Jizan Economic City ... expected to attract $30 billion in investments in 30 years.

Jizan Economic City ... expected to attract $30 billion in investments in 30 years.

Saudi Arabia is well on its way to creating a sound investment base through its new economic cities and a strong economic structure, says Global Investment House in a detailed report titled ‘Saudi Arabia Economic & Strategic Outlook – Building Cities to House Economic Growth’.

Gulf Construction provides some key excerpts:

After entering the World Trade Organisa-tion (WTO), the next big things coming out of the Saudi economy are the mammoth economic city projects, which are going to have a long-lasting impact on the macro-economic policies and on the fundamental structure of the Saudi economy.

Saudi Arabia’s nominal gross domestic product (GDP) is estimated to have grown by 12.4 per cent in 2006 to reach SR1,301 billion ($346.9 billion) while real GDP is estimated to have grown by 4.2 per cent to SR799.9 billion ($213.3 billion).

Saudi economy has been doing exceptionally well in the last few years led by oil-driven growth. Despite a strong growth in surplus, the government is judiciously spending on both oil as well as non-oil sectors which can be seen in the 16 per cent growth in the oil sector GDP in 2005 while the increase in industrial activity saw the non-oil industrial sector grow by 10.1 per cent in the same period.

Although dominated by oil sector, the government intends to diversify the economy and use it as a base for employment creation.

The nominal GDP over the period 2002-06 grew at a CAGR (compound annual growth rate) of 16.5 per cent as the high prices and production levels of oil in 2005-06 kept the GDP on a high growth path. However, in 2006, on account of Opec cuts due to declining prices, lower production levels affected the GDP as it recorded only a 4.2 per cent real growth as compared to 6.3 per cent recorded in the previous year.

Besides the government, the economy saw a growing interest from private and foreign players who have increased investments in the country. The private sector grew by 7.9 per cent in nominal terms in 2006.

The thrust on housing activity by the government as well as private sector can be seen in the 6.3 per cent growth recorded in the construction sector GDP (2005: 6 per cent), while the electricity, gas, and water sector grew by 5.5 per cent (2005: 4.9 per cent), and the transport and communication sector grew by 9.5 per cent (2005: 9.9 per cent).

In addition, the private sector’s contribution to GDP is expected to have been 44.8 per cent in real terms in 2006. The increased investments in the infrastructure sector, construction as well as industrial sector can be seen in the growth witnessed in the sector.

The strong capital expenditure projects that the Saudi government has lined up are expected to add significantly to the GDP growth in the coming years. Fiscal surplus currently witnessed is being invested in infrastructural projects, which will further benefit the other sectors of the economy. This will have the effect of broad-basing the economy (diversification) along with the job creation, which is much needed in the burgeoning economy.

Saudi Arabia’s 2007 national budget projects revenues at SR400 billion and expenditure at SR380 billion, resulting in a surplus of SR20 billion. The revenues are 38.9 per cent lower than 2006 actual figures of SR655 billion. It is to be noted that the actual revenues of 2006 were higher by 68 per cent than the budgeted revenues reported for 2006, indicating the conservative estimates maintained by the government while preparing the budgets.

In the 2007 budget, the government continues to pay special attention to impart quality education and improving the technical and managerial skills of its nationals. Manpower development continues to account for one of the largest allocations in the budget and accounts for 25.4 per cent of the total budgeted expenditure for 2007.

According to the 2007 budget report released by the Ministry of Finance, the public debt is expected to drop from SR475 billion in 2005 to SR366 billion, accounting for 28 per cent of the GDP. The government has been using its fiscal surplus in the last few years to settle part of its outstanding public debt. As a result, the debt as a percentage of the GDP has declined from 93.3 per cent in 2001 to the current 28 per cent. We expect that the debt reduction policy will continue in the wake of the strong surplus expected to be generated by the government.

The trade balance is estimated to record a surplus of $147.6 billion in 2006, registering an increase of 17.5 per cent. The current account balance increased to $102.7 billion in 2006 as compared to $90 billion recorded in the previous year. This indicates the strong growth in imports, which is indicative of the strong economic activity in the country. The current account balance is lower as compared to balance of trade as it includes outflow of funds on account of services and repatriation of funds by expatriate workers.

