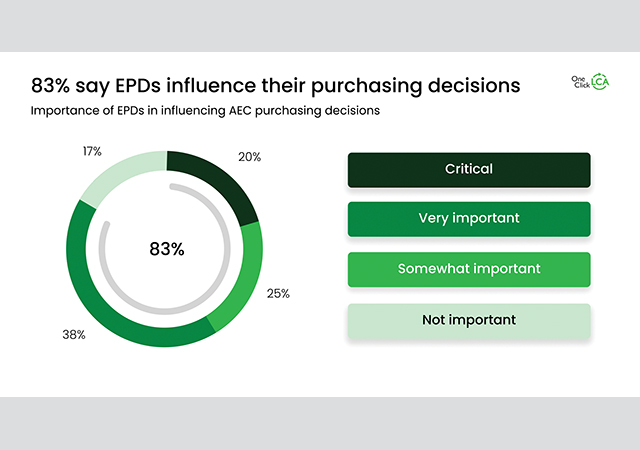

A global study has highlighted a strong industry need for carbon transparency, with over 80 per cent of all respondents stating that environmental product declarations (EPDs) influence material purchasing decisions in building projects.

The new study by One Click LCA, a leading sustainability platform for construction and manufacturing, explores the positive impact of life-cycle assessments (LCAs) on reducing embodied carbon in construction, the increasing influence of building material choices, and the barriers to further progress. LCAs are tools for calculating the environmental impact of processes and products during their life cycle.

The platform’s annual global Carbon Experts Report for 2025 identifies a susbstantial possibility to reduce embodied carbon through construction life-cycle assessments. Respondents to the study are from both the manufacturing and architect, engineering, and construction (AEC) professionals sectors.

More than 60 per cent of AEC respondents estimate reductions of at least 10 per cent, showing the significant impact on decarbonisation of widespread LCA adoption in the industry. Encouragingly, 31 per cent of respondents have already successfully reduced embodied carbon by up to 20 per cent through LCA use, while 23 per cent have achieved reductions of up to 30 per cent. These findings are supported by One Click LCA’s own research, which shows that carbon emissions can be reduced by more than one-third if the lowest-carbon-emitting products are selected for all materials in a building.

As many as 86 per cent of surveyed manufacturers expect to reduce carbon in product development by up to 30 per cent. Half aim for reductions of up to 10 per cent, while 36 per cent plan to cut between 11 per cent and 30 per cent. Confidence among manufacturers has risen since the last study was published in early 2024, when 59 per cent of the respondents saw a reduction potential of 10 to 30 per cent, according to One Click LCA.

|

|

|

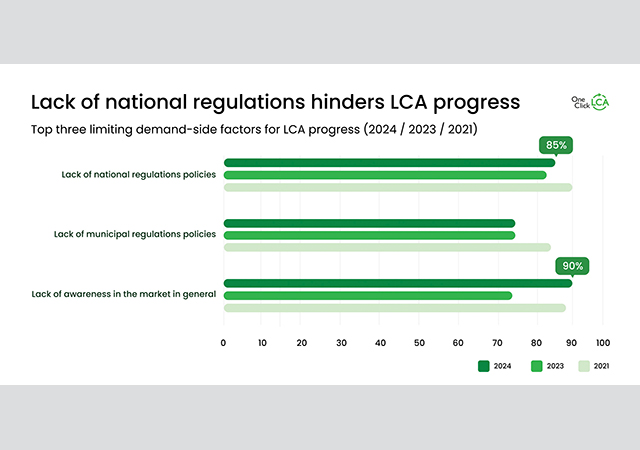

Lack of regulations slows down progress

The report points to critical barriers hindering progress toward a low-carbon built environment. These include a lack of robust national regulations, which 85 per cent of AEC professionals cite as a core hurdle. One Click LCA also noted this obstacle in its 2024 study. Implementing consistent carbon reduction strategies across projects and regions remains challenging, as there are great variations in national regulation and a lack of clear and consistent policies, it says.

“The construction value chain is critical in our collective effort to address climate change. We hope these findings serve as a call to action for the industry and regulators. We are now at a tipping point where technology, market demand, and regulations are coming together to speed up sustainable practices across the construction value chain. The path to decarbonisation requires sustained commitment from all stakeholders,” says Panu Pasanen, One Click LCA’s Founder and CEO.

EPD demand to grow ‘significantly’

In addition to widespread LCA adoption, EPDs that show a product’s environmental impact and performance are becoming increasingly critical in material selection and procurement decisions throughout the global construction industry.

Both manufacturers and AEC professionals agree that EPDs influence material purchasing decisions, with 89 per cent and 83 per cent of respondents confirming this, respectively. Nearly 50 per cent of manufacturers identify improved market position as the primary benefit of EPDs, while almost 40 per cent view EPDs as essential for staying competitive. The vast majority of respondents see increased carbon transparency between supply and demand sides as vital for improved sustainability in the industry, One Click LCA notes.

Significant obstacles slow EPD adoption. More than 80 per cent of manufacturers say high costs and the complexity of creating and verifying EPDs are major bottlenecks. Many manufacturers also struggle with the technical requirements of producing them. The fragmentation of EPD data makes adopting LCA and EPD practices even more complicated, hinting at a need for greater carbon- and data transparency between the demand and supply sides.

.jpg)

(1).jpg)