has been a marginal rise in the number of announced greenfield projects across the GCC in 2024, up one per cent to 1,830 from 1,813 the previous year with the growth being spearheaded by regional heavyweights – the Kingdom of Saudi Arabia and UAE, according to Emirates NBD Research.

As the primary destination market for greenfield foreign direct investments (FDI) within the GCC, Saudi Arabia walked away with the lion’s share in 2024, accounting for 54 per cent of the total value of projects in the region followed by UAE with 36 per cent share, it stated.

There does, however, appear to have been a decline in the average project value across the GCC, with the total value of projects having fallen by 26 per cent year-on-year in 2024, the report stated.

The primary sources of FDI into GCC economies in 2024, on a value basis, included the US (25 per cent), China (17 per cent), the UK (9 per cent) and India (9 per cent). The UAE also made a material contribution to greenfield FDI in the rest of the GCC, accounting for 5 per cent of announced projects in 2024, said the report.

Sectors seeing the highest value of greenfield projects include communications (18 per cent), renewables (14 per cent), metals (8 per cent), electronic components (8 per cent), as well as coal, oil and gas (8 per cent), it added.

According to the report, the value of greenfield project announcements across Saudi Arabia declined 28 per cent y/y in 2024 to almost $22 billion but remains a strong showing, being the third highest annual value on record. The kingdom has set an explicit target for FDI in its Vision 2030 plans, hoping to attract $100 billion annually by 2030, with greenfield FDI projects playing an important role in reaching that figure.

On the UAE, the Emirates NBD Research said the value of new greenfield projects plunged 33 per cent y/y to $14.5 billion, representing a normalisation after a particularly strong 2023.

Dubai remained the largest recipient of greenfield FDI in the UAE, accounting for around 58 per cent of the total value of announced projects, followed by Sharjah with almost 12 per cent in 2024, it stated.

Abu Dhabi accounted for just under 11 per cent of the total value of announced projects last year but saw a sharp reduction from the levels seen in both 2022 and 2023, years in which there were substantial investments made in renewables, automotive OEMs and the ICT sector.

Industries that saw the largest value of announced greenfield projects in the UAE in 2024 include real estate, software and IT, renewables, coal, oil and gas, business services, and automotive OEMs, it added.

On the global scenario, Emirates NBD Research said the FDI flows witnessed a drop in 2024 in both value and volume. As per UNCTAD estimates, the number and value of announced greenfield FDI projects declined by 8 per cent and 7 per cent y/y respectively.