The Middle East’s aviation sector is gearing up for a monumental leap forward, fuelled by two key trends: the revolutionary potential of Advanced Air Mobility (AAM) and the construction of colossal new airports.

Airports across the region – which are already undergoing significant expansion to handle surging passenger numbers, with both Saudi Arabia and the UAE having confirmed plans to construct some of the world’s largest airports – are being urged to adapt their plans for the imminent arrival of AAM vehicles by the Airports Council International (ACI) Asia-Pacific & Middle East, which addressed a recent aviation conference in Riyadh.

According to the recently published ACI Asia-Pacific and Middle East Air Connectivity Ranking 2023, the Middle East is experiencing a steady growth in air connectivity and recommends meeting current and future demand by building new airport infrastructure.

The Asia Pacific region accounts for more than 70 per cent of the investment in airport infrastructure, with the global figure standing at 225 new airport projects. According to a CAPA report, 425 major construction projects are under way at existing airports worldwide, with $450 billion in investments.

There were 1,074 airport investors, of which 258 were airport operators, groups or consortiums. About 68 per cent of all projects were based on terminals, either expansions or new developments. A report has disclosed that the global airport construction market grew to $1.14 trillion in 2023 and would reach $1.8 trillion by 2030.

With the civil aviation industry almost fully recovered after the steepest fall in passenger numbers due to the Covid-19 pandemic, airports across the world are bracing themselves to handle a big boom in air travel until 2030 by going in for expansions and redevelopments.

The Middle East aviation market, valued at $60 billion in 2023, is predicted to rise substantially until 2030. Air connectivity in the Middle East had seen a 26 per cent-plus growth in 2022 compared to 2019, said a WAM report, ahead of The Airport Show held in Dubai early this year.

The Middle East’s airports are set to handle 1.1 billion passengers by 2040, more than double the 2019 figure of 405 million passengers. They will be required to invest around $151 billion in capacity expansion. The region, with over 110 airports, is among the fastest-growing aviation markets in the world, the report said.

A look at projects in each of the GCC states:

Bahrain

Bahrain’s Ministry of Transportation and Telecommunications is reported to have embarked on plans for a new greenfield airport project to meet with the kingdom’s airport infrastructure needs as the existing site does not allow room for further expansion. The ministry has awarded the contract for the initial study on the estimated $10-billion project to Netherlands Airport Consultants (Naco).

The proposed new airport will eventually replace Bahrain International Airport (BIA) – which now has a capacity to handle 14 million passengers annually – when the existing airport site can no longer effectively meet the kingdom’s airport infrastructure needs. The airport’s new $1.1 billion terminal expansion was opened in January 2021.

Kuwait

Kuwait is investing in its aviation sector with the expansion of Kuwait International Airport. The ongoing projects include the construction of a new terminal, Terminal 2 (T2), designed to handle 25 million passengers per year. This expansion is part of Kuwait’s Vision 2035 to transform the country into a regional transportation hub.

|

|

Work in progress on the new T2 Terminal at Kuwait International Airport. |

Work on the T2 project, designed by acclaimed architecture firm Foster + Partners, is well advanced. Construction work is being carried out by Limak İnşaat of Turkey, which is currently managing the construction of the Terminal 2 project’s Package One under a $4.3-billion contract, which involves a new state-of-the-art airport terminal building, and Package Two, which comprises the car park, service buildings, and roads leading to T2.

Last October, Limak secured yet another contract, worth KD236 million ($767.9 million) to build a package of aircraft parking aprons, taxiways and service buildings.

Once the terminal is operational, it is expected to triple the capacity of Kuwait’s airport to 25 million passengers a year.

Last month, Dar Al Handasah, one of the world’s leading consultancies, was awarded a landmark contract by Kuwait’s Directorate General for Civil Aviation (DGCA) to provide design and construction supervision services at the country’s airport. Spanning a period of five years, this assignment is divided into a 1.5-year design phase followed by 3.5 years dedicated to construction supervision.

The scope of work includes a 1.5-sq-km cargo platform designed to accommodate 77 aircraft stands. It also involves upgrading the central runway and associated taxiways to a length of 4,300 m, conforming to ICAO code 4F standards with a precision approach CAT III B.

Plans are also afoot to establish a new VVIP (Amiri) apron, including dedicated aircraft stands and a run-up area to cater to distinguished guests.

Oman

The Sultanate of Oman will have six new airports and most of them are expected to be operational by 2028-2029, according to Naif bin Ali Al Abri, Chairman of the Civil Aviation Authority.

