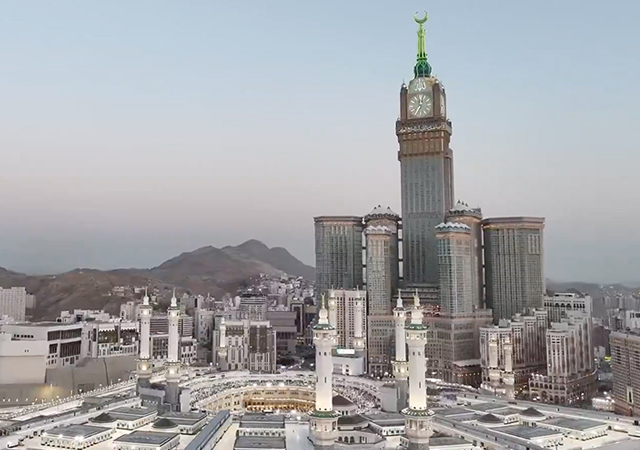

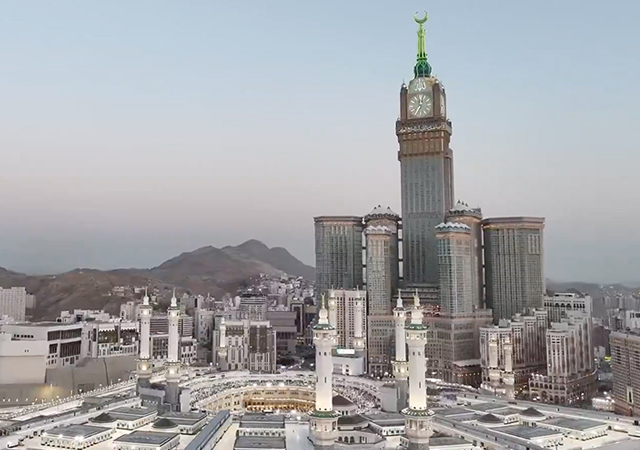

The real estate and construction sectors in Makkah and Madinah are undergoing a significant transformation, driven by Saudi Arabia’s Vision 2030 – which aims to diversify the national economy and to increase religious tourism – and the recent opening of the property markets of these holy cities to foreign investment.

While direct foreign ownership in Makkah and Madinah is generally restricted, indirect investment is now permitted through Saudi-listed companies and real estate funds. As of January 27, 2025, the Capital Market Authority (CMA) formally allowed foreign investment in Saudi-listed companies that own real estate in these holy cities. This approach allows the kingdom to attract capital and expertise for its mega-projects while retaining control over sacred areas. A new, more progressive legal framework, the Law of Real Estate Ownership and Investment by Non-Saudis, was approved on July 8, 2025, and will come into effect in January 2026, replacing the restrictive 2000 framework. The new law allows Muslim foreign individuals and foreign-owned Saudi businesses to acquire limited ownership and property rights in Makkah or Madinah, under certain conditions to be detailed in the regulations.

The ambitious goals of Saudi Vision 2030 place Makkah and Madinah at the very core of the kingdom’s economic diversification strategy. A primary objective is the Pilgrim Experience Programme, which aims to host 30 million Umrah performers and six million Hajj pilgrims annually by 2030. Achieving these targets necessitates a monumental expansion of accommodation, services, and supporting infrastructure. The ongoing real estate boom in these cities is a direct consequence of this national imperative.

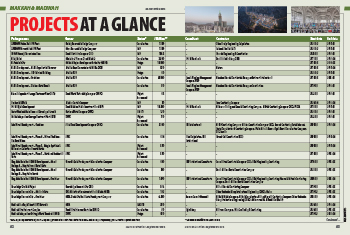

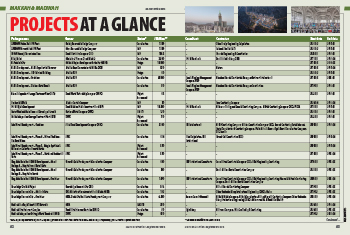

|

|

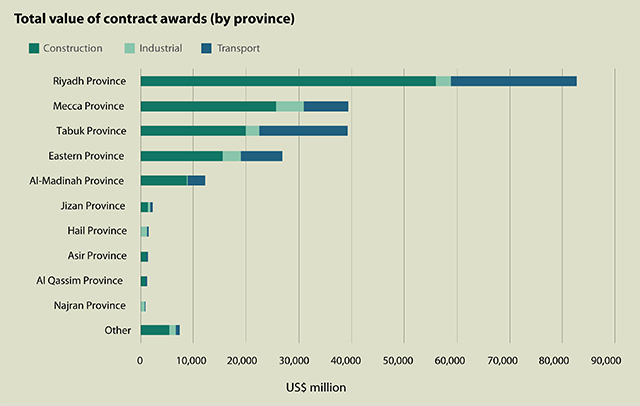

Total value of contracts (by province) |

Saudi Arabia’s construction output value is expected to reach $191 billion in 2029, representing a rise of 29.05 per cent compared to 2024, according to an analysis by Knight Frank. In its latest report, the global consulting firm highlighted the growth in residential developments, the ongoing giga-projects, and increased demand for office space as the key drivers for this rise.

