The newly-opened dusitD2 Naseem Resort, Jabal Akhdar offers breath-taking views of the surrounding Al Hajar mountain range.

The newly-opened dusitD2 Naseem Resort, Jabal Akhdar offers breath-taking views of the surrounding Al Hajar mountain range.

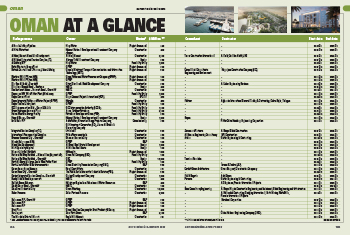

The subdued construction sector of Oman got a shot in the arm with the recent announcement of the multimillion-riyal Yiti integrated tourism development, even as the sultanate’s Vision 2040 diversification programme progresses, keeping growth hopes alive.

The launch of the Yiti integrated tourism development and the interest it has garnered from regional developers sends a clear signal of confidence in the potential Oman offers in the tourism sector – despite the adverse impact of the Covid-19 pandemic on key sectors of the economy.

Spearheading the sultanate’s ambitions in the sphere is the Omran group, which is developing tourism projects and assets, complexes and unique destinations that integrate key players in this dynamic sector.

|

|

Omran has launched work on a 1,800-m dual zipline project in Wilayat of Khasab. |

The group has formed multiple partnerships with global and regional companies to develop mixed-use projects and integrated tourism complexes and continues to attract seasoned players in the tourism and real estate development sector to help achieve the sultanate’s goals.

Omran has in earlier years struck partnerships with regional players for the development of a number of other master-developments, namely the Madinat Al Irfan and Madinat Sultan Qaboos Development.

Tourism has been identified as one of the key enablers of the sultanate’s economic diversification plan in line with Oman Vision 2040 and the 10th Five-Year Plan (2021-2025), while increasing the GDP’s non-oil revenues, and attracting foreign direct investments.

In line with the diversification plan, industrial development is another major area of focus and driving its ambitions in this sphere is the Public Establishment for Industrial Estates (Madayn). Plans for industrial cities abound and the sultanate is actively seeking foreign investment in pushing ahead with its agenda.

The diversification programme and focus on other areas such as housing, renewable energy and transportation infrastructure are expected to support the expansion of the construction sector in the coming years. For this year, the industry is projected to register a growth of 3.3 per cent, and then expand by an annual average rate of four per cent over the 2023-2025, according to projections by Global Data’s Construction in Oman – Key Trends and Opportunities to 2025 (H1 2021) report.

|

|

The 500-MW Ibri Solar Project was inaugurated last month. |

While the sultanate continues to enhance its oil recovery techniques to boost oil production, it will keep pursuing its Vision 2040 programme, and construction will continue to be a major contributor to growth in Oman’s non-oil GDP, it said.

Meanwhile, Modor Intelligence, a market intelligence and advisory firm, states that Oman’s construction market is expected to register a compound annual growth rate (CAGR) of more than five per cent during 2021-2026. The construction industry in Oman, as with other key sectors, has been severely impacted by the Covid-19 outbreak and recovery is expected to be slow, it said.

In the wake of the pandemic the government has had to cut back on spending and hence Oman will have to increasingly look to the private sector to propel growth and assist in its diversification drive.

Transport

Oman’s plans to develop a 2,144-km-long high-speed national railway system connecting the country’s three main seaports at Salalah, Duqm and Sohar and integrating with the GCC network have been put on the backburner since 2014, when oil price plummeted.

However, Asyad Group – the state-owned holding company of government assets in ports, transport, shipping and logistics businesses – has been exploring options for a 375-km dedicated mineral railway line linking vast mining sites in the south of the country with the Port of Duqm, according to the Oman Observer.

|

|

The LPG plant in Salalah ... built by Petrofac. |

Asyad Group’s dedicated Oman Rail unit has been working with government agencies, including the wholly government-owned Mineral Development Oman (MDO) in exploring private investment in the venture via the public-private partnership (PPP) route.

Among other plans, Oman intends to set up a light metro network linking Muscat’s Ruwi and Muttrah areas to the airport and Seeb. The metro will be one of the main transport arteries of a new, revitalised Muscat, which will have Ghala as the centre of its commercial activities.

