Riley ... “Understanding the true demand for cement and clinker is critical to ensuring that policies, technologies, and investments align with reality”.

Riley ... “Understanding the true demand for cement and clinker is critical to ensuring that policies, technologies, and investments align with reality”.

The cement industry is responsible for eight per cent of global CO2 emissions – a staggering figure that demands urgent action, particularly as 2024 marked the first year the planet surpassed the 1.5 deg C global warming limit. Against this backdrop of escalating climate concerns, the World Cement Association (WCA) has issued an immediate call for transformative change.

WCA President Wei Rushan told members that the global cement industry needs to focus on innovation, sustainability, and collaboration, urging stakeholders to proactively address the evolving economic, regulatory, and geopolitical landscape.

To address these challenges, the WCA recently released its landmark white paper, “Long-Term Forecast for Cement and Clinker Demand”, authored by CEO Ian Riley, which challenges conventional wisdom and offers critical insights for navigating the industry’s transition to a low-carbon future.

“The cement industry is experiencing profound changes, with businesses managing overcapacity and upgrading, balancing sustainable development with short-term survival, and weighing social responsibility against shareholder returns,” stated Rushan. “While each region faces unique challenges, our shared focus remains on driving sustainable growth, embracing technological advancements, and tackling climate change.”

The white paper projects a 22 per cent decline in global cement demand down to 3 billion tonnes per annum (tpa) by 2050, far below existing forecasts. Even more striking is the anticipated drop in clinker demand, the primary source of CO₂ emissions in cement production, to 1.5 billion tpa by 2050.

“The cement industry is undergoing an unprecedented transformation. As we move towards a decarbonised future, understanding the true demand for cement and clinker is critical to ensuring that policies, technologies, and investments align with reality. This white paper aims to provide industry leaders and policymakers with the clarity needed to plan effectively and sustainably,” explains Riley.

|

|

|

Established markets like Europe and North America anticipate continued price increases, while some emerging markets may experience short-term price dips. However, the long-term outlook for emerging markets remains robust.

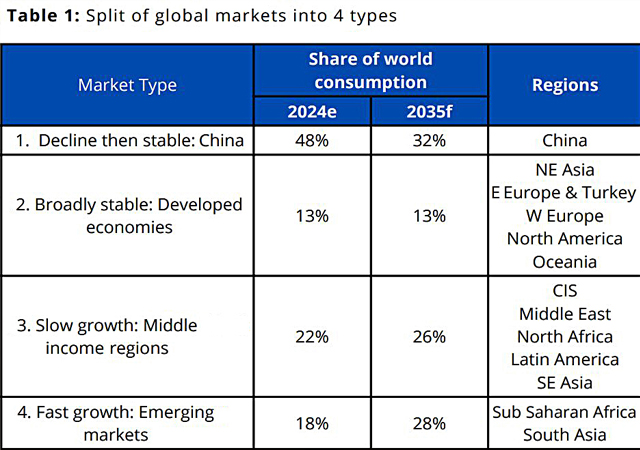

The report splits the world markets into four types, with the Middle East grouped in the middle-income countries, including the CIS, North Africa, Latin America and Southeast Asia. These regions are expected to witness steady growth in production from 0.84 billion tonnes in 2024 to 0.95 billion in 2035 and 1.03 billion in 2050, representing an average growth rate of 0.8 per cent per year, just slightly ahead of population growth which is forecast to be 0.7 per cent per year.

This is a heterogeneous group with different trends in different countries. Population growth varies considerably as does the stage of development. Some countries, such as Saudi Arabia and the UAE, will reach a stage of development where cement consumption will start to decline. Others, such as the central Asian republics, will continue to experience rapid population and per capita consumption growth due to ongoing development, according to the white paper.

The findings have significant implications, including a reduced need for Carbon Capture and Storage (CCS), which will impact investment and policy priorities.

