The construction sector is waiting expectantly for the launch of projects in the run-up to the 2006 Asian Games, the biggest international event to be staged by the country.

Already, there is a sense of euphoria in what many contractors term a "mini-boom". If not busy, all of them now have a slice of the action, they say.

Several government projects will undoubtedly be announced to put the much-needed infrastructure in place for this major event at an estimated cost of $800 million.

The next six years are likely to be busy for this Gulf state which has recently been ranked as the wealthiest Arab country in terms of per capita income, according to an annual Arab economic report for 2000. The report was prepared jointly by the Abu Dhabi-based Arab Monetary Fund, the Organisation of Arab Petroleum Exporting Countries (OAPEC) and the Arab Fund for Economic and Social Development.

Work has already been launched on Qatar's first independent water and power project in Ras Laffan. The major projects in the offing are the new Doha International Airport, which is likely to cost some $650 million, and the Salwa Road upgrade. The construction of around 80 schools is also reported to be on the cards. The state is also pushing ahead plans for industrialisation, with LNG and petrochemicals being the big-ticket projects.

Public expenditure is a very important factor affecting the future of this sector and the realisation of budgetary surpluses could bring in increased public spending. The budget for 2001/2002 shows a 14 per cent rise in expenditure to reach QR17.56 billion ($4.83 billion). Allocation for major public projects has seen a rise of 56 per cent, reaching QR3.2 billion, which covers the area of public services, infrastructure, social and health services, education, and youth welfare.

The drop in oil prices has had little effect on state spending or development plans, as the government can count on increased income from gas and petrochemicals, according to Finance Ministry officials.

Despite wilting oil prices, the budget is on course to produce a forecast surplus of QR497 million ($136.5 million) if Qatar's oil remains above $17 a barrel up to March 2002, according to Finance Minister Yousef Hussein Kamal.

Qatar's construction sector represented 3.4 per cent of the total GDP in 2000, according to an economic review by the Qatar National Bank (QNB). The sector has since recorded a substantial growth. The QNB review said the foreign investment law would act as a major boost for the building and construction sector in the coming years.

Power & water

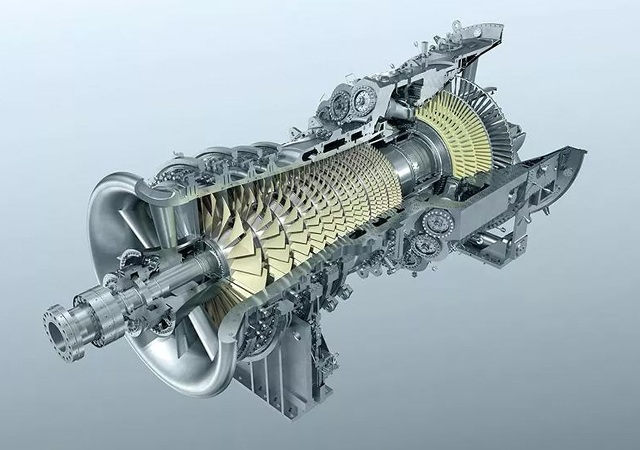

Last September, Qatar established its first private sector utility firm - the Ras Laffan Electricity Company - to carry out a $700 million independent water and power project (IWPP) in Ras Laffan.

US firm AES Energy will hold a 55 per cent stake in the venture, while majority privately-owned Qatar Electricity and Water Company (QEWC) will hold a 25 per cent stake, officials have said. The rest of the equity will be equally held by state-run Qatar Petroleum and Kuwait-based Gulf Investment Corporation.

Power supply is planned for March 2003, initially producing 430 MW, and output is expected to gradually rise to 1,400 MW during the project's 25-year life cycle. The plant will also produce 40 million gallons a day (mgd) of desalinated water. Of the $700 million cost, 70 per cent will be financed by a syndicated loan.

The project will be built at Ras Laffan Industrial City and export power and water to the national networks in addition to satisfying local utility needs at the industrial city.

Output will be purchased under a 25-year agreement by Qatar General Electricity and Water Corporation (Kahramaa), a regulatory body set up in July 2001 to replace the Ministry of Electricity and Water.

Minister of Energy, Industry, Electricity and Water Abdullah bin Hamad Al Attiyah has said Kahramaa would operate on a commercial basis, eventually abolishing subsidies.

