The residential sector is seeing a big push towards branded residential and resort-living concepts.

The residential sector is seeing a big push towards branded residential and resort-living concepts.

Post pandemic, throughout 2022, the GCC saw many new developments come to fruition and new projects being announced. This year is already showing a focus on tourism mega-projects as well as super-luxury residential and mixed-use developments.

Fast-growing interest in the Middle East’s hospitality sector has now extended to the residential markets. Dubai continues its trend of being a hotbed of luxury residential development, with the sector seeing a big push towards branded residential and resort-living concepts as market differentiators. Engaging hospitality design experts in these projects has now become a practical mandate.

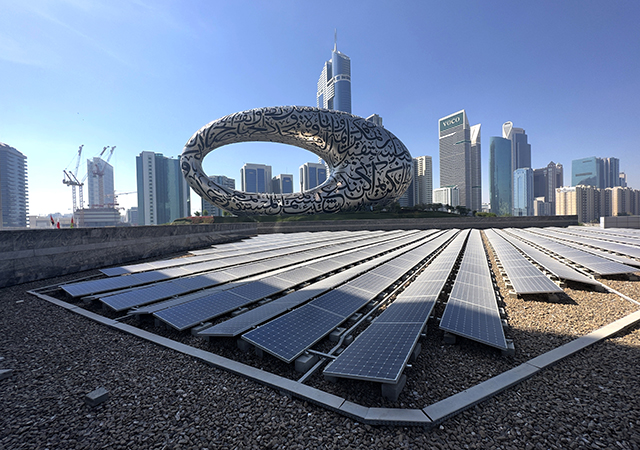

As the profiles of the UAE and Saudi Arabia continue to grow with world-first giga projects in progress and an impressive contingent of top industry talent moving into the countries, the entire region is feeling the ripple effect. The UAE now has a viable competitor in Saudi Arabia for record-breaking developments, and this continues to be at least some of the impetus behind more innovative thinking, design and development, moving forward.

Designers at Gensler, which has a global presence, look to highlight the respective cultures, values and USPs in the tourism and residential markets as more global citizens feel the irresistible pull of the region. In this context, Gensler Middle East has designed a multitude of ultra-luxury developments and is seeing a particular movement toward resort-style branded residences with a focus on wellness and restoration. This involves connecting a community with the environment and creating spaces that are designed to support a healthy live-work-play lifestyle.

|

|

Thomas Williams, Studio Director, Gensler Middle East |

The latest set of branded residence projects by Gensler has been designed for Majid Al Futtaim Properties’ Tilal Al Ghaf, a high-end mixed-use community on Hessa Street in Dubai that features an oasis of public green zones with gardens, mosques, play areas, schools, cafes and a central lagoon to complement the lush community lifestyle. Its designs achieved BREEAM (Building Research Establishment Environmental Assessment Method) “Very Good” status and promote WELL building principles, which have taken on greater importance amongst developers. Besides Aura Gardens, Serenity and Elysian Mansions, the company created the interior design for Alaya Grand Villas, a refined collection of four- to six-bedroom properties that encapsulate the essence of inspired living.

Gensler’s team curated experiential visuals, telling a meaningful story used to successfully launch the product in the market with a positive response. Finished samples displayed as an art installation and used as a marketing tool transferred the attention to the detail of the product.

On another note, Dubai offers branded residences such as the first Six Senses Residences, planned for 2024, as the CEO of the global luxury hospitality brand reported demand from affluent current and future UAE residents.

Four Seasons Hotels and Resorts, the world’s leading luxury hospitality company, has announced plans to expand its presence in the Middle East alongside Saudi-based investment firm Midad Real Estate. Together, they will introduce the Four Seasons Hotel and Private Residences Jeddah at the corniche, a new-build coastal retreat, also scheduled to open in 2024.

|

|

A living room at Alaya Grand Villas. |

The luxury segment in Dubai continues to flourish. Increasing pressure from Saudi developments will, over the coming years, force the emirate to develop even more distinctive offerings. This race may benefit both the development pipeline and the consumer. At the moment, the market is solidly Dubai, which is recognised as the world leader in branded residential offerings with all eyes on the city’s upcoming openings. The slower approach of Abu Dhabi will be something to watch as it makes large-scale investments into the luxury sector.

Global property consultancy, Knight Frank’s 2023 Prime Prediction report showed that Dubai topped the list in a ranking of the world’s top luxury real estate markets and Dubai’s prime residential prices are set to see the strongest growth globally in 2023.

The number of real estate transactions in the GCC declined by six per cent year-on-year (y-o-y) during January to October 2022 to 511,239 deals despite a jump of over 61 per cent in Dubai, as other markets such as Saudi Arabia, Qatar and Kuwait witnessed lower activity as compared to the same period in 2021. The GCC countries outside of the UAE are also firmly in the luxury real estate race, and as we have seen historically, it only takes one city to prove a market perception for the rest to follow. We are already seeing huge plans across Saudi Arabia for luxury real estate projects, mainly in hospitality, residential, retail and leisure, commercial and sports.

|

|

Many branded residences now feature a spa area. |

The average value per transaction across the GCC in 2022 was $280,000, which surpassed 2017’s average of $223,000 by 25.6 per cent. At its current pace, sales transaction volumes across the region are on course to reach one of its highest levels ever recorded, with strong demand for both off-plan and completed residential assets. This has been mirrored by Gensler’s requests for proposal type, project value, and star rating.

The UAE property market, and Dubai in particular, has experienced quite a year. Despite global economic headwinds, high-net-worth individuals (HNWIs) have flocked to the UAE over the past 18 months, which has added to the momentum in the luxury market. The number of HNWIs is expected to rise by 22 per cent in the next five years, according to Savills.

Knight Frank forecasts Dubai to have the highest prime price growth in the world in 2023, ahead of Miami and Paris. Among the records in 2022 was Dubai's most expensive property on Palm Jumeirah sold for $163 million, while another villa on The Palm was rented out on a six-month basis for Dh4 million, and monthly sales totals surpassed previous highs throughout the year.

|

|

A walk-in closet at Alaya Grand Villas. |

Analysts, developers, and market specialists believe the market for luxury homes in Dubai has led the charge and is expected to continue to do so during 2023. The luxury property segment in Dubai will continue to climb this year as prices are expected to sustain an upward trend due to rising demand from HNWIs, tight supply and fewer launches of new developments, albeit at a slower pace than the latter half of 2022, experts say.

Based on the latest statistics, the prices of luxury properties witnessed a y-o-y growth of nearly 89 per cent during the third quarter of 2022 and is expected to continue in 2023. A recent report from Knight Frank also predicts that the luxury property market will grow further in 2023 by 13.5 per cent. This is a record in itself, as no other global property market is expected to touch the double-digit mark this year.

.jpg)

.jpg)

.jpg)