A number of projects are under construction in Ras Al Khaimah, particularly at Al Marjan Island which will host the Wynn Al Marjan.

A number of projects are under construction in Ras Al Khaimah, particularly at Al Marjan Island which will host the Wynn Al Marjan.

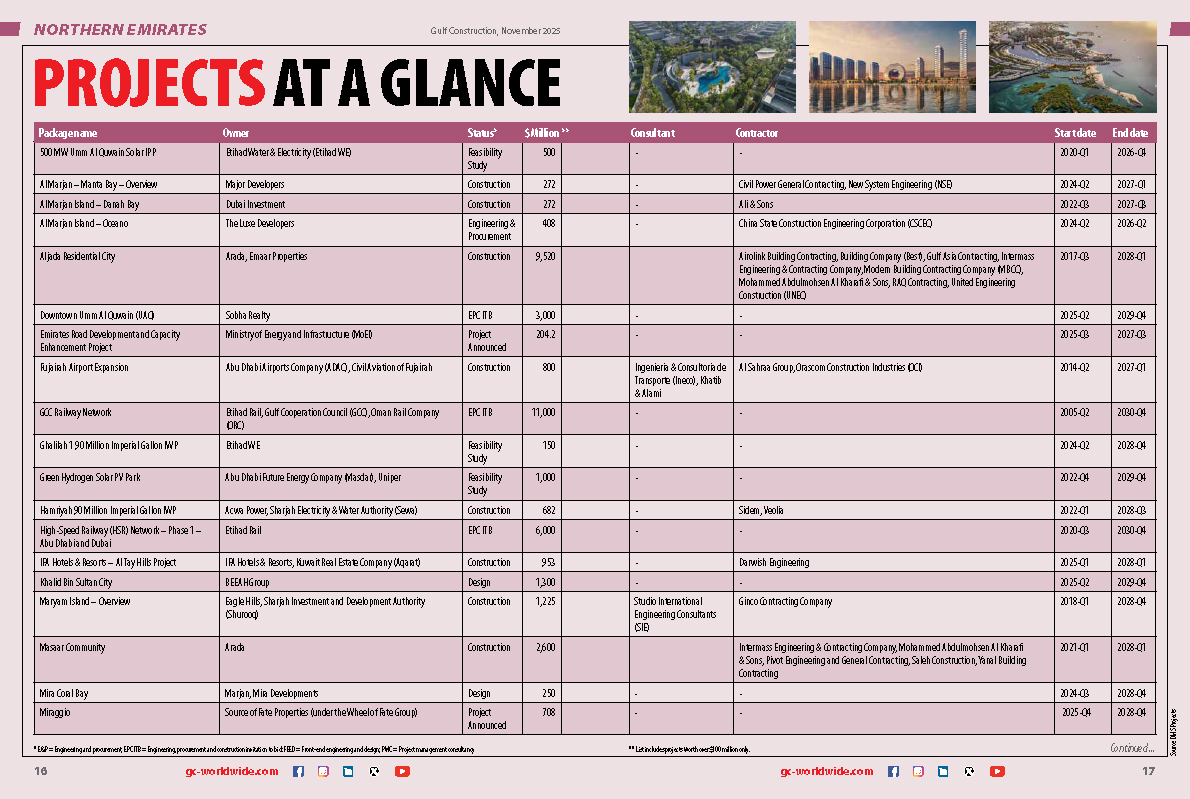

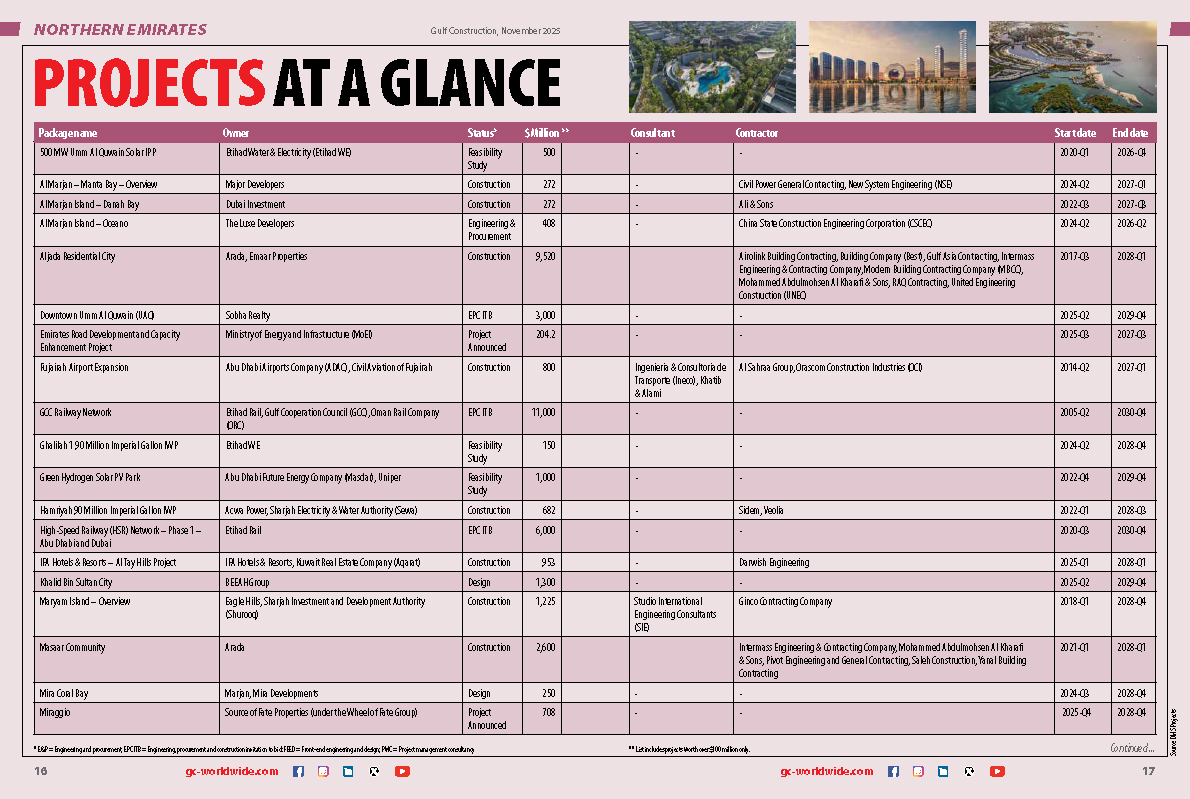

The construction sector across the Northern Emirates of the UAE – Ajman, Fujairah, Sharjah, Ras Al Khaimah (RAK), and Umm Al Quwain (UAQ) – is experiencing a seismic shift, driven by government initiatives, investments in infrastructure, and the launch of landmark urban masterplans.

Over the past two years, these emirates, particularly Sharjah and Ras Al Khaimah, have witnessed a surge of landmark project launches, reshaping the northern UAE’s investment landscape with ventures spanning ultra-luxury hospitality, branded residences, sustainable communities, and mixed-use projects.

|

|

Wynn Al Marjan is expected to be topped out shortly. |

Each emirate is developing its own signature projects, shaping local real estate and collectively supporting the UAE’s vision for sustainable, diversified growth. Sharjah continues to scale mixed-use and community projects that serve residents and culture-led tourism; Fujairah is reinforcing its strategic advantage outside the Strait of Hormuz by redoubling efforts on port expansion, oil/product storage, and logistics infrastructure; Ajman is consolidating residential and light-commercial delivery, capitalising on spillover demand from Dubai and Sharjah; Umm Al Quwain is growing freehold communities and light industry, positioning itself for affordable housing and niche tourism; and Ras Al Khaimah is focusing on high-end tourism and waterfront real estate – and through these efforts, it has emerged as a star attraction not only in the UAE but also regionally.

RAS AL KHAIMAH

RAK’s economic resilience provides the bedrock for its current boom. S&P Global Ratings projects the emirate’s economy will expand by an average of 4.2 per cent until 2027, anchored by strong performance in tourism, real estate, manufacturing, and mining.

|

|

Danah Bay community by Dubai Investments ... under construction in Ras Al Khaimah. |

According to the ratings agency, RAK’s economy is more diversified than that of most of its peers, with no single sector dominant; manufacturing, trade, and construction/real estate activities together contribute approximately 55 per cent of its GDP. Although oil prices still spur economic cycles through fluctuations in demand from RAK’s oil-dependent trade partners, this is generally less pronounced than for sovereigns directly dependent on oil, it says.