Two years ago, the government handed over the operation and maintenance of its 610-MW Ras Abu Fontas B power-cum-water desalination complex to QEWC, which is 57 per cent owned by Qatari investors and 43 per cent by the government.

The Ras Abu Fontas B station is being expanded at a cost of QR523.28 million ($152 million). The main contractor is Alstom Power.

The project involves the installation and commissioning three generating plants which will raise Ras Abu Fontas (RAF) B power and water complex's capacity to 900 MW and it will be installed within the existing RAF premises and will be commissioned by this summer.

Following the award of the IWPP, the government is now looking at upgrading the country's transmission and distribution network

Meanwhile, Qatar Petroleum has taken a major step in its drive to set up a common seawater-cooling system project at Ras Laffan industrial city.

The company has appointed a consortium of Athens-based Consolidated Contractors International Company (CCC) and Japan's Chiyoda Corporation for the project. The engineering, procurement and construction (EPC) contract will be worth about $300 million.

The two-year project includes dredging a 1.5 km channel to depths of 4.5-9 m and the construction of two breakwaters, a pumphouse, intake and discharge channels and a chlorination plant.

The plant will supply 300,000 cu m of seawater per hour to meet the seawater-cooling requirements of the Ras Laffan independent water and power project and future industrial capacity planned in the area.

Oil, gas & industry

Qatar has been making concerted efforts to exploit its massive gas reserves and is already reaping the rewards through its LNG projects. The country has also taken signed major deals recently supply gas to neighbouring countries.

In January, Qatar Petroleum signed a memorandum of understanding (MOU) with Bahrain to supply natural gas to the kingdom as part of a plan to build a regional gas pipeline grid.

The state-owned firm did not give further details, but senior Qatari energy officials said the two sides have discussed supplies of 500 million cu ft per day (cf/d) as of late 2005 or early 2006, rising to 800 million cf/d eventually.

In December, Qatar signed a final agreement with Abu Dhabi-based Dolphin Energy to supply 2 billion cf/d of gas to the UAE.

Moving further afield, Qatar and Pakistan are reviewing a huge gas pipeline project between the two states, after the completion of a study by Crescent Petroleum of Sharjah.

Ras Laffan Liquefied Natural Gas Company (RasGas) began construction of a third LNG train in January to boost output capacity to 11.3 million tonnes a year (tpy) by 2004 from a current 6.6 million tonnes. The project is estimated to cost $1.4 billion

RasGas is one of Qatar's two multibillion-dollar LNG ventures, designed to cash in on the North Field - the world's largest single concentration of gas, which the Gulf Arab state shares with Iran.

RasGas - a joint venture of state-run Qatar Petroleum and Exxon Mobil, also has plans a fourth train - also of 4.7 million tpy capacity.

The country's other LNG venture, Qatargas is currently exports 7.5 million tonnes per year of LNG to Japan and Spain.

Last June, Qatar Petroleum signed a joint venture agreement with the US-based Chevron Phillips Chemical Company for developing a world-class petrochemical complex at Ras Laffan. The project involves development of an ethane cracker unit with an initial capacity of 1 million tonnes of ethylene. The cracker is expected to come onstream in the second half of 2006. Plans call for increasing capacity to 1.5 million tonnes per year in a second phase, making the facility the largest of its kind in the world.

The new petrochemical complex is the second joint venture between Qatar Petroleum and Chevron Phillips in Qatar. The first is Qatar Chemical Company (Q-Chem), which is building its first integrated complex at Messaieed scheduled to be commissioned in the third quarter of 2002.

Qatar Petroleum is also considering another ethane cracker to be set up in joint venture with Atofina, a TotalFinaElf subsidiary. The project, to be located at Ras Laffan, is schedule for completion in 2008.

Meanwhile, the expansion of Qatar Petroleum's oil refinery in Messaieed was inaugurated last January. The expansion has more than doubled the capacity of the facility.

The expanded refinery now has the flexibility to process crude oil as well as condensates from the gas production facilities. A fluid catalytic cracking unit (FCCU) included in the new facility uses the technology to convert residue from the crude unit and new condensate refinery into premium products. The two grade motor gasoline being produced in the refinery is totally lead-free.

LG Engineering and Construction and Lurgi Oil Chemie undertook the expansion work.

