Lifestyle properties ... Riviera, a French Mediterranean-inspired residential and commercial community at MBR City being developed by Azizi.

Lifestyle properties ... Riviera, a French Mediterranean-inspired residential and commercial community at MBR City being developed by Azizi.

As the curtains come down on Expo 2020 Dubai, which helped the emirate draw the world’s attention to itself for over six months, the natural question is what next for the city that never tires of hitting headlines for the right reasons.

By all measures, despite the challenges of the Covid-19 pandemic, the Expo was a splendid success, once again proving to the world the organisational capabilities of Dubai and its vision.

Will there be a lull now that the mega event is finished?

Those who have followed the emirate’s developments over the last two decades know the answer … Dubai never sleeps.

|

|

The Colours of the World Parade at Expo 2020 during UAE National Day ... the site is being repurposed to host District 2020. |

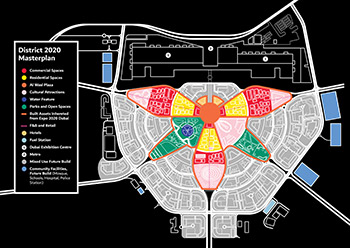

The immediate focus is on repurposing the Expo 2020 site which hosted the world’s largest showcase of human achievements. The site itself is home to three signature pavilions, the observation tower (Garden in the Sky), the Expo 2020 Water Feature – all designed by world-leading architects – along with numerous other structures purpose-built for the event which will now become part of the District 2020. Dubai is now set to reimagine and repurpose some 80 per cent of the site to host a smart and sustainable city. While an official announcement is awaited on the decisions being made in terms of legacy, the district will soon welcome a first cohort of 85 start-ups and small businesses as part of its global entrepreneurship programme Scale2Dubai before the end of this year (see Page 24).

Dubai is showing the world what can be achieved with good ideas, marketing and real estate – albeit in a desert environment – and has been amazing the world with awe-inspiring buildings, achieving several “world-firsts” too along the way.

Its innovative strategy to attract high net-worth individuals (HNWIs) through its golden visas, programmes to ‘work remotely from Dubai’ and staycation appeal is already unleashing a plethora of uber-luxury properties.

Hence, the real estate market is now catering for these HNWIs with property that is unique, offering a dreamed-of lifestyle and even managed by international brands with all amenities money can buy.

|

|

Infinity Bridge, a key component of the AED5.3-billion Al Shindagha Corridor Project, |

For instance, Omniyat last month marked a double celebration – the handover of its ultra-luxurious One at Palm Jumeirah, managed by the iconic hospitality brand, Dorchester Collection, Dubai and the launch of its AVA Palm Jumeirah – with drones illuminating Dubai’s sky in one of the greatest light shows in the Middle East. The AVA Palm Jumeirah will boast 17 hanging palaces (see UAE Focus, Page 59).

Also last month, another property developer Damac Properties pitched in its latest development, Safa One de Grisogono – The Nature of Luxury – with designs inspired by Swiss jeweller de Grisogono. The one-of-its-kind twin-tower project will feature luxury and super-luxury floors with hanging gardens, with the base of the project hosting an artificial beach (see UAE Focus, Page 58).

The emirate continues to be a magnet for international investors, accounting for the lion’s share of new investments or AED99 billion ($53 billion) of the AED148 billion in 2021, according to reports. Of the total 52,415 investors, 38,318 were foreigners.

Social housing, meanwhile, continues to be a priority and is a key part of the Dubai 2040 Urban Master Plan for sustainable urban development announced by HH Sheikh Mohammed bin Rashid Al Maktoum, Vice President, Prime Minister of the UAE and Ruler of Dubai, early last year.

Sheikh Mohammed last year also approved the allocation of AED65 billion in funding for an Emirati housing programme in Dubai, which will be spent over the next two decades to provide quality housing for Emiratis.

|

|

The 2,400 MW Hassyan power plant ... work in progress. |

Apart from real estate, Dubai is also looking to transform the emirate into a vital player in global economic development and one of the smartest and happiest cities in the world and to achieve this goal it is increasingly seeking private sector participation. Late last year, the Department of Finance (DoF) announced a large number of projects worth more than AED25 billion under the public-private partnership (PPP) portfolio. These include more than 30 significant projects in the infrastructure, public transportation and urban development sectors.

