Natural History Museum Abu Dhabi

Natural History Museum Abu Dhabi

Abu Dhabi is experiencing a transformative era in construction, marked by robust growth, ambitious projects, and strategic economic diversification. The emirate is channelling significant investments into residential, commercial, industrial, and infrastructure developments, which are reshaping its economic landscape and urban fabric.

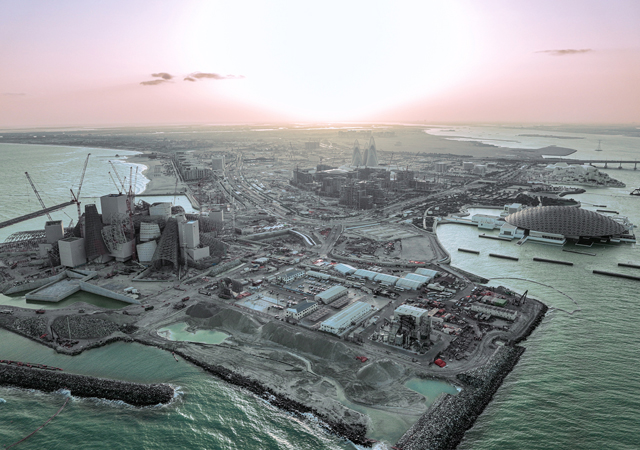

Central to this transformation is the ambitious islands development programme, which is rapidly reshaping Abu Dhabi’s real estate, tourism, and cultural sectors, with iconic projects emerging across Saadiyat, Al Maryah, Fahid, Yas, Jubail, Al Reem, Ramhan, and Lulu islands.

Recent months have seen significant milestones and new announcements across key islands. Late last month, the launch of the Al Maryah Waterfront enhancement project began its transformation into a major year-round visitor attraction; while in June, the masterplan was unveiled for Fahid Island, positioning it as Abu Dhabi’s first coastal wellness island.

Yas Island continues to evolve as a world-leading entertainment hub, now further bolstered by the announcement of the Middle East’s first Disney theme park, joining the established Ferrari World, Warner Bros World, and Yas Waterworld (see Page 9).

Development work is ongoing on Jubail Island, envisioned as a unique sanctuary featuring salt marshes and mangroves, alongside six distinct residential “village estates.”

Meanwhile, work is steadily progressing on Saadiyat Island, anchored by its world-renowned cultural district. This future-focused vision has already given rise to architecturally stunning structures like the Louvre Abu Dhabi (inaugurated 2017) and the Abrahamic Family House (2023). This year marks a significant fruition of this vision, with the recent opening of teamLab Phenomena Abu Dhabi, and the anticipated completion later this year of three other major museums: the Zayed National Museum, Natural History Museum Abu Dhabi, and Guggenheim Abu Dhabi (see Pages 18-27 for details).

|

|

Al Reem Island ... one of Abu Dhabi’s dynamic destinations. |

The establishment of these museums is, in turn, significantly boosting demand in the adjacent real estate precinct, attracting affluent residents and investors drawn by the emirate’s growing cultural prestige. Developers are actively responding, launching projects strategically located near these institutions; for example, Aldar Properties is currently developing 10 housing projects on Saadiyat Island alone.

This ambitious development agenda is directly reflected in the emirate’s robust economic performance, where Abu Dhabi’s construction and real estate sectors are pivotal to its economic diversification strategy. Fuelled by strategic government initiatives outlined in Vision 2030, the non-oil economy has achieved unprecedented expansion, with construction emerging as a key driver.

According to the Statistics Centre – Abu Dhabi (SCAD), the emirate’s gross domestic product (GDP) reached AED291 billion ($79.23 billion) in the first quarter of 2025, recording a 3.4 per cent increase compared to the same period in 2024. This performance was driven by the strength of the non-oil economy, which expanded by 6.1 per cent year-on-year, reaching AED163.6 billion. For the first time in the Q1 period, the non-oil sector contributed 56.2 per cent of the total GDP, while the oil sector accounted for the remaining 43.8 per cent, equivalent to AED127.4 billion.