The new airports are expected to ease access to tourism destinations such as Rass Al Hadd and Salalah, as well as industrial centres like Sohar and Quqm, said an Oman Observer report.

According to the report, a site has been chosen for the Musandam Airport, while tenders have been floated for site studies, masterplanning for airports at Jabal Akhdar, Masirah and Sohar.

Meanwhile, Asyad Group, Oman’s global integrated logistics provider, is developing the first phase of Muscat International Airport Free Zone, and has issued tenders for infrastructure works like site clearance and road construction. This zone aims to strengthen air freight logistics with state-of-the-art logistics facilities, ready-to-use warehouses and premium land plots.

Among other projects, Oman Airports Management Company (OAMC) has invited developers and developer consortiums to submit expressions of interest (EOIs) for the re-development, operation and management of Muscat International Airport Old Terminal. The project is being implemented on a build-operate-transfer (BOT) model.

“The old Muscat airport terminal building will be redeveloped as a multi-purpose facility, with plans to convert it into an aviation museum that will showcase the history of aviation of the country,” Al Abri had said earlier this year.

Qatar

Hamad International Airport (DOH), a showpiece built for the 2022 FIFA World Cup, is soaring to new heights – this time in environmental responsibility. The airport is well on track to meet its ambitious 2030 target of a 30 per cent reduction in relative carbon emissions. A key pillar of this strategy is a large-scale LED lighting project initiated in 2018. Over 65,000 traditional lights were replaced, resulting in 3 million kWh energy savings in 2023 alone. Optimised HVAC systems, smart metering for utilities, and investments in sustainable building solutions have earned DOH a Four-Star certification from the Gulf Organisation for Research & Development’s Global Sustainability Assessment System (GSAS-D&B).

DOH’s waste management strategies are taking flight: Between April 2023 and March 2024, a 81 per cent of the airport’s waste was diverted from landfills through reuse, recycling, or conversion into energy, according to the airport authority. This achievement, one of the highest in the industry, includes over 1,000 tonnes of segregated plastic waste. Its advanced wastewater treatment plant treats 100 per cent of sewage effluent for irrigation purposes, with over 3 million cu m of sewage treated for irrigation from April 2023 to March 2024, it added.

Hamad International Airport is also implementing the second phase of its expansion project to further increase its passenger capacity and lifestyle offerings.

Saudi Arabia

Saudi Arabia is leading the charge in airport development, driven by a desire to diversify its economy and attract more tourists. According to the third Future Aviation Forum (FAF), hosted by the General Authority of Civil Aviation (GACA) in May, the kingdom aims to attract investment exceeding $100 billion into its aviation sector.

|

|

Red Sea International airport ... work is 80 per cent complete. |

A significant portion of the targeted investments, over $50 billion, is earmarked for the development of the kingdom’s airports. Airlines are expected to place new aircraft orders valued at roughly $40 billion. The remaining $10 billion will be distributed amongst other aviation-related projects, including $5 billion dedicated to special logistics zones within the major airports of Riyadh, Jeddah, and Dammam.

The King Salman International Airport in Riyadh is one of Saudi Arabia’s most ambitious projects. In addition, the country is reported developing 12 new airports.

Being designed by leading architectural firm Foster + Partners, King Salman International Airport will spread over a 57-sq-km area in Riyadh. It will boast six parallel runways and comprise the existing terminals named after King Khalid. It will also include 12 sq km of airport support facilities, residential and recreational facilities, retail outlets, and other logistics real estate.

Once operational, the airport aims to accommodate up to 120 million travellers by 2030 and 185 million travellers, with the capacity to process 3.5 million tonnes of cargo, by 2050.

The new airport will boost Riyadh’s position as a global logistics hub, stimulate transport, trade and tourism, and act as a bridge linking the East with the West, according to Foster + Partners.

