Financing has been allocated for new roads totalling 8,000 km.

Financing has been allocated for new roads totalling 8,000 km.

Infrastructure development is key to rapid economic growth and plays a vital role in enticing foreign investment into a country.

It is, however, an area that has sadly suffered neglect in Saudi Arabia over the past two decades.

According to the World Bank, infrastructure increases economic output directly by making private capital more productive by increasing attractiveness of the region served, while stimulating the construction market. As the infrastructure network expands, national economic and financial efficiencies grow.

It also has long-term effects on the type of social structure that will be developed – in particular growth of urban centres and their linkages. Inadequate attention to infrastructure maintenance can cause an increase in costs to producers and, in extreme cases, a breakdown in economic activities.

Saudi Arabia is facing increasing competition in the region where nations are busily extolling their comparative advantages in order to attract Foreign Direct Investment (FDI) with the associated technology, market savvy, intellectual and financial capital needed for growth, sustainability and social development of their countries.

Having one-quarter of the world’s oil reserves, the world knows Saudi Arabia has a comparative advantage in ‘natural capital’. However, it is commonly known that the kingdom faces shortages in most other resources required for sustainable growth and development. Therefore, any means to further enhance its ‘natural capital’ will increase its comparative advantage to other countries.

‘Natural capital’ refers to the stock of physical assets including location, soil, air, minerals, fuels and built infrastructure, producing a flow of useful goods and services for use by the country and to gain export earnings. It is different from ‘social capital’ (people, their knowledge, cultural institutions and social structures). Sustainability requires the maintenance and/or growth of both natural and social capital.

In its earlier stages of development until 1986, Saudi Arabia spent heavily on ‘natural capital’ investment, funded primarily by increasing oil revenues. However – as is always the case in cyclical commodity markets – with several years of lower oil revenues between 1986 and 2002, the government reduced its spending on ‘natural capital’ as a proportion of total GDP, with its investment primarily directed to maintenance activities.

As oil prices and Saudi Arabia’s revenues increased rapidly from 2003 onwards, the government has spent more heavily on ‘social capital’ investments in order to meet the requirements of a rapidly-increasing population. Such expenditures are now so big that the government breakeven is now estimated at just under $40 per barrel, which means infrastructure must compete against several other developmental requirements for funding.

Therefore, a 20-year (1986-2006) dearth in government expenditures on infrastructure development relative to population and economic growth has led to Saudi Arabia’s declining ranking among competing countries on one of the most essential attractions for FDI – that is, quality infrastructure for efficient movement of goods and services.

Therefore, a 20-year (1986-2006) dearth in government expenditures on infrastructure development relative to population and economic growth has led to Saudi Arabia’s declining ranking among countries competing for FDI – for which quality infrastructure for efficient movement of goods and services is an essential attraction.

The problems facing infrastructure development in keeping pace with today’s requirements and then maintaining sustainability is: How can public/private infrastructure planning ensure that the right projects are chosen to obtain optimum sustainable development?

The solution to this problem has not been arrived at even through Saudi Arabia’s new 20-year plan, recent five-year plans and current annual budgets – which are increasingly shifting the burden of development to the private sector – and despite the fact that the country is under pressure to deliver major infrastructure improvements to meet the needs of a fast-growing population and has established goals to decentralise while furthering industrial development and international competitiveness.

It is no longer possible to look at Saudi Arabia individually, as the GCC countries are still primarily energy-dependent on income flows, where the rise of the oil price in recent years has rendered the region flush with funds. These funds can freely flow between these economies as well as elsewhere in the world. Standard Chartered Bank estimates that the GCC posted a current account surplus of more than $157 billion in 2006, equivalent to 26 per cent of their GDP, with a combined fiscal surplus of $59 billion, or 16 per cent of their GDP. This raises the question of why there is not a comparable rise in infrastructure development within and between GCC countries?

One reason is the impact of inflation. Given this surplus of funds and that most currencies are tied to the US dollar without appreciation, then the spillover of liquidity affects prices of other commodities such as asphalt, cement, steel, aluminium and other construction-related infrastructure inputs, with inflated prices dampening infrastructure growth planned by the various governments.

Another reason is that the young stock markets in the region have yet to provide the sophistication that is required to sop up excess liquidity, with the larger part flowing outside the region to more sophisticated stock markets. More specifically, there are no special funds established with regard to infrastructure, leaving the sector too dependent on governments that are already hard-pressed with increased allocations made to meet the social needs of the populace. Given the wide fluctuations in these stock markets in recent months, there are also no market stabilisation funds to protect investors in the region, thus encouraging the outflow of needed capital that could otherwise be applied to infrastructure development.