The manufacturing sector continued to lead the non-oil economy with a total value added of AED28.5 billion in Q1 2025.

|

|

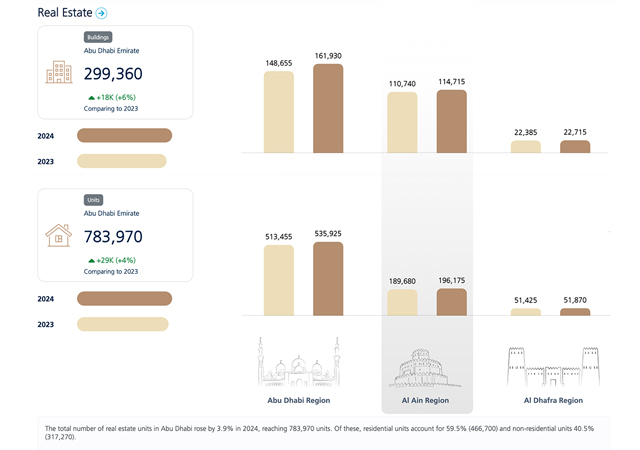

Annual growth rate of number of buildings by region in Abu Dhabi in 2024. |

Construction activity experienced an expansion of 10.2 per cent in Q1 2025, reaching a total value added of AED27.5 billion and contributing 9.4 per cent to the GDP of the emirate, according to SCAD. The performance is linked to continued investment in infrastructure, housing, and urban development.

Recent initiatives such as the launch of the Binaa digital building permit platform, powered by artificial intelligence, are expected to further enhance project delivery and regulatory efficiency across the construction landscape, it added.

According to SCAD’s report for 2024, the sector contributed 9.1 per cent to total GDP, with an impressive growth rate of 11.3 per cent and a record high value of AED107.4 billion.

Highlighting some of its accomplishments for 2024, the Department of Municipalities and Transport – Abu Dhabi (DMT) said it completed AED4 billion worth of key projects, part of a broader set of long-term initiatives with a total budget exceeding AED75 billion.

Mohamed Ali Al Shorafa, Chairman, DMT, said: "The future-focused AED75 billion-plus budget embodies an ambitious vision to enhance infrastructure, elevate services, and promote urban development across the emirate. We strongly believe that these investments are a vital step towards building a solid, holistic foundation for the future.”

According to him, DMT invested AED3.4 billion in the completion of key mobility and road network projects including the expansion of the Helio-Abu Al Abiyad Road in Al Dhafra Region; and a double-bridge project with a total value of AED315 million that has reduced average morning peak-hour delays by up to 80 per cent on Abu Dhabi’s Al Khaleej Al Arabi Street.

Other notable roadworks completed in the last 12 months include a major overhaul of Al Ain Region’s 760-m landmark Sheikh Khalifa bin Zayed Street. The emirate also got 247 km of new cycling paths, bringing the total length of dedicated tracks to more than 1,200 km (see also Page 32).

|

|

Fahid Island, a $10.89-billion wellness sanctuary by Aldar, will boast an 11-km coastline, 4.6 km of beachfront, and mangrove forests. |

Abu Dhabi’s construction sector is also set to receive a boost through a wave of strategic joint ventures, capital injections, and pioneering public-private partnerships that could reshape the infrastructure and real estate landscape across the emirate.

In April, a landmark joint venture was launched between state-owned ADQ, International Holding Company (IHC) and Modon Holding, forming Gridora, a new infrastructure platform under Modon. Positioned as a central delivery mechanism for major infrastructure schemes, Gridora will focus on both project execution and asset investment, enhancing Abu Dhabi’s ability to scale infrastructure delivery both domestically and internationally. The platform’s dual business lines – Infrastructure Projects and Infrastructure Investments – aim to streamline procurement, attract capital, and accelerate development cycles.

Further reinforcing institutional collaboration, Aldar Properties and Mubadala Investment Company unveiled in October last year a new series of joint ventures to manage and develop assets valued at over AED30 billion across the emirate. The partnership will span premium retail destinations, sustainable income-generating real estate in Masdar City, strategic waterfront islands, and a massive industrial logistics park near Zayed International Airport.

This initiative not only consolidates Aldar’s development strength with Mubadala’s land bank and capital resources but also signals a major long-term investment in the growth and urban evolution of Abu Dhabi.

Meanwhile, Aldar’s financial strength was underscored by securing in January this year a record-breaking AED9 billion sustainability-linked revolving credit facility – the largest of its kind for a regional real estate developer.

