The corporate sentiment in the Middle East and Africa (MEA) is geared towards targeted investments in overall space design and fit-outs to support return-to-office strategies, according to leading real estate expert JLL.

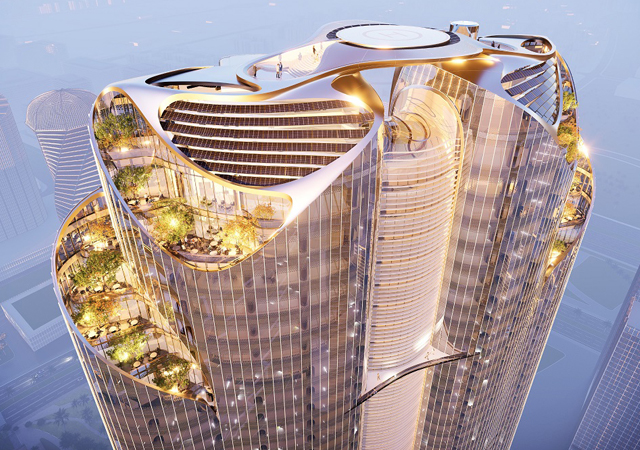

This has accelerated demand for high-quality Grade A office spaces and fit-outs that enhance workplace experience and performance.

In its latest 'EMEA Office Fit-Out Cost Guide 2025', JLL has identified Saudi Arabia and the UAE among the top countries globally with a high proportion of cost for high quality finishes, averaging more than $2,400/sqm, against the global average of $1,830/sqm, as workplace design becomes a component part of talent attraction and retention.

The JLL EMEA Office Fit-Out Cost Guide 2025, which analyses data from 25 countries to provide insights into cost variations, drivers, sustainability concerns, and market sentiment, has also outlined the complex cost pressures for the EMEA construction sector in 2025, with office fit-out costs increasing in the last 12 months.

The steady rise in costs reflects the growing trend of organisations (44%) in the region to increase office-based workdays over the next five years.

Dubai also ranks among the top 20 cities globally in the City Cost Index, reflecting continued competition for Grade A spaces, while in Saudi Arabia, initiatives such as regional headquarters (RHQ) programme is also driving demand.

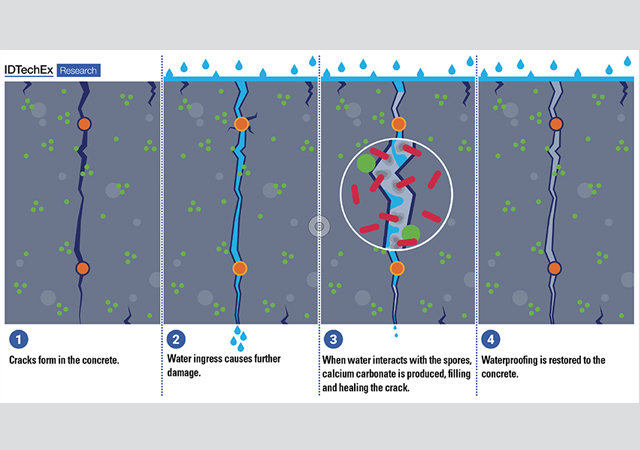

JLL has also found that sustainability is a key driver in many relocation strategies and office fit-outs, with 68% of organisations globally planning to increase investment in sustainability performance in the next five years.

In MEA, the sentiment is strongest in Saudi Arabia and the UAE, where 78% of corporate real estate leaders aim to enhance value through sustainability.

Maroun Deeb, Head of Project & Development Services, Saudi Arabia and Bahrain at JLL, said: "The general optimism towards investing in workspaces is likely to continue throughout 2025 as growth-oriented corporations invest in office fit-outs to support their hybrid workplace policies."

"Targeted investments to enhance employee experience will see an increased focus on workplace design, innovative technology solutions, and refurbishment opportunities amid growing interest in healthier, energy-efficient workspaces," he stated.

Several factors are contributing to the current market dynamics. Supply chain disruptions in 2024 disproportionately affected the Middle East and North Africa, tightening project timeframes and escalating pricing.

According to JLL, builders' works, which includes partitions, flooring, finishes, and joinery, typically accounts for the largest component of fit-out costs, ranging from 26% in Cairo and 36% in the UAE to 40% in Saudi Arabia.

These costs are among the most susceptible to raw material prices and supply chain risks, it stated.

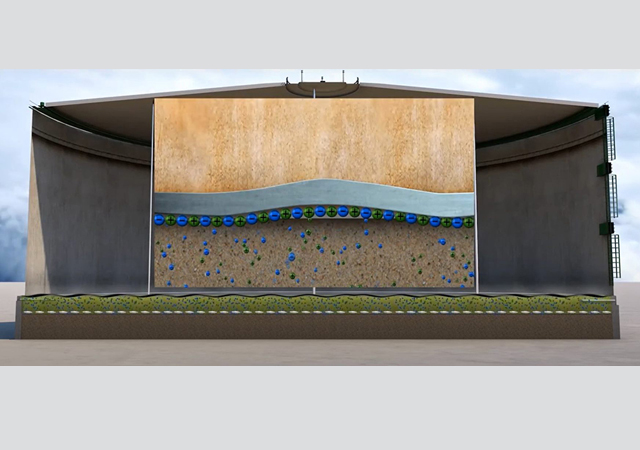

Mechanical & Electrical (M&E) services now account for a higher proportion of office spend as stricter environmental and sustainability standards require more complex systems.

Cairo (39%) ranks among the top cities globally for average proportion of costs per sqm for M&E services, while Dubai (30%) and Riyadh (29%) are on par with the global average cost of 29%.

Technology integration is also pivotal to enhancing hybrid work environments across all office typologies, with companies in MEA investing in improved and extended AV systems.

Gary Tracey, the Head of Project & Development Services UAE at JLL, said: "The demand for high-performance office spaces is intensifying in the UAE as stakeholders increasingly prioritise environmental considerations to drive asset value."

"Offices that embrace innovative technologies and sustainable design principles and have higher levels of green certification command a premium, especially in Dubai. Investments to improve sustainability will mitigate future operational expenses, remaining highly attractive to tenants seeking modern, efficient workplaces," he added.

JLL said the momentum for sustainable workplaces continues to surge in the region, driven by corporate commitments, evolving expectations, and stricter regulatory requirements.

Companies are weighing the cost-benefits of relocation to newer Grade A buildings compared to upgrading existing assets.

However, organisations in the region face challenges in meeting sustainability requirements due to limited suitable stock and high costs of upgrading older buildings. To address these challenges, early planning and integration of sustainability targets in relocation strategies and fit-out projects are crucial, it stated.

Ahmed Hemmat, Head of Project & Development Services at JLL in Egypt, said: "In a climate of economic uncertainty, organisations that build flexibility and agility into planning will be better positioned to adapt their work settings to evolving workforce needs."

"This also supports leasing decisions, as flex spaces optimise costs for landlords and occupiers and create a more engaging and productive work environment to support the needs of today’s hybrid work model," he added.

Despite the complex landscape of challenges and opportunities, office construction will remain active in the region.

To ensure the success of fit-out initiatives, JLL recommends the need for greater collaboration and effective partnerships. From environmental and smart building systems to adaptive workspaces and settings, supply chain engagement is critical in managing costs and allowing for innovation in future-focused workspaces.-TradeArabia News Service

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

Doka.jpg)