Riyadh’s $50.6-billion Diriyah redevelopment plan will see the opening of 38 hotels in the first phase.

Riyadh’s $50.6-billion Diriyah redevelopment plan will see the opening of 38 hotels in the first phase.

With some 275,000 hotel rooms slated to be completed by the end of this decade, Saudi Arabia now has by far the highest pipeline of hotel projects in the planning and construction stage in the GCC, relegating the region’s hospitality hub UAE to the second place in terms of upcoming projects.

In line with Saudi Arabia’s ambitious Vision 2030, which aims to attract some 100 million tourists annually, including both domestic and international travellers, the kingdom has unleashed multiple giga-projects which will transform the country’s hospitality market and will see the completion of 275,000 hotel rooms by 2030, according to research carried out by global property consultancy Knight Frank.

The delivery of the planned hotel room supply is forecast to cost a whopping $110 billion, added the report.

|

|

Southern Dunes hotel ... part of The Red Sea project in Saudi Arabia, which is expected to offer 3,000 rooms in 16 hotels in its first phase. |

“Given this is the biggest hotel supply pipeline ever seen in the region, it will usher in a golden age of hospitality for Saudi Arabia,” comments Turab Saleem, Partner – Head of Hospitality, Tourism & Leisure at Knight Frank.

Faisal Durrani, Partner – Head of Middle East Research at Knight Frank, adds: “We stand at the precipice of a sea-change for Saudi Arabia’s hospitality landscape – we are moving from vision to reality. The $110-billion herculean task of transforming Saudi Arabia’s hospitality landscape goes well beyond the delivery of extra hotel room keys. Care and attention must be taken to deliver the correct quantum of product in the right locations.”

Knight Frank’s research has also revealed a change in the country’s top hotel room operators by 2030.

Durrani comments: “The competition is starting to heat up as hotel operators jostle for a piece of the remarkable hospitality and tourism vision now unfolding in the kingdom. The real crown jewel for hotel operators will be securing a presence in the giga-projects, with Neom and Roua Al Madinah forecast to add around 80,000 keys each.”

Neom is a futuristic city being built in Tabuk Province in northwestern Saudi Arabia at an estimated cost of $500 billion, while Roua Al Madinah is a mega mixed-use real estate development taking shape in Madinah. Ennismore is the inaugural partner for Neom’s mountain tourism destination Trojena, with its brands 25hours Hotels and Morgans Originals two of the first to be unveiled.

|

|

The Ski Village at Trojena in Neom. |

Knight Frank estimates that by 2030, the Accor Group will cement its place as Saudi Arabia’s largest hotel room operator, doubling the number of rooms it manages to almost 28,000. Hilton hotels will leapfrog from fifth place currently to emerge as the country’s second biggest brand, with almost 19,000 rooms under management by 2030.

“As it stands, the kingdom’s giga-projects represent nearly 73 per cent of the hotel supply pipeline. And nationally, we are poised to see a 63.2 per cent surge in the number of four- and five-star hotel rooms by the end of the decade.” Saleem says. “The advantage Saudi Arabia has over other countries in the region is its vast size. Each of the kingdom’s 13 provinces offers something unique and this, in itself, will play a significant role in drawing in regional and international tourists. The giga-projects, with their unique offerings, will further enhance what is already an incredibly diverse range of tourist attractions.”

