The Pearl-Qatar, a major artificial island development by United Development Company (UDC), continues to see expansion.

The Pearl-Qatar, a major artificial island development by United Development Company (UDC), continues to see expansion.

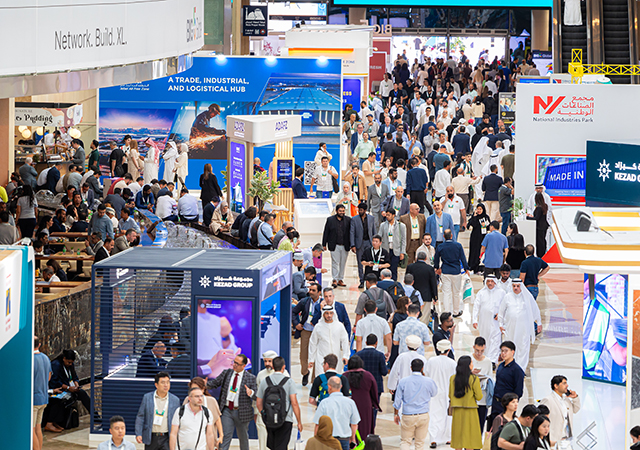

Qatar’s construction sector is charting a new era of expansion marked by robust government-led infrastructure programmes, private sector partnerships, and visionary national strategies.

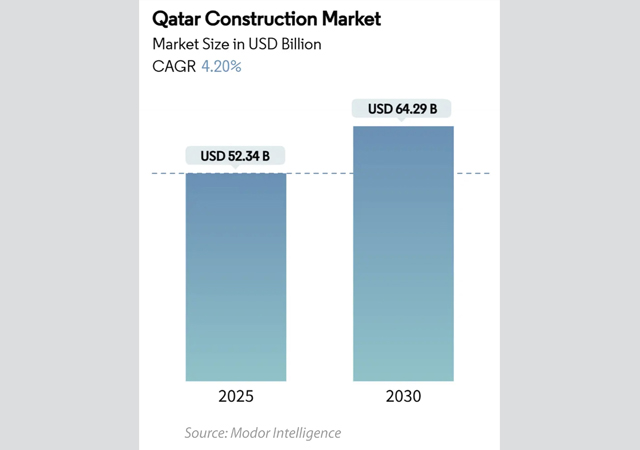

The country’s construction market size is projected to be $52.34 billion in 2025, with expectations to reach $64.29 billion by 2030, representing a compound annual growth rate (CAGR) of 4.20 per cent, according to market research company Mordor Intelligence, This steady growth is driven by the country’s long-term economic diversification under Qatar National Vision 2030, substantial public spending on transport and energy infrastructure, and an accelerating pipeline of liquefied natural gas (LNG) projects led by QatarEnergy.

QatarEnergy, the rebranded state-owned company previously known as Qatargas, is the central force behind the massive North Field expansion, which underpins the entire national economy.

Qatar’s construction sector experienced a post-World Cup dip – triggered by a cooling real estate market, fewer large-scale commercial permits, and global cost pressures. The country’S construction industry saw an annual growth of 1.4 per cent in 2024, according to data analytics and consulting company Global Data, which states that the sector is expected to expand by 3.4 per cent in real terms in 2025, supported by investments in residential, renewable energy and transportation infrastructure sectors.

|

|

Qatar Construction Market |

Growth will also be supported by the total allocation of QR210.2 billion ($57.8 billion) in the 2025 budget, an increase of 4.6 per cent compared to the 2024 budget. The major allocations in the budget include QR22 billion for the healthcare sector and QR21.9 billion for the municipality and environment sector. Despite the presence of positive factors, the waning commercial construction output continues to weigh on Qatar’s construction industry, the report says.

GlobalData expects the industry to rebound at an annual average growth rate of 4.7 per cent from 2026 to 2029, supported by public and private sector investments in renewable energy, water infrastructure and LNG projects.

Since hosting the FIFA World Cup Qatar 2022, the country has pivoted from event-focused construction toward strategically diversified development aligned with the Qatar National Vision 2030 and the Third National Development Strategy (2024-2030). The ambition is to build an innovative, sustainable economy bolstered by LNG expansion, clean energy investments, and world-class infrastructure. Infrastructure works account for about 30 per cent of total construction activity, underpinned by transport, roads, bridges, and utility upgrades.

Energy remains a core driver, with the North Field Expansion Project strengthening Qatar’s global LNG leadership, says a report by Turner & Townsend, a leading global programme and project manager firm. It adds that $2.5 billion green bonds will fund renewable energy and sustainable infrastructure projects, aligning with development goals.

|

|

Lusail City, Qatar’s largest urban development project, spearheaded by Qatari Diar. |

The North Field Expansion is not merely a construction project but the central economic engine powering Qatar's entire development agenda. It is an ambitious, multi-phase undertaking to expand production from the world's largest single natural gas reserve, which Qatar shares with Iran. The project, with an estimated cost of $30 billion, aims to increase Qatar's total LNG production capacity from 77 million tonnes per annum (mtpa) to an impressive 142 mtpa by 2030, representing an approximately 85 per cent increase in production.

