Government agencies are pushing to improve infrastructure across the country.

Government agencies are pushing to improve infrastructure across the country.

The recent wave of contract awards – driven largely by social housing and infrastructure projects – has reignited optimism in Kuwait’s construction sector. After years of stagnation due to excessive bureaucracy and deep-seated political gridlock, this momentum signals a potential turning point.

Despite persistent challenges, the government remains steadfast in its commitment to Kuwait Vision 2035 (New Kuwait 2035), pushing forward with strategic investments in infrastructure and social development. The increasing emphasis on public-private partnerships (PPPs) reflects a decisive shift toward greater efficiency, innovation and long-term sustainability.

However, unlocking the sector’s full potential requires tackling critical hurdles such as project execution bottlenecks, cost overruns and bureaucratic delays. Yet, with strong underlying drivers – population growth, economic diversification, and a clear strategic vision – the outlook for Kuwait’s construction industry is promising.

A pivotal move reinforcing Kuwati’s intent to address these issues came last month with the Council of Ministers’ approval of the long-awaited Public Debt Law – officially known as the Financing and Liquidity Law. This landmark legislation marks a bold shift in Kuwait’s fiscal strategy, enabling the government to issue sovereign bonds and Islamic sukuk. By addressing liquidity constraints, financing vital infrastructure, and reducing dependence on oil revenues, this move could reshape the country’s economic landscape and propel the construction sector into a new era of growth.

|

|

Madinat Hareer anchored by a 1,001-m tower |

According to Middle East Briefing, the Public Debt Law establishes a framework for structured borrowing, allowing Kuwait to access international debt markets with clearly defined limits and conditions. The law grants the government the authority to issue up to KD20 billion ($65 billion) in sovereign bonds and Islamic sukuk over a 50-year period. This flexibility enables Kuwait to diversify its funding sources while maintaining financial stability. Borrowed funds will primarily be allocated to infrastructure projects, economic diversification efforts and potential fiscal deficit financing.

One of the primary objectives of the Public Debt Law is to finance large-scale infrastructure projects essential for Kuwait’s economic transformation. According to the 2025-26 draft budget, the government has allocated $42 billion across 370 development projects. Major infrastructure plans include: Mubarak Al Kabeer Port; Kuwait International Airport’s T2 Terminal expansion; and digital transformation initiatives, says the report.

To meet the demand of a rising population, the government is investing in substantial infrastructural projects including social housing, roads and electricity and water. Many of these projects are being developed through PPP arrangements or by inviting foreign companies to provide engineering, design, and construction capabilities. Chinese firms especially, have made significant inroads in public sector projects including housing, roads, Mubarak Al-Kabeer Port and other infrastructure projects and waste water schemes.

Another flagship project, Madinat Hareer or Silk City, an ambitious urban development anchored by a 1,001-m tower, is also likely to be developed with foreign investment. Plans for Silk City – which is expected to cover 250 sq km in Subiya on the north shore of Kuwait Bay opposite to Kuwait City – were first mooted nearly two decades ago (see Gulf Construction, December 2007).

Over the past year, Kuwait has taken a number of measures to address its housing shortage issues. The provision of social housing is a central pillar of Kuwait Vision 2035 objectives. With the outstanding number of housing applications having increased to 98,099 by end of October last year, Kuwait has been pushing ahead aggressively on its housing programmes, with key contracts having been awarded in the past three months for the South Saad Al Abdullah City and its affordable housing projects. The government, through the Public Authority for Housing Welfare (PAHW), had earlier given the go-ahead for new infrastructure projects in Al-Mutla City and two contracts for homes and infrastructure within the affordable housing programme.

|

|

Sheikh Jaber Al Ahmad Cultural Centre’s stunning design reflects Kuwait’s forward-thinking approach to urban development. |

According to leading market research company Mordor Intelligence, the Kuwait construction market is projected to grow from $14.77 billion in 2025 to $19.70 billion by 2030, driven by a number of factors including government tax reforms that aim to attract foreign investment, economic diversification efforts and PPPs.

Although Kuwait holds the world’s fifth-largest oil reserves and oil and petroleum products account for around 95 per cent of export revenues and 80 per cent of government income, the country has been actively pursuing its plans for economic diversification.

The proposed GCC Railway network could play a major role in Kuwait’s economic diversification plans, boost pan-GCC economic integration and sustainable development and further the country’s ambitions to be a regional hub for commerce and transports.

Roads & Railway

In January, Kuwait awarded the design contract for its portion of the GCC-wide railway project to Turkish firm Proyapi. This 111-km rail line, connecting Kuwait to Saudi Arabia, is a key part of the larger 2,177-km regionwide network extending from Kuwait in the north to Oman in the south. Proyapi, with prior experience in Kuwait and railway projects in Türkiye, offered the lowest bid.

This initial phase is set to last for 12 months, after which the tender for the construction phase will be launched. The passenger station in Kuwait will be located in the Shadadiya area.

