The total capacity of data centres in the region is expected to almost triple to 3.3 GW within five years.

The total capacity of data centres in the region is expected to almost triple to 3.3 GW within five years.

The Middle East’s data centre market is entering a period of unprecedented growth, with billions of dollars in public and private investment driving the development of cutting-edge digital infrastructure. Fuelled by national digital transformation strategies, the rise of smart cities, and soaring demand for cloud and AI capacity, the sector is opening vast opportunities for the construction industry, which now sits at the heart of this technological revolution.

According to MEED Projects, nearly $7 billion worth of data centre projects are currently under construction, with an additional $13 billion in the pre-execution phase. PwC Middle East projects that total regional capacity will triple from 1 GW in 2025 to 3.3 GW within five years, underscoring the scale of the building boom.

Government policy is playing a decisive role. Saudi Arabia’s Ministry of Communications has announced an $18 billion masterplan to establish a national network of state-of-the-art facilities, creating opportunities from hyperscale builds to edge deployments. PwC notes that the GCC’s regulatory frameworks – such as Saudi Arabia’s Cloud Computing Special Economic Zone (CCSEZ) – are helping attract global technology investment while streamlining construction approvals.

|

|

Dubai’s Moro Hub, a 100 MW facility that is the world’s largest fully solar-powered data centre. |

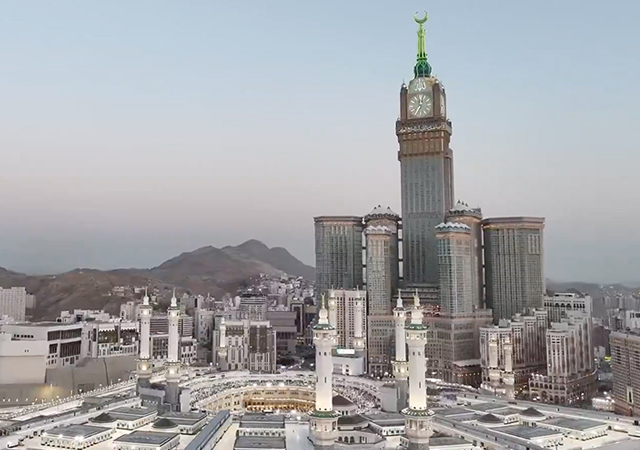

Meanwhile, the UAE is pushing digital infrastructure in tandem with its smart city ambitions. A showcase is Dubai’s Moro Hub, a 100 MW facility within the Mohammed bin Rashid Solar Park that is the world’s largest fully solar-powered data centre. It exemplifies how energy-efficient design, renewable integration, and AI-powered maintenance are becoming mandatory features of new builds.

Similarly, Egypt’s “Digital Egypt Vision 2030” – being set up in a partnership between the UAE’s Ministry of Investment and Egypt’s Ministry of Communications under an agreement signed in December 2023 – has sparked plans for up to 1 GW of new data centre capacity, with construction challenges ranging from site design and power integration to advanced mechanical systems.

Construction sector’s evolving role

The construction industry is adapting rapidly to meet these digital infrastructure demands. Three clear trends are shaping the approach:

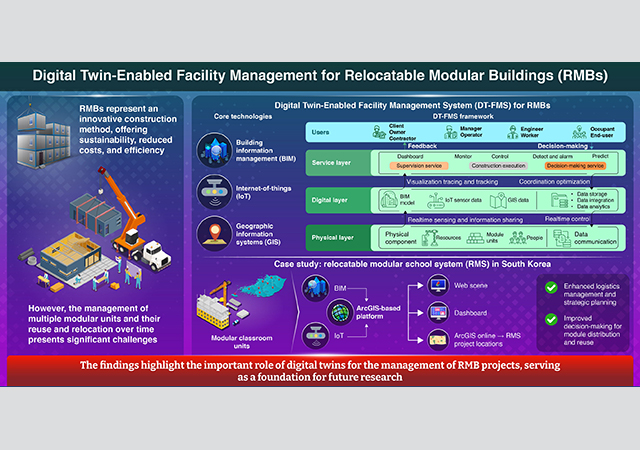

• Modular and accelerated builds: Projects are increasingly adopting modular and prefabricated methods, reducing timelines for edge and micro data centres, and allowing scalability to meet evolving workloads.

• Sustainability as a design mandate: PwC highlights cost-effective land and energy advantages in the Middle East (for example, power tariffs of just $0.05–0.06 per kWh compared to the US average of $0.09–0.15). But with AI facilities requiring up to 10 times more power than traditional centres, operators are mandating solutions such as liquid cooling, water-based chillers, and integration with solar projects like Abu Dhabi’s Al Dhafra Solar Park. Mechanical and civil contractors will be central to this shift.

|

|

Projects are increasingly adopting modular and prefabricated methods. |

• Complex logistics and supply chain integration: Advanced facilities depend on graphics processing unit (GPUs), cooling systems, high-density racks, and AI chips, many of which face global supply bottlenecks. PwC stresses the importance of hubs like Jebel Ali in the UAE and Dammam in Saudi Arabia for importing and distributing these components, positioning logistics planning as a core part of construction delivery.

Opportunities and Challenges

For construction contractors, this boom brings both promise and pressure.

