Habib ... project will cater to expat needs.

Habib ... project will cater to expat needs.

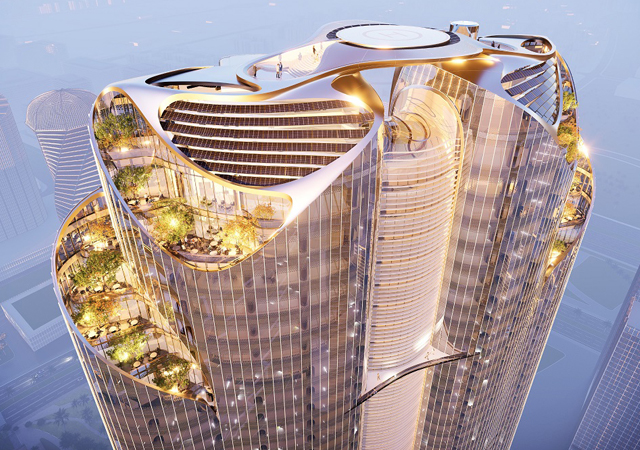

CAPITAL, one of the largest and most active alternative investment firms in the Middle East, has launched an ambitious SR1-billion ($266.6 million) residential project in Saudi Arabia’s capital Riyadh – marking its formal entry into the kingdom’s residential market.

The project will be implemented through its real estate development arm, Gulf Related, a joint venture between Gulf Capital and Related Companies, the largest privately-owned real estate development firm in the US.

The development will be a world-class residential compound in Riyadh, conveniently located about 10 minutes from King Abdullah Financial District and 20 minutes from King Khalid International Airport.

Gulf Capital has acquired two strategically located plots of land totalling an area of 300,000 sq m for the project. The plots are located in the growing north-western part of Riyadh on the Salboukh Highway.

The first phase of the project will consist of a residential compound which will be built on the first 157,000-sq-m plot, and is expected to be completed by early 2015. About 450 residential units will be built in the first phase in a lush landscaped environment that will enjoy first-class facilities. Gulf Related has appointed award-winning international master planners, architects, designers and landscapers to design and develop the unique residential community.

Commenting on the launch of this ambitious project, Dr Karim El Solh, chief executive officer of Gulf Capital and co-managing partner of Gulf Related, said: “We are proud to be launching this SR1-billion project in Riyadh to cater to the growing residential needs of the country. This development is in line with our vision to pursue marquee real estate development opportunities across the region which will contribute significant stable income to Gulf Capital and its shareholders.”

Emile Habib, managing director of Gulf Related, said: “This high-end residential compound, in the up and coming Salboukh area in northwest Riyadh, will cater to the growing needs of expat housing in the capital.”

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

Doka.jpg)