Emirates Steel facility .... proposed merger with Arkan Building Materials.

Emirates Steel facility .... proposed merger with Arkan Building Materials.

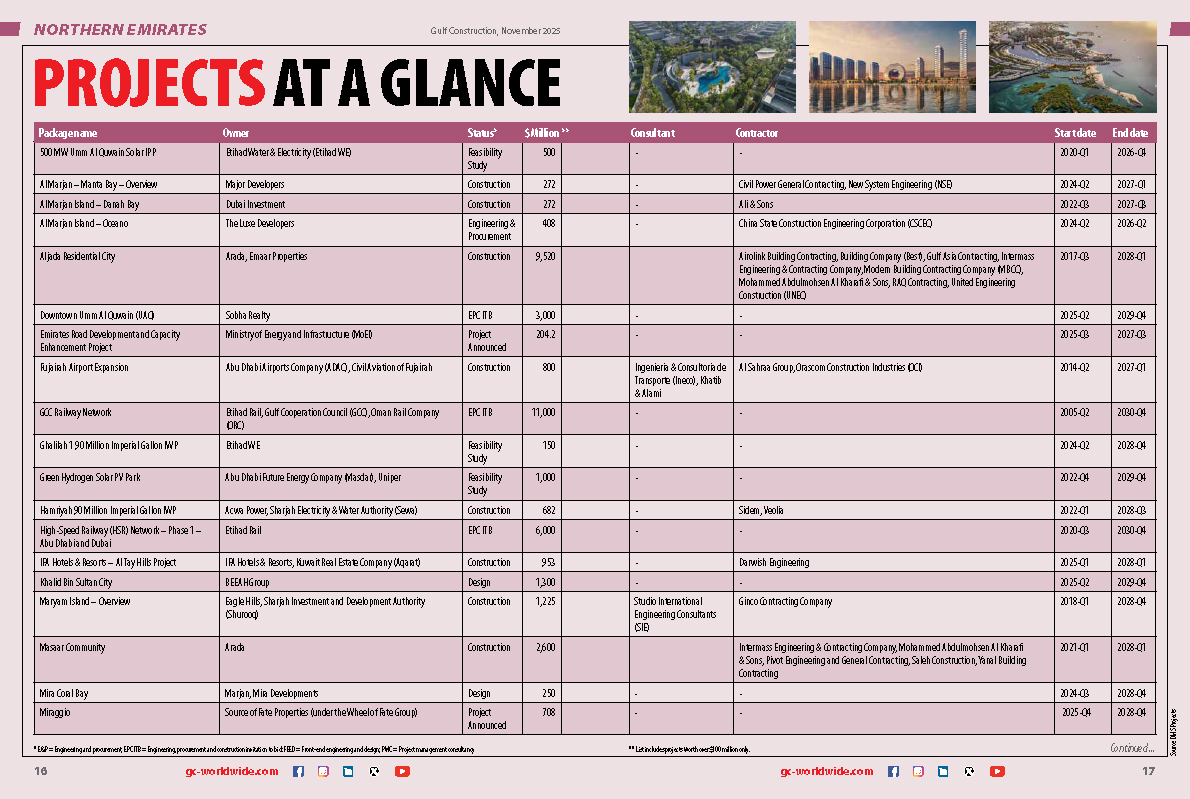

UAE-based Arkan Building Materials Company has received an offer from Abu Dhabi’s Senaat, a part of state-owned holding company ADQ, proposing a merger with its wholly-owned subsidiary, Emirates Steel.

Confirming this, Arkan said its board of directors is studying the proposal received last month for merger of the two firms in exchange for the issuance of an instrument that would automatically convert into approximately 5.1 billion ordinary shares (at a fixed price of AED 0.798 per share) in Arkan’s capital.

When applied to Senaat’s valuation of Emirates Steel, the offer implies an equity value for Arkan of AED1.4 billion ($381 million), said Arkan in its filing to the Abu Dhabi Securities Exchange (ADX).

Post completion, Senaat would own 87.5 per cent of the entire issued share capital of the combined group, it stated.

The board of Arkan will consider the transaction proposed by Senaat before making any recommendation to shareholders, said Arkan in its ADX filing.

Should an agreement be reached between the two parties, an Arkan general assembly meeting would consider approving the transaction during the second half of this year. The offer is subject to receipt of all relevant governmental approvals including regulatory approvals by the Securities and Commodities Authority (SCA), as well as shareholder approvals.

(5).jpg)

.jpg)