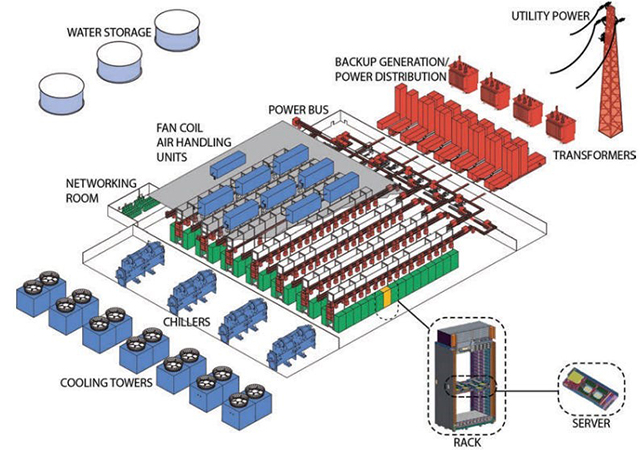

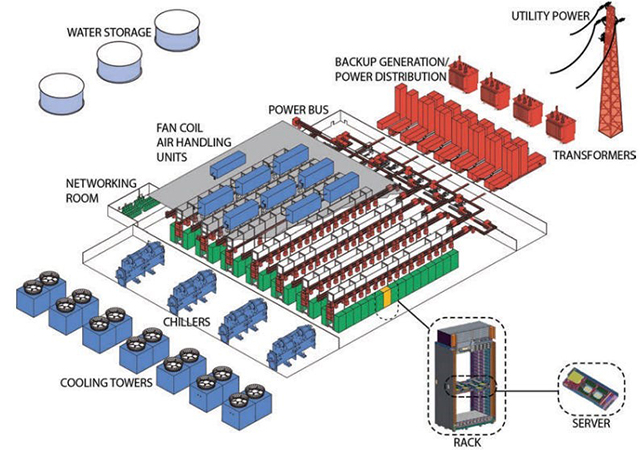

Figure 1: Schematic architecture of large AI data centres (via construction physics).

Figure 1: Schematic architecture of large AI data centres (via construction physics).

The rapid rise of artificial intelligence (AI) is creating a huge demand for digital infrastructure. From powerful computing structures and massive data storage set-ups to cutting-edge cooling technologies, AI data centres and associated infrastructures are evolving quickly, becoming game changers. This transition is not only affecting how we incorporate technology in construction; it is also transforming the design and practices that the sector is used to.

With a remarkable annual growth rate of 36 per cent of AI data centres since 2022, regional companies are uniquely positioned to lead the charge in creating the next wave of AI-ready and complex infrastructure (see Figure 1), aligning with global trends and regional ambitions.

Building the future of a power- data-hungry era

In my article in Gulf Construction’s July 2024 issue, I highlighted how AI is transforming the construction industry, redefining the way we work over the next 24 months. Since then, its impact has expanded rapidly, transforming even the construction landscape. To put this in context of opportunity, power consumption and construction progress, ChatGPT – a major AI platform – consumes enough electricity daily to power over 17,000 average US households, or roughly 10 to 20 times the energy Google uses for each search query. Looking ahead, the number of AI data centres is projected to grow globally by an astonishing 250 per cent year-on-year by 2029.

|

|

Khader |

Globally, the energy demand, for example, from AI and cryptocurrency data centres is set to skyrocket, potentially doubling from 460 TWh to over 1,000 TWh by 2026. As a comparison, that’s equivalent to Japan’s entire energy consumption and could represent four to six per cent of the world’s electricity use. In Europe, AI-driven energy demand is projected to increase by approximately 60 per cent over the next five years. Meanwhile, in Ireland, a key data centre hub for Europe, ongoing construction projects could account for nearly a third of the country’s electricity consumption if all planned developments are completed. Amazon, Meta, and Google are projected to collectively invest approximately $250 billion in the development of global AI digital infrastructure over the coming years.