The expansion is divided into three key phases: the North Field East (NFE) project, the North Field South (NFS) project, and the North Field West (NFW) project. The first phase North Field East (NFE) is expected to bring the capacity to 110 mtpa by 2026, while the subsequent phases will further increase it to 126 mtpa and then 142 mtpa by the end of the decade.

Despite the post-World Cup dip, the construction sector’s renewed focus is on resilience, project delivery efficiency, and environmental stewardship. The growth of the market is propelled by a robust project pipeline and the strategic initiatives of key government and private entities. The primary players driving this market are state-owned enterprises and government bodies. Ashghal, the Public Works Authority, is responsible for the design, construction, and management of public buildings and infrastructure projects, and its mandate has expanded to include major public-private partnerships.

|

|

Msheireb Downtown Doha, a project which has revitalised Doha’s city centre. |

Asghal is currently spearheading the transformation of five West Bay beachfront plots and the iconic Al Safliya Island for Qatar Tourism, which will be developed in a public-private partnership (see Page 56).

Qatari Diar, a real estate investment company, is the master developer behind landmark urban projects like Lusail City and the ambitious Simaisma tourism project (see Page 54), which is now set to take off following the closure of a public beach in June to facilitate its development.

ROADS & BRIDGES

Ashghal is currently engaged in a wide range of significant infrastructure projects across the country, aligning with its ambitious five-year plan for 2025-2029. This plan, with an estimated value of over QR81 billion, is the largest in the public works authority’s history.

Its roads and expressways projects are grouped under the Expressway Programme, comprising a world-class highway network, featuring new tunnels, bridges, and multi-level intersections to improve traffic flow and reduce travel times; the local Areas Infrastructure Programme; and specific road projects.

POWER & WATER

Qatar is aiming to increase the country’s renewable energy share in the total power mix from five per cent in April 2024 to 18 per cent by 2030, along with reducing the carbon dioxide emissions by 25 per cent by 2030 compared to business as usual (BAU) level (the level of emissions without climate policies) and having carbon zero footprint by 2050, according to Global Data.

It is part of the government’s National Renewable Energy Strategy that was launched in April 2024 by the Qatar General Electricity and Water Corporation (Kahramaa) to increase solar energy sources in the country.

In the solar power sector, the country has just flagged off work on its Dukhan plant, having recently brought a number of such projects on stream. The Ras Laffan and Mesaieed solar power plants – built at an investment of QR2.3 billion – were commissioned last April, adding a combined electricity generation capacity of 875 MW following the inauguration of the 800-MW Al Kharsaah plant, the country's first large-scale solar power facility, in 2022.

QatarEnergy last month signed an agreement with Samsung C&T’s Engineering & Construction Group (Samsung C&T) for the construction of a solar power plant in Dukhan, about 80 km west of Doha.

The Dukhan plant, one of the largest in the world, will be developed in two phases, reaching a total electricity generation capacity of 2,000 MW by mid-2029. Once completed, it will double Qatar’s solar power production capacity (see Page 89).

Meanwhile, Samsung C&T is also working on Qatar’s fifth independent water and power project. The project was awarded in late 2024 to a consortium led by Japan's Sumitomo Corporation, with Samsung C&T handling the engineering, procurement, and construction (EPC) work. The Ras Abu Fontas area Facility E project includes a 2,415 MW power plant and a 110 million gallons per day (MIGD) desalination facility. The contract is valued at approximately $2.8 billion.

The agreement includes a three-phase commissioning plan for the facility. The first power date is set for April 2028, with 836 MW of power coming online. The final water date is scheduled on August 2028. The target full operations date is scheduled for June 2029.

REAL ESTATE

The real estate and rental activities sector contributed 7.4 per cent to GDP with value added reaching QR13.44 billion in the first quarter (Q1) of this year, according to the Real Estate Regulatory Authority – Aqarat.

The sector registered a growth of seven per cent compared to the same quarter in last year, said the authority in a X post, a report in Peninsula newspaper said.

The value of real estate activities in the first quarter of this year has grown by 20 per cent since the first quarter of 2022, it added.

Qatar’s real estate construction is rapidly adapting to shifting local and international demand, especially in hospitality and tourism after the 2022 World Cup. Key projects and locations include:

• Lusail City: An ambitious new urban centre north of Doha, featuring business districts, luxury residences, retail boulevards, parks, and a waterfront promenade, with long-term plans for over 200,000 residents.

• The Pearl-Qatar: A major artificial island with premium apartments, hotels, and a thriving retail ecosystem.

• Msheireb Downtown Doha: A project which has revitalised Doha’s city centre focused on sustainability and mixed-use integration.

• Simaisma Project: An entertainment hub that will offer new tourism clusters, beach resorts, and theme parks.

(5).jpg)

.jpg)