Shangri-La Barr Al Jissah ... expansion to get under way.

Shangri-La Barr Al Jissah ... expansion to get under way.

Albeit slowly, but steadily, Oman is trying to catch up with the rest of the GCC states in terms of investments in mega projects, through strengthening its infrastructure that will hold the Sultanate in good stead over the years to come.

This is apparent from the refineries, petrochemical ventures, oil and gas infrastructure, smelters, power plants, airports and roads being set up.

The Omani government is also investing heavily in its air transport infrastructure to support both its efforts to promote the tourism sector and to ensure continued industrial growth.

The seat of its ambitions is the northern town of Sohar and the southern city of Salalah, where ports and free zones as well as an array of industrial ventures have been taking shape. Sohar is one the Gulf’s fastest developing industrial zones, witnessing large investments, especially in gas-based industrial ventures. A new airport is also on the cards for the town.

Even as the two towns have become beehives of activity, the Sultanate now appears to have selected Duqm as the next growth hub – where the government proposes to build a new refinery, an airport, a port and dry-dock facility and a power station. The refinery project – which is in a conceptual stage – is expected to be the Sultanate’s third and will have dedicated export facilities and a capacity of 200,000 barrels per day (bpd).

Oman plans to spend $10 billion within the next five years to boost its oil and natural gas output, according to the government.

The Sultanate has been maintaining a steady growth and the new budget for 2007 rides on this momentum, with increased spending allocated for social development, especially for education, health and infrastructure while emphasising fiscal consolidation. Oil and gas revenues estimated for 2007 represent 79 per cent of overall income.

The GDP at constant prices is expected to have grown by six per cent in 2006, and 16.8 per cent at current prices. Other than the improved non-oil exports, industries such as LNG and petrochemicals have also contributed to the strong performance last year.

Last year, a number of projects were launched in response to royal directives to boost social welfare and infrastructure involving a total cost of RO612 million ($1.59 billion), an increase of 20 per cent in development costs. Of this, projects worth RO364.1 million are to be implemented this year. The government has made additional allocations of RO225 million for the road sector, RO18 million for ports, RO43 million for housing, RO41 million for airports, RO37 million for health, RO49 million for town planning and municipalities services and RO27 million for education sector. The road projects include dualisation of Amerat-Quriyat road, Salalah-Thumrait road and Sohar-Al Buraimi road, construction of Seeb International Airport intersection and interior roads. The port-related projects include construction of docks for the third phase of Sohar Industrial port. Airport sector jobs include filling up and levelling works for the new Seeb International Airport site, consultancy services for Seeb and Salalah airports and consultancy studies for the construction of two new airports in Sohar and Duqm.

Following the privatisation of a number of power projects – the latest being the Barka power plant – Oman looks set to open up the water and sewage sectors to private investment.

The private sector, in partnership with the government, is also spearheading a real estate boom. The sector has also received considerable impetus with Sultan Qaboos Bin Saeed having promulgated a new law clearing way for the non-Omanis to own real estate at designated ‘tourist complexes’. The decree has also empowered the Ministry of Housing, Electricity and Water to prepare the regulations for non-Omani ownership of real estate at tourism projects in coordination with the Ministry of Tourism..

The boom is concentrated primarily in the Muscat region, which is expected to remain as one of the key contributors to the nation’s construction and economic vitality.

As in other parts of the Gulf, contractors are lamenting the rising cost of building materials especially steel and cement, and with the tightening of the labour market, the higher labour costs are making most projects planned earlier unviable, according to industry sources.

Airports

The much-awaited Seeb and Salalah airport projects are now beginning to move ahead, while the Sultanate presses on with its plans to upgrade its air transport infrastructure with three other airports: in Sohar in the north, in the southern city of Duqm, and in Ras Al Hadd, a tourist destination near the country’s turtle nesting grounds.

The Seeb expansion aims to support tourism growth, with annual passenger capacity set to increase from its current level of around 3 million to 12 million. At Salalah, a new terminal with a capacity of 2 million passengers is to be built, along with new cargo facilities, which will aim to support the upcoming Salalah free trade zone.