Saudi Arabia has been the largest oil producer in the GCC and accounts for almost 10 per cent of the world’s oil production. Most of the kingdom’s oil reserves are controlled by the state-run Saudi Aramco. According to Ministry of Petroleum and Mineral Resources, total crude oil reserves amounted to 264.2 billion barrels at the end of 2005 in 82 discovered oil fields. The production increased from 3.25 billion barrels in 2004 to reach 3.4 billion barrels in 2005, out of which 2.6 billion was exported.

To cater to the huge demand for oil and gas emanating from developing countries and to keep oil prices stable, the government has initiated various programmes to increase production levels. Saudi Aramco’s projected investments in crude oil production, NGL and ethane, exploration, refining, marketing and international operations, shipping and support services amount to $45.3 billion starting from 2007 up to 2011.

The kingdom’s production capacity stands at 11 million barrels per day (mbpd). To gradually increase this to 12.5 mbpd will require numerous upgrades to both old and new fields and reservoirs, which have already been identified for capacity increases.

The Saudi gas reserves are estimated at 243 trillion cu ft, ranking fourth in the world. Most (around 60 per cent) of its currently-proven natural gas reserves consist of associated gas, mainly from the onshore Ghawar field and the offshore Safaniya and Zuluf fields. Saudi Aramco’s onshore exploration activities are in high gear to support the existing gas plants and add new reserves. During the next 10-year period, Aramco will add 50 trillion cu ft of non-associated gas reserves. By the end of 2009, Aramco anticipates a significant increase in gas development well completions. It is planning to drill and complete more than 300 new gas development wells during the coming five years.

Saudi Aramco has been pursuing major opportunities for building new export refineries and integrating existing refineries with new petrochemical projects.

Saudi Arabia has become a hub of petrochemical industry thanks to initiatives such as Jubail I and Jubail II. Its petrochemicals output was expected to go up from 40 million tonnes per year (tpy) in 2005 to 75 million tpy by 2010. The total production of Saudi Basic Industries Corporation’s (Sabic) manufacturing complexes was 49.1 million tonnes in 2006 compared to 46.7 million tonnes reported in the previous year, registering an increase of 5 per cent. A total of 38.5 million tonnes was marketed in 2006 compared to 36.6 million tones reported in 2005.

As part of its expansions plans, the company plans to spend up to $74 billion on 60 projects in Saudi Arabia in the next 14 years.

The country is attracting foreign participation as seen in Sabic’s and Exxon-Mobil’s recent announcement that they have begun work on a feasibility study to define a potential project that would grow their two joint petrochemical ventures at Yanbu and Jubail.

In the GCC, Saudi Arabia accounts for about 48 per cent of the region’s total power generating capacity. The formation of Saudi Electricity Company (SEC) opened the door to private sector construction of new power plants on BOO (build-own-operate) and BOT (build-own-transfer) bases. In Saudi Arabia, over 2000-2005, power-generating capacity increased at a CAGR of 4.6 per cent from 25,790 MW in 2000 to 32,301 MW. During 2005, the capacity was increased by 1,775 MW or up by 5.8 per cent over 30,526 MW reported in 2004.

Out of the total capacity addition during 2005, SEC added 1,340 MW, Saline Water Conversion Corporation (SWCC) added 94 MW and other producers added 341 MW. SEC accounted for almost 90 per cent of the country’s total power generation capacity while SWCC and other large producers accounted for 8 per cent and 2 per cent respectively in 2005.