The estimated KD300-million project, which is aimed for completion by 2030, is being expedited by Kuwait’s Cabinet and is expected to bring significant strategic and economic benefits to the country.

In the roads sector, a key infrastructure upgrade project is the Fourth Ring Road which is aimed at easing traffic congestion in the city, enhancing road safety and improving access to main highways at an estimated cost of KD416 million.

Ports & Airports

|

|

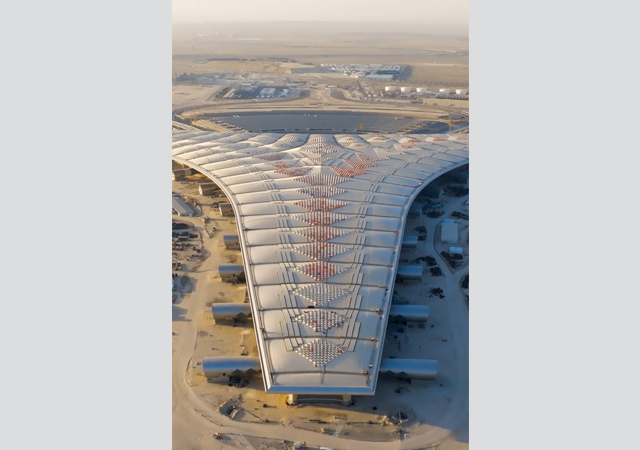

Kuwait International Airport’s T2 project ... well advanced. |

Another key project that aims to transform the Gulf nation into a regional trade hub is the Mubarak Al-Kabeer Port project, a cornerstone of Kuwait Vision 2035. Early this year, Kuwait and China solidified their partnership on the project, when the Ministry of Public Works signed a contract with China State Construction and Communications Corporation – a company affiliated with the Chinese Ministry of Transport – for the study, design, and implementation of the project. The landmark development aims to boost the country’s economy, and create jobs, while also developing Bubiyan Island.

Kuwait resumed talks with China in May to revive the ambitious port project, which had been stalled for nearly a decade and was about 50 per cent complete under its three-phase programme before work stopped. In October, Kuwait’s Municipal Council approved a significant expansion of the Mubarak Al-Kabeer Port project, increasing its area tenfold to 116 million sq m to accommodate 24 new berths.

Now in its final phase, the project is expected to be completed by the end of 2026, according to the Council of Ministers’ latest update.

The completion of Mubarak Al-Kabeer Port is a priority project for Kuwait, with the development and reconstruction of Bubiyan Island, aimed at attracting commercial investments, providing housing, and establishing tourism projects.

|

|

Mubarak Al-Kabeer Port ... an ongoing project now being implemented on a priority basis. |

The port will connect land and sea via multiple transportation modes, positioning Kuwait as a key player in transit trade and regional logistics. The project is also part of plans to develop the northern region as an integrated economic and urban development zone.

Meanwhile, earthworks have begun for the final phase of Kuwait International Airport’s T2 terminal project. This phase involves several critical tasks, including the construction of the food preparation building, technical support centre, security checkpoints, employee and cargo inspection areas, waste disposal zones, service tunnels and aircraft taxiways and parking areas.

The $4.34-billion Kuwait airport expansion project is divided into three phases: the first includes the passenger terminal, central station and service tunnel connections; and the second comprises car parks, service buildings and access roads.

The project, being built by Turkish company Limak Insaat, aims to triple the airport’s capacity to 25 million passengers annually. The terminal is designed to achieve LEED Gold certification. Reports suggest that the project is scheduled for completion next year.

Housing

Kuwait is making significant investment in its social housing sector in a bid to meet the housing needs of its expanding population. Mega-projects such as Al-Mutlaa City and South Saad Al Abdullah City are central to this effort. A notable trend is the increasing involvement of the private sector in housing development through public-private partnerships.

|

|

Al-Mutlaa City housing scheme ... nearing completion. |

Over the past few months, the Public Authority for Housing Welfare has signed key contracts to accelerate these social housing initiatives. In early March, the authority awarded two infrastructure contracts worth KD172.1 million for the South Saad Al Abdullah residential project to China Gezhouba Group.

This new urban centre is projected to house around 150,000 residents in more than 20,000 housing units. Infrastructure development is progressing rapidly with an anticipated completion date of November 2027.

The scope of work includes construction and maintenance of the infrastructure works for residential suburbs as well as substations, said PAHW.

In addition, Kuwait Company for Process Plant Construction & Contracting (KCPC) secured an infrastructure contract valued at KD89.6 million in January for South Saad Al Abdullah project.

Another major ongoing project is the Al-Mutlaa City housing scheme located 38 km northwest of the Kuwait City. The 104-sq-km city, which features 12 suburbs, is designed to house up to 400,000 people and will include residential, social, commercial and light industrial areas. Three principal contractors, China Gezhouba Group Corporation (CGGC), Kolin, and Salini Costruttori, were appointed to implement the masterplan.