The kingdom aims to deliver over one million homes, more than 362,000 hotel keys, over 7.4 million sq m of retail coverage, and more than 7.7 million sq m of new office space by the end of this decade as part of its Vision 2030 economic diversification drive.

|

|

Madinah airport ... set for expansion. |

According to Faisal Durrani, partner, head of research of Knight Frank in the Middle East and North Africa, some $1.3 trillion is planned to be invested in real estate and infrastructure projects as part of Vision 2030. The Western Region is expected to account for 53 per cent of this total.

Flagship projects such as Thakher Makkah, Masar Destination and Jabal Omar Development in Makkah, and Rua Al Madinah and Knowledge Economic City (KEC) in Madinah are reshaping the urban landscape, adding substantial capacities in hospitality, residential, and commercial sectors. Thakher Makkah is aiming for 42,000 hotel rooms and Rua Al Madinah is targeting 47,000 hotel rooms, representing a massive expansion of rooms supply. These developments are progressing rapidly, with several phases already operational or nearing completion.

|

|

Rua Al Madinah aims to offer 47,000 hotel rooms and 63 per cent of open/green space. |

To ensure the success of these projects, extensive investment is being made into modern transportation networks, including significant airport expansions, new road systems, and advanced public transit solutions. These infrastructure works are vital enablers, ensuring seamless connectivity and enhancing the overall experience for millions of pilgrims and visitors.

Madinah Airport, Saudi Arabia’s first airport privatisation project, is set to be expanded with a new 39,000-sq-m domestic terminal and the existing terminal developed to accommodate 18 million passengers annually. A consortium of TAV Airports and Al-Rajhi Holding will invest a total of $275 million in this expansion. The consortium holds the concession rights to operate Madinah Airport until May 2041.

Real Estate

Since January 2025, foreigners can invest in Makkah and Madinah’s real estate markets by acquiring shares in listed property development companies, with non-Saudi ownership capped at 49 per cent per company.

Demand from global investors – especially those from the Muslim world – is high, with “designated investment zones” such as the central areas of both cities expected to outperform the broader market in price growth and rent appreciation.

|

|

A seven-star hotel and serviced apartment complex designed by RMJM for the Jabal Omar Development. |

Housing demand in the holy cities has multiplied with these reforms, international hotel chains announcing new openings, and capital inflows increasing rapidly for both residential and commercial projects. The influx is especially visible around the Grand Mosque in Makkah and the Prophet’s Mosque in Madinah where numerous mega projects are under way.

Key Projects in Makkah:

|

|

Thakher Makkah, a $7-billion mixed-use development, just 1 km from the Grand Mosque. |

• Thakher Makkah: A SR26-billion ($7 billion) mixed-use development, just 1 km from the Grand Mosque. Spread over 320,000 sq m, the project aims to deliver about 100 hotel, residential, and commercial plots, and over 42,000 hotel rooms operated by international brands including Radisson, Novotel (world’s largest in terms of rooms), and Park Inn. Phase One of the infrastructure work is nearing completion, and the Novotel Hotel and Residences is operational.

• Jabal Omar Development: Work continues on this mega-project, which remains a central part of Makkah’s skyline featuring luxury hotels, serviced residences, retail, and an elevated pedestrian boulevard for pilgrims. The project surrounds the Haram and is considered one of the largest ongoing hospitality developments worldwide. Jabal Omar development is being implemented in seven phases with work on Phase Four reported to be more than 80 per cent complete. The fourth phase consists of three structural bases accommodating seven towers, as well as a facility dedicated to government agencies and located at the centre of the project. The total construction area for this phase is 309,557 sq m. The developer Jabal Omar Development Company (JODC) continues to win investors, with its latest land sale agreement having been signed in August with Azhar Company for SR1.16 billion, following a deal worth SR1.3 billion with Durrah Taybah Investment Company early this year.

• Masar Destination: The Masar urban renewal project in Makkah is a major development designed to accommodate the growing number of pilgrims. Spanning 1.2 million sq m, the project includes a long pedestrian boulevard, hotels, retail areas, and enhanced transport infrastructure.

The development, owned by Umm Al Qura for Development and Construction, will feature 41,000 hotel rooms, 9,000 residential units, and 330,000 sq m of commercial space. It will also have a hospital, mosques, and cultural centres. The core infrastructure is almost complete, with the entire project expected to be operational by the end of 2025.

|

|

Masar Destination includes a long pedestrian boulevard, hotels and retail areas. |

The Masar project has attracted significant investment recently. Among the major investors are Wijhat Al Bayt Real Estate Company, which bought two plots to develop two residential towers with over 412 units, for a total investment exceeding SR1.3 billion and Qaid Real Estate Development and Investment Company, which is investing SR1.3 billion to build a 720-room luxury hotel.