French engineering and infrastructure specialist Airport de Paris Ingenierie (ADPi) has won a RO7.7 million ($20 million) contract to provide project management consultancy services linked to the development of the Seeb and Salalah airports. The opening of all these new facilities is planned for November 2010.

A joint venture of Cowi and Larsen Architects and Consulting Engineers has already commenced work on the design of the airports under a contract worth RO18.3 million awarded in May last year.

Oman has also invited bids from international consultants for a feasibility study on the planned airport in Sohar. Hamza Associates of Egypt has won the contract for a pre-design study of the planned international airport. The scope of the work includes preparation of a masterplan for the next 30 years, as well as presentation of a layout for the airport facilities and runways.

Meanwhile, Parsons International, a US-based engineering consultancy firm, has secured a contract to advise Oman’s government on the design and construction of the proposed airport at Al Duqm. Parsons is expected to draw up the design and assist in preparing tender documents, cost estimations as well as in selecting an EPC (engineering, procurement and construction) contractor for building the airport. The cost of the airport has not yet been estimated.

Ports

Oman is moving ahead with the third phase of expansion of the Port of Sohar to ensure the success of the numerous industrial projects taking shape in the zone. A Dutch-Belgian consortium of Van Ord Dredging, Interbeton and Six Construct has been awarded a RO94 milion contract for the project, which is to be implemented in 27 months.

A further contract has been signed for additional dock works at the new port and the fishing harbour in Sohar (second phase), completion of the government’s dock, excavation and refilling works at the dock front. The project is for completion in a year.

The Salalah free zone is seeking bids to choose a consultant to design and oversee its second phase development at an estimated cost of $130 million. According to Mohammed Al Dheeb, deputy CEO of the state-run zone, facilities to be built include roads, utilities, a headquarters building, 54 warehouses, staff accommodations as well as banks, restaurants and a fire station.

Power & Water

Oman continues to take strides in its pioneering privatisation programme of the power sector. The latest power project awarded to the private sector is the new power and desalination plant in Barka.

A consortium including Abu Dhabi’’s investment arm Mubadala Development Company, Suez Energy International and National Trading Company of Oman will build the estimated $500 million plant, as well as acquire a 100 per cent stake in Al Rusail Power Company, a 665 MW power plant currently owned by the government.

The Barka project will comprise the development, construction and operation of Barka Phase II, a 678 MW and 26.4 million gallons per day (gpd) independent power and water project. South Korea’s Doosan Heavy Industries & Construction Company has been contracted to construct the desalination facility and the power plant at Barka by April 2009.

Among other privatisation projects is the Independent Water Project (IWP) at Sur, for which Veolia Environnement of France is reported to have been recommended as developer. Veolia’s team consists of the local Bahwan Engineering Company. The French firm’s in-house team will carry out the EPC scheme.

Meanwhile, Hasan Juma Backer Trading and Contracting has won a RO66.2 million contract from the Ministry of Housing, Electricity, and Water to supply potable water in the Batinah region. Billed as the single largest water supply contract to be awarded in the Sultanate, the project envisages carrying potable water from the Barka desalination plant transmission network to the wilayats of Ar Rustaq, Al Awabi, Nakhal, Wadi Al Maawil and Musannah.

Industry

Sohar continues to be the focus of the Sultanate’s industrial ambitious, where Oman is investing more than $12 billion in projects, including an aromatics complex, a polypropylene plant, methanol and fertiliser projects and an aluminium smelter. The industrial city will also be home to at least two steel plants.

A pivotal project is the Sohar Refinery, which has successfully overcome initial operational hiccups and is all set to start commercial operations soon. The refinery project, which was built by Japan’s JGC Corporation on an EPC contract basis, has a crude unit with a capacity of 116,400 barrels per day (bpd) and a residue fluid catalytic cracking unit with a capacity of 75,260 bpd.

The project will provide feedstock for another major venture – Aromatics Oman (AOL) – located in the Sohar Industrial Port. The $1.6 billion plant will process naphtha from the refinery using Axens technology. With a production capacity of 814,000 tonnes of paraxylene and 210,000 tonnes benzene per year, the project will shape up to be the world’s largest grassroots paraxylene plant.

