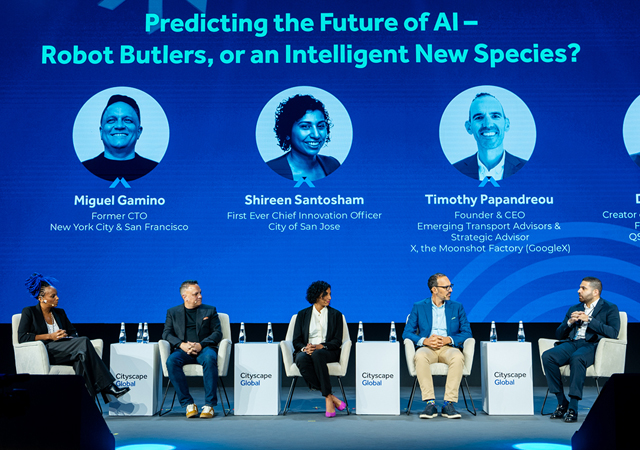

Shaw (left) and Al Shaikh …. at the press conference.

Shaw (left) and Al Shaikh …. at the press conference.

DUCAB posted record sales of Dh3.6 billion ($980.07 million) for 2010, representing a 51 per cent increase over the previous year, the company announced at a press conference in Dubai last month.

The leading manufacturer of high-quality power cables in the Middle East also recorded a 47-per-cent increase by tonnage in production of copper rod.

Ducab said it anticipates a further increase in volumes of about 15 per cent compared to last year, despite the global economic downturn and a rise in copper prices.

Ducab, which is a 50:50 joint venture between the governments of Dubai and Abu Dhabi, has for the first time announced sales results to the public.

Ducab chairman Ahmad Al Shaikh attributed the success to an expansion into new sectors and markets within the Middle East, Europe, Africa and Asia, as well as the addition of eight new product ranges to the company’s portfolio.

Cost and efficiency improvement contributed too with savings of Dh17 million ($4.62 million) achieved through operational efficiencies and cost optimisation initiatives.

Ducab has been successful despite competitive margin pressures, with the company’s local UAE market share maintained at between 33 per cent and 50 per cent, depending on the cable segment. Last year’s record of Dh3.6 billion comprised cable and wire sales of Dh2.2 billion ($598.93 million) while the external sales of copper rod accounted for the balance Dh1.4 billion ($381.13 million). Significant areas of growth included 22 per cent higher sales to utilities and a 143 per cent increase in sales to the oil, gas and petrochemical sector.

Ducab’s shareholders’ equity has also increased by Dh100 million ($27.2 million) by the end of 2010, and a further Dh50 million ($13.6 million) was paid in dividend to its shareholders.

“Last year was a very challenging period worldwide for an industry such as ours, where real estate and construction are major drivers of demand, and the Middle East market was no exception,” said Al Shaikh. “Fortunately, infrastructure projects and energy investment throughout the GCC have been counter-cyclical in this downturn and have provided some compensation for the construction slowdown. Ducab managed to grow despite the market condition and increased competition in the region.”

Meanwhile, work on Ducab HV – the Dh500-million ($136.2 million) joint venture project with Dewa (Dubai Electricity and Water Authority) and Adwea (Abu Dhabi Water and Electricity Authority) as 25 per cent partners – is nearly complete. This will be the region’s first high-voltage cable production facility.

“This project is nearing completion and will be the major addition to the product range this year, catapulting Ducab to the next level with extra high voltage cable systems up to 400 kV produced in a world-class facility here in the UAE,” Al Shaikh said.

Ducab cables and copper products are currently sold in more than 40 countries worldwide across Middle East, Europe, Africa, and Far East in Asia. Approximately 65 to 70 per cent of Ducab’s cable sales are currently made within the UAE market. However, if copper rod exports are included then export sales will rise to 60 per cent of Ducab’s total sales.

In particular Ducab is now the single largest exporter of copper rod to India, according to Andrew Shaw, managing director of Ducab, as Indian cable companies appreciate the superior quality and service offered by Ducab in comparison with other local Indian and international suppliers to the Indian market.

Although Ducab’s focus has always been on fulfilling its obligations to the local market, exports are increasingly important to the company – particularly in high-technology, high-value niche markets such as the oil, gas and petrochemical industries. According to Al Shaikh, cable exports have risen from 10 per cent of the company’s production in 2007 to more than 30 per cent in 2010. This demand for cables and copper rod has spurred the company to investigate opportunities to establish production facilities outside the UAE.

Recent unrest in the region has caused some projects to be put on hold but Ducab is actively undertaking feasibility studies for facilities in Saudi Arabia and outside the GCC. Several factors are taken into consideration when feasibility studies are undertaken notably local demand, the laws of the target country and, perhaps most importantly, the percentage of ownership allowed to foreign entities. As Al Shaikh says, “We do not want to go into any partnership as a minority. Our mentality is to be a majority (shareholder) in any such partnership, basically because we are not investors we are a cable producer and we know our work.”

Also, the massive GCC rail projects present massive opportunities for Ducab according to Shaw. “Rail projects do need a lot of cable. We can see this entire segment growing throughout the region,” he said.

Shaw was quick to dispel concerns about an apparent lack of experience in rail, pointing out that because of Ducab’s exports and links with large multinationals like Siemens and Arriva it has already been making a number of railway products. “Three or four years ago, we supplied the Delhi Metro with trackside cables. Dubai Metro has plenty of Ducab cable also. We see this as an opportunity to apply the knowledge and technology we have into more specialist cable grades.”

Ducab will continue to focus on its traditional strengths of customer service and product quality, “with the strong belief that such commitment to high quality and exceptional value will continue to drive the sale of Ducab cables and allied products across the region”, Al Shaikh concludes.