This sound foundation has fuelled an unprecedented real estate market boom. RAK’s property sector has undergone a dramatic transformation, with total real estate transactions skyrocketing by over 855 per cent between Q1 2017 and Q1 2025.

Official data from the Ras Al Khaimah Statistics Centre confirms this exponential growth, showing activity reached AED13.06 billion ($3.55 billion) in Q1 2025, up from just AED1.36 billion in Q1 2017. This sharp rise solidifies the emirate’s prominence as a major hub for sustained investment and finance-backed property ownership.

Growth is driven by strategic planning, a commitment to world-class developments, and a projected population increase from 0.4 million to 0.65 million by 2030, necessitating an estimated 45,000 additional residential units. Global real estate adviser Savills projects the residential stock in the emirate will effectively double by the end of 2030.

|

|

Four Seasons Resort and Residences Ras Al Khaimah ... being developed by RAK Properties within the Mina masterplan. |

The market’s stability is further reinforced by investor-friendly regulations and the entry of global developers like Emaar, Aldar, and Ellington, working alongside local leaders such as Marjan, Al Hamra, and RAK Properties.

Al Marjan Island is the undisputed focal point of RAK’s transformation. It features ultra-luxury anchors like JW Marriott and Nobu, with Wynn Al Marjan Island serving as the primary catalyst. Now close to structural completion and on track for a 2027 opening, the $3.9-billion integrated resort – the UAE’s first to be granted a commercial gaming operator’s licence – has drawn a succession of luxury hospitality and branded residential projects (see Page 25).

Over the past year, the island has seen a wave of luxury launches reshaping its skyline. Among them are the $500-million Mondrian Beach Residences by One Group and Ennismore; Jacob & Co Residences by Mantra Properties; the AED1-billion Aqua Arc by BNW Developments; and The Astera, featuring interiors by Aston Martin. Other key projects include the Danah Bay community by Dubai Investments, Oystra by Zaha Hadid Architects being developed by Richmind, Ardee Al Marjan Island, and the multi-branded Mira Coral Bay.

|

|

RAK Central ... designed to be Ras Al Khaimah’s new commercial heart. |

Marjan is also developing the emirate’s new commercial heart, RAK Central, where infrastructure is complete and ALEC has been appointed main contractor for the headquarters complex. Within the same precinct, Dara Properties will develop a 27-storey residential tower featuring 350 apartments.

Further transforming the coastline is RAK Properties’ AED5-billion Mina masterplan, already home to Anantara and InterContinental resorts. This 4-million-sq-m lifestyle destination is anchored by the Mirasol Residences on Raha Island, set for handover in 2028. The developer is also partnering with global hospitality brands on the Four Seasons Resort and Residences Ras Al Khaimah, which will feature 150 rooms and 130 branded homes and Nikki Beach. Adding to its ultra-luxury portfolio, RAK Properties has joined forces with Giorgio Armani to launch the world’s first Armani Beach Residences within Mina.

Developer Al Hamra continues to enhance integrated living with its Al Hamra Village and projects like Falcon Island,

On the industrial side, Ras Al Khaimah’s free zones and industrial precincts are attracting manufacturing and pharmaceuticals, which creates demand for industrial buildings, cold-store facilities and specialised process-plant contractors.

SHARJAH

Sharjah’s development remains firmly anchored in massive mixed-use communities, led by Arada, BEEAH Group, Alef, and Ajmal Makan Real Estate Development. The emirate’s focus is on integrated living, cultural tourism, and environmental stewardship.