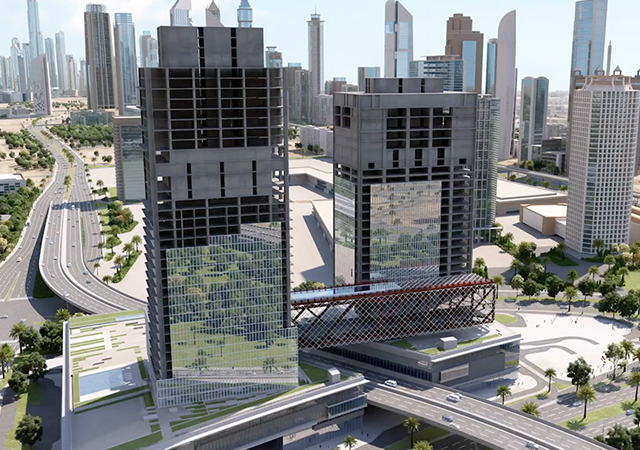

The government has done a commendable job in making Saudi Arabia a key destination for companies intending to set up their industrial units. The kingdom’s ambitious plan to dramatically raise its investment competitiveness in a bid to place Saudi Arabia among the world’s Top 10 globally competitive investment destinations by 2010 can be best seen in the “Economic Cities” announced in recent times. According to Sagia, the four cities are expected to attract investments worth more than SR300 billion and create more than a million jobs within the next 10 to 20 years. Sagia, supported by the Custodian of the Two Holy Mosques and the Crown Prince, has launched three integrated economic cities in 2006, one each in Hail, Madinah and Jizan, while the King Abdullah Economic City in Rabigh was launched in 2005 (see separate report).

A study is under way to establish two more economic cities, one in Tabuk and the other in the Eastern Province in 2007. We believe that these economic cities will help in reshaping the Saudi economy in terms of attracting private/foreign investments, thereby helping the overall goals of broad-based socio-economic development of the country.

The huge projects announced in the Saudi construction sector also have positive implications for the country’s cement sector.

Saudi Arabia’s Communica-tions and Information Techno-logy Commission (CITC) has announced plans for liberalizing the telecom sector. Around eight consortia, comprising Saudi and foreign investors and specialised international companies, are vying to win the kingdom’s second fixed-line phone licence and third mobile phone licence. The new licences will break the monopoly of STC on landline phone services and add at least a third mobile phone operator.

After the strong growth seen in 2003-05 period, the Saudi market underwent a correction and ended 2006 at 7,933.3 points, down a whopping 52.5 per cent over the 2005 close of 16,712.64 points. It witnessed strong volatility last year as it touched a high of 20,634.86 points on Feb 25, 2006 and low of 7665.73 points recorded on Dec 3, 2006. The market capitalisation at the end of the year reached $326.3 billion (2005: $645.9 billion). However, the strong sell-off seen in the secondary market did not wane investors’ as well as corporates’ interest in the primary markets. The aggregate earning of the Saudi corporates was SR75.9 billion in 2006, up 18.1 per cent as compared to the previous year. The Saudi corporate sector especially the bluechip companies have rewarded their investors with liberal dividends. We believe that the corporate profitability will continue to show good growth in 2007-08 as the economy moves ahead backed by spate of reforms, improved regulations, increased liquidity and trickle down effect of mega-projects under way in the country.

Budget allocations

In the 2007 budget, the allocation towards human resource development has increased to SR96.7 billion as compared to SR87.2 billion allocated in the 2006 budget. We believe that increased government expenditure is a step in the right direction as it will equip the nationals in taking up jobs or enable them start their own business and take advantages of the growth in the economy. This is also important in the wake of small and medium enterprises (SMEs), which are the booming in the country as a trickle-down effect of the huge expenditure by the government and the private sector.

The new budget for human resources includes capital expenditure of SR29 billion. The appropriations in the category include:

• 2,000 new schools (in addition to 4,800 schools currently under construction);

• Rehabilitation of 2,000 existing school buildings;

• Opening of four new universities in Tabuk, Abha, Najran, and Girls University in Riyadh;

• New university hospital (in addition to five university hospitals under construction);

• Completing infrastructure of other universities; and

• Building of 56 colleges, and opening of 19 new colleges.

In the technical and vocational training sector, the new budget includes seven new technical colleges, 12 technical and vocational training centres, opening of five new technical institutes for girls, and nine vocational training centres.

The increase in the population has compelled government to increase the finances earmarked for health and social affairs where the total expenditure amounted to SR39.5 billion in the 2007 budget, recording an increase of 47.3 per cent over the allocation made in the previous budget.

The allocations for health-related expenditures include a capital spending of SR5.6 billion on new projects that include over 380 primary care centres, 13 hospitals with a capacity of 1,100 beds, expansion and development of existing health facilities, and furnishing newly-completed hospitals. Meanwhile, there are 64 hospitals under construction, which will add 9,850 beds.

With respect to social services, the new budget includes an allocation to build social centres, social welfare and labour offices.

