The residential component of JEC.

The residential component of JEC.

Two aluminium smelters and an oil refinery are among the first mega industrial ventures that are expected to break ground at the ambitious $30 billion Jazan Economic City (JEC), being built by the Red Sea, 725 km south of Jeddah.

The groundbreaking ceremony for the project – the fourth economic city launched by the Saudi Arabia General Investment Authority (Sagia) – was held last November.

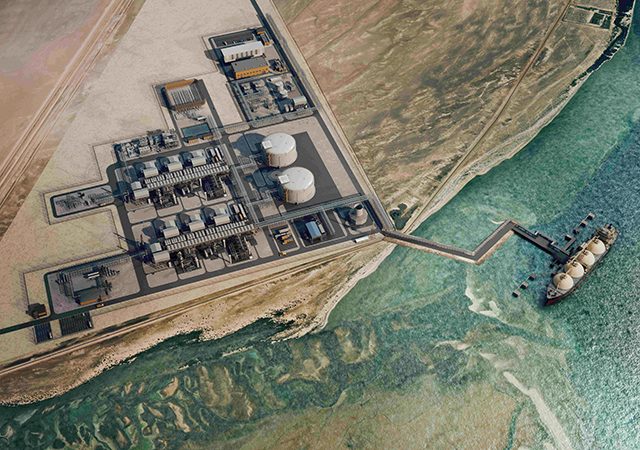

Jointly developed by MMC Corporation Berhad of Malaysia and the Saudi Binladin Group, the project will cover more than 100 sq km of land and include a seaport, an industrial zone, a commercial business district, residential areas, public amenities such as hospitals and schools, as well as other academic and vocational training institutions.

Oil refinery

Bids to build and operate the new oil refinery at JEC are expected to be invited this month. Abed Al Saadoun, the Oil Ministry spokesperson for Jizan, said the winner could be chosen by the end of this year.

He said the refinery will have a capacity of up to 400,000 barrel per day (bpd) but declined to speculate on costs. The Oil Ministry said last year that eight Saudi and 43 foreign companies had been prequalified to take part in the JEC tender. Aramco is listed as one of the prequalified companies.

When the project was announced in 2006, the government had said that the refinery would be 100 per cent privately owned and that an initial public offering would be held only once the refinery was deemed viable.

Smelters

In addition, two smelters are set to come up within the JEC, making them the first industrial units to set up within the economic city. The first one, which was launched last year, will be developed by Sino-Saudi Jazan Aluminum Limited, while the second one will be developed by a consortium led by Saudi Arabia’s Western Way for Industrial Development Company. Both the smelters will have a Chinese partner, showing the strengthening of Sino-Saudi ties in the manufacturing sector.

The first smelter will be jointly owned by Aluminum Corporation of China Limited (Chalco) with 40 per cent, MMC Corporation with 20 per cent and a Saudi consortium including SBG with another 40 per cent. Alumina feedstock for the smelter will be supplied by Chalco.

Work on the Phase One of the SR11.2 billion ($3 billion) Chalco aluminium smelter is expected to begin early next year (2009) and take 30 months to complete.

The project’s bankable feasibility study is currently under way and negotiations with the Saudi Arabian government over the allocation of fuel for the smelter’s associated oil-fired power station are also ongoing. Phase One will have an annual production capacity of 335,000 tonnes of aluminium, which will be raised to one million tonnes per year over two further phases of construction.

Also part of the project is a power plant with a generation capacity of 1,860 MW, which is estimated to cost $2 billion and cater to the smelter’s power requirements.

MMC intends to own at least 50 per cent of this power plant, which will form part of a larger power plant complex that is planned to have an eventual generation capacity of approximately 5,000 MW.

For the second smelter, China National Machinery Industry Corporation (Sinomach), and China Nonferrous Metal Industries (NFC) have signed a deal with Saudi-based Western Way for Industrial Development Company (WWIDC). The $4 billion Saudi Arabia Jazan Aluminum Power Project will be a large integrated turnkey project for aluminium oxides and electrolyzed aluminium. The plant, which consists of an oil-fired power plant with the capacity of 1,800 MW, an aluminium oxide plant with the annual capacity of 1.6 million tons, an electrolysed aluminium plant with the annual capacity of 660,000 tonnes and a dedicated bulk cargo harbour with the associated equipment. On completion, the second smelter is expected to be the largest aluminium and power project in the world, says a spokesman for Sinomach.

“We are very pleased with the overall progress of JEC, which commenced construction within one year of its launch. The addition of the second aluminium smelter and power plant with an investment close to $5 billion will bring the total capital invested in JEC to $20 billion,” says Amr Al Dabbagh, governor of Sagia.

“The original investment envisaged for JEC was $30 billion over a period of 25 years. We have achieved two-thirds of this amount one year after the project’s launch,” he adds.

Located at the confluence of available raw materials and abundant labour, JEC will also sit along the main Red Sea shipping route. Facilitating its high connectivity and accessibility will be its proximity to the new international airport located 60 km south; a new proposed road running east; as well as the future rail connection to Jeddah, situated approximately 600 km northwest.

The economic city, which focuses on four areas: heavy industries, secondary industries, human capital and lifestyle, will provide a high quality environment for key industries, technology exchanges, commerce and trade, employment opportunities, education and training, housing and a broad spectrum of socio economic activities for a projected population of 300,000 people.

Commercial, residential, community and industrial components are arranged in concentric circles with commercial business district (CBD) centre forming the city’s core. The primary industries will be situated southwards with an internal utility corridor connecting the proposed road to Jizan city. The secondary industries are located between the primary and high-tech industrial sectors in proximity to the workers housing areas.