Opportunities include long-term contracts on hyperscale projects, ongoing operations and maintenance (O&M) partnerships; demand for sustainable building engineering (meeting LEED standards, net-zero goals, and AI-ready cooling loads); and a surge in edge and micro facilities supporting IoT, autonomous mobility, and smart city services.

Challenges include high upfront capital needs for AI-ready facilities (PwC highlights higher investment due to specialised GPUs, cooling systems, and dense electrical infrastructure); supply chain volatility for critical technologies; scarcity of skilled workforce trained in cloud, AI, and high-density mechanical systems (a priority PwC warns must be addressed through training programmes by global firms like Amazon Web Services (AWS) and Microsoft); and rising competition and compliance with evolving sustainability and cybersecurity regulations.

Market players and mega-projects

A diverse ecosystem is shaping the market. International players like AWS, Microsoft, Oracle, and Equinix are partnering with regional leaders such as du, Etisalat, Mobily, Ooredoo, and Zain. On the construction side, specialised firms such as Digital Realty, Gulf Data Hub, Pure Data Centres, and DataVolt are executing rapid buildouts across the GCC. PwC points to sovereign wealth funds – such as Saudi Arabia’s sovereign wealth fund Public Investment Fund (PIF), UAE’s Mubadala, and Qatar’s Investment Authority – as critical financial backers, accelerating construction timelines and enabling global-scale deployment.

|

|

The NEOM-DataVolt project will take shape in Oxagon. |

At the mega-project level, Saudi Arabia’s NEOM-DataVolt project stands out: a 1.5 GW AI-ready facility to be built in phases, with $5 billion allocated for initial construction and operations by 2028. The project will be implemented in Oxagon, NEOM’s hub for clean and advanced industries.

The AI data centre will feature an integrated system for high-density computing and energy-efficient infrastructure, supporting Oxagon’s ambition to address the global challenges associated with traditional data centres.

Designed to run fully on renewable power and sustainable cooling systems, the site exemplifies how green architecture, advanced civil works, and scalable site development are becoming integral to future hyperscale facilities.

DataVolt has also signed a land lease agreement with the Saudi Authority for Industrial Cities and Technology Zones (Modon) for the development of a state-of-the-art AI-ready data centre in in Riyadh’s First Technology Park.

The data centre facility will be designed for advanced AI processing and will serve growing demand from hyperscalers, cloud and content providers, and enterprises in Saudi Arabia.

According to PwC, the UAE has made significant strides in its data centre ecosystem with Khazna Data Centres recently unveiling a 100 MW AI facility in Ajman and plans to deploy significantly more capacity in the long term. Saudi Arabia has also announced several initiatives in this space including the $100-billion Project Transcendence AI Initiative backed by the PIF and a $5.3 billion commitment from AWS to develop new data centres. Qatar's investment in digital infrastructure, along with strict data security regulations, has attracted global players to establish data centres within the country.

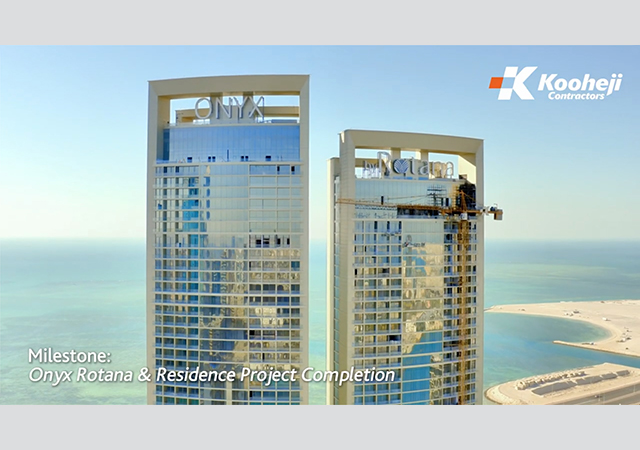

Other nations in the Middle East have also planned significant investments including Omniva's announcement of 1GW data centre in Kuwait, Equinix-Omantel partnership for SN1 in Salalah, Oman, and Batelco-Qareeb partnership for a facility in Bahrain.

|

|

Beyon Digital Oasis ... being built in Bahrain. |

Batelco, part of the Beyon Group, late last year appointed Almoayyed Contracting Group to develop Bahrain’s first-ever White Space Data Centre. The new facility will be strategically located within the Beyon Data Oasis and adjacent to a scalable solar farm highlighting the project’s emphasis on both sustainability and innovation.

Outlook

According to PwC, the Middle East’s blend of low-cost land, affordable power, robust connectivity, and unparalleled access to capital makes it one of the most attractive digital infrastructure markets globally.

ResearchAndMarkets further estimates that the GCC will command over 60 per cent of MEA data centre investment by 2030.

For the construction sector, demand will increasingly favour:

• Turnkey solutions (from masterplanning and engineering to commissioning and O&M);

• Modular and AI-optimised data centres that can scale dynamically;

• Sustainable builds tied to renewable energy projects; and

• Sophisticated MEP (mechanical, electrical, plumbing) integration to balance high-energy AI workloads with green commitments

Despite challenges around supply chains, costs, and talent, the long-term trajectory is clear: construction firms are central to enabling the secure, scalable, and sustainable backbone of the digital economy.

PwC summarises the opportunity as a transformative investment cycle, where infrastructure delivery partners stand to gain significantly from the region’s rapid digital expansion.