For municipality services, the total allocation in the 2007 budget amounted to SR15.5 billion. New project include intercity roads, intersection and bridges, streetlights, and cleaning-related projects. Out of the total expenditure allocation of SR13.6 billion in the transportation and telecommunication sector, capital spending amounts to SR9.3 billion. New projects to be taken up this year include roads extending a total distance of 8,000 km – in addition to the 16,000 km of roads currently under construction, ports, airports, and railroads development, and new postal services.

The government continues to pay special attention to the water, agriculture, and infrastructure sector where the total expenditure allocated in 2007 budget amounts to SR24.8 billion. However, here the majority of the expenses are capital in nature, which includes projects for water, sewage, and desalination projects amounting to SR16.4 billion. In addition, the budget includes appropriation for the two industrial cities of Jubail and Yanbu, agricultural projects and flour mill projects.

Electricity & Water

Saudi Arabia has a per capita power generation capacity of 1,313 W as against GCC region’s per capita average of 1,835 W.

The formation of SEC has opened the door to private sector construction of new power plants on BOO and BOT bases and the country saw its first independent power producer (IPP) come online when Saudi Petrochemical Company’s (Sadaf) co-generation power plant with a capacity of 250 MW came on steam in June 2005. It was the first captive IPP cogeneration plant in the Middle East.

Among the upcoming projects, SEC is developing several new power plants at a total investment outlay of SR46.5 billion ($12.4 billion), which will add a total of about 19,175 MW of power generation capacity during the period 2006–2017 (see table 1). The company will also invest SR8.0 billion ($2.1 billion), over 2006-2017, in transmission projects, which will have length of 3,860 km.

The Water and Electricity Company (WEC) was established by the Supreme Economic Council to promote private investments in independent water and power projects (IWPP). It will be the single off-taker of the power and water produced by the IWPPs that will be implemented on a BOO basis with a concession of 20 years.

Although as per the original plan, four IWPPs had been planned, recent media reports indicate that WEC has cancelled the Al Jubail project (1,100 MW of power and 340,000 cu m per day of water) - the fourth in WEC’s IWPP series. The size of Ras Al Zour project has been increased to 3,000 MW of power and 1 million cu m of water per day from the earlier envisaged 2,500 MW of power and 800,000 cu m per day of water. The initial stage of the IWPP will entail three projects (as in Table 2).

The transmission and distribution of power and water produced by the IWPPs will require additional investments of $3.2 billion.

Other IPPs are also planned. Saudi Aramco, Sabic and Sadaf are forming the driving forces in power generation enterprises for their captive plants usage.

In late 2003, Saudi Aramco launched four new IPPs – at Ras Tanurah (150 MW); Juaymah (300 MW); Uthmaniyah (300 MW); and Shedgum (300 MW) – with a combined capital investment exceeding SR2 billion. These projects have been established in cooperation with the private sector (consortium of Saudi Oger and International Power) on a BOOT basis (with a concession period of 20 years).

Ma’aden (Saudi Arabian Mining Company) is planning an independent power generation plant at Ras Al Zour, which will have capacity of 1,800 MW to meet demand for its integrated aluminum complex.

Marafiq (Power and Water Utility Company for Jubail and Yanbu) is also planning an IWPP in the industrial city of Jubail with an estimated cost of SR9.4 billion ($2.5 billion). However, the project cost is expected to rise in line with the change in scope of the Request for Proposals (RFPs).

It will be implemented in two phases. The first phase will have capacity of 2,500 MW of power and 800,000 cu m of desalinated water per day, which will be implemented by 2009. This is as per the revised RFP as compared to originally planned 2,400 MW of power and 300,000 cu m of water per day. Phase II will have capacity of about 1,500 to 2,000 MW of power and 100,000 cu m of water per day and an announcement is yet to be made on its launch date.

Marafiq was established by Sabic, Saudi Aramco, Royal Commission for Jubail and Yanbu and the Public Investment Fund to offer electricity and water to the twin cities of Jubail and Yanbu. It currently owns and manages the 1,060 MW power plant, located in Yanbu industrial city, and various water treatment plants such as cooling water, drinking water, sanitary waste water, and industrial waste water facilities.

Demand for power in Saudi Arabia is growing at the rate of 6 per cent per annum. The peak demand has grown by about 7 per cent a year, which is likely to be in double digits over the next few years, mainly because of the massive investments being planned in mega energy, industrial and real estate projects.