Work is also expected to start this year on the Middle East's first gas-to-liquids (GTL) plant at Ras Laffan. Foster Wheeler UK unit, Foster Wheeler Energy is handling the front-end engineering and design contract for the estimated $800 million gas-to-liquids project, a Sasol (South Africa) and Qatar Petroleum joint venture. Four international firms are reported to have been prequalified for the EPC package.

The gas-to-liquids facilities will provide fuel, naptha and liquefied petroleum gas for domestic consumption. It is expected to launch commercial production in the first quarter of 2005.

A second world-scale GTL facility is also proposed to be set up by Qatar Petroleum and Shell International Gas Limited.

Among other developments, the $700 million Qatar Vinyl Company (QVC) plant at the Mesaieed Industrial City became fully operational last June.

QVC is producing 290,000 tpy of caustic soda, 175,000 tpy of ethylene dichloride (EDC) and 230,000 tpy of vinyl chloride monomer (VCM). The unit is the first producer of EDC, VCM and caustic soda in Qatar, utilising available ethylene produced by Qatar Petrochemical Company (Qapco) as one of the feedstock materials.

Krupp Uhde of Germany was responsible for the core process unit of the plant. Italy's Technip installed the 130 MW power generation/distribution plant and major utility plants and off-site facilities including upgradation of several existing Qapco plant utility systems and construction of QVC offsite facilities.

Krupp Uhde also has an EPC contract with Qatar Fertiliser Company (Qafco) for its estimated $535 million fourth ammonia-urea plant (Qafco IV). The new plant will have a production capacity of 2,000 tonnes of ammonia per day and 3,200 tonnes of urea daily and is expected to be operational by May 2004.

A number of foreign firms too are eyeing projects in Qatar. Hindustan Electro Graphite (HEG), part of India's $400 million LNG Bhilwara Group, plans to construct a plant in the state at an estimated cost of $100 million.

Bahrain Aluminium Extrusion Company (Balexco) is setting up a BD8.5 million ($22.5 million) factory in Um Saeed. The plant will have a capacity to produce 7,000 tpy of extrusions and will include a 3,000 tpy anodizing plant and a 2,000 tpy powder coating plant.

A number of plans have been put forward to build an aluminium smelter in Qatar. Among the latest is a project with an initial capacity of 500,000 tpy proposed by United Development Company (UDC) and two plant builders, Ferrostaal of Germany and JGC Corp of Japan.

Qatar continues to encourage industrial expansion and to this end is expanding its infrastructure to support industries. Last April, the first contracts were signed for a new $137 million industrial city for small- and medium-scale industries. Three local firms signed four contracts worth a total of QR148 million ($40.7 million) to build roads for the planned city, to be set up 15 km west of the capital Doha. The city will cover an area of 11 sq km, with roads, utilities and other necessary facilities provided.

The local Trags has a QR20 million ($5.57 million) contract to set up a power distribution network at the new industrial area.

Airport

Qatar looks likely to move ahead with plans to build a new Doha International Airport at an estimated cost of $650 million.

Bids were submitted last year for the first package involving reclamation and land development and a contract is expected to be announced shortly.

Bids are being evaluated for the second package involving road works associated with the airport project. The Municipal Affairs and Agriculture Ministry invited contractors last October to submit bids for the Ras Abu Abboud-F ring road project, which covers the main highway network serving the new airport. The estimated $60 million contract involves the construction of about 8 km of dual carriageway, a major tunnel and several interchanges.

Tenders for the main package entailing work on a new terminal are yet to be announced.

The current international airport at Doha, meanwhile, has been expanded.

The focus of the extension project was the development of the departure and arrival lounges over 6,600 sq m, The new meet-and-assist lounge at the arrival terminal has more seats. Some 1,200 seats have been provided throughout the terminal building. The number of check-in counters have been increased to 40 from 32.

Sports facilities

Qatar is set to become the site for a major sports city to host the 2006 Asian Games. The Qatar National Olympic Committee is reported to have already set aside a site for a new Olympic Village 10 km north of the West Bay Lagoon development in Doha and consultants are expected to be appointed shortly to produce a masterplan for the development.

Local contractor Contraco is putting the finishing touches to two sports stadia which have been built at a cost of QR84.7 million ($23.29 million). The projects are part of plans to boost the sports infrastructure in the run up to the Games. The sports stadia are the Al Rayan Sports stadium located at Umm Al Afaai and the Al Ittehad Sports stadium at Gharaffa (see separate report).

