The estimated $6.8-billion South Saad Al-Abdullah Town project ... newly flagged off.

The estimated $6.8-billion South Saad Al-Abdullah Town project ... newly flagged off.

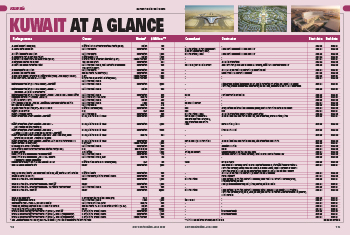

Kuwait has a multitude of projects on the drawing board; with the soaring oil prices, it has the means too to carry out these long-awaited projects that will give a much-needed push to the non-oil sectors, including construction.

However, one big question on everyone’s lips is, does the political class have the will and determination to implement these projects?

The project list is awe-inspiring not only for residents, but also for investors, developers and contractors – from airport, metro, highways and housing to oil and gas and industries; it’s endless.

One such project that received the go-ahead in late April was the estimated KD2.1-billion ($6.87 billion) South Saad Al-Abdullah Town project, signalling that Kuwait does intend to press ahead with its New Kuwait 2035 Vision aspirations.

|

|

The $16-billion Clean Fuels Project (CFP) became fully operational in September last year. |

Kuwait continues to be plagued by the political impasse between the legislative and executive authorities and excessive bureaucracy, which have thwarted its well laid-out plans and impacted its ability to attract foreign investment in pushing ahead with its development strategy.

The country is currently in the throes of yet another political crisis, having last month witnessed the collapse of its third Cabinet in just over a year and a half – a phenomenon that is not new to the nation whose parliament is regarded as one of the most powerful in the GCC.

According to the Economist Intelligence Unit, the risk of political stalemate as well as the bureaucracy will continue to deter some investors and possibly slow the flow of public-private partnership (PPP) deals.

Kuwait lags behind its GCC neighbours in attracting foreign direct investment. The EIU believes that the continued delays in major projects since 2016 and the opposition of the National Assembly to foreign investment raise persistent doubts about Kuwait’s ability to follow through on its plans and will limit the interest of foreign companies in participating in the country’s projects. Seven sectors in 2020/2021 attracted inward FDI inflows, with oil and gas accounting for the largest percentage with a 38 per cent share and the construction sector drawing in 15.8 per cent of the inflow.

Meanwhile, as the global war continues on Covid-19, the construction sector – along with other sectors – is contending with the impact that the coronavirus has had on the economy. In interviews with the Kuwait News Agency (Kuna), key players in the industry reported a surge in construction material prices by as much as 30 per cent, shortage of manpower, and increase in transportation expenses. One contractor indicated that the cost of building one square metre prior to the pandemic was estimated at KD150 ($495) whereas currently it is estimated at KD250 ($825), marking a 70 per cent increase.

|

|

Byout Hessah, part of the Hessah Al Mubarak District, is targeted for completion next year. |

Following a slump in 2020, the construction sector rebounded in 2021 and is expected to register a growth of 14.3 per cent in 2022, before expanding by an annual average rate of 4.1 per cent over the remainder of the forecast period (2023-2025), according to Globaldata’s report entitled Construction in Kuwait – Key Trends and Opportunities to 2025 (H2 2021).

According to a report in the Kuwait Times, the country currently has more than 700 active projects with a combined value of $230 billion, 20 per cent of which are near completion.

The government’s programmes to promote the development of economic zones, logistic cities, transport and renewable energy infrastructure are expected to continue supporting the recovery of the industry in the coming years. Kuwait’s priority to fast-track economic reforms and diversify its economy away from dependence on hydrocarbons will also support the construction industry. The country aims to position itself as a centre for re-exports, shipping and warehousing; to achieve this goal, it aims to develop a series of ‘logistic cities’.

A Mordor Intelligence report states that the country’s development plan (2020-2025) focuses on economic reform and implementation of numerous long-stalled megaprojects, including several large infrastructure projects estimated at $124 billion. These include the $7-billion Kuwait City Metro; a rail project that will eventually link all GCC countries; a $4-billion new airport; new planned cities including Silk City/Northern Economic Zone; further development of the Mubarak Al-Kabeer Port on Bubiyan Island; and a large number of mega oil projects. The government is working on over $4 billion worth of hospital projects as part of its plan to boost the bed capacity of hospitals across the country. There are also plans to increase power generation capacity in the country, the report added.

This apart, significant investment is going into infrastructure including the construction of roads and utilities.

Project implementation has seen frequent delays, especially with large infrastructure projects. The government itself has acknowledged that only 10 projects out of 135 projects included in the 2015-2020 five-year development plan were completed. With 81 projects delayed and four projects yet to be tendered, these projects are now included in the current five-year development plan (2020-2025), according to Mordor Intelligence.

During the first quarter of this year, Kuwait’s project awards fell short of expectations, according to Isam Al-Sager, the Vice-Chairman and CEO of National Bank of Kuwait (NBK) Group, who added that these numbers are expected to gradually recover in the coming months to touch up to KD3 billion for the rest of the year. Just KD110 million worth of project awards were recorded in the first quarter, which Al-Sager blamed on the slow approval process as well as supply chain issues.

However, the silver lining is the improved oil prices which could help accelerate infrastructure project awards in the Gulf state.