Expanding population and social developments are other major drivers for demand at this high rate. Apart from these domestic demand drivers, the upcoming GCC power grid will also add to the demand growth and Saudi Arabia will have a major role to play as it has the largest capacity in the region.

To fulfill the likely growth in demand, several IPPs are coming up apart from the new projects under SEC. As per Sagia, overall power capacity in Saudi Arabia is forecast to grow to 59,000 MW by 2024 requiring an estimated investment of SR430 billion ($115 billion).

To achieve this target, the ministry will present several joint projects to the private sector, local and foreign, in order to increase power generation capacity. With electricity demand expected to more than double over the next 20 years, an encouraging number of investors have shown interest in establishing new power generation companies in the country. The regulatory authority (ESRA) will licence newly-formed companies while the SEC will handle electricity distribution.

At the moment, the total number of electricity subscribers exceeds 4.7 million in Saudi Arabia, where more than 10,160 cities, towns and villages have been electrified. It has been predicted that by 2008 the power supply will cover all settlements and villages not previously supplied with electricity, raising the number of electrified cities and villages to 11,112. The company also has targeted to increase its customer base to 5.7 million by 2009. Thus, the sector has tremendous growth potential in the booming economy, which will witness growing demand not only from the home turf but also from the region with the upcoming GCC power grid.

Infrastructure

In order to improve the infrastructure services in the country, an investment of $443 million has been envisaged to increase the capacity of the Jeddah Islamic Port (JIP) by 45 per cent.

Saudi Railway Organisation (SRO) is also planning to establish two more railway lines linking Jeddah and Jizan as well as Taif and Khamis Mushayt. SRO has already signed a SR3.3 million contract with an engineering consultancy firm in order to conduct a feasibility study of the two railway lines. The Supreme Economic Council had approved three railway projects: A Landbridge linking the Kingdom’s east and west; a Makkah-Madinah rail link; and the northern railway linking Riyadh with the Jalamid region.

The Landbridge project involves construction of 950 km of new tracks between Riyadh and Jeddah and another 115-km line between Dammam and Jubail. It is the cornerstone of a massive multi-billion riyal railway expansion project and will be the first rail link between the Red Sea and the Gulf (The project has been delayed because of difficulties in acquiring land).

Airports in Jeddah, Madinah and Tabuk will be expanded at a cost of SR30 billion in order to meet the growing number of passengers and the requirements of two new domestic private airlines, according to the General Authority for Civil Aviation (GACA). The Civil Aviation Authority has already launched a $1.5 billion expansion for Jeddah’s King Abdul Aziz International Airport (KAIA), which is designed to accommodate the world’s largest aircraft, including A380s and will increase the airport’s annual capacity to 21 million passengers (see separate report).

Construction & Real Estate

With the strong liquidity and increased investors’ interest to park their funds within the country, real estate sector has received a major boost. The contribution of the construction sector in the GDP (see table 3) increased from SR41.7 billion in 2000 to SR54.8 billion in 2005. Gross fixed capital formation too has recorded a strong increase from SR123.3 billion in 2000 to SR174.3 billion in 2005 and is expected to grow at a much faster rate in 2006-08 periods.

The economic cities, discussed earlier, will constitute mega-construction projects of all types and are likely to spur allied real estate activity in the nearby regions.

Among other developments, Emaar Middle East (EME), a joint venture between UAE-based Emaar Properties and Saudi-based real estate company Al Oula Development, has announced the development of Jeddah Hills - a SR42 billion ($11.2 billion) community located in the port city of Jeddah. The development marks the second major foray into Saudi Arabia for Emaar Properties, with the massive 2,286-hectare Jeddah Hills project following the announcement of the King Abdullah Economic City.

Another major development is Dar Al Arkan Real Estate Development Company’s Riyadh View, a SR6 billion residential community with 8,000 housing units in Riyadh. The residential project, 100 km outside the capital, Riyadh, will target middle-class citizens and will stretch over 5 million sq m of land. According to the company, the project is in line with the second phase of Dar Al Arkan’s strategic plan launched last year, which aims at developing 65,000 residential units by the end of 2009.