In spearheading its goals, the emirate has been a frontrunner in adopting the latest technologies including 3D printing, digitalisation and artificial intelligence and switching to renewable energy in line with its focus on sustainability. For instance, Dubai Electricity and Water Authority (Dewa) clinched the Guinness World Records title for setting up the first 3D-printed laboratory in the world last year.

Two key enablers in its drive to anticipate and address the challenges of the future will be District 2020 and Dubai’s latest engineering marvel the Museum of the Future, which opened at the end of February to much fanfare (see Page 14).

|

|

Peninsula masterdevelopment ... to comprise nine developments. |

Power & Water

In line with the Dubai Clean Energy Strategy, under which the emirate aims to produce 75 per cent of its energy requirements from clean sources by 2050, Dubai is developing one of the largest solar parks in the world as well as a hydroelectric power plant.

The mega solar park project – Mohammed bin Rashid Al Maktoum (MBR) Solar Park – is being implemented in five phases, with the first phase having begun with a pilot 13 MW project. The total production capacity of the solar park’s three operational phases has reached 1,013 MW late last year, with the commissioning of the 300-MW first stage of 900 MW Phase Five.

The first stage of the 950 MW fourth phase is now set to kick off with a capacity of 217 MW. Dewa and Acwa Power formed a project company, Noor Energy 1, to design, build, and operate the fourth phase. It is 51 per cent owned by Dewa and 25 per cent by the Saudi-based Acwa Power, while the Silk Road Fund has a 24 per cent stake.

Noor Energy 1 is spearheading the largest single-site concentrated solar power (CSP) and a single hybrid solar power project in the world with three different solar energy technologies in deployment. The technologies called for the construction of a CSP central tower, a CSP parabolic trough and solar photovoltaic panels. This phase also has the largest storage capacity in the world for 15 hours, which allows for around-the-clock energy production.

Dewa has also implemented the Green Hydrogen project, in collaboration with Expo 2020 Dubai and Siemens Energy at the MBR Solar Park – which is the first in the Middle East and North Africa to produce hydrogen using solar power.

Meanwhile, work on Dubai’s new hydroelectric power plant is reported to be more than 35 per cent complete. The $386-million Hatta power plant will have a production capacity of 250 MW with a storage capacity of 1,500 megawatt-hours and a lifespan of up to 80 years.

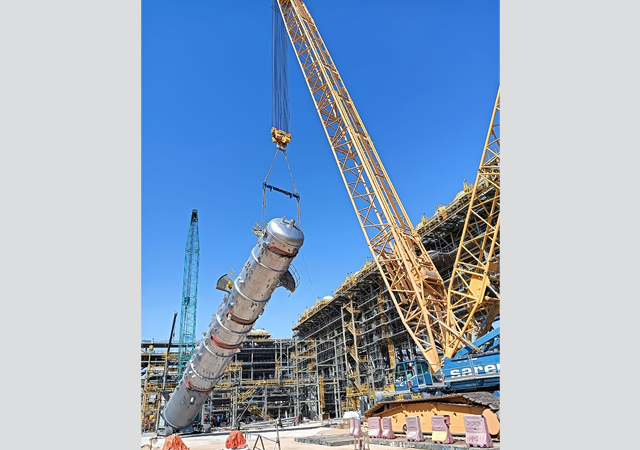

The emirate has recently announced that one of its power plants is switching from clean coal to natural gas. The 2,400 MW Hassyan Power Complex, which has a current production capacity of 1,200 MW and is being developed using the Independent Power Producer (IPP) model, will be converted from clean coal to natural gas by its developer Acwa Power. The plant will add a further 600 MW of capacity in Q4 of 2022 and 600 MW by Q3 of 2023, thus taking its total capacity to 2,400 MW.

A pioneering project in the waste-to-energy sector is a mega $1.2-billion development by a consortium comprising Besix, Dubal Holding, Itochu, Hitachi Zosen and Tech Group. The greenfield facility in Warsan will process up to 45 per cent of Dubai’s municipal waste and generate up to 200 MW green electricity supplying 120,000 households.