According to the NBK’s Macroeconomic Outlook 2022-2023, high oil prices will provide substantial support for the economy, given the country’s oil revenue dependency. A large fiscal surplus – the first since 2014 – is expected this year, helping to alleviate recent government liquidity constraints.

The authorities are believed to be working on a new strategic plan to drive medium-to-long-term non-oil growth, with a special focus on an expanded role for the private sector. But political disputes between the government and parliament continue to impede effective implementation of reforms and the Vision 2035 development programme for now, according to the NBK report.

Other sources voiced concern about the delay in approving the new budget which may have a negative impact on the economy as these projects have already suffered delays, and the cost of implementing them now would have risen significantly due to inflationary pressures.

Housing

Kuwait gave the green light for the last of the five major housing developments envisaged in the country’s Vision 2035 plan, under which it intends to provide some 65,500 housing units through five projects costing about KD3.22 billion by 2029. In fact, the Public Authority for Housing and Welfare (PAHW) is now looking at building a total of 250,000 housing units in the next 15 years to address the huge housing shortage faced by the country.

The latest residential city to be launched, the South Saad Al-Abdullah housing project, will cost a total of KD2.1 billion, which will be phased over the coming state budgets. Other housing programmes underway include Al-Mutlaa Residential City, being built at a cost of KD987.8 million and reported to be 64 per cent complete; South Sabah Al-Ahmad Residential City, being built at a cost of KD732.5 million; Jaber Al-Ahmad City costing KD537.7 million, which is 95 per cent complete; and the suburb of South Abdullah Al-Mubarak, which is 72 per cent complete.

The South Sa’ad Al-Abdullah project, which extends over an area of 59 sq km, will include 25,000 housing units that will be built as “smart city” under a joint project agreed upon in 2016 between the Public Corporation for Housing Welfare and a South Korean consortium.

Airport & Ports

The construction of Kuwait International Airport’s new terminal 2 (T2) suffered a setback recently when a fire in the basement construction area caused damage within the zone. However, the contractor, Limak Construction – a part of leading Turkish conglomerate Limak Group – is now pressing ahead with its plans and expects to repair the damage this year in parallel with other activities (see Page 14).

Among other plans, Kuwait has also indicated that it intends to build a new airport in the north of the country.

As part of its ambitions to become a regional hub, the country is also focusing on expanding its ports. Kuwait Ports Authority (KPA) has approved 12 projects to expand capacity. It recently awarded Hyundai Engineering & Construction a $160-million contract to develop seven berths at the port of Mina Al-Shuwaikh, following contracts for infrastructure and power works at Shuaiba Port in southern Kuwait with a combined value of about $63 million.

Mina Al-Shuwaikh is the main manufacturing and industrial area of Kuwait, and is also home to its free trade zone. The port has 21 berths with a total length of a little over 4 km.

KPA is also expected to award the design and consultancy study contract for its estimated $400-million Logistics Cities Project spanning Doha, Mina Al-Shuwaikh and Mina Abdullah ports shortly.

Oil & Gas

The new Al-Zour refinery is expected to be operational “within the next few weeks”, Kuwait Integrated Petroleum Industries Company (KIPIC) said in late April. Al-Zour was initially expected to come online by the end of 2021, but this was delayed to June 2022.

Meanwhile, Kuwait’s $16-billion Clean Fuels Project (CFP) became fully operational in September last year after six years of work. The last CFP unit to come online was a 70,000-barrels-per-day (bpd) hydrocracking unit at the 454,000 bpd Mina Abdullah refinery.

Among other major developments in the sector, Al-Zour LNG Import Terminal has recently begun commercial operation. A consortium of Hyundai Engineering Company, Hyundai Engineering & Construction Company and Korea Gas Corporation won the $2.93-billion construction deal from KIPIC for the construction of the LNG terminal in March 2016.

Real Estate

Kuwait’s real estate market is recovering and gathering pace following supportive governmental measures and the rebound in oil prices, according to a report on the sector by Marmore Mena Intelligence, a fully-owned subsidiary of Kuwait Financial Centre (Markaz). While the sector was impacted by Covid-19, overall transaction values have now reached pre-pandemic levels. A new mortgage law being proposed for the private housing sector will allow Kuwaiti banks and financing companies to extend mortgage loans to citizens and – given the fact that several residential projects are underway – if the new law is approved, sales are expected to grow in the coming quarters, the report said. The outlook for private housing sector is expected to stay positive in the future due to stable demand from Kuwaiti nationals, it added.

Leading developers have reported an increase in revenues and profit for 2021 and the first quarter of 2022. For instance, United Real Estate Company (URC) reported a 41.64 per cent increase in its net profit for the first quarter. The company is developing the one-of-its-kind Hessah Al Mubarak District which is seeing increased interest from homeowners seeking luxury high-rise living with seaside and city views, according to the developer. Some of the district’s key components are well under way such as the Hessah Towers, which is expected to be ready by Q4 2022, and Byout Hessah, which is targeted for completion next year.

Among other components, work on the Commercial District received the green light late last year with Ahmadiah Contracting and Trading Company having been appointed as contractor while Hessah Gardens Residential Towers is in the design stage.

Hessah AlMubarak District is the first-comprehensive, mixed-use district in Kuwait, spearheaded by Kuwait Projects Company (Holding) – Kipco, one of the largest holding companies in the region. URC is a Kipco subsidiary and the holding company’s real estate arm. SSH is the consultant on various components of the district.

.jpg)

.jpg)

.jpg)