AOL has signed the EPC contract with LG International Corporation and GS Engineering and Construction Corporation for the world-scale plant.

The $1.7 billion aluminium smelter, being set up jointly with Alcan, is expected to have an installed production capacity of 350,000 tonnes per year (tpy) when completed by late 2008. The project will also involve building a captive 1,000 MW power station. The first development phase will involve the installation of AP35 potlines with an option to add a second series of potlines.

Oman plans to build at least two steel factories to help ease spiralling steel prices while existing plants at Rusayl and Raysut could be expanded.

Abu Dhabi-based Al Gaith Holdings is developing a Dh2.75 billion ($750 million) Shadeed Iron and Steel plant, work on which is on track to start operations in the third quarter of 2008. The plant, in Sohar Industrial Port, will produce some 1.5 million tpy of steel billets.

Another steel plant is being set up in joint venture with Brazilian mining company Vale do Rio Doce. Vale will supply 100 per cent of the raw material for the mill.

A major project in the fertiliser sector is being spearheaded by Sohar International Urea and Chemical Industries (SIUCI). The trial production of urea at the facility is expected to commence by December this year and the commercial operation by the second quarter of 2008.

With an annual production capacity of 1.2 million tonnes of granular urea, the project is considered as one of the largest greenfield private sector fertiliser projects in the world.

Roads

The Muscat Municipality marked a milestone recently by laying of more than 300 km of roads within a year. The roads in some of the districts pass through spectacular mountainous terrain.

Among the largest road construction projects under way is the $342 million Southern Expressway (see Roads and Bridges feature).

Meanwhile as Oman continues with its drive to link interior areas, work is in progress on the expansion of the Salalah-Thumrait highway, while other projects such as the Shaleem-Al Shuaimiyah road in Dhofar Governorate and the Al Rustaq-Ibri road linking the Al Dhahirah region to the Batinah region, where completed in time for the National Day celebrations last November.

The Ministry of Transport and Communications has awarded the local Shanfari Trading and Contracting Company the RO47.7 million ($124 million) contract to expand the Salalah-Thumrait highway. The scope of work of the project involves the widening of the 128 km road from Salalah to Thumrait. Nespak is the project consultant.

The RO10.55 million ($27.4 million) Seeb Airport Interchange project has been awarded to Carillion Alawi. The project, one of several being implemented by Muscat Municipality in the capital area, will help address a major rush-hour bottleneck at the Seeb Airport roundabout, as well as streamline traffic along the key Sultan Qaboos Street. Besides interconnecting with the Southern Expressway, the interchange will also facilitate smooth traffic flows in and out of Seeb International Airport, which is targeted for a major expansion over the next few years.

Real Estate

The Wave, Muscat – a tourism and beachfront residential development – has announced that its first residential release has evoked a good response with sales touching over $100 million. Half of the units in the first residential release, covering 221 townhouses and villas and due to be completed in early 2008, were bought by Omanis with the remaining bought by the expatriates mostly based in the Sultanate.

The Wave, Muscat is the first mixed-use development, which has been granted the right to sell freehold property rights to all buyers, including foreigners (see separate report).

The construction work to develop the Sultanate’s ambitious residential-cum-resort Blue City will kick off shortly. Al Sawadi Investment and Tourism Company is implementing the biggest residential-cum-resort development in Oman, while AAJ Holdings is involved in investment and structuring the project (see separate report).

Journey of Light intends to develop the $1.6 billion Omagine real estate development project near Muscat and hopes to sign the development agreement with the Government of Oman by the first quarter of 2007. The project is planned to be an integration of cultural, heritage, educational, entertainment and residential components, including: a “high culture” theme park, four and five-star hotels, 3,900 residences and a host of other facilities (see separate report).

