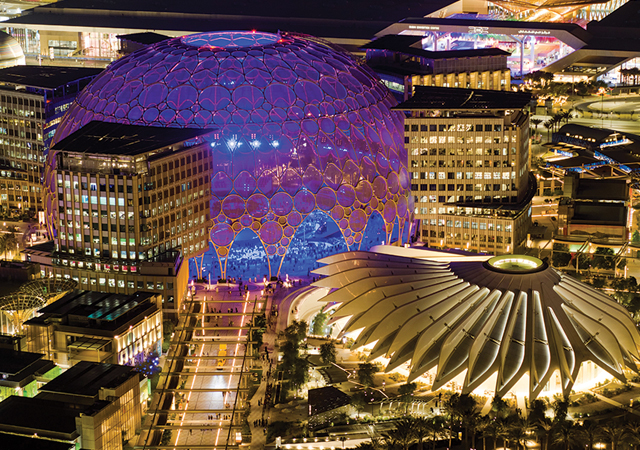

Qatalum’s new smelter in Qatar ... the Gulf’s aluminium industry is growing.

Qatalum’s new smelter in Qatar ... the Gulf’s aluminium industry is growing.

THE high-growth aluminium market of the Middle East, especially Saudi Arabia, will come into focus at Aluminium Dubai, the most comprehensive and specialised event covering various aspects and sectors of the aluminium industry.

Leading industry players from the Middle East and North Africa (Mena) region will showcase the latest innovations and technological advancements in the industry at the second edition of Aluminium Dubai to be held from May 9 to 11, 2011.

The region’s leading aluminium trade show will see participation from more than 150 exhibitors at Sheikh Saeed Halls 2 and 3 of the Dubai International Convention and Exhibition Centre in Dubai, UAE.

“At the event, industry players will be able to get deep insights into Saudi Arabia’s high potential market for aluminium. The event connects regional and international suppliers, customers and investors from both the government and the private sector to make best use of the business opportunities offered by the region’s high-growth market, while exposing them to the latest technology and concepts in the aluminium industry,” says Tarek Ali, show manager, Aluminium Dubai, Reed Exhibitions.

A recent report by Ventures Middle East said the value of Saudi Arabia’s construction sector is expected to increase from $27 billion in 2010 to $44 billion in 2015, witnessing a compound average growth rate (CAGR) of 10 per cent. Total building construction spend is estimated to be $217 billion – excluding projects on hold.

The kingdom is planning to become one of the major aluminium upstream producers in the Middle East, after announcing three aluminium smelting projects at a total value of $19.5 billion. The total capacity of the planned projects is estimated to increase from 740,000 tonnes in 2013 to 2.4 million tonnes in 2016.

As for the downstream aluminium industry, Saudi Arabia is now the base for the largest number of aluminium-processing factories in the region, which are in excess of 100. The five largest extrusion companies have a combined production capacity of around 144,000 tonnes per annum.

Meanwhile, demand for fabricated aluminium products in Saudi Arabia’s building construction sector is expected to increase at a CAGR of nine per cent from $920 million in 2010 to $1.44 billion in 2015. The demand in volume is expected to increase at a CAGR of 10 per cent, from 5.4 million sq m (and 249,000 m for kitchens) in 2010 to 8.4 million sq m (and 377,000 m) in 2015. Products with the greatest aluminium demand by value are: windows, 33 per cent; curtain-walls, 17 per cent; and cladding, 17 per cent. Aluminium demand by volume is highest for windows at 35 per cent, followed by cladding at 24 per cent and curtain-walls at 15 per cent.

The Ventures Middle East study also indicates a significant global increase in the demand for aluminium. The construction sector constitutes only 26 per cent of the world consumption of aluminium, while the other uses of aluminium in various sectors like energy, transportation, packaging and others constitute about 74 per cent – sectors which were negatively affected to a lesser degree compared with the construction sector during the global financial crisis, it says.

Also at Aluminium Dubai, industry experts and leaders will share their insights and present technological solutions at the ‘Innovation Podium Programme’.

According to estimates, investments in the aluminium industry in the Gulf are expected to grow to $55 billion by 2020 with smelter expansions taking place and a host of new projects on the anvil.

The region’s stronghold in this industry is attracting heavy foreign investment and generating high interest from industry players worldwide, says Reed Exhibitions.

This year’s event aims to build on the success of the show’s 2010 edition, which gathered 165 exhibitors from 23 countries and over 3,000 visitors from 61 countries.