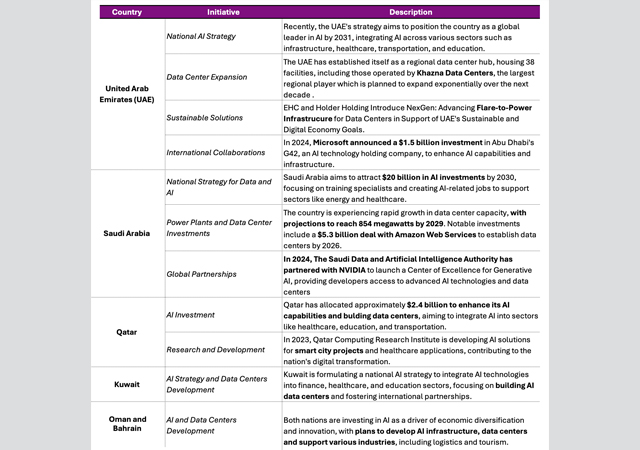

Many countries in the region (Table 1) are pouring billions into accelerating AI transitions. Leaders are actively encouraging major companies to set up their data centres locally, creating a growing demand for advanced infrastructure and paving ways for smart cities. The UAE and Saudi Arabia, with their strategic locations, are making significant investments in digital infrastructure to establish themselves as key regional data hubs.

It’s important to highlight that the region’s hot climate adds extra challenges to cooling data centres, driving companies like the Abu Dhabi-based Emircom to develop innovative solutions like immersion cooling. These advancements help lower energy consumption and minimise environmental impact.

Additionally, partnerships such as the one between Vertiv and Gulf Data Hub – signed in August 2024 – which is building a cutting-edge 16 MW data centre in Dubai Silicon Oasis, showcase the region’s dedication to improving power efficiency and sustainability in data centre operations.

|

|

Table 1: AI and data centre investment initiatives in the region. |

The data centre and associated digital construction landscape in the region is undergoing rapid transformation. According to market research firm Mordor Intelligence, the regional market is projected to reach $4.2 billion by 2024 and grow at least at CAGR of about 25 per cent, soaring proximality to $15.9 billion by 2030.

This massive expansion raises an important question: Are our construction players in the region prepared to seize and catch such opportunities created by AI’s growing demand?

Simultaneously, do the sector’s existing strategies correspond with the national goals for data centres and AI, which is crucial for digital transformation and economic diversification?

Now is, in my opinion, the best moment for the leaders to take action.

Bridging AI Ambitions with Present Realities

The unexpected rise in global demand for large-scale data centres is set to drive a significant surge in their construction, alongside the development of supporting power plants – especially in light of the initiatives highlighted in Table 1. To remain competitive and play an active role in delivering such projects that are characterised by high complexity, fast-paced, and agility, regional construction firms must move beyond current outdated strategies. This requires a strategic shift to enhance their expertise, workforce capabilities, as well as positioning their market presence.

This involves embracing energy-efficient designs, developing specialised workforce skills, and meeting client priorities such as cost efficiency to encourage major data players to set up large-scale data centres in the region, while also favouring regional contractors over international alternatives.

During my recent visit to Gitex, a premier information technology exhibition held annually in Dubai, I was struck by the ambitious scale of AI initiatives in the region. While these plans are undeniably impressive, they also revealed potential challenges – particularly in project execution capacities – and a noticeable gap between the vast potential of AI and the region’s current readiness to fully support and sustain these ambitions. While this might seem surprising, I firmly believe that regional contractors need a stronger presence at such high-tech events. Showcasing their capabilities and forming partnerships at all levels is essential to bridge this gap.

At the 40th opening of the leading energy ecosystem platform Adipec last November, UAE Special Envoy for Climate Change, and Minister of Industry and Advanced Technology Dr Sultan Al Jaber highlighted the region’s need for better infrastructure, strategic investments, and enabling policies to meet the energy demands driven by AI and expanding data centres, all while prioritising UAE’s urban and sustainability plans. His message reinforces the urgency of adapting to these evolving demands to unlock the region’s full potential in the digital age.

Final Remarks: Shaping a Resilient Future

The rapid rise of AI and the resulting demand for data centre infrastructure bring both challenges and opportunities. While ambitious plans and significant investments position the Gulf as a potential global data hub, the key to success lies in addressing the readiness gap through proactive measures. Collaboration across industries, including authorities, will play a critical role in navigating execution such gaps, as well as challenges and regulatory complexities.

To streamline a resilient future for the construction sector, regional firms must expedite and embrace innovations more swiftly by integrating latest practices in this field and investing in workforce development. When all these components are in place, the area can turn the energy demand and AI-driven data into a driver of sustainable growth, giving the construction sector also – which is already characterised by narrow profit margins and intense rivalry – a competitive edge.

* Haitham Khader |MBA, MLSCM, CCCM, PMP, RMP, ACP, PSP, CCP, BGS| is Chief Commercial and Investment Officer at EHC Investment, a prominent enterprise holding company in Abu Dhabi. He has over 20 years of diverse experience working with top organisations across the Middle East, Asia, and Europe.

.jpg)

.jpg)

.jpg)