In the public-private partnership (PPP) sector, Abu Dhabi inaugurated its first PPP schools project in Zayed City. Developed by ADIO and ADEK in collaboration with the Plenary-Besix consortium, the project delivered three state-of-the-art schools for over 5,000 students, built to Estidama sustainability standards. This milestone sets a precedent for future PPP-led education and social infrastructure projects in the UAE, opening new channels for private sector participation in public service delivery.

Collectively, these initiatives reflect Abu Dhabi’s increasing reliance on institutional alliances, innovative funding models, and private sector engagement to unlock new phases of development.

Real Estate

Abu Dhabi’s real estate sector is experiencing robust growth, driven by high demand for luxury and premium residential properties, strategic partnerships with global brands, and a focus on innovative, sustainable developments. The emirate is positioning itself as a hub for luxury living, wellness, and cultural connectivity, with major projects launched on islands like Fahid, Hudayriyat, Al Reem, and Al Maryah.

The real estate sector delivered outstanding performance in the first half of 2025, with the total real estate transaction value increasing by 39 per cent compared to the same period in 2024.

The total value reached AED51.72 billion, up from AED37.2 billion last year, according to data released by the Abu Dhabi Real Estate Centre (ADREC).

The number of property transactions increased by 12 per cent, reaching 14,167 deals. Sales and purchases transactions grew 32 per cent in value, hitting AED32.69 billion through 7,964 transactions, while mortgage transactions recorded a significant 52 per cent increase in value, amounting to AED19.03 billion through 6,204 deals.

“The recent launch of high-quality projects has further energised the market and opened doors to attractive investment opportunities, reinforcing Abu Dhabi’s attractiveness as a leading destination for sustainable real estate investment,” said Eng Rashed Al Omaira, Acting Director General of ADREC.

Among the mega real estate projects launched last month was Fahid Island, Al Maryah Waterfront enhancement project, (see Page 12); Bab Al Qasr Canal View Residence 22 in Al Raha Beach and Vida Residences Saadiyat Island (see Page 29).

Fahid Island, a $10.89-billion wellness sanctuary by Aldar, will boast an 11-km coastline, 4.6 km of beachfront, and mangrove forests. Spanning 2.7 million sq m, the island will feature 6,000 luxury residences, with Fahid Beach Residences as the first phase (seven buildings, 65 residences each).

Designed by renowned architects such as Kengo Kuma and Koichi Takada, the project is located between Yas Island and Saadiyat Island, with access to theme parks, cultural districts, and Zayed International Airport in under 15 minutes.

Another leading developer Modon Holding achieved two major sell-out successes this summer. Its Nawayef Village on Hudayriyat Island – the first townhouse community on the island – sold all 378 units within a single day of launch, generating around AED2 billion. The development, inspired by Tuscan architecture, forms part of the upscale Nawayef district. Modon received a similar response for Muheira, its luxury apartment development on Al Reem Island near Abu Dhabi Global Market (ADGM), where all 475 units were sold out on launch day, raising approximately AED1 billion.

Meanwhile, Bloom Holding expanded its flagship community, Bloom Living, with the recently-unveiled Carmona, its eighth residential phase. Inspired by Spanish-Mediterranean design, Carmona will comprise two- and three-bedroom townhouses and is set for completion in Q2 2028.

Premium real estate developer Mered, renowned for its recently launched Iconic Tower in Dubai, announced its entry into the Abu Dhabi market with a mixed-use waterfront project on Al Reem Island. Currently in the schematic design stage, the project will feature luxury residential and commercial spaces, with a focus on cutting-edge design and sustainability.

Branded residences are now becoming a watchword in Abu Dhabi’s real estate sector and developers are elevating their offerings with world-class design, community integration, and strategic locations.

Apart from Bab Al Qasr Canal View Residence 22 and Vida Residences Saadiyat Island unveiled last month, other branded residences recently launched include Bvlgari Resort & Mansions Abu Dhabi, Elie Saab Waterfront by Ohana W Residences Abu Dhabi – Al Maryah Island.

Italian luxury brand Bvlgari Hotels & Resorts, in partnership with UAE-based developer Eagle Hills, is developing the Bvlgari Resort & Mansions Abu Dhabi, a beachfront sanctuary slated for completion by 2030. Located on a private island extending from the city’s iconic corniche, the development will feature a 60-room resort, 30 sea-facing villas, and 90 bespoke mansions offering views of both the open sea and Qasr Al Watan.