The SR12 billion Jabal Omar real estate project in Makkah entered a new phase with the Cabinet approving the formation of a joint stock company late last year to carry out the project. Makkah Construction Company, which holds the largest stake in Jabal Omar, said the project would provide housing facilities for more than 160,000 pilgrims. The project includes building of 40 residential towers, five-star hotels and commercial centres, construction of a road parallel to Um Al-Qura Road and parking for thousands of vehicles.

According to Habib Zain Al-Abidine, undersecretary at the Ministry of Municipal and Rural Affairs, some 25 new real estate projects are being carried out in the central region including Jabal Omar, Shamiya and Khandama projects. Economists say new real estate projects around the Grand Mosque will draw investments in excess of SR100 billion ($26.7 billion).

Another key area is housing development. According to the Saudi Economic Survey, Saudi Arabia intends to build one million new housing units in the next five years to provide adequate housing accommodation to about 5 million citizens, through the participation of governmental authorities, as well as national and welfare organisations. The Ministry of Social Affairs, and some welfare organisations are also building about 35,000 Saudi traditional houses in various regions of the kingdom.

The eighth development plan indicates that the private sector would undertake to build about 875,000 housing units to fulfill part of the demand for housing, in different regions of the Kingdom.

Out of these housing units, about 225,000 would be built with the support and assistance of the government. The development plan also envisages provision of about 280 million sq m of residential land to meet part of the demand for housing, during the years of plan.

The new 2007 budget’s capital expenditure includes construction of numerous educational and vocational facilities. This will also provide fillip to the construction as well as contracting companies in the country.

Other major projects include Benaa City ($533 million); Jabal Khandama Real Estate project in Makkah ($1.71 billion); Jamarat Bridge project ($1.28 billion); Jowharah real estate project in Jeddah ($598 million); King Abdulaziz International Airport (KAIA) expansion project ($1.3 billion); Meridien Hotel Towers in Makkah ($278 million); Asia-Africa bridge in Tabuk ($1 billion); Saudi Construction Group’s Housing Project on the outskirts of Riyadh ($16 billion); Saudi Landbridge Project ($3 billion); and Wali Al Ahad Development in Makkah ($5 billion).

The government formed the Real Estate Development Fund (REDF) in the mid-1970s to address its housing problems. The REDF by 2006 had provided financing for some 613,000 housing units. In 2004, the fund was running low on capital and received a further SR9 billion ($2.4 billion) from Sama. Another injection of the same amount was made in 2006, as the situation became more pressing. The REDF’s current capital base stands at SR92 billion ($25 billion).

In a major development, Saudi-based Dar Al-Arkan Real Estate Development Company has announced that it will form the first housing finance company to take advantage of upcoming mortgage regulations. The firm, to be launched shortly with a capital of SR1 billion is an alliance with Arab National Bank, the International Finance Corporation, the private sector arm of the World Bank, and Housing Development Finance Corporation of India. The company will develop mortgage finance in Saudi Arabia, a sector that is expected to grow rapidly when a new regulation governing mortgage foreclosure is approved by the government.

Cement

The Saudi construction sector has huge projects worth $175 billion believed to be identified, and projects worth about $120 billion already announced, which spells good news for the country’s cement sector (see table 4). The eight listed cement companies in the kingdom have been operating at over-100 per cent capacity utilization rates for the last two years to meet the booming domestic demand. While exports have reduced to almost a trickle, import duties have recently been withdrawn to enable freer cement movement into the country.

Cement prices – both bulk and retail – have ruled at high levels for more than a year now. This state of affairs has led almost all the eight cement companies to launch capacity expansions, with work on most of them well under way. The near-doubling of capacities that should be going on stream in phases by 2008, have, purportedly, been planned in anticipation of a sustained high cement demand in the years to come.

In May last year, Eastern Province Cement Company (EPCC) launched its third clinker production line, increasing the company’s annual capacity to 3.3 million tonnes of clinker. This year is expected to see about 34 per cent of the new capacities, or 29 per cent incremental capacity, going on stream, while 2008 is likely to see the 46 per cent of the new capacities, or 30 per cent incremental capacity, going into production, including the single biggest capacity expansion of 6.6 million tpy from Saudi Cement.

