Residential and mixed-use development projects account for 39 per cent of the total project pipeline.

Residential and mixed-use development projects account for 39 per cent of the total project pipeline.

Bahrain’s construction output contracted by an estimated 0.2 per cent in real terms in 2020 as the industry faced disruptions due to the Covid-19 pandemic and movement restrictions to prevent its spread.

However, driven by investments in infrastructure, oil and gas and in renewables, the industry is expected to recover in 2021 with an expected real growth rate of 2.1 per cent, according to GlobalData, a leading data and analytics company.

The kingdom’s construction industry is expected to grow at an average rate of 4.3 per cent between 2022 and 2025, stated GlobalData in its report, ‘Construction in Bahrain – Key Trends and Opportunities to 2025.’ This will be supported by investments in the development of the country’s overall infrastructure in line with its economic vision 2030, it added.

Dhananjay Sharma, an analyst at GlobalData, said: “Despite economic diversification efforts, hydrocarbons still account for more than 70 per cent of fiscal revenue and, as a result, the public finances are vulnerable to oil price volatility. The IMF’s forecast of a rise in oil prices by 21 per cent in 2021 offers respite to Bahrain’s government as it would facilitate further investments in the industries, energy and utilities and infrastructure sector, which would help in the government’s diversification efforts.”

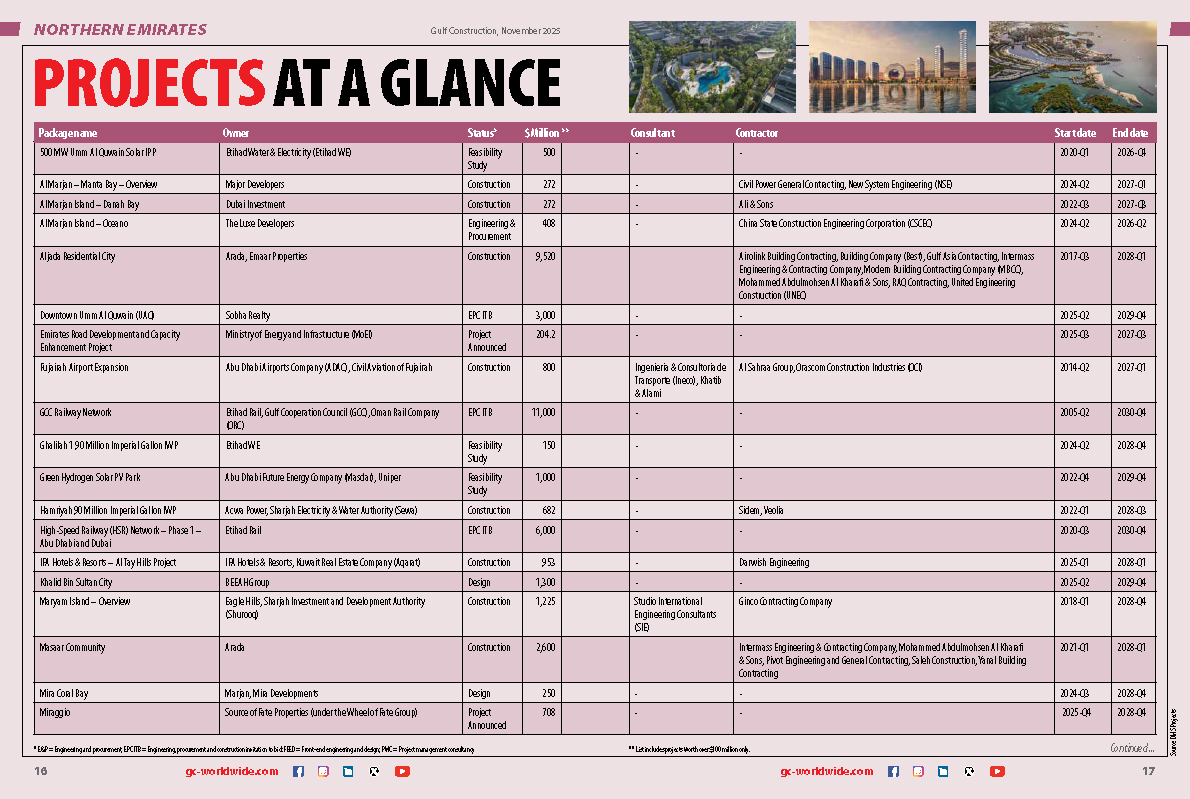

Projects in Bahrain, as tracked by GlobalData, have a combined value of $80.2 billion.

The pipeline – which includes all projects from pre-planning to execution with a value above $25 million – is skewed towards late-stage projects, with those in the execution stage accounting for 63.1 per cent of the pipeline’s value as of January, he explained.

According to Sharma, the residential and mixed-use development projects account for the largest proportion of the project pipeline, with a share of 39 per cent of the total project pipeline.

“This reflects the enormous potential in the residential sector, which has so far been mostly driven by government investments. The government’s efforts at attracting private players as well as foreign investments will boost growth in this sector over the forecast period,” he added.

(5).jpg)

.jpg)

.jpg)