The $23-billion King Salman Park ... set to be the world’s largest urban park.

The $23-billion King Salman Park ... set to be the world’s largest urban park.

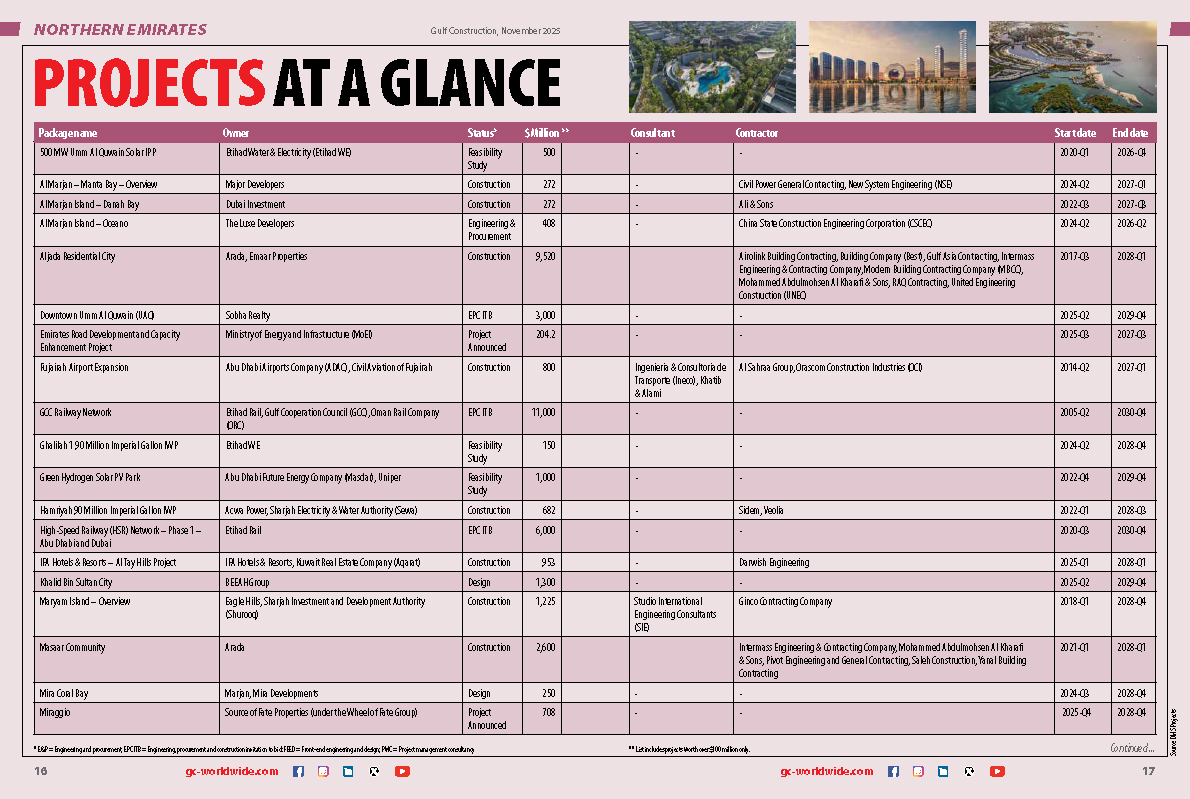

Saudi Arabia’s capital is in the midst of a massive urban transformation, with a skyline and infrastructure pipeline that underline its drive to become a global hub for commerce, culture, tourism and sport, in line with the kingdom’s Vision 2030 ambitions.

Construction output across the kingdom reached $148 billion in the first half of 2024, up 4.6 per cent year-on-year, according to Knight Frank, with Riyadh accounting for almost two-thirds of awarded contracts since 2020. The capital’s $195 billion development plan includes 340,000 new homes, 28,800 hotel rooms and millions of square metres of retail and office spaces.

Riyadh is preparing to host two global events, the 2030 World Expo and the 2034 FIFA World Cup, which are propelling both the construction and real estate sectors. Work on the 2030 World Expo Riyadh has been flagged off with the appointment of the American engineering, procurement, construction, and project management company Bechtel as the project manager for the Expo site. The six-month event is projected to attract more than 40 million visitors and inject nearly $95 billion into the economy.

|

|

King Salman International Stadium ... designed to be the largest-capacity stadium in Saudi Arabia. |

The World Cup will see the construction of 11 new stadiums and refurbishment of four of its existing venues – eight of which are slated for Riyadh, with several being entirely new constructions, including the mega King Salman International Stadium adjacent to King Abdulaziz Park in northern Riyadh and the Prince Mohammed bin Salman Stadium in the Qiddiya entertainment hub.