Among other projects under way in this sector, work is set to reach the halfway mark on the Hassyan Sea Water Reverse Osmosis project, the largest Independent Water Project (IWP) in the emirate. Utico, a leading private utility company in the UAE, and Dewa are shareholders in the project which will have a 120-million-gallons-per-day capacity in its first phase.

The $450-million project – billed as the ‘most Sustainable Desal Project’ in the region, and pathbreaking for its design, power consumption and sustainability – includes a 600-million-gallons-per-day seawater intake system for the first two phases, two 132-kV substations, and potable water storage tanks with a capacity of 120 million gallons of, according to Utico.

Roads & Railways

Among the largest road projects in progress in Dubai is the AED5.3-billion Al Shindagha Corridor Project, which spans 13 km along Sheikh Rashid, Al Mina, Al Khaleej and Cairo streets. The project recently witnessed the inauguration of a key component, the architecturally striking Infinity Bridge (see Gulf Construction, February 2022).

Al Shindagha Corridor is a strategic project that is being undertaken by the RTA in 11 phases. Construction works for the project started in 2016 and will be completed by 2027 according to the urban development plan of the area.

Also, the completion of the railway track linking Dubai with Abu Dhabi on the Etihad Rail project last month marks the start of a new phase of logistic and economic integration between the two emirates (see UAE Focus, Page 59).

Real Estate

With the delivery of One at Palm Jumeirah, Dorchester Collection, and the launch of yet another uber-luxury development AVA Palm Jumeirah, Omniyat and other key property developers such as Damac and Select Group have sent clear signals that they are catering for the HNWIs who seek the ultimate in luxury.

Apart from Safa One de Grisogono, Damac Properties also recently launched ‘Damac Lagoons’, a new luxury development that promises its very own ‘Eight Wonders of the Mediterranean’ concept.

The fact that Dubai attracts HNWIs with a penchant for uber-luxury is amply illustrated by the fact that a number of duplex apartments and penthouses were snapped up recently for near record-breaking figures. These include properties at The 118, a boutique luxury project by Signature Developers located in Downtown Dubai, where one of its trademark apartments was sold for AED50 million.

Omniyat recently closed the sale of the three most expensive penthouses in the region, carrying a total value of more than AED260 million – at One at Palm Jumeirah, Dorchester Collection.

In addition, since the onset of the coronavirus pandemic and the popularity of the work-from-home approach, developers have been responding to the demand for larger homes in communities that offer lifestyle amenities.

While it was generally expected that there would be a lull in new project announcements following the intense activity in the years preceding the Expo 2020, Dubai has seen a number of project launches recently notably at Tilal Al Ghaf, a lifestyle destination, and Peninsula at Business Bay, in addition to the projects announced by Omniyat and Damac.

Majid Al Futtaim Communities is expanding its exclusive resort-style community Tilal Al Ghaf with the launch of Elysian Mansions, featuring six bedrooms, multiple entertainment areas, spa and wellness spaces, Sky Suite and an underground glass-encased car gallery with a capacity for six to eight vehicles, and Alaya Beach, an ultra-exclusive neighbourhood which will include 14 mansions and 30 reserve grand villas, each set in landscaped grounds – with direct access to a lagoon bordered by white sandy beaches, and a range of premium amenities. This followed the launch late last year of Aura Gardens, featuring three and four-bedroom townhouses and four-bedroom twin villas with exclusive Sky Suites at the development.

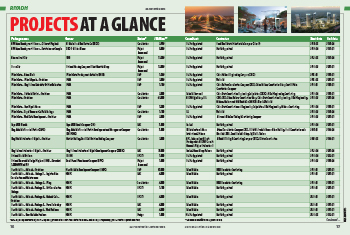

Meanwhile, at the Peninsula masterdevelopment in Business Bay, Select Group’s most recent launch is the 36-storey ‘Peninsula Two’ tower, which offers a mix of residential and commercial units with prime views of Burj Khalifa, Downtown skyline and Dubai Canal. Peninsula, which was unveiled last October, will be delivered in phases over the next five to seven years and will feature nine developments, ranging from high-rise towers to low-rise waterfront villas.

