A rendering of the departure hall at the new Doha airport terminal.

A rendering of the departure hall at the new Doha airport terminal.

Qatar is on the threshold of becoming a gas-driven economy, with liquefied natural gas (LNG) and condensates set to overtake oil as the biggest export earner by 2003.

Over most of the past decade, the country has been hampered by a huge debt which had surged to nearly $12 billion in 1999, accumulated largely on account of infrastructure spending in the oil and gas sectors, construction of facilities for the export of LNG, and petrochemical plants. This has meant that projects away from the oil and gas, and industrial sectors have been few and far between.

Prospects look much brighter now for the country, with both its LNG plants now in full operation and even contemplating expansion. A luminous star on the horizon is the Dolphin Project, an integrated gas pipeline grid which will take Qatari gas to the UAE, and Oman, with a possible subsea connection linking Oman to Pakistan.

The state is firmly on the path to industrialisation with a number of ventures being promoted by Qatar Petroleum (formerly Qatar General Petroleum Corporation), including downstream gas projects and petrochemical plants.

As with most of the countries within the GCC, Qatar is seriously looking at privatisation. A first step has been the creation of Qatar General Electricity and Water Corporation (Kahramaa) taking on some of the responsibilities of the Ministry of Electricity and Water, thus starting the restructuring and eventual privatisation of the utility sector.

This entity is actively boosting the country's power and desalination capacity, having already awarded a contract for the expansion of an existing power and desalination facility and invited bids on Qatar's first independent water and power project (IWPP) at Ras Laffan.

Meanwhile, a new foreign investment code, which will allow majority ownership in certain sectors, has still to come into force.

So what are the repercussions of all these developments on the construction sector?

The sector has suffered over the past few years because of a dearth in infrastructure projects and most of the jobs have come from private projects and subcontracts from international firms working on expanding the country's industrial base.

What the state requires is a greater investment by the private sector in development projects to keep the construction sector cogs turning and eliminate the cut-throat competition for contracts.

The scenario is not likely to change drastically in the short term. However, power projects will figure prominently along with further major contracts in the gas and petrochemicals sector.

The Doha International Airport expansion project appears to have been taken off the backburner. Long term, the Dolphin project holds promises for local contractors, who will be called upon to provide their services for the setting up of the infrastructure that this ambitious venture demands.

Dolphin project

Qatar is viewing the $8-10 billion Dolphin project, which is sponsored by the UAE Offsets Group (UOG), as the first step towards a GCC gas grid. Abdullah bin Hamad Al Attiyah, Qatar's Minister of Energy and Industry said the project will help Qatar to bring economic prosperity to the country and also open up opportunities for local companies in the domestic market and the UAE.

"The project will lead to the setting up of downstream industries (petrochemicals, power generation, steel and aluminium and gas to liquids conversion)," Al Attiyah said.

On opportunities for the construction industry, Al Attiyah said the project involves major construction and installation works, including offshore production facilities, onshore processing and storage facilities, as well as offshore and onshore pipelines, all of which represent an opportunity for the concerned contractors.

In March last year, the UOG selected US gas giant Enron and France's TotalFina as partners in the project and a new company, Dolphin Energy Limited (DEL) was formed. UOG said the initial goal of the partnership would be to develop the backbone of the Dolphin project, bringing up to 3 billion cu ft per day of gas from Qatar's giant offshore North Field via a new 800-km pipeline to Abu Dhabi, Dubai and Oman.

A significant breakthrough on the project is expected to be made this month with the signing of a multi-billion dollar deal to channel Qatari gas to the UAE. The $3.5-4 billion deal would entitle DEL to develop a tract of the North Field and produce up to 2 billion cu ft per day of gas.

"This initial phase will focus on development activity along the entire gas value chain - upstream, midstream and later downstream - and will ultimately include multiple partnerships and industrial facilities in all of the countries," UOG said. UOG said Elf, a unit of TotalFina, will focus on upstream development of the project while Enron will focus on pipeline development, gas marketing and project risk management.

The upstream sector covers the development of gas reserves in the North Field and elsewhere, and the construction of gas and liquids processing facilities offshore and onshore based on supplies from the North Field and other sources.

The midstream sector includes the building of a new gas pipeline linking Qatar with the UAE and other key markets in the region. The downstream sector covers the development of new and existing industrial clusters in the UAE, Qatar and the region and the investment in both energy-intensive industries such as petrochemicals as well as in gas-fed power generation projects and conversion programmes.

Oil & gas

Qatar Petroleum is actively pursuing a number of projects to diversify its sources of revenue, efficiently utilise its vast natural gas resources and further develop the industrial base in the country.