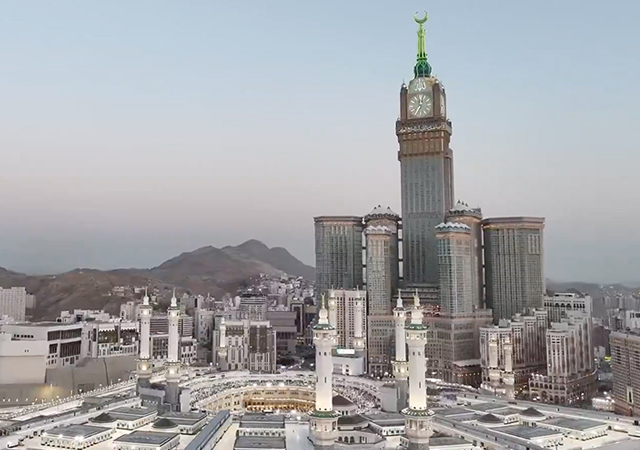

Work on the second phase of the Shangri-La Barr Al Jissah Resort is in the tendering stage, following the opening of a new restaurant and a spa at the resort village development last month. Phase Two will include a convention centre, villas on the beach, a shopping centre and staff accommodation. Turner is the construction manager. Phase One of the 124-acre project included three separate hotels with 683 rooms and suites and a spa. The triangular-shaped property is enclosed by mountain ranges on two sides and the beachfront on the third. Turner International is the construction manager.

Among other developments, Majan Gulf Properties (MGP), an Omani real estate company, has tied up with International Gulf Development and Contracting Company (IGDC) for the development of the 1 million sq m Sohar Residential and Commercial Project. The project – the first major development of its kind in Sohar comprising commercial, industrial and residential components – includes the Al Bustan furnished deluxe apartment complex and the residential villa compounds.

Also in Sohar, the Saud Bahwan Group is implementing a greenfield township project at Sohar, 300 km from Muscat, to meet the increasing demand for residential properties. Larsen & Toubro (L&T) Oman has successfully bid for and secured contracts for two packages in the township. The packages are worth $56.5 million and $63.5 million and are to be completed by the first quarter of 2008. They include the construction of 288 two and three-bedroom apartments; 149 three and four-bedroom villas.

Diar Real Estate Investment Company of Qatar is developing the RO115.6 million ($300 million) Ras Al Hadd project and has recently awarded Spillis Candela DMJM of the US the main consultancy contract for the eco-tourist destination near Sur. The masterplan is currently being carried out and the infrastructure contract will be tendered in April. The construction contract will commence in mid-2007 and will take four years to complete.

As with the rest of the Gulf, Oman is also developing its fair share of mega shopping malls. The local Tilal Development Company (TDC) is pressing ahead with the construction of the country’s largest shopping mall. The scheme is part of the Tilal residential complex, located in Muscat’s Al-Khuwair district. The estimated $120 million Muscat Grand Mall Complex, with a built-up area of 220,000 sq m. also includes two storeys of car parking, apartments and offices. Six consultants have been shortlisted for the project management contract. The design consultant, Australia’s Design, is also working on the schematic designs for further stages of development, including a hotel and commercial district.

Construction is also under way on Muscat City Centre’s RO23 million expansion plan, which will include Oman’s first multi-storey car park. The total expansion will see the centre extended by over 31,000 sq m, which will not only double its current size and add over 60 new outlets to the malls existing 80 shops. Carillion Alawi is committed to deliver the project in two phases and is on target to be complete it by mid-2007.

Sharaf Group, one of the UAE’s leading business conglomerates, recently opened Al Masa Mall in Muscat.

Water & wastewater

The Government of Oman has awarded Consolidated Contractors Company Oman (CCC) and Vinci Construction of France the main contract to build the RO43 million ($111.7 million) Wadi Dayqah Dam, the biggest of its kind in Oman. The project is part of a strategic water supply scheme for the capital area of Muscat as well as Quriyat and is to be implemented in four years.

Oman Wastewater Services Company (OWSC) has prequalified eight groups to build an 82,000-cu-m-a-day sewage treatment plant at Seeb. The project will be tendered by March and is part of the $1 billion Muscat wastewater scheme. OWSC has prequalified companies and is preparing to issue tenders for several other projects including the RO100 million ($260 million) for the second phase of a sewage network, entailing the construction of a sewage treatment plant, a 25 km trunk line and a drainage basin near Muscat. The construction is expected to start this year for completion by the end of 2010.