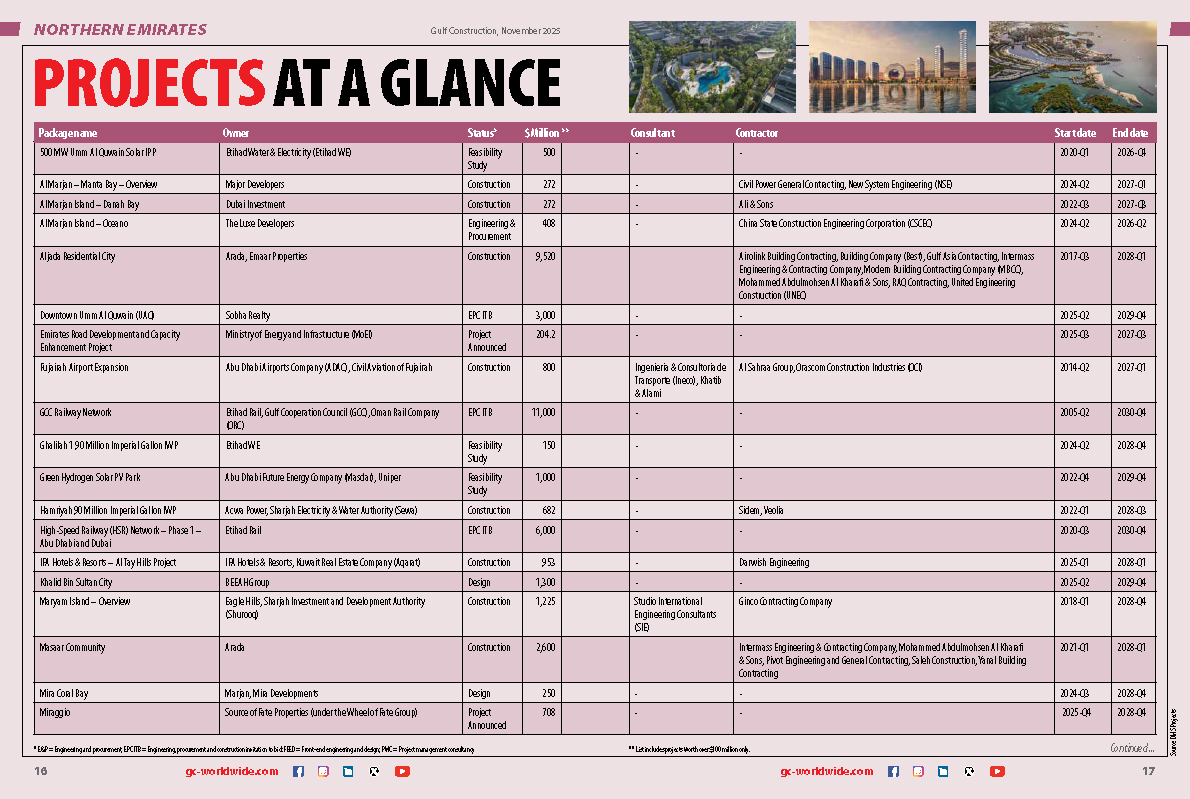

When it comes to the country’s existing cities, Knight Frank estimates some $3.4 billion is needed to deliver Jeddah’s planned 11,300 rooms, the highest level nationally. Riyadh comes in a close second, with 11,200 new hotel keys forecast to cost $3.2 billion, swelling the capital’s hotel room supply to around 30,000.

According to the TopHotelProjects’ database which covers four and five-star projects, a massive 80 hotel projects are scheduled for completion in Saudi Arabia next year and it reveals that the kingdom’s hotel construction rate is due to nearly treble in 2023, with about 50 per cent of the 167 projects on its database due for delivery within those 12 months.

Altogether, 56 per cent (35,884) of the 63,753 Saudi Arabian rooms included in the database will come online next year, far dwarfing the 9,207 keys from this year’s 24 projects. Development returns close to this rate in 2024, with 23 projects delivering 9,599 rooms, while 2025 and beyond will see at least another 40 hotels representing 9,063 keys joining the market, says TopHotelProjects.

First-class four-star properties account for 77 projects and 30,229 rooms – 46 per cent of the total, with the remaining 54 per cent in the luxury five-star segment, totalling to 90 builds comprising 33,524 keys.

Makkah, Jeddah, Riyadh and the Red Sea region account for the lion’s share of these projects.

|

|

The four- and five-star hotels in Riyadh’s projects pipeline. |

The hotel brands that lead in the country are headed by Holiday Inn Hotels & Resorts, with nine projects comprising 5,154 rooms. Joint runners-up are Hilton Hotels & Resorts and Radisson Blu Hotels & Resorts, both with six newbuilds, with the former adding 2,483 keys and the latter welcoming 1,063 rooms to its portfolio.

The Radisson Hotel Group itself has three hotels within the Thakher Makkah urban development completing in Q3 2023 which will add a total of 992 rooms and apartments, doubling the group’s portfolio in the city.

