A consortium including Germany's Westdeutsche Landesbank and France's BNP-Paribas had been appointed as joint lead arrangers for the financing of the Salalah power system privatisation project in Oman by Dhofar Power Company (DPC) and its subsidiary, Dhofar Generation Company (DGC).

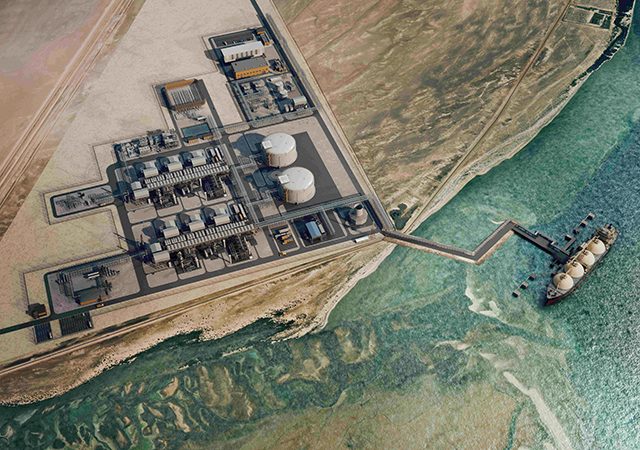

The Salalah concession is a vertically integrated electric utility, the first of its kind in the Middle East. DPC will build a world-classs 200 MW gas-fired electricity generation facility and modernise the Salalah transmission and distribution network.

BNP Paribas and WestLB have underwritten 100 per cent of the base and standby facilities valued at $233 million. Financial closure is expected in September 2001 with general syndication planned shortly thereafter. Both international and regional banks are expected to participate.

Larsen and Toubro (L&T) of India has been awardeda $233 million contract to build the power plant.

Construction is to begin in September and due to be completed in February 2003.

General Electric of the US will supply the power island and Sargent and Lundy of the US will design the project.

Meanwhile, work on another independent power project in Oman, the $415 million Barka power and desalination plant, has started. AES Barka, a subsidiary of AES Corporation of the US, said that the launch marked successful financial closure for the project.

The company has entered into a loan agreement with ANZ Investment Bank and Arab Banking Corporation acting as lead-arrangers to secure $348.6 million in financing for the plant that will produce 427 MW of power and 20 million gallons per day (gpd) of desalinated water. AES holds an 85 per cent interest in the business with Multitech, a local partner holding the remaining interest.

The power plant is being designed and built by a consortium of Enelpower of Italy and Hitachi Zosen of Japan. The plant features two gas turbines, a steam turbine and two steam generators supplied by Ansaldo.

Commercial operations are expected in April 2003.