In line with Qatar Petroleum's strategic masterplan for the utilisation of gas reserves in Qatar, several major petrochemical and gas utilisation projects are in various stages of development:

The new project aims to produce 1.75 billion standard cu ft per day of gas from the North Field. It will also produce condensates, butane and propane for export and ethane as feedstock for future petrochemical ventures.

Phase one will produce 500 million cu ft per day of gas from the North Field and will be taken up on a fast-track basis. This will meet gas demand for the Ras Laffan-based power project and new ventures at Mesaieed Industrial City and other industrial enclaves.

Meanwhile, National Oil Distribution Company (Nodco) has begun construction of the Nodco-3 expansion project. This phase will upgrade the company's facilities and raise its refining capacity from 60,000 to 137,000 bpd, complying in the process with the latest international environmental standards.

Production is expected to start during the first quarter of the year 2002. The expansion includes two new condensate refining units with a total capacity of 57,000 bpd, to refine condensate products coming from Phase One of the North Field and from the Dukhan Arab-D project which was commissioned recently; debottlenecking of the refining capacity of the existing units from 62,000 to 80,000 bpd; the construction of a fluid catalytic cracking unit to convert fuel oil into lighter products with a higher value; upgrading the instrument control and information systems; and upgrading and expanding berth/shipping facilities to cope with the increase in exports.

Industry

Qatar Petroleum invited prequalifiers to bid by January 21 for a common seawater intake project at Ras Laffan. Ten international contractors had prequalified to bid for the engineering, procurement and construction (EPC) contract, worth $100-200 million. The 24-month contract involves the dredging of a 1.5-km channel and the construction of two breakwaters, a pump house, intake and discharge channels, four cooling towers, two substations, and a chlorine and chlorination building. The new facility will meet the seawater cooling needs of future industrial and utility capacity planned in the Ras Laffan industrial city.

Qatar Chemical Company (Q-Chem) is building a $1.1 billion petrochemical complex at Mesaieed which is expected to come onstream in late 2002. The plant will have capacity of 500,000 tpy of ethylene, 460,000 tpy of polyethylene, including high-density and linear low-density polyethylene, and 47,000 tpy of hexene-1.

The US/French group of Kellogg Brown & Root (KBR) and Technip were awarded the estimated $800 million plant contract in August 1999. Athens-based Consolidated Contractors International Company (CCC) and Dodsal of India have two subcontracting packages, each worth $60 million, for the project. Both subcontracts cover onshore civils, mechanical, electrical and instrumentation works. CCC has been awarded the package covering the polyethylene plant and offsites and utilities. Dodsal will be working on the ethylene cracker and the hexene-1 unit.

The local Midmac Contracting is working on the estimated $20 million buildings package which involves the construction of about 23 industrial and non-industrial buildings over 14 months. Midmac has already undertaken the site preparation package on the project.

Q-Chem is a 51:49 joint venture between Qatar Petroleum and the US’ Phillips Petroleum Company.

Other petrochemical projects on the drawing boards are a plant in Ras Laffan and a toluene di-isocyanate (TDI) project, estimated to cost $400 million.

Qatar Fertilisers Company (Qafco), a Qatari-Norwegian joint venture, said last May that it plans to go ahead with its fourth expansion project to cash in on growing global demand for urea and ammonia and recovering Asian markets. A concept study for a fourth ammonia/urea expansion project (Qafco 4), adjacent to the existing ones at Mesaieed, is currently in progress. If implemented, Qafco could emerge at the forefront of global fertiliser producers.

The company currently produces 1.6 million tonnes of urea and 1.3 million tonnes of ammonia a year from its three existing complexes. Qafco-4 will have a capacity of 2,000 tonnes per day of ammonia and 3,200 tonnes a day of urea. The cost of expansion is estimated at $550 million.

The Qatar Plastic Products Company (QPPC), a venture between Qatar Petrochemicals Company (Qapco), Qatar Industrial Manufacturing Company (Qimco) and the Italian FEBO, was inaugurated in Mesaieed last November. It produces heavy-duty plastic bags, plastic sheets and other plastic products for industrial purposes.

Power & water

The Qatari government took a major step towards privatisation of its power sector in May last year when assets owned by the Ministry of Electricity and Water (MEW) were transferred to the Qatar General Electricity and Water Corporation (QEWC). QEWC is 57 per cent controlled by local investors and 43 per cent by the government.

The major project awarded by QEWC was a $152 million contract to France's Alstom Power to expand power generation capacity at the Ras Abu Fontas B plant, the country's largest and newest power and water desalination plant.