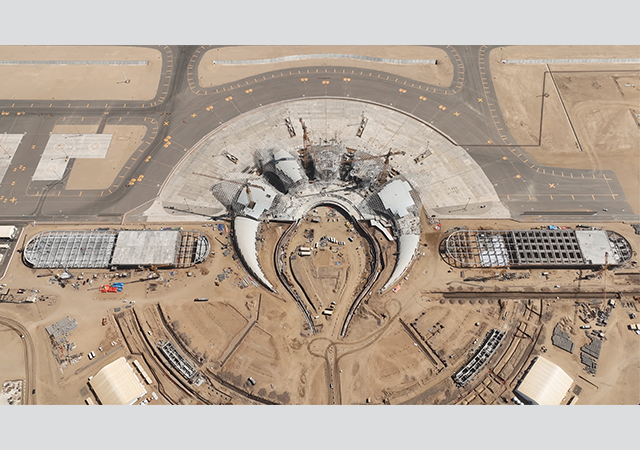

|

|

King Salman International Airport will spread over a 57-sq-km area in Riyadh. |

King Salman International Airport reimagines the traditional terminal as a single concourse loop, served by multiple entrances and connects passengers to the sensory experiences of the city, with natural elements, tempered light and state-of-the-art facilities, according to Foster + Partners. British engineering consultancy Mace has been appointed as the lead consultant providing project management, design management, cost consultancy and procurement services on the massive development. Saudi authorities have also sealed deals with US-based Jacobs for the infrastructure design. The new airport aims to achieve LEED Platinum certification by incorporating cutting-edge green initiatives into its design and will be powered by renewable energy. It will also have a dedicated terminal for the country’s national carrier, Saudia.

Another airport which has been designed by Fosters + Partners is the Red Sea International Airport which will serve the regenerative tourism destinations of Red Sea Project and Amaala. Work on the airport’s terminal is reported to be 80 per cent complete.

The design of new Red Sea Airport has been inspired by the forms of the desert, the green oasis and the sea.

Another key development in the aviation sector is the Abha International Airport in the Aseer region. Matarat Holding Company – which manages the kingdom’s airports and monitors the operations of 27 airports in the country through its subsidiaries – and The National Center for Privatization & PPP (NCP) had invited expressions of interest (EOI) from leading companies for the development of the facility, which will cover an estimated area of 4.6 sq km, and be implemented in two to three phases.

Under Phase One, a new terminal building will be set up on a total area of 69,400 sq m by 2028, followed by its expansion to 73,200 sq m in the second phase. Once completed, the Abha airport will be able to accommodate eight million passengers by 2030, increasing to more than 13 million passengers by 2054.

Meanwhile, Egis, a global player active in the consulting, construction and engineering sectors, said it has secured two major contracts from Saudi Arabia’s Royal Commission for AlUla to undertake several projects related to the development of the private aircraft terminal at AlUla’s International Airport.

UAE

Dubai is expanding Al Maktoum International Airport under a $35-billion investment, aiming to handle 240 million passengers annually when fully completed. This follows the approval given by HH Sheikh Mohammed bin Rashid Al Maktoum, Vice President, Prime Minister and Ruler of Dubai, for the designs of the new passenger terminal.

Almost five times the size of Dubai International Airport, Al Maktoum International will comprise five parallel runways with a quadruple independent operation, west and east processing terminals, four satellite concourses with over 400 aircraft contact stands, uninterrupted automated people mover system for passengers, and an integrated landside transport hub for roads, metro, and city air transport.

On completion, it will be the world’s largest with a capacity to handle 260 million passengers.

The move, which comes as part of the Dubai Aviation Corporation’s strategy, will see all operations of Dubai International Airport get transferred to the new facility in the coming years.

“With the use of new technologies for the first time in the aviation sector, we are preparing for a new phase in the growth of the global aviation sector. We are preparing for a phase in which Dubai leads the international aviation sector for the next 40 years,” remarked Sheikh Mohammed.

“We are also building an entire airport city in Dubai South, which will raise the demand for housing for one million people... and will include the most important companies in the world in the logistics and air transport sector,” he added.

Another UAE emirate, Sharjah, is also expanding its airport under a $653 million expansion plan, which will increase its passenger capacity to 25 million annually, once completed in mid-2027.

According to Ali Salim Al Midfa, Chairman of Sharjah Airport Authority (SAA), work on the expansion of the passenger terminal and central facilities station at the airport is progressing according to the planned schedule which is being carried out in 18 packages. The airport is also looking at developing its cargo centre and enhancing its logistics services.

Meanwhile, Abu Dhabi International Airport’s long-awaited Midfield terminal building began operations in early November, bolstering the emirate’s position as a global centre for trade and business.

Covering 742,000 sq m of built-up area, Terminal A, as it is known, is one of the largest airport terminals in the world and significantly increases Abu Dhabi International Airport’s passenger and cargo capacity. The new building can accommodate up to 45 million passengers per year, process 11,000 travellers per hour and operate 79 aircraft at any given time, state-owned operator Abu Dhabi Airports.