Bilaj Al Jazayer ... a key project being spearheaded by Edamah.

Bilaj Al Jazayer ... a key project being spearheaded by Edamah.

Ambitions run high in Bahrain which announced a future-focused $30-billion Strategic Projects Plan late last year to steer the country towards economic recovery and sustained growth over the long term.

To drive this plan forward, the kingdom will increasingly turn to the private sector – a validation of this is the tender for Phase One of the much-awaited Bahrain Metro project announced in November, where the preferred private partner will work on the development on a design, build, finance, operate, maintain, and transfer (DBFOMT) basis. Also, the Bahrain Northern Link Road will be developed on a public-private partnership (PPP) basis (see Tenders).

The estimated $3-billion metro is among the multi-year projects on the Strategic Projects Plan. The plan represents one of Bahrain’s most significant injections of capital investment and will drive the Economic Recovery Plan, designed to enhance the long-term competitiveness of the country’s economy, and stimulate post-pandemic growth, said Deputy Prime Minister Shaikh Khalid bin Abdulla Al Khalifa, while announcing it in November.

Among the 22 projects outlined in the plan are five cities situated on newly-developed islands, which will increase Bahrain’s total land area by more than 60 per cent; a ‘Tourist City’, a series of resorts in the southwest of Bahrain; and the largest ‘Conference City’ in the Middle East, which will be part of the New Bahrain International Exhibition and Convention Centre, officials said.

|

|

Work is in progress on a number of mid-rise and high-rise buildings at the prestigious Bahrain Bay. |

Other key developments include the new 25-km, four-lane King Hamad Causeway, which will run parallel to the existing Bahrain-Saudi link; and the Sports City, a complex that will house the largest sports stadium in the country and a multi-purpose indoor sports arena.

Following the announcement of the Strategic Projects Plan, Shaikh Salman bin Khalifa Al Khalifa, the Minister of Finance and National Economy, said: “Bahrain is emerging from the pandemic with a bold ambition that looks beyond economic recovery to a more prosperous future. This transformative investment will raise education and lifestyle opportunities for young people and provide quality healthcare, homes, and career paths for them as the progress into adulthood.”

While the Covid-19 pandemic has dealt a serious blow to both project schedules and costs, the construction sector has been limping resolutely forward over the past year, bolstered by government efforts to keep the cogs of the industry turning.

Major projects such as Phase Two of the Bahrain Airport Modernisation Programme, $6-billion Bapco Modernisation Programme, Alba expansion (see Regional News, Page 6), the new expo centre, various big-ticket social housing projects and roads and sewerage project have been ongoing, while entities such as Bahrain Real Estate Investment Company (Edamah) – the real estate arm of the kingdom’s sovereign wealth fund Bahrain Mumtalakat Holding Company – have been spearheading growth with their business-as-usual approach. Several infrastructure projects financed by the GCC Development Fund have been ongoing, bringing the cumulative total value of projects awarded under the fund to $5.63 billion, according to a Ministry of Finance report.

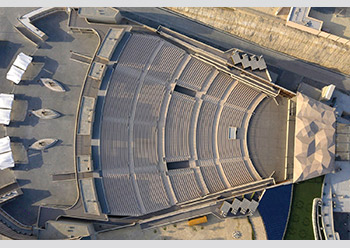

Among the striking projects completed in Bahrain last year were the 10,000-spectator-capacity Dana Amphitheatre, built 15 m into the ground of the Sakhir desert, and a new cathedral in Awali.

Early shoots of recovery have been witnessed over the past year, among them an uptick in contracts awards and a growth in real estate transactions. Bahrain awarded a total of 1,070 tenders worth BD1.3 billion ($3.42 billion) during the first six months of last year, despite the difficult economic conditions triggered by the Covid-19 pandemic, according to data released by Bahrain’s Tender Board.

Of this, the lion’s share was for oil sector projects worth BD696 million, followed by aviation (BD179 million) and the construction and engineering consultancy (BD155 million). The total value of the tenders awarded grew by 60 per cent from BD820 million in the first half of 2020.

