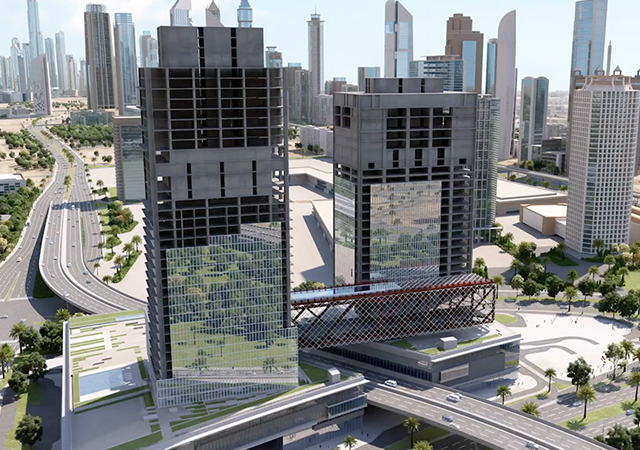

Riyad Capital, one of the kingdom’s largest asset managers and a leading company in real estate investment, has announced that it will join hands with the Saudi Railway Company (SAR) to establish a real estate fund aimed at developing a mixed-use project based on the Transit Oriented Development (TOD) model, a global concept focused on creating integrated urban communities adjacent to public transport stations.

The project will be developed on a 90,000-sq-m land plot located in the Al Rusifah district near the Haramain High-Speed Railway Station in Makkah at total investment of up to SAR6 billion ($1.6 billion), said the topasset manager in a statement.

This collaboration reflects Riyad Capital’s commitment to supporting major development projects in the holy cities and strengthening its role as a key partner in advancing the kingdom’s real estate infrastructure, in line with the objectives of Saudi Vision 2030 to stimulate strategic investments and diversify the national economy, it stated.

On the strategic tie-up, Abdullah Alshwer, the CEO of Riyad Capital, said: "This project marks a strategic milestone in Riyad Capital’s efforts to strengthen its presence in the real estate development sector, particularly in cities of religious and economic significance."

"Our collaboration with SAR embodies a shared vision to transform the project site into a modern urban destination aligned with Makkah’s development aspirations, while providing promising investment opportunities," he stated.

The project is expected to feature mixed-use components, including hotels, commercial centres and residential facilities, thus enhancing the area’s position as a promising investment and development hub.-TradeArabia News Service

.jpg)

.jpg)

.jpg)