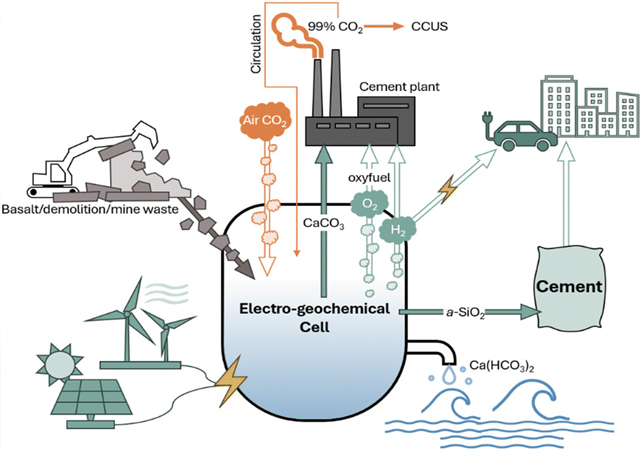

Riley underscores the complexity of this challenge: “Carbon capture remains a vital tool for tackling emissions in hard-to-abate sectors like cement. However, flawed demand assumptions and the fragmented nature of cement production globally could undermine the feasibility of such projects. Industry stakeholders must rethink their strategies and embrace innovative, sustainable practices to achieve meaningful emission reductions.”

The report also examines disruptive factors such as alternative materials, supply chain optimisation, and clinker-free technologies, which are reshaping demand patterns. By outlining three potential scenarios, it helps to provide a roadmap for stakeholders to adapt to varying degrees of change and seize opportunities for innovation.

Regional Dynamics

Multinational corporations are recalibrating strategies, with some scaling back cement operations and focusing on North America. Meanwhile cement production in Europe continues to decline due to stringent CO2 regulations and necessary capacity reductions, which is driving up cement prices. China and Japan have undergone significant consolidation and restructuring to address overcapacity.

Conversely, India’s cement production is booming, exceeding 200 million tons. Indian companies are consolidating their domestic dominance, while some multinationals are exiting this high-potential market.

Globally, regional players are gaining prominence, with the exception of Europe and North America, where European multinationals maintain a strong foothold. Chinese cement producers and other independent companies are aggressively expanding their footprint, particularly in Africa and Southeast Asia.

Confronting Global Challenges

Rushan identified overcapacity as a pressing industry challenge. The WCA, as a global representative, is committed to collaborating with producers and stakeholders to modernise and upgrade outdated facilities.

“To remain both profitable and environmentally responsible, the cement industry must aim to reduce capacity by 50 per cent, from 4.7 billion tons to 2.3 billion tons within the next decade. This requires focusing on modern, sustainable production units,” he emphasised.

“Cement plays a crucial role in building sustainable infrastructure,” Rushan continued. “By accelerating innovation, adopting low-carbon technologies, and fostering global collaboration, we can ensure cement remains an environmentally responsible material.”

The WCA calls on industry stakeholders worldwide to take immediate action by adopting sustainable practices, championing innovation, and redefining industry norms for a sustainable future.

The White Paper provides a comprehensive roadmap for the industry’s decarbonisation journey, highlighting the following critical insights:

• Declining cement and clinker demand: Global cement demand is expected to drop to approximately 3 billion tonnes annually by 2050, while clinker demand could decline even more steeply, reaching just 1.5 billion tonnes annually.

• Implications for Carbon Capture and Storage (CCS): With reduced clinker production, the need for CCS is expected to decline, necessitating a shift in investment and policy priorities.

• Alternative materials and clinker-free technologies: These innovations hold transformative potential for reshaping demand patterns and cutting emissions.

• Supply chain optimisation: Enhancing logistics and reducing waste are key strategies for adapting to evolving market dynamics.

Path to Lower Emissions

Clinker production, the largest source of CO2 emissions in cement manufacturing, generates one-third of emissions from fuel combustion and two-thirds from limestone decomposition. According to WCA’s White Paper, transitioning to lower-carbon fuels could reduce specific fuel emissions per tonne of clinker by nearly 70 per cent by 2050. Overall CO2 emissions from cement production are forecast to decline from 2.4 Gt in 2024 to less than 1 Gt by 2050, even before factoring in carbon capture technologies.

“This white paper provides actionable insights to help the cement industry accelerate its decarbonisation journey. By prioritising innovation and collaboration, the industry can achieve substantial emissions reductions and align with global climate goals,” he concludes.

The association invites its members and the broader industry to collaborate on solutions for the challenges ahead, using the white paper as a roadmap for navigating the evolving cement landscape.

.jpg)

(1).jpg)