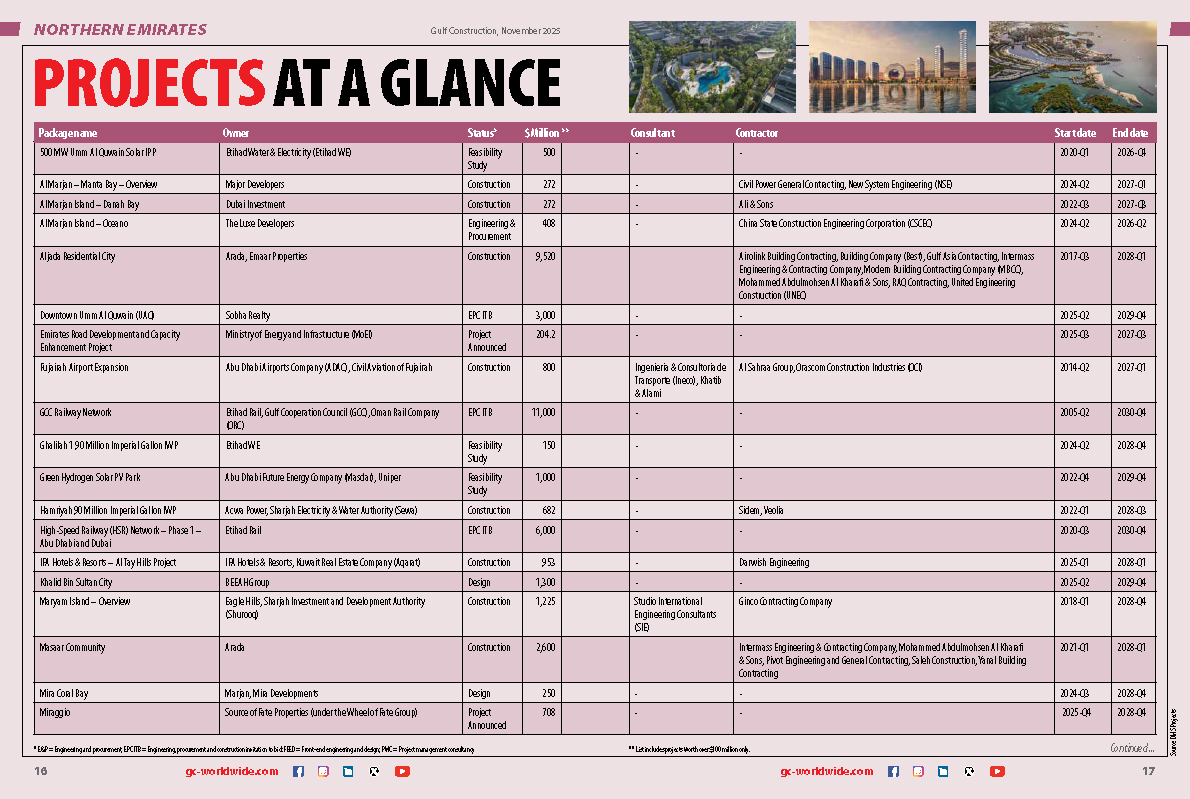

The two plants will have 3.6 GW of power generation capacity.

The two plants will have 3.6 GW of power generation capacity.

Abu Dhabi National Energy Company (Taqa), together with Japan’s largest power generation company Jera and AlBawani Capital (AlBawani), a subsidiary of leading Saudi contracting and development group AlBawani Holding, have announced the successful financial closing of two greenfield power plants in Saudi Arabia.

The project companies, Rihab ElAwal Power Company (Rumah 2) and Nawras Power Company (Al Nairyah 2), are being set up at a total investment of $4 billion. Together, the greenfield combined cycle gas turbine (CCGT) power plants will deliver approximately 3.6 GW of power generation capacity. The projects are being developed on a build, own-and-operate (BOO) basis and will support the kingdom’s growing energy need.

Financing was secured from a consortium of leading regional and international lenders through senior debt and equity bridge loans. Senior debt leverage exceeds 80 per cent, reflecting the strong fundamentals of the projects and lender confidence.

These include Al Rajhi Bank, Riyad Bank, Saudi Awwal Bank, Saudi National Bank, Arab Petroleum Investments Corporation, Abu Dhabi Commercial Bank, Abu Dhabi Islamic Bank, Bank of China and First Abu Dhabi Bank.

This milestone was achieved under the supervision of the Ministry of Energy, Saudi Arabia, in partnership with the Saudi Power Procurement Company (SPPC), following the signing of two 25-year power purchase agreements (PPA) between Taqa, Jera and AlBawani.

Construction will be undertaken through a special purpose vehicle majority owned by Taqa with a 49 per cent stake, along with Jera (31 per cent) and AlBawani (20 per cent).

Operation and maintenance services will be provided by dedicated O&M companies owned by the consortium under the same shareholding structure. Engineering, procurement, and construction (EPC) contracts were awarded to Harbin Electric International Company and China Tiesiju Civil Engineering Group Company.

(5).jpg)

.jpg)