• Makkah Gate Project: This long-term, multi-phase urban development will provide residential villas in a full-service suburb, with integrated schools, clinics, and green spaces, situated on the main approach to the city from Jeddah. A significant focus is on the development of residential suburbs over an area of five million sq m and comprising more than 8,300 housing units. The National Housing Company (NHC) is a primary driver of the project and has been actively signing agreements with various real estate developers. In April 2025, Sumou Real Estate Company was awarded a contract worth SR680 million to develop over 900 residential villas within the Makkah Gate project.

|

|

Makkah Gate Suburb (Al-Bayt) ... being developed by Abar Al-Mamlakah Real Estate. |

A key project is the Makkah Gate Suburb (Al-Bayt) is a large-scale housing project with 554 housing units planned across 42 blocks that are set for completion by May 2028. It is being developed by Abar Al-Mamlakah Real Estate.

Other developers for the Makkah Gate project include Saudi Real Estate Co, Ajdan Real Estate Development Co, Abdul Rahman Saad Al Rashid and Sons Co, and Al Tahaluf Real Estate. Its first phase will provide more than 2,300 housing units.

• Al Khalil Mixed-Use Project: This is a large mixed-use development along Prince Sultan bin Abdulaziz Road, near the Al Awali District. Spanning 220,000 sq m, it will feature a shopping mall, major retail outlets, two hospitals, landscaped open spaces, and parking for about 2,800 vehicles. In June, Saudi authorities launched a new Expression of Interest (EOI) and Request for Qualification (RFQ) for the project, which will be delivered through a Public-Private Partnership (PPP).

|

|

The Joint Development Project on Prince Sultan bin Abdulaziz Road (Makkah–Alhada) will be implemented under a BOOT model. |

• The Joint Development Project on Prince Sultan bin Abdulaziz Road (Makkah–Alhada): A major mixed-use development in Makkah, spearheaded by the Holy Makkah Municipality (HMM) in collaboration with the Ministry of Municipalities and Housing (MOMAH) and the National Center for Privatization & PPP (NCP). This PPP project will be implemented under a build-own-operate-transfer (BOOT) model with a 30-year term. It aims to transform a government-owned site spanning approximately 220,000 sq m near the Al Awali District. The development includes a regional shopping mall; Big-box retail outlets for home improvement, electronics, furniture, and lifestyle products; two hospitals: a 200-bed long-term care facility and a 100-bed multi-specialty hospital; and infrastructure such as roads, landscaped open spaces, and parking for 2,800 cars.

Major Madinah projects

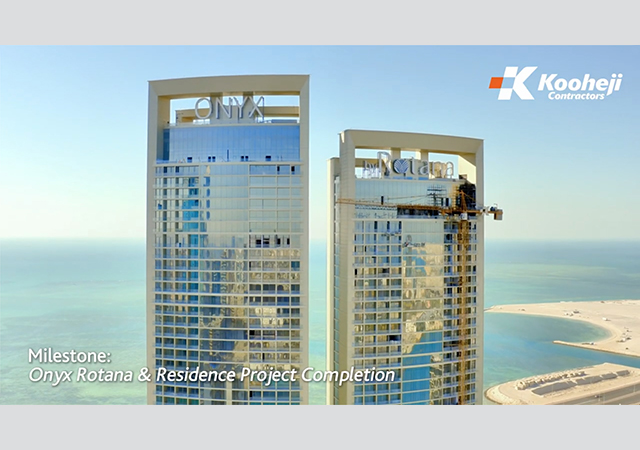

• Rua Al Madinah: A Vision 2030 flagship project covering 1.5 million sq m near the Prophet’s Mosque. Rua Al Madinah aims to offer 47,000 hotel rooms and 63 per cent of open/green space. First-phase completion is expected by 2026. Major hotel chains (Hyatt, Marriott and Accor) will together open over 7,000 rooms within Rua Al Madinah. Several contracts have been awarded for work on the project: Parsons is managing the main infrastructure, including the tunnel, road, and utility works in the holy city; and Jacobs is providing design services for 12 hotel brands in the fourth Super Blocks of Rua Al Madinah, in addition to large spaces to support the establishment of restaurants and cafés managed by global operating companies.

• Knowledge Economic City (KEC): Another large-scale Madinah project, blending business, hospitality, retail, and residential uses to further diversify the economy and tourism. In July, Knowledge Economic City Company signed a SR399.32-million development and leasing agreement with Riyadh Schools Holding Company, a subsidiary of Mohammed bin Salman’s non-profit foundation (MiSK Foundation), to establish an educational complex in KEC. Spanning 20,000 sq m, the complex will accommodate around 1,800 male and female students.

|

|

KEC comprises business, hospitality, retail, and residential components. |

KEC is developing integrated urban areas such as Al Alalya’a (a residential scheme with gardens, a mosque, and shops), the KEC Hub (a large commercial complex with a Hilton hotel tower, residential tower, entertainment centres, sports club, and boulevard with restaurants and cafes), and Dar Al Jewar (the first gated community in Madinah).