Tariq Williams

Tariq Williams

The demand for premium office spaces across the UAE has risen thanks to an increasing number of companies in the UAE returning to face-to-face work and several overseas companies wanting to set up operations in the country.

As businesses are also increasingly seeking high-quality, well-located office spaces to meet their evolving needs, Bayti Real Estate, a specialist in premium real estate services focusing on providing high-quality commercial and residential spaces across the region, has revealed that it has recently closed a deal for a record-breaking price per square foot of office space in Dubai.

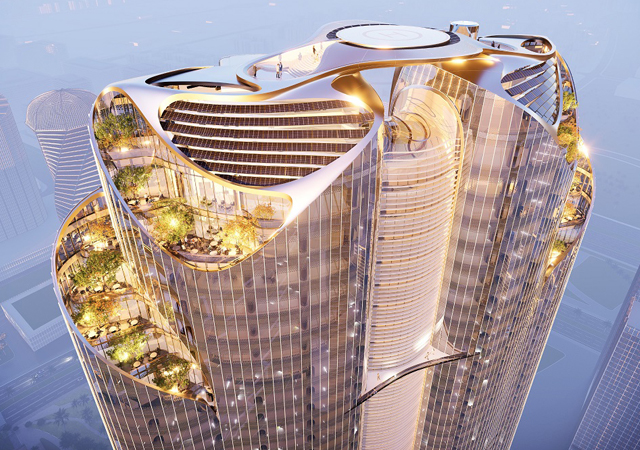

The sale transaction involved a 2,879-sq ft premium office space located at The Opus, Business Bay, which they have sold for AED7,040 ($1,917) per sq ft. This represents the highest sale value per sq ft of any sale transaction recorded by the Dubai Land Department (DLD).

New benchmark

This office, which was designed by the legendary Zaha Hadid, exemplifies the demand for premium, Grade A office spaces in Dubai. Clearly, the sale has set a new benchmark for commercial properties in the area, highlighting the continued appeal of The Opus as a business hub.

Commenting on the transaction, Tariq Williams, Chief Executive Officer of Bayti Real Estate, said: “This transaction is reflective of the ongoing positive trend in property demand across Dubai, the UAE and the rest of the region. We are seeing a significant shift in how businesses are approaching their office requirements.

“With increasing demand for flexible, fully serviced offices in prime locations, companies are prioritising spaces that can accommodate hybrid work models and offer collaborative environments. High-end, move-in-ready spaces in premium locations such as Business Bay, Downtown Dubai, and DIFC are in particularly high demand.

“With prime locations in short supply due to rising demand, businesses are increasingly seeking high-quality, well-located office spaces to meet their evolving needs. Dubai’s office market has responded with increasing occupancy rates, rising from 90.1% in Q1 2023 to 91.3% in Q1 2024, according to CBRE’s latest report,” Williams added.

Shorter flexible lease terms

Leasing trends across the UAE indicate a growing preference for shorter, more flexible lease terms, as well as office spaces that integrate cutting-edge technology and sustainability features. Many businesses are now seeking prestigious office locations that reflect their corporate image while offering scalability and adaptability.

“This demand for flexibility and high-quality office environments is driving competitive bidding for Grade A spaces, with businesses keen to secure prime locations that offer both functionality and prestige,” Williams explained.

The strength of Dubai’s commercial property market is underpinned by solid economic fundamentals and strategic urban planning initiatives like the Dubai 2040 Urban Master Plan. As Dubai continues to invest in infrastructure and enhance its appeal to international investors, the real estate market is expected to maintain its upward trajectory, with sustained growth anticipated through 2025.--TradeArabia News Service

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

Doka.jpg)