Driving the industry’s digital transformation requires a balance between talent and technology.

Driving the industry’s digital transformation requires a balance between talent and technology.

Construction within the UAE remains in good health. Despite wider regional challenges and a global macroeconomic picture characterised by slow growth, the market in the UAE presents a picture of resilience, growth and innovation. According to Turner & Townsend’s newly-released UAE market intelligence report, 69 per cent of those surveyed perceived increased market activity in 2023.

The UAE construction has bounced back from the decline of the pandemic with a robust project pipeline that is buoyed by strong levels of investment, record non-oil trade, and the introduction of several significant public-private partnership initiatives.

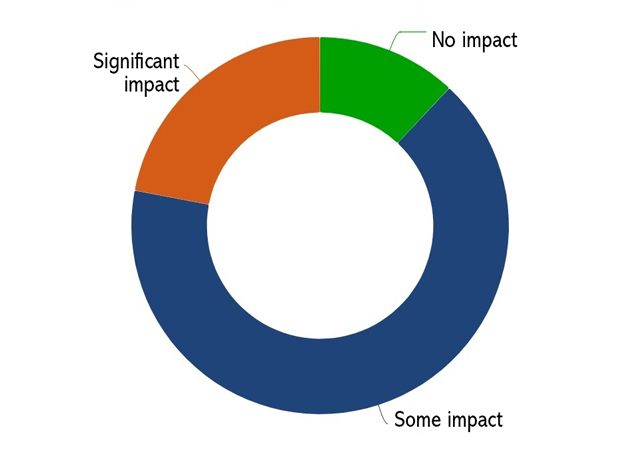

One of the most exciting aspects for the UAE construction sector is the greater take-up of digital strategies and innovative construction techniques that are advancing programmes and securing better levels of productivity. Despite the positivity and growth in the market, projects still face threats from rising costs and a stretched supply chain (see Figure 1), especially around labour. Clients increasingly understand that fresh approaches to digital can help tackle these wider pressures.

|

|

Ralph, Country Manager |

This investment in digital is part of a wider agenda around the UAE Digital Government Strategy 2025 and construction is helping to lead this charge by integrating technologies and techniques for more advanced programmes. For clients who are yet to embrace these methods, investment will be key to avoid being left behind. For businesses and programmes already implementing new digital tools and ways of working, it is vital to understand how they can be best utilised and integrated.

Harnessing advanced technologies

Levelling up construction in the UAE will require bringing in the key technologies that can transform project delivery. Navigating the pressures that come with an expanding economy relies on thinking differently – establishing innovative solutions that aid UAE’s strategy towards sustainable growth. There are a number of tools and approaches that businesses should be looking at to aid this process.

Digital twins, often facilitated by Building Information Modelling (BIM), are currently revolutionising construction by providing detailed models that can aid decision-making, planning, and benefit the long-term operation and lifecycle of assets. A recent analysis by Turner & Townsend’s team revealed that 78 per cent of respondents were using BIM (the most popular of any digital platform), partly due to the improved visibility it provides that can enhance decision-making, especially around carbon reduction.

|

|

FIGURE 1: How severely do you feel supply chains have been disrupted during the last six months? |

Across the market, we’re also starting to see increased use of artificial intelligence (AI) in projects. Regionally developed AI powered solutions like BuildStream, WakeCap and Safety.ai are not just for better data management, but are also increasingly being used to support building design, and even health and safety.

Software tools deploying AI and BIM can go hand-in-hand with hardware such as robotics and drones that support improved planning, progress tracking and surveying. As well as better productivity and reduced demands on labour, they can help to enhance safety, data collection and project management.

Ultimately, these various types of advanced technologies are helping the UAE to be at the forefront of digital construction and boost delivery schedules. However, there are issues around upfront investment costs, particularly in the case of robotic solutions, so clients will need to carefully monitor and engage with supply chains. Fully understanding the long-term benefits and cost savings will help to justify this digital investment.

Upskilling workforce

The successful use of these tools, however, will also be reliant on having a capable workforce that can get the best of these platforms. Driving the industry’s digital transformation requires a balance between talent and technology that helps put the right training and integration in place to maximise the impact of investment in new tools.