The Western and Eastern regions currently dominate the Saudi cement capacities with a combined 56 per cent of the total clinker capacities (see table 5) – 29 per cent in the Eastern region and 27 per cent in the Western. Post-expansions, the combined share of the two regions will go up marginally, with 32 per cent and 26 per cent share of the total capacities, respectively. The capacity of the Eastern region is expected to jump up 7.6million tpy, or 36 per cent of the new capacities – the single largest increase among all the regions in the Kingdom, or by 121 per cent in absolute terms, on the back of a 6.6mtpy expansion (31 per cent of the total projected capacity expansions across all companies) by Saudi Cement Company. The Northern and Southern regions’ shares are likely to decline – from 6 per cent and 18 per cent respectively, to 4 per cent and 12 per cent respectively. The single-biggest gainer in terms of the percentage share of total clinker capacities is the Central region, whose share in the total capacities is likely to jump from 20 per cent currently to 25 per cent, or by 147 per cent in absolute terms, by 2008. This is on the back of about 30 per cent of the new capacities coming up in this region.

The situation is further complicated if we take into account industrial licences issued/ renewed for additional cement capacities approximately worth about 40 million tpy, involving an investment of over SR18 billion. Out of these, projects amounting to about 11million tonnes are believed to be in advanced stages of finalisation. While how many of the other licences will actually get on to the drawing boards and, thereon, to ground-zero is to be seen, it serves to show the enthusiasm for putting in large investments in the Saudi cement sector.

During 2006, cement production rose to 27.03 million tonnes as compared to 26.03 million tonnes in 2005. Domestic deliveries stood at 24.8 million tonnes (88.2 per cent of production) as compared to 24.4 million tonnes in 2005 (93.6 per cent of the total). Saudi Cement achieved the highest production numbers, clocking 4.9 million tonnes in 2006 as compared to 5.0 million tonnes in 2005. Southern Cement was the second largest producer, producing 4.58 million tonnes in 2006, as compared to 4.56 million in 2005.

Though the cement companies have plans to ramp-up their production levels, it will take some time and till then the demand-supply gap needs to be filled through imports. As a result of EPCC’s new clinker line coming onstream this year, it recorded strong growth in cement production, which reached 3.22 million tonnes in 2006 as compared to 2.5 million tonnes reported in 2005.

The aggregate profit of listed cement companies in Saudi Arabia reached SR3.68 billion in 2006, up 18.2 per cent from SR3.11 billion reported in the previous year. The highest growth was registered by EPCC, which reported a 49.2 per cent growth in net profit in 2006 which can be attributed to increased production as it ramped up its capacity in 2006.

With the increase in production due to the capacity increases planned in next couple of years, we expect profits of cement companies to show good growth. We believe that the new initiatives such as the economic cities will provide incentive to increase capacity, which will translate to increased revenues and profits.

Industrial sector

The government has exerted concerted efforts to make Saudi Arabia a key destination for companies intending to set up their industrial units by providing investment benefits, setting up a world-class infrastructure and by making the entry in the industrial sector lucrative for foreign as well as private investors.

One of the major milestones in government efforts to woo industrial investments has been Jubail, which has been named as the city with the best economic potential in the Middle East by the Financial Times’ Foreign Direct Investment (fDi) magazine in the past and it has gone ahead in attracting foreign investment further. The Jubail II project, which covers an area of 1,950 hectares, is expected to cost SR2.54 billion and attract investment projects worth SR220 billion.

Since its inception in April 2000, Sagia has licensed 3,608 projects (up to March 2006) worth SR292.7 billion. Foreign investors, contributed 38.3 per cent, or SR112.2 billion of the total licensed investments, whereas the Saudi share amounted to SR180.5 billion or 61.7 per cent of the total investments In January this year, Sagia announced its target to licence investment projects worth more than SR300 billion during this year.

The second quarter 2006 results of Sagia released recently indicate the launch of two economic cities along with measures to lure domestic and foreign investments aimed at transforming the kingdom into a more competitive investment destination. The value of investment licences issued during second quarter of 2006 rose thanks to government attempts to improve the economic and investment climate in the kingdom, stronger confidence in the Saudi economy, as well as joining the WTO.

Sagia’s One-Stop-Shop (OSS) issued 505 licenses with a total value of SR72 billion, a 107 per cent rise over the same period last year when 219 licenses were issued at an aggregate value of SR35 billion.