The city’s ambitious projects are reshaping its urban fabric. The high concentration of mega projects within the capital signifies a deliberate and intensive government strategy to transform the city into a leading metropolis on the world stage.

|

|

New Murabba, a $50-billion new downtown anchored by the cube-shaped Mukaab. |

New Murabba, a $50-billion new downtown anchored by the cube-shaped Mukaab, is advancing site works and tendering multibillion-dollar packages, while having signed deals with PIF-backed Alat and US firm Falcon’s Creative Group to integrate technology and immersive experiences.

Qiddiya City is gearing up to open key attractions including Six Flags Qiddiya and the Aquarabia water park (see Gulf Construction, September 2025).

Diriyah, a $63-billion cultural and heritage development, has flagged off contracts worth a total of SAR18.75 billion ($5 billion) in the first half of the year and launched a number of new ultra-luxury residential projects, signalling the rapid acceleration of the project. The Diriyah Gate project is transforming the historical city of Diriyah into a world-class cultural and lifestyle destination, celebrating the kingdom’s rich heritage (see Page 28).

|

|

The first phase of Sports Boulevard – a 135-km linear park – is already open. |

Other landmark initiatives include the $23-billion King Salman Park, set to be the world’s largest urban park, and the Sports Boulevard, a 135-km linear park where the first phase is already open.

Plans on the anvil for the capital include a 2-km-tall tower as an anchor project for the ambitious North Pole development, though not many details have emerged in the public domain. Other mega-developments unveiled include The Pulse Wadi cybersecurity hub, designed by Hong Kong’s LWK + Partners, which will add a $3.2 billion innovation-focused district with 60 per cent of its footprint reserved for green space.

|

|

King Salman International Airport ... planned to be the largest in the world. |

Transport and infrastructure are expanding in tandem: The capital has just invited companies to participate in a public-private partnership (PPP) project that involves connecting King Salman International Airport, King Abdullah Financial District (KAFD), and Qiddiya City in just 30 minutes, via a high-speed rail line of 250 km/h.

The Riyadh Metro, a $22.5 billion driverless network spanning 176 km, is being extended. Plans are also advancing for a seventh line and the $7-billion Landbridge Railway, which will connect Riyadh with Jeddah. On the aviation front, Bechtel and Parsons are managing the delivery of the new King Salman International Airport, planned to be the largest in the world. The King Salman International Airport Development Company has also signed a partnership with the Riyadh Infrastructure Projects Center (RIPC) to strengthen collaboration on the airport’s infrastructure development, focused on adopting best practices, and supporting innovation and sustainability initiatives (see Saudi Focus, Page 93).

Housing remains central to Riyadh’s transformation. State-backed ROSHN Group and the National Housing Company are rolling out vast residential communities, including SEDRA and Banan City, while reforms to stabilise land and rental prices aim to address affordability pressures. The government has approved foreign ownership of property in designated zones from 2026. This is expected to further boost demand which has seen a 63 per cent surge in residential sales values in Riyadh in the first half of 2025, according to leading real estate consultant Cavendish Maxwell.

In a bid to enhance quality, efficiency, and safety in project planning, execution, and oversight, the Riyadh Infrastructure Projects Centre has made a unified Infrastructure Code mandatory for all developments, setting technical standards across energy, transport, water and sanitation.

ROAD & RAILWAYS

Saudi Arabia is investing heavily in its transportation infrastructure, with notable progress reported on the expansion of the Riyadh Metro network, the ambitious Landbridge railway project and major road development projects.

The Royal Commission for Riyadh City (RCRC), in partnership with the National Center for Privatization & PPP and Qiddiya Investment Company, has just invited companies to express their interest in bidding for the construction of the Qiddiya High-Speed Rail Project, under a Public-Private Partnership (PPP) model.

The project aims to connect King Salman International Airport, King Abdullah Financial District (KAFD), and Qiddiya City in just 30 minutes, via a high-speed rail line of 250 km/h. Companies are required to register their interest by October 12 (see Saudi Focus, Page 90).

This follows the recent award of a contract by RCRC, worth up to $900 million, to the Arriyadh New Mobility Consortium, led by Italy’s Webuild, for the 8.4-km Line 2 (Red Line) extension of the Riyadh Metro. The project includes five new stations, mostly underground, linking King Saud University with Diriyah.