The capital of Saudi Arabia is set to host 48 new hotel projects, which between them will bring as many as 9,838 new rooms to the city. Of these hotels, 28 properties with 6,022 rooms between them will have five-star status, with the remaining 20 projects, encompassing a total of 3,816 rooms, falling within the four-star category, according to TopHotelProjects.

Of these projects, 15 are in the pre-planning phase, six are at the planning stage, 19 are under construction and eight are now in the pre-opening phase.

Significant openings to look forward to include the late 2023 opening five-star, 141-key Samhan Heritage Hotel, Autograph Collection – the first of several luxury hotels becoming a part of the Diriyah cultural and lifestyle tourism development. The four-star Element Riyadh will then open in the third quarter of 2025 alongside Westin Riyadh as one of two hotels in an architecturally striking mixed-use project close to the King Abdullah Financial District.

According to data from TopHotelProjects, more than 7,000 rooms will come online in Jeddah over the next few years. With at least 33 separate developments under way, the upscale and luxury segments will be well-served in the Red Sea coastal city, breaking down as 19 four-star and 14 five-star hotels.

In terms of pipeline pace, just three sites are due to complete by the end of this year, while 2023 will see 14 additions. Only one each in 2024 and 2025 are slated to complete, while the remaining 14 projects’ opening dates are still to be decided.

Notable sites include the 500-room Hyatt Regency Jeddah Serafi Mall opening in Q4 2023.

Elsewhere, Rixos is upgrading and restyling Makarem Annakheel Village into Rixos Obhur Jeddah, a fully-fledged 174-room tourist resort complete with an array of family-friendly, five-star facilities which will reopen in Q3 2023.

UAE pipeline rises to 48,000 keys

|

|

The four- and five-star hotels in the UAE’s projects pipeline. |

The UAE’s hotel development pipeline has swelled to 48,000 keys with the delivery of the planned room supply forecast to cost around $32 billion, according to Knight Frank’s analysis.

Durrani says: “The UAE’s world-leading hospitality market is set to expand 25 per cent by 2030, with a further 48,000 rooms adding to the nation’s extensive 200,000 key portfolio. Perhaps unsurprisingly, Dubai is set to account for the lion’s share of this total, with 76 per cent of all new rooms coming to the emirate, which already boasts over 130,000 rooms. This stockpile of hotel rooms is already higher than cities like London or New York.

Saleem explains: “The UAE’s vibrant hospitality market continues to expand, with a clear focus on the luxury end of the price spectrum. Our analysis shows that 70 per cent of all the rooms planned will fall in the four- and five-star category.”

Knight Frank’s research has also revealed a growing proportion of international operators are rushing to be part of one of the world’s most successful hospitality markets.

Durrani continues: “The success of the UAE’s hospitality market means international operators are keen to continue cementing their presence. Indeed, the proportion of international operators to local ones is set to rise to 60 per cent, from 56 per cent today.

“Interestingly, Hilton Hotels will add the most rooms overall, with close to 5,000 new keys expected by the end of the decade, a 43 per cent increase on today. This mirrors the group’s plans in Saudi Arabia, where Hilton hotels will emerge as the second biggest operator by 2030 with 19,000 rooms under management, around 3,000 rooms more than the group will have in the UAE by that stage.”

Knight Frank estimates that by 2030, the Accor Group will cement its place as UAE’s largest hotel operator, with close to 25,000 rooms under management, a position the group also enjoys in Saudi Arabia.

TopHotelProjects’s database, meanwhile, shows that the UAE currently has 161 hotel projects with 45,332 keys in the pipeline. Given the UAE’s reputation for embracing the finer things in life, it may come as no surprise to learn that the country has more five-star schemes on the go (92 hotels with 26,882 rooms) than it does four-star projects (69 properties with 18,450 keys). The vast majority of its development activity, moreover, is focused on Dubai (108 hotels, 32,705 rooms) – far more than nearest challengers Ras Al Khaimah (16 properties, 5,093 keys) and Sharjah (14 schemes, 2,454 rooms) combined.

Some 67 projects (collectively accounting for 21,094 rooms) in the UAE are expected to be delivered before the year is out, with a further 47 properties (and 12,865 keys) following swiftly in 2023. There’ll also be 13 hotels with 2,821 rooms completing in 2024, and 34 openings with 8,552 keys landing in 2025 and beyond, the report adds.

(5).jpg)

.jpg)