WITHOUT mincing words, the truth is Kuwait has been through a bad year in terms of release and implementation of projects. The global economic gloom compounded by low crude oil prices and the recurring political turmoil have done substantial damage to the confidence within the construction sector.

Kuwait, which relies on oil exports for the majority of its government revenue, was among the harder hit of the Gulf Arab nations as the global recession battered demand for crude.

However, now with oil prices having firmed up, Kuwait logged a budget surplus of KD4.99 billion ($17.5 billion) in the first six months of its 2009/10 fiscal year on higher-than-forecast oil revenues, according to official data.

This figure could rise to KD6.2 billion ($21.66 billion) for the entire 2009/10 fiscal year on higher-than-forecast oil prices, the National Bank of Kuwait (NBK) said in a report.

Revenue of the world’s fourth-largest oil exporter stood at KD8.22 billion ($28.84 billion) at the end of September, about 112 per cent of the revenues forecast for the whole fiscal year, according to figures posted on the finance ministry’s website.

Oil revenues came in at KD7.74 billion ($27.16 billion) and spending in the first six months to September 30 amounted

to KD3.23 billion ($11.33 billion), the data showed.

The country’s 2009/10 budget forecast a deficit of KD4.85 billion ($16.97 billion), assuming its crude would fetch $35 a barrel.

Hence, Kuwait is now sending some signals that it is determined to push itself forward and the public sector has got into the driving seat with the objective of spearheading growth. This can be seen from recent public announcements made by senior government officials in a bid to instil confidence. Kuwait’s Minister of State for Development Affairs and Housing Sheikh Ahmad Fahad Al Sabah has stated that Kuwait plans to spend up to KD40 billion ($139.9 billion) on its proposed five-year development plan (2009 to 2014). The plan, once finalised by the government, needs to be approved by the Kuwaiti parliament before implementation. If implemented, it would be the government’s first since 1986.

Last month, Sheikh Ahmad was quoted as saying that the oil-rich country wants to tender $8.7 billion in new development projects by next April. These projects include three new housing communities, a bridge, a hospital and a port expansion. Sheikh Ahmad had earlier indicated that Kuwait is planning to build 70,000 new homes by 2015 to meet the country’s growing housing needs. He said the housing scheme would help push the country’s real estate sector towards recovery after the effects of the global financial crisis. The ambitious property plan will be carried out by Kuwait's Public Authority for Housing Care (PAHC).

|

Construction of Avenues Mall |

Another report in the Al Watan newspaper stated that Kuwait plans to spend KD18 billion ($63 billion) over the next four years on 250 massive projects.

The projects are included in a four-year programme (2009-2013) approved by the cabinet in October (pending the go-ahead from the parliament), the newspaper said, citing government sources.

Besides the announcements, the nation has also recently indicated that it means business by signing on the dotted line for a few key projects. These include the contract for the construction of the 1,268-bed Sheikh Jaber Al Ahmad Al Jaber Al Sabah Hospital, one of the major proposed projects in the country. The project will cost an estimated total of KD303 million ($1.06 billion), and will take four years to complete.

Opec's fourth largest producer sits on about 10 per cent of global oil reserves and pumps about 2.2 million barrels per day (bpd). The country intends to boost this figure to 4 million bpd by 2020 and this could involve an investment of up to $50 billion to upgrade and expand the country’s existing refineries. Kuwait also plans to build a new refinery – its fourth – at Al Zour, although this project has been on hold since earlier this year, with some speculations about renegotiation.

Besides its investment in the hydrocarbon sector, Kuwait has a plethora of approved projects waiting in the wings such as the $94-billion business hub Silk City, $27-billion Sabah Al Ahmad Future City, $3.3 billion Failaka Island, $2-billion Al Khiran Pearl City, $7-billion metro, new power plants, a new modern port and a railway. The launch of these projects could instil immense confidence in the construction sector.