Under this plan, multi-use areas will be set up around the various metro stations for developments such as offices, retail stores, and residential areas.

Alongside the metro, revised transportation plans include a passenger rail service that will connect Seeb to Sohar, the capital of the North Al Batinah Governorate.

Meanwhile, a key road project opened at the end of last year was the 725-km Rub-el-Khali Highway, the first direct link between Oman and Saudi Arabia. The road is expected to play a significant role in boosting trade, investment and tourism between the two countries.

|

|

Golf Beach Residences ... the latest neighbourhood to be launched at Al Mouj Muscat. |

Ports

Omani authorities have launched an international competitive tender for the development and management of a world-class container terminal planned at the Port of Duqm. Expressions of Interest (EoIs) have been invited to develop and operate the first phase of the port’s container terminal for 30 years. On completion, it will boast a capacity of 1.7 million TEUs with additional scope for expansion in the future.

Also planned are a 300-m-long dry bulk terminal with a capacity of about 5 million tonnes per year, and a 425-m-long multipurpose terminal for cargoes totalling 800,000 tonnes per year.

Other ports that have been opened to developers include the Port of Khasab in Musandam Governorate and Port of Shinas in North Al Batinah Governorate.

Khasab Port, in particular, is a major draw for cruise liners, having attracted as many as 66 passenger ships in 2016 carrying over 35,500 tourists. The port is tipped to be transformed into a waterfront and leisure destination replicating the ambitious plan that Omran envisions for Port Sultan Qaboos in Muscat. Part of the port was converted into a fishing harbour last year.

Shinas has a jetty that primarily caters to fishing boats and dhows. Plans for the development of the facility include potential investments in tourism, leisure and commercial components.

Power & Water

In line with the global trend, the sultanate has been focusing on renewables, particularly its solar energy potential. Oman last month witnessed the inauguration of the country’s largest renewable energy facility of its kind in the Wilayat of Ibri, Governorate of A’Dhahirah. The Ibri Solar Project, a 500 MW utility costing RO155 million ($401 million) is a partnership between Oman Power and Water Procurement Company (OPWPC) and group of GCC investment firms led by Acwa Power, Gulf Investment Corporation (GIC) and the Alternative Energy Projects Company (AEPC).

Among other solar projects, late last year OPWPC announced its intention to embark on two solar power plant projects – Manah Solar Power 1 and Manah Solar Power 2, the development of which is expected to involve an investment of RO300 million for a total output of 1,000 MW.

In line with Vision 2040’s sustainability goals, Madayn has also embarked on an initiative to provide a significant portion of the energy needs of its tenants from a sustainable renewable energy source.

The authority has joined hands with Mubadrah and Solar Wadi to set a 100 MW solar photovoltaic farm in Suhar Industrial City which will be operational this year. Madayn and its partners plan to roll out the Madayn Renewable Energy Project initiative across all industrial cities and free zones in the next couple of years, involving larger centralised solar plants that will cater for needs of all tenants within the industrial city.

Industrial Facilities

Madayn, meanwhile, has opened up a number of industrial cities – existing and greenfield – for local and international investment, according to Oman Observer. Opportunities for investment range from the development and operation of business hotels to the management and operation of new industrial cities based on the PPP model, the report stated. The 90-plus project proposals span multiple sectors, including manufacturing, tourism, logistics and fisheries.

In Sur Industrial City, Madayn – with private sector participation – intends to set up a township for the integrated workforce as well as a shipyard project which will also house a factory for modern fishing vessels along with a ship maintenance facility and repair centre, among other related services.

The authority also plans to develop a new industrial city within Al Dhahirah Governorate. Detailed design work has been completed for the proposed new industrial city which will come up over a 10-million-sq-m area in Ibri. Phase One of the cluster is being planned on a 3-million-sq-m area.

In addition, Madayn aims to establish new industrial cities in Thumrait, Shinas, Al Mudhaibi and Al Rawdah.