A third reason is that the increasing liquidity, thanks to high oil revenues, is primarily channelled into real estate, the fastest-growing sector in Saudi Arabia. It is estimated that more than SR1 trillion ($266.67 billion) of private monies are currently going into real estate investments. However, all these real estate investments, including the announced mega-economic city projects, – together with government budget allocations for the construction of new schools, colleges and universities, public housing and municipal amenities – will add a tremendous load on the current infrastructure network without a commensurate means to make up for the neglect suffered by infrastructure development over the past two decades in preference to maintenance.

Although the construction sector remains the largest non-oil sector in Saudi Arabia – estimated to contribute more that SR15 billion to the economy – it remains to be seen whether private sector funding is forthcoming to maintain this level in view of the fact that many Saudi investors have lost considerably in the stock market over the past several months.

As in the stock market, given the lack of market studies and analyses on real estate, and efforts to meet customer demands by sellers and financiers in Saudi Arabia, it is highly doubtful that all the five new economic mega-city developments will attract the level of private sector investment required to meet the estimated share of the construction industry.

While shopping centres and residential and commercial buildings make up the bulk of construction activities, infrastructure development accounts a small share in the total activity. More importantly, the government and private sector developments under way/planned significantly increase the demand for infrastructure, whether utilities, roads, highways or communications. When taking into account the officially-stated need for 1.5 million new homes by 2015 – or the private realty investor estimate of 5 million by 2010 – the load on an ageing infrastructure is such that very large increases in resource allocations to infrastructure development are much needed.

Saudi Arabia has allocated SR22.5 billion in the new budget for infrastructure development, including SR18 billion worth of new projects. However, most of this planned infrastructure does not address access and egress from the five new economic cities, which individually budget for internal infrastructure needs but omit requirements outside their designated areas. It must be said, however, that investors in these economic cities benefit from a lot of incentives such as tax credits on 15 per cent of invested capital, 50 per cent of payroll for Saudi employees plus 50 per cent of training cost. Again, the question remains: what is being done for potential investors in infrastructure projects?

Planned infrastructure

Infrastructure is not categorised as a separate sector activity in Saudi Arabia’s Development Plans but components of the Eight Development Plan (see Table 1) outline activities that partly fit our definition of infrastructure, which is public utilities (power, telecommunications, piped water supply, sanitation and sewage, solid waste collection and disposal, piped gas and central cooling), public works (flood control, drainage and retention dams for water sources and conservation) and transport (roads and highways, urban and inter-urban railways, urban transport, ports and airports).

As indicated in Table 1, basic utilities comprise nearly 20 per cent of the total plan budget. Although this allocation benefits the growth of the industrial and commercial sectors of the economy, the major need is to keep up with the fast-growing requirements of the expanding population. What should be noted is the large gap in investment shown between utilities and basic transport and communications required in the efficient movement of goods and services required by industry and commerce. Since a large proportion of construction activities is carried out by the private sector, it is recognised that government’s contribution will be smaller, but seems too small for a kingdom that intends to remain internationally competitive.

Similarly, a closer look at the 2007 budget allocations by those agencies playing a large role in infrastructure development reveals that larger increases in percentage terms are assigned to Saudi Arabian General Investment Authority (Sagia) – 44.9 per cent, Saline Water Conversion Corporation (SWCC) – 31.8 per cent and General Seaports Authority (GSA) – 24.7 per cent, which target greater capabilities to facilitate industrial growth through attracting industry, providing basic water requirements and import/export of goods for competitive advantage.

Investment Initiatives

The 2007 Saudi budget outlines a spending of SR380 billion ($101.3 billion), up 13 per cent on the figure budgeted for 2006, resulting in a projected surplus of SR20 billion ($5.5 billion), which is sufficiently large to meet infrastructure requirements that would make the economy more efficient.

Infrastructure spending for water, agriculture and infrastructure received SR24.8 billion. Of this total, SR16.4 billion is allocated to water, sewerage and desalination projects. Private sector partners are expected to contribute a large amount to these types of infrastructure development within the kingdom.