The GDP from construction increased to BD233.45 million in the first quarter of 2021 from BD232.80 million in the fourth quarter of 2020, according to the Ministry of Finance. In the long term, the country’s GDP from construction is projected to trend around BD246.98 million per quarter in 2022 and BD253.15 million in 2023, according to projections by Trading Economics, an information technology and services platform.

|

|

Bahrain Metro ... tenders have been invited from developers. |

Metro

The Bahrain Metro will be implemented as an integrated PPP project and prequalification bids were invited in late November from global and regional developers for the first phase of the 109-km-long network. The deadline for submitting the pre-qualification bids has been set at March 2.

The first phase will comprise an elevated corridor with two lines with a total length of 29 km and 20 stations extending from Bahrain International Airport to Seef, linking both to Manama and the Diplomatic Area.

The project will have an initial capacity of 5,000 passengers per hour per direction (PPHPD) with the scope to increase it to 23,000 PPHPD for each line. The overall project will comprise four lines, which is set to be implemented in multiple phases.

|

|

The new terminal at Bahrain International Airport ... Phase Two works in progress. |

Airport

Construction work is ongoing on the second phase of the $1.1-billion Bahrain Airport Modernisation Programme (AMP), following the completion and launch of operations of the first phase.

Phase Two is 82 per cent complete, according to Hill International, which is providing project management services for the AMP.

Bahrain International Airport officially launched operations at its new 207,000-sq-m passenger terminal at the end of January 2021 (see Page 40).

Apart from the airport expansion, a new Cargo Express Village is to be built at Bahrain International Airport. The key facilities include a warehouses zone spread over a 12,500-sq-m area; two power substations; a landside access road from Al Rayya Highway; a car parking zone and security guard house in addition to water tanks and pumping station and an emergency gate.

|

|

Salman City ... addressing the kingdom’s housing needs. |

Housing

As part of the Government Action Plan (GAP) which stipulates the construction of 25,000 housing units to address Bahrain’s social housing requirements, thousands of new homes are being built in new cities, most notably in Salman City (formerly known as Northern Town), East Sitra and East Hidd.

The massive Salman City covers 740 hectares on the northwestern coast of Bahrain and is designed to house around 15,600 families on 10 islands. Some 2,000 housing units were distributed to beneficiaries at the end of last year.

Current plans entail the construction of a total of 1,382 flats on Island 12 of the city as part of a project worth BD123 million ($324 million) that is targeted for completion by the second quarter of 2023.

The East Sitra Town project, which is now under construction, will offer 3,000 residential units once completed. The first project of its kind being implemented by Bahrain in collaboration with China, it is being carried out in three phases to serve about 20,640 citizens.

A further 520 homes are being built in East Hidd by the Ministry of Housing under a fund from Kuwait Fund for Arab Economic Development (KFAED).

Plans have also been launched by Eskan Bank for the development of Al Ramli Housing project, comprising 400 apartments and a retail area in its initial phase.

Meanwhile, private developers have joined in government efforts to meet the housing requirements of Bahrain’s citizens. For example, Naseej has signed an agreement with Ithmaar Holding to develop a BD40-million residential project in the northern governorate area of Barbar. The project, which will come up on a 150,000-sq-m area, will comprise 400 units and is mainly targeted at the beneficiaries of the Ministry of Housing’s Mazaya programme.

Tourism Projects

In line with the kingdom’s goal of increasing the contribution of tourism to GDP to 11.4 per cent in 2026, Edamah has embarked upon a number of major projects such as Bilaj Al Jazayer, a mixed-use development on the country’s southwest coast, close to the Bahrain International Circuit. Encompassing 1.3 million sq m of land with a 3-km beachfront, Bilaj Al Jazayer will feature resorts, residential villas and apartments, food and beverage outlets, offices, and retail and entertainment offerings.

The kingdom’s sovereign wealth fund has recently signed up Minor Hotels, an international hotel operator, to develop two 110-key upscale hotels – Avani and Tivoli hotels – at Bilaj Al Jazayer, which are scheduled to open in 2024.

Another key Edamah development is Sa’ada, an important heritage project which will link Muharraq’s existing historical setting with the waterfront via an iconic bridge. Phase One has been opened and includes 34 shops, 36 marina bays, and 200 car-parking spaces. Future phases include the revitalisation of the historic bus station and post office, open plazas, more retail outlets, and a multi-storey car-park.