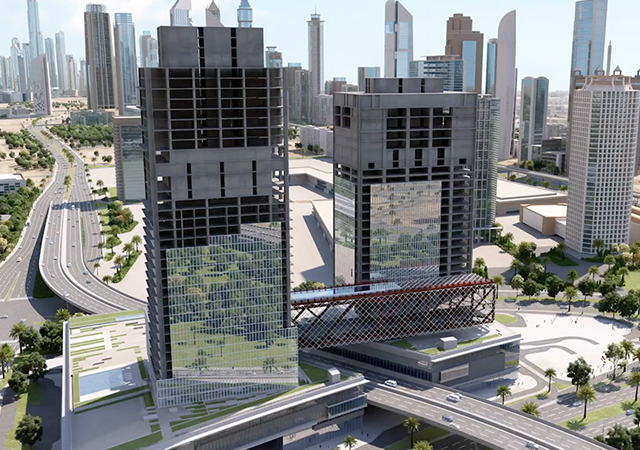

Another striking property under construction is the Uptown Tower, being developed by Dubai Multi Commodities Centre (DMCC) and designed by the architectural firm Adrian Smith + Gordon Gill Architecture. Being built by Besix, the 81-storey tower is scheduled to be delivered in autumn 2022 (see Page 19).

In line with Dubai’s quest for the superlatives, the world’s next tallest hotel tower – Ciel – is now being built in the emirate where it has now crossed the halfway construction milestone (see Page 28).

In response to the demand for branded residences at the luxury end of the market, Saudi-based developer Dar Al Arkan has unveiled two projects: the AED800-million DaVinci Residential Tower, being developed in partnership with Italian hypercar manufacturer Pagani Automobili; and the AED800-million Urban Oasis, a waterfront residential tower on the Dubai Water Canal with homes designed by luxury Italian fashion house Missoni

Other design-led projects include Ellington Properties Harrington House in the heart of Jumeirah Village Circle (JVC), and a new wellness-integrated residential development in Mohammed Bin Rashid (MBR) City.

Developers are also meeting demand for residential projects that offer lifestyle choices. Azizi Developments, for instance is developing a French Mediterranean-inspired residential and commercial community at MBR City. Work on the AED12-billion Riviera is well advanced - Phase One of the project is more than 85 per cent complete, while the second, third and fourth phases are 80, 50 and 20 per cent complete, respectively. Upon its completion, Riviera will boast 16,000 residences spread across 71 mid-rise residential buildings, a mega-integrated retail district, and an abundance of lifestyle-enhancing amenities including a 2.7-km-long lagoon.

Azizi is developing a string of other residential projects including Berton in Al Furjan, and Creek Views I in Dubai Healthcare City (DHCC).

Other real estate developments:

• Master developer Nakheel kicked off 2022 with the launch of Tilal Al Furjan, a new collection of 220 luxury four-and five-bedroom villas overlooking the Al Furjan master community. This followed the sell-out success of Murooj Al Furjan West in September and the 418-villa Murooj Al Furjan last May. Nakheel has also embarked upon transforming the Jebel Ali Village into an upscale residential community comprising a gated, hillside collection of luxury villas set among lush green spaces.

• Union Properties is pushing ahead with its AED2.2-billion Motor City developments with the launch of the AED800-million Motor City Views, the first of the proposed phased developments within the mega project.

• Ithra Dubai has launched One Deira, which is District Four of the Deira Enrichment Project (DEP), which aims to rejuvenate Dubai’s historic commerce and original community centre with a vibrant mix of residential, commercial, retail and hospitality offerings. One Deira consists of an office building and a 131-room hotel tower and a two-level retail podium and will introduce the UAE’s first integrated central transport station.

• Emaar’s 340-m-tall Il Primo Tower in Dubai Opera District is expected to be completed this year. It comprises a 77-storey structure with podium and six levels of basement and parking. Another Emaar project scheduled for completion this year is Creek Edge, a luxurious residential development in two towers of 40 and 20 floors that rise above the waterfront promenade of Creek Island.

• Sobha Realty is developing the 592-unit Waves, within its AED16-billion ($4.35 billion) Sobha Hartland, an 8-million-sq-ft freehold master development at Mohammed Bin Rashid Al Maktoum City. The 35-storey Waves is one of the 12 towers the developer plans to build within The Waterfront District. Work on the project is due for completion in 2023.

.jpg)

.jpg)

.jpg)