Meanwhile, four contracts were awarded by the PAHW to construct 6,455 houses and numerous public buildings across seven suburbs within its affordable housing programme. Among them, The Arab Contractors secured the deal for the construction of 1,777 houses and public buildings within Salmi Affordable Housing Project.

Another affordable housing project is the Al-Naeem Residential Project, aimed to serve as a modern alternative to the older and more densely populated areas of Sulaibiya and Taima, with plans for approximately 10,000 private housing units.

With these contracts, all construction work related to the affordable housing programme has been awarded under six deals worth a total of KD785.3 million. The projects comprise 9,800 houses and 74 public buildings featuring schools, mosques, police stations, health centres, markets. Completion is targeted for 2028.

Power & Water

Kuwait is making substantial investments in its power and water infrastructure to serve the needs of its growing population. The country is also keenly eyeing diversification of its energy sources, to increase the contribution of renewable energy to 15 per cent of the total energy mix (or 14 GW) by 2030, with the participation of the private sector in infrastructure development.

Among such projects, the Kuwait Authority for Partnership Projects (KAPP) has shortlisted companies and consortiums from Saudi Arabia, the UAE and local and international entities for the Dabdeba Electric Power Generation Project and the Shaqaya Renewable Energy Project – Phase Three. These projects, located in the Al-Shagaya complex, aim to develop renewable energy plants with a net capacity of 1,100 MW using photovoltaic technology. Chinese companies will be involved in the Al-Shagaya renewable energy station’s (Area 3 and 4) execution. The complex currently includes a 50 MW thermal solar plant, a 10 MW wind farm, a 10 MW photovoltaic plant and a 132 kV overhead transmission line connected to the national grid.

In a significant move towards long-term renewable energy planning, the Kuwait Oil Company awarded an advisory consulting contract for the development of a comprehensive Renewables and Hydrogen Masterplan, which sets ambitious targets of achieving 17 GW of renewable capacity and 25 GW of green hydrogen production in Kuwait by 2050.

In terms of thermal power, Kuwait intends to invite bids for the installation of gas turbine units at the Nuwaiseeb power plant (with a capacity of 3,600 MW) and the Subiya power plant (with a capacity of 900 MW). Another major project, which is reported to be in the bid evaluation stage, is the KD1.2 billion Al-Zour North IWPP Phases Two and Three.

In the water desalination sector, the Kuwait Institute for Scientific Research plans to build a pilot seawater desalination plant in Doha with a capacity of 50 million gallons per day, making it the country’s ninth plant, according to Al Rai newspaper.

The plant is claimed to be the first of its kind globally, utilising advanced technology that harnesses wasted and dissipated energy. Kuwait’s eight desalination plants currently produce 695.1 million gallons of water per day, with the Doha West plant leading at 170.4 million gallons, followed by the Al-Zour South plant at 145.2 million, and the rest contributing the balance.

Real Estate

Kuwait’s real estate market is demonstrating overall growth and stability, particularly in the commercial sector. The increasing involvement of the private sector in real estate development, coupled with the anticipated growth in tourism, presents promising opportunities for investors and developers.

According to the National Bank of Kuwait’s (NBK) latest economic insight report, real estate sales witnessed a broad-based improvement across all segments in Q4 2024, amid stronger demand in the investment and commercial segments especially. Real estate prices, meanwhile, logged their first quarterly increase in a year on rising investment and residential home prices.

Real estate sales surged in Q4 2024 by almost 28 per cent q/q (from a mild fall in Q3) to reach KD1,082 million, the highest level in more than two years, the report stated.

For 2024 as a whole, real estate sales posted their first annual gain since 2021, with the revival concentrated in the investment and commercial segments while residential sales growth continued to lag. The outlook for 2025 is positive, with expectations of growth in the non-oil economy, potential interest rate cuts and the prospect of legislative reforms, including a possible housing finance law.

According to NBK, the outlook for real estate activity in 2025 remains generally positive, with the increase in momentum recorded in Q4 expected to be carried through, helped by improving prospects for the non-oil economy and potential interest rate cuts.

Various legislative reforms could also affect the market, including recent amendments to the residency law, which provided owners and investors with 10-15 years residency, to the law regulating real estate ownership by non-Kuwaitis as well as a law allowing authorities to revise their service fees and regulate the living conditions of workers. These changes could reshape market expectations by increasing demand for investment and commercial real estate, though they might also be expected to exert upward pressure on rents, especially in housing for blue-collar workers.

According to a Kuwait Times report, implementing the Real Estate Developer Law is a significant step towards a regulated and stable housing market. Other issues that need to be addressed include resolving financing challenges for both developers and buyers, which is vital for project completion; and actively involving private developers in housing projects is crucial for efficient construction and increased housing availability, it added.

.jpg)

(1).jpg)