In March, Ohana Development broke ground on Elie Saab Waterfront by Ohana, its luxury residential project in collaboration with the famed fashion designer. Situated on Al Reem Island and due for completion in the second quarter of 2027, the development comprises 174 contemporary apartments and opulent penthouses.

Earlier this year, Ohana Development also partnered with luxury watchmaker Jacob & Co to launch the AED4.7 billion Jacob & Co Beachfront Living by Ohana, a coastal enclave located in Al Jurf between Abu Dhabi and Dubai.

Last October, Taraf, the real estate arm of Yas Holding, announced a partnership with Marriott International to bring the W Residences Abu Dhabi – Al Maryah Island to market. This project marks the debut of the W Hotels-branded residences in the capital and will be located within the city’s premier financial and lifestyle destination.

Power and Water

Abu Dhabi has taken a number of initiatives to reinforce its leadership in renewable energy, combining innovation with scale. Among them is Masdar’s pioneering ‘round-the-clock’ renewable energy project combining a 5.2GW solar PV plant with a 19GWh battery energy storage system (BESS). Developed with EWEC (Emirates Water and Electricity Company), the project aims to deliver 1GW of baseload power 24/7, marking it as the world’s largest solar and BESS initiative.

The UAE clean energy leader has selected Larsen & Toubro and Powerchina as EPC contractors, with JA Solar and Jinko Solar supplying 2.6 GW each of PV modules using TopCon technology, and CATL providing the BESS with Tener technology.

In line with the emirate’s goal of boosting renewables in its energy mix, EWEC recently obtained approval for four sites spanning 75 sq km in Abu Dhabi for new solar PV and wind projects, adding 4.5G W solar and 140MW wind capacity. Located in Al Faya, Al Khazna, Al Zarraf (solar), and Sila (wind), these projects support Ewec’s goals of 10 GW solar by 2030 and 18 GW by 2035, aligning with Abu Dhabi’s DoE Clean Energy Target 2035 and UAE Net Zero by 2050. The developments aim to supply 60 per cent of Abu Dhabi’s power from renewable sources.

Industry

Abu Dhabi’s industrial sector has seen a surge of strategic developments over the past year, solidifying its role as a regional leader in energy, advanced manufacturing, and sustainable construction. Major state-backed initiatives and international partnerships have propelled the sector’s growth, particularly in chemicals, LNG, and green building materials, with the Al Ruwais Industrial Complex emerging as the epicentre of activity.

A key milestone came in January when Samsung E&A secured a $1.7-billion engineering, procurement, and construction (EPC) contract for the Ta’ziz Methanol Project.

The contract includes the construction of a methanol plant with a production capacity of 1.8 million tonnes per annum at the Ta’ziz industrial zone in Ruwais. Ta’ziz, a joint venture between Abu Dhabi National Oil Company (Adnoc) and ADQ, represents a central pillar of Abu Dhabi’s push to develop a low-carbon chemicals and fuels ecosystem.

In late 2024, more than $2 billion worth of EPC contracts were awarded for essential site infrastructure for the Ta’ziz development.

These contracts cover a wide range of critical components, including a chemicals port by NMDC Group, a terminal and storage facility by Rotary Engineering in partnership with Advario, and infrastructure works by Al Geemi Contracting. These developments will support the export of low-carbon ammonia and methanol as well as the import of feedstock for the 17-sq-km site.

In January, Adnoc Gas announced the award of $2.1 billion contracts for the enabling infrastructure of its Ruwais LNG project.

The largest of these contracts, worth $1.24 billion, was awarded to a consortium of ENPPI and Petrojet for a pre-conditioning plant at Habshan 5, part of one of the world’s largest integrated gas processing complexes.

The development also includes $514 million worth of transmission pipelines awarded to China Petroleum Pipeline Engineering Company and $335 million in compression facilities being developed by Petrofac Emirates.

Once operational, the Ruwais LNG plant will stand among the world’s lowest-carbon intensity LNG facilities, integrating artificial intelligence and advanced digital systems to enhance efficiency and reduce emissions.

.jpg)

.jpg)

.jpg)

.jpg)