Refineries

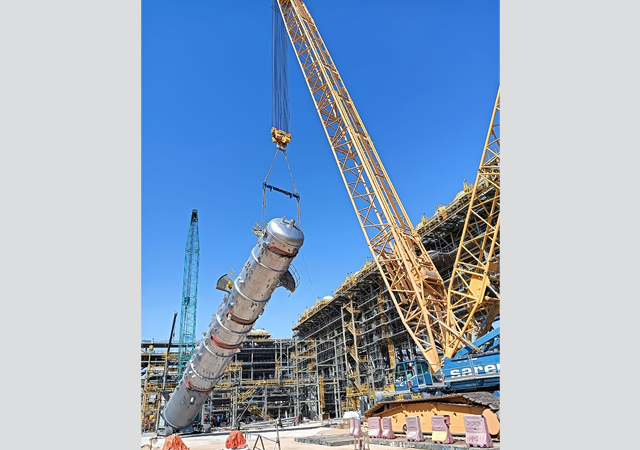

Saudi Aramco has been pursuing major opportunities for building new export refineries and integrating existing refineries with new petrochemical projects. Saudi Arabia announced that it was studying the possibility of building a crude oil refinery at Jizan on the Red Sea in a bid to boost the kingdom’s position as a major oil refiner. The refinery, which will be semi or full-conversion plant, will produce between 25,000 and 400,000 barrels a day. Saudi Aramco is also in the final stages of formulating a memorandum of understanding with Dow Chemicals to build an estimated $15 billion refinery and petrochemicals complex at Ras Tanurah.

Total SA and ConocoPhilips are targeting early to mid-2008 for the sale of shares on two export refinery projects to be developed with Aramco, at a price of up to $7 billion each. Total, which will build the refinery jointly with Aramco at Jubail on the Arabian Gulf coast, will launch a 30 per cent initial public offering “as soon as front-end engineering design is completed in early 2008”, according to senior vice president for refining and marketing. Each refinery will process 400,000 barrel a day of heavy crude into products such as gasoline, low-sulfur diesel and naphtha for markets in Asia, Europe and the US.

Both projects are scheduled to start operations around mid-2011. Saudi Aramco and Total in May 2006 signed a comprehensive Memorandum of Understanding (MoU) covering the planned development of the refinery in Jubail. Saudi Aramco and ConocoPhillips also signed a MoU in the same month to conduct a detailed evaluation for the proposed development of a 400,000-barrel-per-day, full-conversion refinery at the Rea Sea port of Yanbu.

Petrochemical Industry

Saudi Arabia has lined up ambitious plans to increase its petrochemical production and become a leader in the world petrochemical market.

According to Sabic’s CEO Mohammed Al Mady, Saudi petrochemicals output was expected to go up from 40 million tpy in 2005 to 75 million tpy by 2010. The kingdom’s share in the global petrochemicals industry would hence go up from 7 per cent to 13 per cent in the same period.

Major expansion plans include:

• A joint venture between Sabic and Al Kayan, which will comprise a 2 million tpy ethane/butane cracker, including benzene extraction facilities; a 700,000 tpy polyethylene plant; a polypropylene plant with capacity of at least 350,000 tpy; and a 530,000 tpy ethylene glycol unit;

• Sabic and Exxon-Mobil’s project that would grow their two joint petrochemical ventures at Yanbu and Jubail. The firms have begun work on a feasibility study on the project, which would target domestic supply of carbon black and rubber and thermoplastic specialty polymers (EPDM, TPO, Butyl, SBR/PBR) to serve emerging local and international markets. The expected project start-up date is 2011;

• Saudi European Petrochemical Company (Ibn Zahr), a subsidiary of the Sabic has awarded Samsung Engineering Company of South Korea, a contract for the construction of 500,000 tpy polypropylene plant. The plant will be erected at the Ibn Zahr complex in Jubail and is planned to be completed by the third quarter of 2008. This is the third polypropylene plant being built at Ibn Zahr;

• Yansab’s greenfield project will produce 1.3 million tpy of ethylene; 770,000 tpy of ethylene glycol; 500,000 tpy of LDPE; 400,000 of HDPE; 400,000 tpy of polypropylene; 100,000 tpy of butene-1 and butene-2; and 250,000 tpy of benzene, xylene and toulene compound.

.jpg)

.jpg)

.jpg)

.jpg)