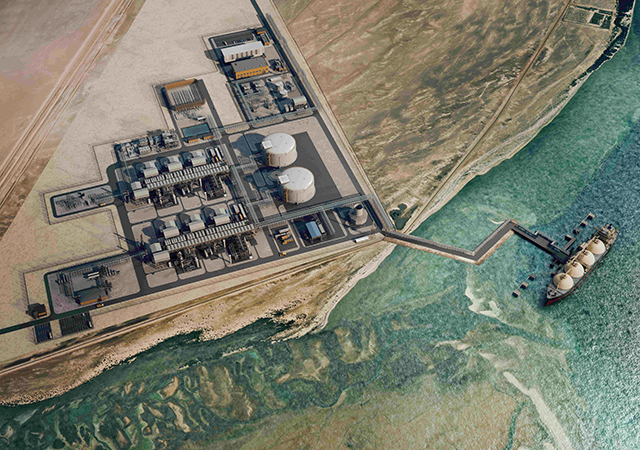

Construction of Adnoc Gas’s Ruwais liquefied natural gas (LNG) export terminal is now well under way, with commercial operations slated for 2028, according to DMS Projects, a leading source for project-related information.

This follows the award of a $5.5-billion engineering, procurement and construction (EPC) contract in March last year to French engineering and technology company Technip Energies, Japan-headquartered JGC Holdings Corporation and Abu Dhabi-based engineering, procurement and construction (EPC) company NMDC Energy. The project marked a critical milestone when it broke ground in November last year.

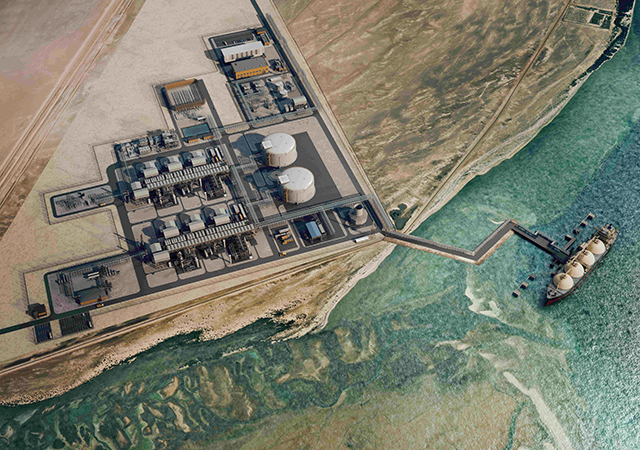

Initially planned for Fujairah Port, the project was relocated to Al Ruwais Industrial City in Abu Dhabi, near Ruwais Refinery West, after a comprehensive site evaluation. The facility comprises an LNG terminal, offsite and storage tanks and is designed to process and export up to 9.6 million tonnes per annum (mtpa) of LNG.

At the heart of the project are two natural gas liquefaction trains, each with a capacity of 4.8 mtpa. The plant will use electric-driven motors instead of conventional gas turbines and will be powered by clean energy. Hence, the Ruwais LNG Terminal is set to be the first export facility of its kind in the Middle East and Africa (MEA) region to operate entirely on clean power, making it one of the lowest-carbon-intensity LNG plants globally. The facility will integrate artificial intelligence and cutting-edge technology to enhance safety, minimise emissions, and optimise efficiency.

|

|

The first LNG train is expected to be operational by Q4 2028. |

The plant will more than double Adnoc’s LNG production capacity, aligning with global natural gas demand and the shift towards decarbonisation. It aims to supply key markets in Asia, including Pakistan, India, China, Japan, and South Korea. Up to 8 mtpa of Ruwais LNG’s output is already committed to customers across Asia and Europe.

Adnoc holds a 60 per cent share in the Ruwais LNG Terminal project, while Shell, BP, TotalEnergies, and Mitsui will each hold a 10 per cent stake in the project. Adnoc Gas announced in November 2024 that it expects to acquire Adnoc’s stake in the LNG project in the second half of 2028.

NMDC Group is currently undertaking a $200-billion dredging contract for the project. The contract encompasses extensive dredging operations, involving the removal of approximately 15 million cu m of material across a 5-km channel with a 245-m width. NMDC Group will also instal vital navigational aids, ensuring safe maritime access to the new LNG facility.

Other key contractors involved on the project include CB&I (now part of McDermott), which secured an estimated $250-$500 million lumpsum contract for two cryogenic tanks and associated infrastructure, with construction activities set to commence in November this year. CB&I’s UAE office will be in charge of tank construction, and the US office for engineering. The Saudi Arabia and Thailand offices are set to provide fabrication and modularisation support, respectively.

Early feasibility studies were conducted by KBR, followed by FEED work which was awarded to McDermott International. Al Jaber Energy Services undertook the site preparation works on the project under a contract awarded in December 2023.

Among other key players, Nuovo Pignone International, a subsidiary of Baker Hughes, has secured a $400-million contract to supply electric compression systems to power the LNG trains at the export terminal.

The first LNG train is expected to be operational by Q4 2028, with the second coming online in Q1 2029.

With construction progressing and multiple long-term supply agreements in place, Adnoc Gas is poised to solidify the UAE’s position as a key LNG supplier in the global energy market.

The Ruwais LNG terminal is expected to significantly increase the UAE’s LNG export capacity, strengthening its position in the global gas market. The facility’s focus on clean energy and advanced technology aligns with Adnoc’s sustainability goals.