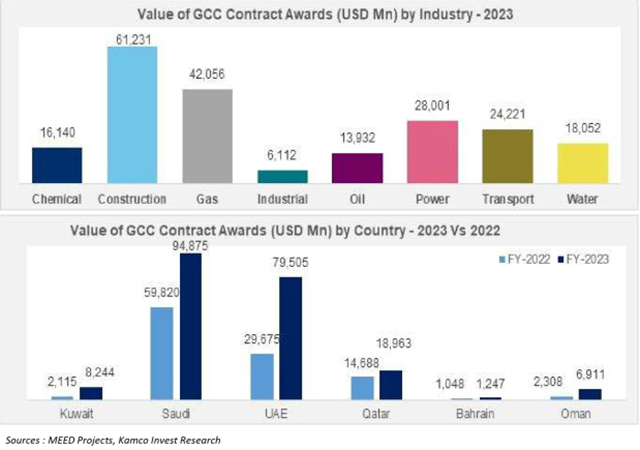

Defying regional and global geopolitical challenges, GCC project awards increased by 20.3 per cent in the first quarter to hit $45 billion compared to $37.4 billion last year, with regional heavyweights Saudi Arabia and Qatar spearheading the growth, according to Kamco Invest, a non-banking financial powerhouse based in Kuwait.

The trend also defies oil production cutbacks which have all weighed on economic growth in the region as seen from IMF’s latest forecast that slashed GCC economic growth forecast for 2024 to 2.4 per cent from its previous forecast of 3.7 per cent, it said.

The consistent growth in GCC contract awards underlines the resolve of GCC governments to see through their diversification projects, as well as state funding support, stated the industry expert in its GCC Projects Market Update April 2024 report.

Growth in GCC contract awards was evenly distributed during Q1-2024 as three out of the six countries in the GCC recorded y-o-y growth in their projects awards, including two of the largest projects markets in the region, Saudi Arabia and Qatar, as well as Oman while the remaining three countries witnessed declines.

According to Kamco, Saudi Arabia represented over 52.2 per cent of total GCC projects awarded during Q1-2024 that reached $23.5 billion. It achieved this feat despite recording a y-o-y dip in aggregate projects awarded in the construction, transport and chemical sectors. The growth was mainly attributed to the kingdom’s gas sector which witnessed its total value of contract awards jump from $40 million in Q1-2023 to $6.2 billion in Q1-2024.

Comparatively, total contracts awarded in the UAE witnessed a marginal dip of 1 per cent y-o-y to reach $11.5 billion during Q1 as compared to $11.6 billion for the same period last year.

On the other hand, aggregate value of contracts for Qatar jumped 68.5 per cent y-o-y during Q1-2024 to reach $6.1 billion against $3.6 billion in Q1-2023. According to Kamco, total value of contracts awarded in Qatar increased by 68.5 per cent y-o-y to reach $6.1 billion during Q1-2024 as compared to $3.6 billion in Q1-2023, according to data gathered by MEED Projects.

.jpg)

(1).jpg)