One of the most significant challenges that clients are facing in the UAE, and the Middle East as a whole, is the tightening labour pool. Several survey participants in Turner & Townsend’s most recent report highlighted that the general warming in the market has resulted in a shrinking pool of contractors, which is having an impact on development timelines and cost escalation. Businesses in the UAE cannot control wider macroeconomic factors, but they can work to get more from less and upskill their current workforce to be more digitally fluent.

Turner & Townsend’s own findings demonstrate that there is a need for greater investment in this area. An overwhelming majority of participants in the survey (97 per cent) recognise the opportunity to be gained by implementing digital strategies. This reflects the desire to act, but also that there is even more that can be done to meet the collective ambition.

Turner & Townsend’s sentiment data showed that there was a gap between the intent to use pioneering methods and real capability available – indicating room for innovation and advancement of digital practices. It means that even businesses that are currently investing in the necessary tools will need to go further to upskill teams and encourage the integration of the tools into existing systems. This will help to offset some of the wider challenges they face and get programmes moving forward.

Embracing innovative techniques

Improving outcomes also goes beyond the individual tools. Clients should be looking at their overall approaches as well. The UAE is experiencing a strong pipeline of projects that are aiming to support the country’s growing population and demand from tourism. Achieving these ambitious programmes necessitates the use of the latest and most innovative construction techniques to get timely, cost-effective delivery.

Embracing modern methods of construction (MMC) will be key to this. Turner & Townsend’s report indicates that the second-most flagged constraint on construction is excessive lead times. MMC and off-site techniques help to mitigate risks such as this, as well as support sustainable practices and accelerate delivery on major programmes.

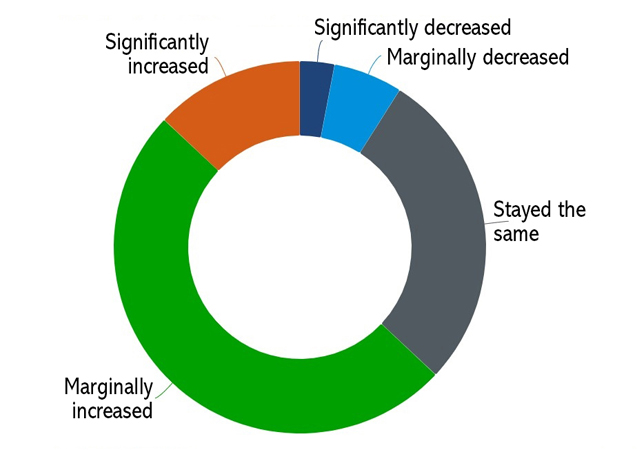

Turner & Townsend’s survey found that 63 per cent of respondents noted an increase in the adoption of off-site manufacturing and prefabricated components in the local construction market during 2023 (Figure 2). The findings showed an 18 per cent rise in perceived increase in take-up of MMC in comparison to its 2022 survey, with just nine per cent of the data set believing adoption to have decreased in some capacity.

|

|

FIGURE 2: To what degree do you believe the adoption of off-site manufacturing and prefabricated components has varied in UAE over the past 12 months? |

The report shows a diversity of perspectives when it comes to MMC, although it presents evidence to suggest that the local market is capitalising on its advantages more and more.

Differing factors such as project scale, regulatory frameworks and market dynamics will mean that MMC’s take-up may be less widespread in the short term, but its benefits are numerous. If clients are able to integrate MMC into their programmes, they will reduce their reliance and exposure to traditional supply chains, boost the transition towards a circular economy, improve their sustainability credentials and see greater efficiencies in terms of cost and timelines.

Leveraging insight to deliver results

On the whole, it is vital that clients understand the evolving landscape of UAE construction, the nuances of new innovative techniques, and the potential of digital transformation. This understanding will be essential to reducing costs, finding efficiencies in programmes and capitalising on the country’s extraordinary growth. However, investors and developers will need to be aware of the deeper challenges associated with integrating these strategies, which includes maintaining investment in skills. By doing this, clients will be able to take advantage of the immense opportunity to drive growth and embrace innovation.

.jpg)

(1).jpg)