A landmark project on Oman’s industrial scene is a green ammonia project announced by Acme Group, one of the India’s fastest growing companies in the solar energy sector. Acme Group has signed a land agreement with Oman’s Public Authority for Special Economic Zones and Free Zones (Opaz) to set up the plant in the Port of Duqm, which will be one of the world’s largest green ammonia projects.

The plant would be developed at an estimated cost of $3.5 billion in phases over the next three years, with the first phase to be operational later this year. It will be an integrated facility using 3 GWp of solar and 0.5 GWp of wind energy to produce 2,400 tonnes per day (tpd) of green ammonia with an annual production of 0.9 million tonnes. The project will export green ammonia to demand centres like Europe and Asia.

A major industrial venture launched last month in Oman was the first liquefied petroleum gas (LPG) plant in Salalah, which was developed by OQ, the sultanate’s national petroleum investment company. The state-of-the-art plant was built by Petrofac, a leading provider of oilfield services to the international oil and gas industry, which currently is working on two contracts worth a total of around $300 million for Petroleum Development Oman (PDO).

Meanwhile, work is ongoing on the 230,000-barrels-per-day Duqm refinery, which is a 50-50 joint venture owned by state-owned energy company OQ and Kuwait Petroleum International (Q8).

The $8-billion Duqm refinery, which will mainly produce diesel, jet fuel, naphtha and LPG, is expected to come online in the first quarter of 2023.

Among other developments, Saudi Basic Industries Corporation (Sabic), the biggest petrochemical maker in the Middle East that is 70 per cent owned by Aramco, has joined hands with OQ to study the development of a petrochemical project in the Duqm free zone.

Real Estate & Tourism

Late last year, Oman unveiled the masterplan for the massive Yiti project, one of the largest integrated tourism developments in the sultanate. Spanning over 11 million sq m, the Yiti Development is strategically located in Muscat overlooking the Sea of Oman. It is being undertaken in four phases with the first phase set to host the sultanate’s first-of-its-kind projects under the Sustainability City brand of the Dubai-based Diamond Developers (see Page 38).

The project is being spearheaded by Omran Group, which with another Dubai-based group Majid Al Futtaim, is developing Madinat Al Irfan, the sultanate’s largest urban development project that will create a new downtown area for the Muscat capital district, adjacent to the Oman Convention and Exhibition Centre (OCEC).

Omran Group late last month inaugurated the dusitD2 Naseem Resort, Jabal Akhdar, which boasts Oman’s first 8,000-sq-m Adventure Park. Built with an investment of RO24 million and located in Al Jabal Al Akhdar, dusitD2 Naseem Resort offers over 250 rooms with breath-taking views of the surrounding Al Hajar mountain range.

Meanwhile, Omran has launched work on a 1,800-m dual zipline project in Wilayat of Khasab which begins from Jebel Fitt and passes through scenic landscapes of Khor Qadi and Mokhi area and sea views of the Strait of Hormuz, to end at the upcoming Atana Khasab Hotel.

Among the most successful leading integrated tourism complexes launched by the sultanate is Al Mouj Muscat – previously known by its English equivalent The Wave Muscat. The $3.5-billion mixed-use waterfront development, which is a public-private venture between Omran, Tanmia and Majid Al Futtaim, has seen major growth since it first broke ground in 2006.

Its latest launch was the premium gated neighbourhood, Golf Beach Residences, featuring beachfront mansions offering six-bedroom homes located in the prestigious Shatti District and within walking distance of the Golf District and award-winning Al Mouj Golf.

Meanwhile, the sultanate’s largest shopping and leisure destination, the Mall of Oman, was opened in September last year by Majid Al Futtaim.

Another government entity driving development in several sectors of the country is Muscat National Development and Investment Company (ASAAS), which has recently launched construction works for the development of the 60,000-sq-m Al Hafa waterfront in Al Hafa area of Salalah among other projects.

An interesting project on which work is in progress is the Oman Botanic Garden in the dramatic landscapes of the northern Hajar Mountains. Covering 420 hectares, the botanic garden will be the largest of its kind in the Arabian Peninsula and one of the largest in the world.

.jpg)

.jpg)

.jpg)

.jpg)