It has an electric generation capacity of 610 MW and water output of 33 million gallons per day (gpd). Alstom will supply, install and commission three generating plants which will raise Ras Abu Fontas B power and water complex's capacity by 380 MW and desalination capacity by 25 million gpd.

Meanwhile Fahad Hamad Al Mohanadi, the director general of the QEWC said the Ras Abu Fontas B will be further expanded at a cost of QR2.2 billion ($604.39 million) in two phases, which are slated to be completed by 2003.

QEWC also issued a tender last year for the proposed Ras Laffan Independent Power and Water Project (Ras Laffan IWPP"), which will have a power generating capacity of 750 MW and produce 30 million gpd of desalinated water when completed. AES, CMS, Marubeni and PSEG Global, and Tractebel emerged as the four bidders for the project. A preferred bidder is expected to be announced in shortly.

The first 400 MW is scheduled to be operational by 2003. Construction work is expected to begin this year on the project, in which a foreign developer will hold a 60 per cent stake. The remaining stake would be shared between Qatar Petroleum and QEWC.

Qatar's power demand - growing at an average eight per cent a year since 1990 Ñ is projected to reach 2,008 MW this year from 1,702 MW in 1999 and 3,280 MW in 2005.

Airport

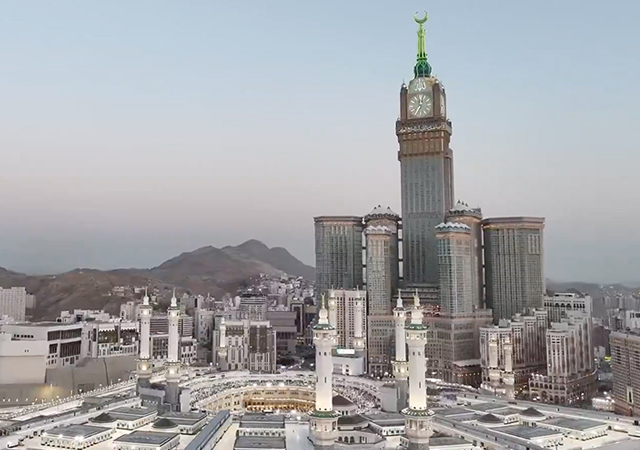

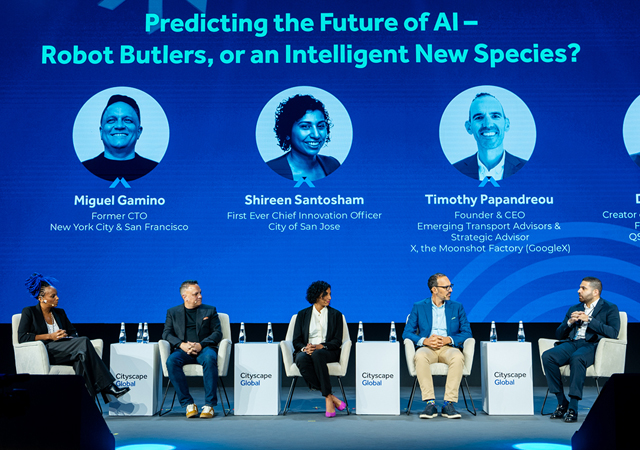

Fresh moves are being made on the long-awaited Doha International Airport expansion plan, with contractors having been invited to submit prequalification documents for the first package. The tender involves dredging and reclamation work.

The estimated QR1.6 billion ($450 million) project calls for the construction of a new terminal east of the existing facility and a second runway.

Meanwhile, renovation work has been carried out at the existing airport complex.

City Centre

A major section of the Phase One of the $200 million City Centre opened in October last year with work nearing completion on other aspects of the phase such as an ice skating rink. A grand opening has been set for this month (see separate article).

Work on the second phase is scheduled to start in two months for completion by 2002. The City Centre is also planning a third phase over an area of 10,922 sq m which is expected to take off by 2003, said Shaikh Faisal bin Qassem Al Thani, the promoter of Shaikh Faisal bin Qassem Al Thani Group of Companies.

Medical facilities

Qatar's first private hospital is being set up by Al Ahli Hospital Company. The 250-bed hospital in Doha will supplement the existing state-run Hamad Medical Corporation facilities.

The $70 million hospital will contain 191 beds, 21 ambulance clinics, and 16 rooms for day-care and is expected to be ready within two years. The consultant on the project is Dar Al Handasah.

The Al-Ahli project will be the second new hospital project to proceed in Qatar. The local HBK Contracting has recently started building the Al-Shamal hospital in the north, following a funding allocation in the 2000/01 budget.

The consultant on the government-funded project is Dar Al Handasah Consultants while Contraco Contracting Company is the contractor.

Other projects