Yet, if the nation is looking to proceed on some of these projects with private sector participation, this would now be even harder to attract in the wake of the global credit crunch and the Dubai debt crisis. The past year has been particularly difficult for the private sector investment finance houses, which are a traditional strength of the Kuwaiti economy. In the interim, it will be government investments that could drive growth and help the private sector regain confidence.

This view has been echoed by Arqaam Capital, a growing player in the investment banking world. “There is wide-ranging recognition that Kuwait has seen bad times this year when many projects were constrained. The economy may have passed through a lull phase but it is one that has not decimated hopes for renewed growth. In the interim, until the private sector regains some degree of confidence, the economy is well-served pursuing government investments,” says a statement from the company.

Real estate

Real estate projects in Kuwait will still go ahead, but developers need to review their plans to meet changing market conditions, according to Jones Lang LaSalle, a global real estate services firm specialising in commercial property management, leasing, and investment management.

According to the Global Investment House’s GCC Real Estate Sector Quarterly issued last month: “Kuwait residential real estate market is expected to pick up as it continues to witness a huge shortage in supply. The latest amendments regarding laws 8 and 9 and allowing construction in new areas will create increasing activity in the market. Moreover, extended credit for the segment is expected to pick up in the medium term.”

According to sources, Kuwait’s real estate scene has witnessed a revival by the final quarter of 2009 especially in new housing areas.

Key drivers

Housing is expected to be a major driver of construction activity in Kuwait, where at least four new housing communities have been planned at a cost of between $27.8 billion and $31.3 billion. These include the new city of Khairan, where work on infrastructure is expected to be speeded up and Saad Al Abdullah City, where a number of packages are in various stages of construction.

The power sector has seen some movement, with high-profile contracts such as the Subiya power plant re-tendered successfully. In August, General Electric (GE) was awarded the contract for $2.65 billion. In most cases re-tendering has resulted in lower costs and tighter specifications. Plans to provide a connected power grid across GCC countries also progressed in July with the link up of Kuwait’s and Qatar’s electricity grids.

Work on extending the existing road network and water-treatment facilities are set to be a mainstay for local companies for some time, including the second and third ring-road extension and the upgrade of Jamal Abdul Nasser Street and Jahra Roads.

Following the recent completion of the Amiri Terminal at the Kuwait International Airport, Kuwait is expected to award a contract soon for the airfield package. The airport expansion includes the construction of a new terminal which will be linked to the airport’s existing one through a tunnel and connected to an access road from the south. The new terminal will increase the airport’s capacity to up to 20 million passengers a year.

Another key infrastructure development is the Kuwait Metropolitan Rapid Transit scheme. Consulting firms were expected to submit documents for expression of interest last month on the 171-km metro, which is expected to include more than 60 km of underground network. The masterplan is scheduled for completion in March.

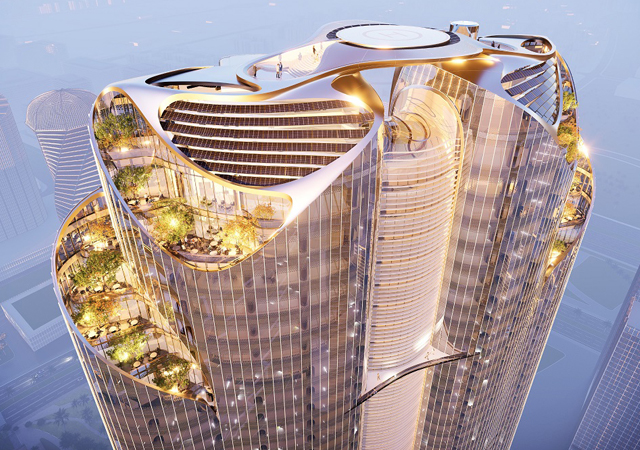

Meanwhile, work continues on a number of commercial and residential developments in Kuwait – some of which are set to be stunning additions to the country’s skyline. Among them are the Al Hamra Tower, Kuwait Business Town, Central Bank of Kuwait and United Tower (see separate reports).

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

Doka.jpg)