Meanwhile, Saudi Arabia Railways (SAR) has invited expressions of interest from leading contractors for the construction of a new railway line, called the Riyadh Rail Link, that will run from the north of Riyadh to the south, according to MEED. The project is expected to become a key component of the $7-billion Saudi Landbridge railway project, featuring more than 1,500 km of new track. The planned network, primarily intended for freight, includes a new 900-km link between Jeddah on the Red Sea coast and Riyadh.

The scope of the contract encompasses the construction of a 35-km-long double-track rail line, connecting SAR’s North-South railway network with the Eastern Railway network.

Meanwhile, a striking project that has been revived is the transit system at King Abdullah Financial District. Egis, a global leader in architecture, consulting, construction engineering and operations and maintenance, has been appointed as the site supervision consultant (SSC) for the revitalisation of 3.6-km monorail project, which will complement KAFD’s innovative mobility infrastructure, which includes the world’s longest skywalk network, enabling seamless connectivity throughout the district. The monorail is integrated with the broader Riyadh Metro.

In the roads sector, the RCRC is implementing the Second Group of the Riyadh Ring Roads and Main Axes Development Programme, involving eight major road projects at a total cost of over SAR8 billion.

Parsons Corporation was awarded a three-year contract by RCRC to provide programme management office (PMO) services for its main and ring roads programme, encompassing approximately 500 km of new and improved road corridors.

HOUSING

Saudi Arabia’s housing sector continues to expand rapidly, driven by the kingdom’s Vision 2030 goals to increase homeownership and provide quality housing for its citizens. State-backed developers like ROSHN Group and the National Housing Company (NHC) have large-scale projects and awarded significant construction contracts across the country.

ROSHN Group, powered by PIF, is spearheading two community developments in Riyadh: SEDRA and WAREFA. Last month, the multi-asset developer opened up sales for SEDRA’s fifth phase, which covers more than 1.3 million sq m, and will include over 2,000 homes. The overall project will offer more than 30,000 homes when completed.

WAREFA will cover 1.4 million sq m and feature 2,380 homes and 20 amenities. Infrastructure work is nearing completion on the project (see Page 24).

The National Housing Company has embarked on 11 key residential projects in the Khuzam area of Riyadh, featuring over 10,000 units catering to diverse needs. NHC has also joined forces with Egypt’s Talaat Mostafa Group to develop Banan City, a $12-billion smart city project in northeast Riyadh that will include over 27,000 residential units.

REAL ESTATE

Residential property sales values in Riyadh surged 63 per cent year-on-year to SAR65.7 billion in the first half of 2025, according to a report published by Cavendish Maxwell last month.

The report notes a 10 per cent increase in transaction volumes in Riyadh, which climbed to 35,600 during the same period. The city experienced significant price and rental growth for apartments and villas, with apartment prices jumping 10.5 per cent and villa prices rising 12.4 per cent year-on-year. Correspondingly, apartment rents increased 10.3 per cent and villa rents were up 14.4 per cent.

The surge in demand is attributed to Riyadh’s growing population and major national initiatives under Saudi Vision 2030, including the Riyadh Expo 2030 and FIFA World Cup 2034. The kingdom aims to achieve 70 per cent home ownership among its nationals by 2030.

According to Sean Heckford, Director of Built Asset Consulting at Cavendish Maxwell, a new law allowing foreigners to invest in real estate in designated zones from January 2026 is expected to further heighten demand.

The report also notes significant new supply entering the Riyadh market, with 6,000 new units delivered in the first half of the year. An additional 18,000 are expected to be delivered by the end of 2025, with a further 48,000 projected by 2027. Major projects like Diriyah and New Murabba are contributing to the capital’s housing supply.

Meanwhile, to address the recent surges in land and rental prices, Crown Prince Mohammed bin Salman recently initiated comprehensive reforms in Riyadh to stabilise prices.

The reforms signal a strong government commitment to addressing affordability and speculative practices in the capital’s real estate market. Releasing substantial land for development and capping the price of residential plots for citizens aims to increase supply and reduce price pressures. These measures could lead to a more stable and accessible housing market in Riyadh over the medium to long term.

In the residential real estate sector, as much as SAR3.57 billion of private capital is set to be deployed into Saudi Arabia’s branded residential market, according to The Saudi Report 2025 from global property consultant Knight Frank. Branded residences are now increasingly becoming part of mega projects such as Diriyah, which has recently announced three new utra-luxury collections: the Aman Residences, Amansamar, The Chedi Residences Wadi Safar and Armani Residences Diriyah (see Page 28).

(5).jpg)

.jpg)