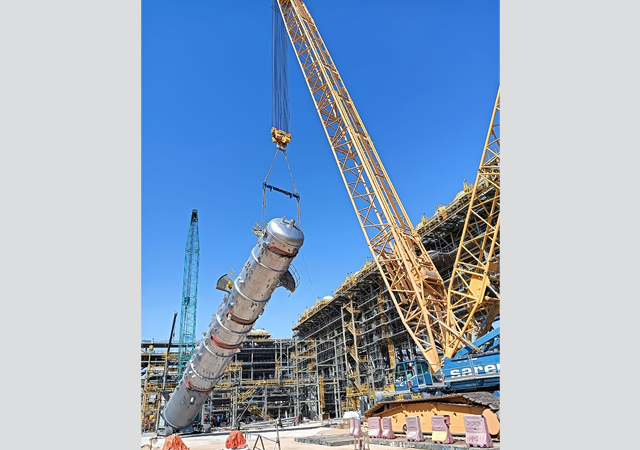

Transportation and telecommunications expenditure is budgeted at SR13.6 billion. Financing has been allocated for new roads totalling 8,000 km, in addition some 16,000 km of roads are under construction. Development of ports, airports, railways and new postal services are also planned. According to a report by the Saudi American Bank (Samba), about 37 major projects with a total value of $283 billion are currently under way or are highly likely to be implemented over the next few years.

However, on closer examination of announced projects classified into general infrastructure and non-infrastructure development (Table 3), it should be noted that the latter includes only minor components of infrastructure while adding considerable a load to current and planned infrastructure.

In summary, non-infrastructure projects compete for the scarce infrastructure construction resources, requiring 72.7 per cent of the total planned or under way. Even for utilities, 95.5 per cent goes to oil pipelines and development, plus another 3.9 per cent converting oil and gas to energy requirements, leaving a very minimal – only 0.5 per cent – applied to water and sewerage. As for transportation, the newly-planned railways are required to exploit Saudi Arabia’s largely untapped mineral resources, but roads, airports and ports are essential to move goods and services to markets. Thus, one has to question the perceived allocation of scarce construction resources in making Saudi Arabia’s economy most efficient.

Again, importance must be given to international competitive concerns that can be illustrated by the rate of investment and resource allocations in infrastructure development relative to select competitors. Table 4 indicates that Saudi Arabia does not score well in such comparisons ranking at best at 3 out of 6 with only growth a positive over Group Average (+0.1) with all other indicators shown in red as below average. Of special note is that a capital-rich country such as Saudi Arabia under-allocates capital on an employee basis as well as not paying employees enough to maintain a competitive position.

Factors impacting growth

Although the need for greater investment in infrastructure remains, the way development is carried out is constrained by and must be responsible to several realities:

• Environmental factors: The environmental revolution under way imposes new requirements for environmental assessment, protection and enhancement on virtually every infrastructure development. These new requirements increase plan/project costs and further constrain the availability of resources for alternative use and/or meet sustainability objectives;

• Urbanisation: Land is being urbanised for industrial, commercial and residential purposes, changing the balance of urban/rural distribution as well as impacting costs, treatment requirements and required infrastructure;

• Increasing budget constraints: Given the government policy to shift responsibility to the private sector, new and better ways must be sought to do more with less. Development of rational methods for dealing with unpredictable events when they occur and sound techniques for prioritising plans/projects in a competitive environment will be major challenges;

• Broader set of stakeholders: A growing number of voices wish to be heard in the future, requiring a more collaborative approach to infrastructure development; and

• Title transfer: Transferring ownership of government-owned facilities to the private sector introduces budgetary and oversight issues that may necessitate new business models.

Factors affecting performance

The World Bank considers that three factors contribute to poor performance of infrastructure development in select countries:

• Government monopoly over infrastructure provision;

• Lack of managerial and financial accountability; and

• Views of the end-users not being heard.

However, each can be addressed given the political will. Two broad reforms are required:

• Infrastructure development to be open to competitive forces; and

• Private ownership and operations can be selectively applied.

Telecommunications and power supply are good examples of technologies that have progressed in a way that allows a variety of suppliers to compete for the market. Private ownership and operation of ports and other transportation facilities as well as contracting-out maintenance has proven feasible. What remain are institutional reforms to foster greater private participation in infrastructure development for all the public utilities, works and transport sectors.

* Dr P Thomas Cox serves as CEO and director of Petrochemical Projects Development Company (PPDC), executive director of Development Group International Limited, Global Best Consult and Al-Sudairy Foundation while providing consultancy services with The Economic Bureau and others. Saeed A Ali serves as research Intern at PPDC in connection with the Co-operative Education Program of Prince Sultan University.

.jpg)

.jpg)

.jpg)

.jpg)