Contraco is also reported to have secured a contract to build two indoor sports stadia, work on which is due to start this month.

A $16.5 million design-and-build contract was awarded last year to France's Gregori International for a state-of-the-art race track. To be built at Al-Rayyan for the Qatar Racing & Equestrian club, the new floodlit complex will comprise a grass racing track, a training track of sand and a grandstand for 1,500 spectators. The project is due for completion in mid-2003.

Commercial complexes

The local Construction Development Company (CDC) is working on a $137 million contract to build the West Bay complex in Doha. The contract, expected to take up to three years to complete, involves the building of a new hotel, apartments and houses, and leisure and recreational facilities.

The 18-storey hotel will be managed by the Four Seasons chain (see separate report).

The Four Seasons will be the third new five-star hotel to be built in West Bay. The Ritz Carlton was opened last October while the Intercontinental Doha opened a year ago.

A Holiday Inn hotel is expected to open in Doha in November.

Roads & drainage

A causeway to Bahrain is among the ambitious projects which are on the drawing boards.

As per the current schedule, Qatar and Bahrain will be physically linked in 2006 by the world's longest fixed link - a 38-47-km causeway known as the Friendship Bridge. A Danish consortium, headed by engineering consultant Cowi has been appointed to carry out a feasibility study for the project which is estimated to cost $1.5 billion.

Together with Sund & B3/4lt, DHI Water & Environment and the architects Dissing+Weitling, Cowi is responsible for environmental and engineering studies to determine the siting of the link.

Furthermore, the project team will prepare a pre-study of toll stations, customs and immigration facilities, pull-ins and junctions to the existing infrastructure on both shores.

The bridge is expected to start near the Zubarah fortress in western Qatar and end south of Manama on Bahrain's east coast. The Qatari government is expected to finance most of the project's costs, which will partly be recouped through toll charges.

Apart from the Ras Abu Aboud-F ring road scheme associated with the new airport development, moves are being made on three other major road projects. These include the $30 million Salwa and immigration interchange project, bids for which were submitted early this year and the Salwa road upgrade, for which prequalified contractors are scheduled to submit bids by next month.

The Salwa road upgrade involves reconstruction of a 95-km stretch of highway and its expansion into an eight-lane expressway with hard shoulders, collector roads and several interchanges.

Consultants have also submitted bids for the Doha expressway upgrade project.

Last July, Minister of Municipal Affairs and Agriculture Ali bin Mohamed Al Khater has signed 10 key contracts worth a total of QR96 million ($26.38 million) for roads and drainage systems in different parts of the country.

Further contracts with a total value of almost QR152.5 million ($40.4 million) for carrying out infrastructure projects in several areas of the country were signed last September. These include a QR26.9 million deal with a local contracting firm for carrying out a sewerage pumping project in Al Khor. Work is scheduled to be completed by September. The second phase of the drainage and sewage project at Al Maedhir district is being carried out at a cost of QR29.9 million. The job is scheduled to completed by March 2003.

Last November, The Ministry of Municipal Affairs and Agriculture has signed two contracts worth QR19.03 million ($5.2 million) with two local companies for renovation and design of roads in the Shamal and an industrial area.

The Shamal road renovation work will be completed by November, while the work at the industrial area will be completed in February, 2003.

Work is in progress on the new Northern and Southern Perimeter Road in Ras Laffan. Due for completion in June 2003, The project involves the engineering, procurement and construction of a new extension in the northern perimeter road which will be a 3.5 km long dual carriageway and the new southern perimeter road involving a 2.4 km long dual carriageway.

Other projects

The Al Ahli Hospital - Qatar's first such private venture being set up by Al Ahli Hospital Company is scheduled to be completed next year (see separate report).

The four-storey building, which will accommodate nurses, is located near the road linking Al Khor and Al Dakheera towns, overlooking the residential area for RasGas staff and adjacent to Al Shamal Hospital.

It provides for 48 apartments in addition to three sitting halls and three services rooms covering an area of 7,500 sq m. The complex will contain a number of separate one-storey buildings allocated for utilities and public services.

All the buildings to be constructed at the site will reflect traditional Islamic architecture, the minister said.

BIG.jpg)

.jpg)

.jpg)