Arada continues to build momentum within the AED35-billion Aljada masterplan, the largest mixed-use community in the emirate. The flagship development is further expanding its offering of new residential units and world-class amenities, with the AED2.18 billion Madar Mall marking the largest single contract in the company’s history. Awarded to Dubai-based contractor UNEC, the 3.9-million-sq-ft retail and entertainment destination will feature more than 400 shops, 80 dining outlets, and an observation tower, with completion scheduled for December 2028. Work is also under way on Arada Central Business District (CBD), the AED604 million commercial hub within Aljada. The project’s first phase, comprising eight smart blocks and 812,000 sq ft of leasable space, is due for delivery in the first quarter of 2027. Designed to meet LEED, WiredScore and SmartScore certification standards, the CBD will set a new benchmark for sustainable workplaces in the emirate.

Arada is also advancing Masaar, its wellness-focused green master-community, and the AED618-million Anantara Sharjah Residences and Resort on Al Heera Beach, the emirate’s first Anantara destination, which is expected to see completion within two years.

.jpg) |

|

Madar Mall is being built within the AED35-billion Aljada masterplan in Sharjah. |

Sharjah’s sustainability vision is a core driver of its construction activity. BEEAH Group is expanding beyond its headquarters with Khalid Bin Sultan City, a climate-smart mixed-use community designed by Zaha Hadid Architects, focused on a pedestrian-friendly, shaded urban network. The first phase, to be launched in 2025, will combine villas and townhouses within a pedestrian-friendly, shaded urban network. The city’s masterplan introduces seven interconnected residential neighbourhoods and a 2-km linear park that promotes walkability and wellness (see Page 20).

This complements the existing success of Sharjah Sustainable City, the emirate’s flagship green development with 1,250 solar-powered homes.

Other landmark developments include the $6.8-billion coastal development, Ajmal Makan City – Sharjah Waterfront, a transformational development which includes 1,500 villas, mid-rise buildings, hotels, retail spaces, a university, schools, a theme park, and other attractions; and Maryam Islands, where new waterfront residences are being developed by Eagle Hills to boost upscale tourism and redefine marina living.

Ajmal Makan Real Estate Development continues to make progress on its $6.8-billion Ajmal Makan City – Sharjah Waterfront. The developer recently launched The View Island and Blue Beach Residence, two luxury waterfront communities featuring villas, townhouses, and premium apartments. The megaproject spans more than 60 million sq ft and will eventually house 60,000 residents across eight islands, 36 km of coastline and 800 yacht berths.

|

|

The multi-branded Mira Coral Bay, which will come up in Ras Al Khaimah, is claimed to be the world’s first luxury waterfront community, created in partnership with 14 globally renowned brands. |

Complementing this activity, Alef Group is pushing ahead with its AED1.1 billion Al Mamsha Raseel project, part of the wider Al Mamsha mixed-use community. Construction is now under way for completion in 2028. The group has also reported major progress at Al Mamsha Seerah, where structural works are complete ahead of a scheduled Q4 2026 delivery.

UMM AL QUWAIN

Umm Al Quwain, reputed as a quiet emirate, is now in the midst of a transformation, leveraging its affordable land and coastal access to position itself as the UAE’s next destination for mixed-use urban growth. A mega project – Downtown Umm Al Quwain – was announced earlier this year. This 25-million sq ft coastal city, set to host 150,000 residents, is being developed by Sobha Realty in partnership with the emirate. The project offers 11 km of beachfront, integrated luxury, business, and tourism facilities, and sustainable design. The first phase comprises iconic residential and commercial communities, hospitality projects, and supporting infrastructure, with handovers anticipated by 2028 (see Page 28).

AJMAN

Ajman’s real estate market experienced a robust third quarter in 2025, registering 5,048 transactions valued at over AED8.12 billion, a substantial 47 per cent growth year-on-year. This positive momentum, according to the Department of Land and Real Estate Regulation, is driven by the diversity of projects and a stimulating business environment that has attracted more investors. The emirate is also reported to have seen a surge in new building permits – a 300 per cent increase in the first half of the year. The emirate is particularly attractive for affordable investments, with emerging residential communities and new infrastructure driving growth.

FUJAIRAH

Fujairah’s growth strategy is propelled primarily by its strategic position on the Gulf of Oman, directly linking the UAE with global shipping lanes. Mega-projects encompass transport, energy, and public works. Earlier this year, Fujairah opened two new berths at its port to keep up with the rising demand for bunkering services, officials said.

(5).jpg)

.jpg)