In November, Bahrain launched a new tourism strategy for 2022-26. In line with these plans, the Bahrain Tourism and Exhibitions Authority is developing a diving waterfront, the Bahrain Bay beach project, and the Qalali waterfront. Among the resort projects targeted for completion by January 2023 are the Mantis Hotel and Resort on Hawar Islands; the Jumeirah Bahrain Bay Resort; the Tourist City project, in addition to the Bilaj Al Jazayer Beach and Saada projects.

A major project catering to the MICE segment is the New Exhibition and Convention Centre project coming up on a 309,000-sq-m area in Sakhir (see Page 42).

While the retail sector has suffered a major setback due to the pandemic, one landmark waterfront shopping destination has taken the bold step of announcing an expansion. The iconic Avenues – Bahrain is embarking on its Phase Two expansion, estimated to be worth BD60 million, which will include 218 stores and restaurants, two entertainment zones, a supermarket, and a 1,330-slot basement car-park.

Phase Two is projected to be completed by Q4 2023. The development also saw the recent opening of the 192-key Hilton Garden Inn-Bahrain Bay hotel which is connected directly to the mall.

Real Estate

Five new offshore cities are to be built to increase urban areas in Bahrain by more than 60 per cent, with hundreds of square kilometres of land allocated for the construction of residential and tourism facilities, as part of the Strategic Projects Plan. These plans alongside the recent launch of the National Real Estate Plan 2021-24 by Bahrain’s Real Estate Regulatory Authority (RERA) are designed to position Bahrain as a premier destination for real estate investment, while promoting its growth and development.

There has been an increase in activity in the real estate sector over the past year. Bahrain witnessed an impressive growth in property transaction volumes for the first quarter which rose by 36 per cent to hit $600 million, compared to 2020’s figure of just over $440 million, according to the Survey and Land Registration Board.

According to the report, just under 3,000 properties were sold across the kingdom during the first three months, up 51 per cent over 2020.

There were also indications that demand has been increasing for larger homes. Propertyfinder’s Bahrain unit recorded an increase of 2.3 per cent for apartment leads, and a 23 per cent jump in leads for villas listed for rent when compared month-on-month for June 2021, highlighting that most users of the site are searching for a bigger space with added amenities.

Among the major real estate developments under way in Bahrain, much of the action has been at Diyar Al Muharraq, which has been regularly announcing new projects and progress on infrastructure works and housing units. Last month, its eponymous developer announced that Al Kobaisi Group has invested in residential plots within its integrated city located off Muharraq island, while AD Ports Group has signed an agreement to set up new cruise terminal there (See Gulf Construction’s Digital Edition, Page 69).

Meanwhile, significant developments have been under way at Marassi Al Bahrain at Diyar Al Muharraq, which is being developed by Eagle Hills Diyar. Among the new residential projects launched within the development is Marassi Park and Address Residences, Marassi Vista.

Also being built off the coast of Muharraq governorate is Dilmunia, taking shape on a man-made island. Early last year, the $1.6-billion mixed-use development witnessed the opening of Phase One of the Dilmunia Canal – Bahrain’s largest manmade water canal. Phases Two and Three, which continue northwards, are expected to finish by the end of 2022.

Meanwhile, in the heart of the capital Manama, the iconic Bahrain Financial Harbour (BFH), a major live/work/play destination being built on the waterfront, is now in its third phase of construction with third-developers building residential, leisure, hospitality and office properties within the development. GFH Properties is developing Harbour Row and Harbour Heights with over 1,000 luxury apartments and townhouses, food and beverage (F&B), leisure and retail units. Another developer First Energy Bank – now known as Sayacorp – is building its new headquarters, which will comprise offices, 98 hotel apartments to be operated by Hilton and several F&B outlets. Both the tower and the Conrad Residences are due to open by the end of 2022.

Meanwhile, at the prestigious Bahrain Bay, work is in progress on Onyx Bahrain Bay, a twin-tower development which will feature 700 apartments; and Golden Gate Development among other mid-rise and high-rise complexes.

.jpg)

.jpg)

.jpg)