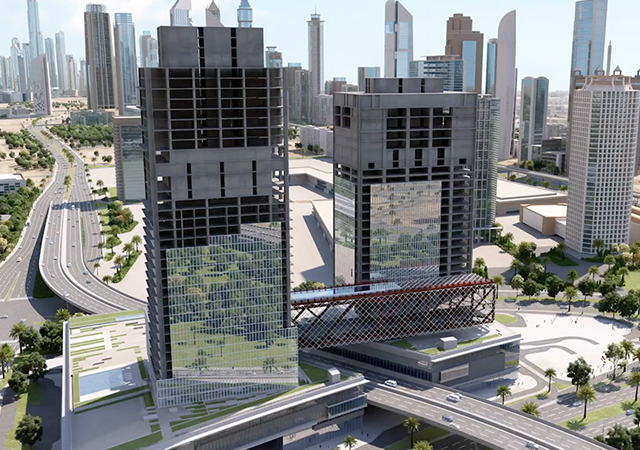

DIFC ... finance hub.

DIFC ... finance hub.

THE Dubai International Financial Centre (DIFC) authority has underlined the tremendous potential for Shari’ah-compliant financing of infrastructure projects across the GCC and world over, in its latest series of white papers.

Entitled ‘Islamic Financing for Infrastructure Projects’, the paper notes that the increasing share of Shari’ah-compliant financing in such projects would help meet a funding demand that ranges from $535 billion to as much as $2 trillion by 2020.

The DIFC, an onshore hub for global finance, says it has made a substantial, long-term commitment to supporting the role of Islamic finance by providing a favourable business, legal and regulatory environment that encourages growth and innovation in the industry. These efforts include creating Shari’ah models of regulation and a legislative regime that provides certainty and clarity regarding Islamic financial transactions.

“This paper is an important contribution to the policy and market discussions regarding both infrastructure finance and the broader Islamic finance industry, and reflects DIFC’s dedication to developing Islamic finance as one of its primary areas of focus,” said Farhan Al Bastaki, executive director of Islamic Finance at the DIFC Authority.

“The paper comes at a time when governments are increasingly looking to the market – through public-private partnerships and otherwise – to help fund enormous infrastructure requirements.”

The white paper highlights infrastructure projects that are ideal for Islamic financing, in part because of Islamic finance’s preference for equity-based and asset-backed projects, as well as because many infrastructure schemes benefit the wider community, which fits well with the moral underpinnings of Islamic finance. An example of this latter point is the recently listed $100-million International Finance Corporation Hilal Sukuk on Nasdaq Dubai and the Bahrain Stock Exchange, the proceeds of which will fund infrastructure and health projects in Yemen and Egypt.

The potential for Shari’ah-compliant sources of infrastructure financing also is driven by its low share in overall Islamic financing. Only 22 per cent of the $40 billion in Shari’ah-compatible financing within the GCC has gone into infrastructure projects, while 11 per cent of the $14.9 billion in sukuks issued in the GCC during 2008 was used for infrastructure.

The paper’s author, Habib Ahmed, professor and Sharjah chair in Islamic Law and Finance at the Institute of Middle Eastern and Islamic Studies, School of Government and International Affairs at Durham University in the UK, said: “The level to which Islamic finance will participate in funding future infrastructure projects will depend on its ability to develop innovative securities and other instruments.”

.jpg)

.jpg)

.jpg)