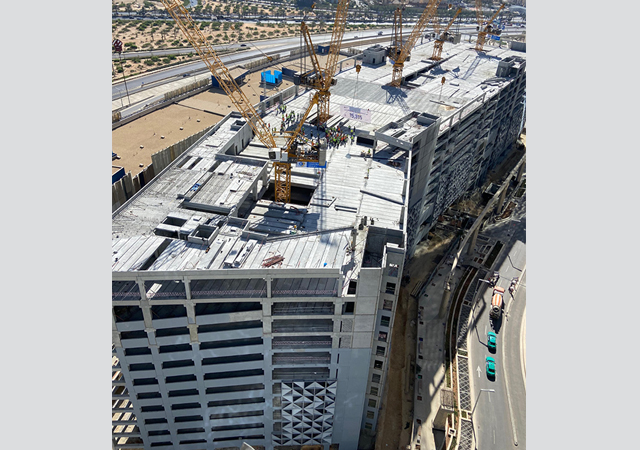

Riyadh stands at the threshold of a historic transformation that will fundamentally reshape its urban fabric, economic structure, and global positioning. As the administrative heart of Saudi Arabia and the primary implementation hub for Vision 2030, the capital is witnessing construction activity on a scale rarely seen in modern urban development.

The convergence of policy-backed growth, strategic international partnerships, and landmark regulatory reforms has created an environment where multiple billion-dollar projects advance simultaneously across diverse sectors, from entertainment and culture to transportation and industrial manufacturing.

The scope of this transformation extends far beyond traditional infrastructure development. Riyadh is actively positioning itself as a global destination for tourism, major events, business, and innovation, while simultaneously addressing fundamental quality-of-life considerations through expanded housing supply, enhanced public transportation, and stabilised real estate markets. This dual focus, combining aspirational mega-projects with pragmatic market interventions, distinguishes Riyadh’s development trajectory from other rapidly growing capitals and reflects a comprehensive approach to sustainable urban growth.

The city’s construction pipeline is supported by clear institutional structures, with the Public Investment Fund (PIF) and various development companies providing both capital and delivery expertise. International partnerships with leading design firms, construction specialists, and technology providers ensure that projects meet global standards while building local capacity and supporting the kingdom’s broader economic diversification goals. This integration of international expertise with local priorities creates a framework for sustainable development that extends beyond the completion of individual projects to establish long-term competitive advantages.

Regulatory framework and market reforms

The Saudi government has implemented comprehensive regulatory reforms designed to create stable, transparent, and accessible real estate and construction markets. At the forefront of these interventions is a landmark shift toward economic openness. Under new laws that became effective last month (on January 22), Saudi Arabia is allowing foreign individuals, companies and entities to own property across Saudi Arabia, with ownership permitted in major cities including Riyadh and port city Jeddah, a move led by the Real Estate General Authority to boost foreign direct investment and accelerate market diversification. Regulatory safeguards protect local interests while signalling a more globally integrated investment environment, positioning Riyadh to attract international capital alongside domestic investment.

In addition, new rental market regulations have frozen rent increases for both residential and commercial properties in Riyadh for five years, directly addressing price volatility that had threatened affordability and market stability. These regulations, enforced through the Ejar digital platform, enhance transparency and establish clear frameworks governing landlord-tenant relationships, creating predictable conditions that benefit both property owners and occupants.

Qiddiya City reached a major milestone with the official opening of Six Flags Qiddiya City on December 31.

Complementing rental controls, HRH Crown Prince Mohammed bin Salman bin Abdulaziz has directed major land and housing reforms aimed at dramatically expanding homeownership accessibility. The government has released over 80 sq km of land in northern Riyadh for development, with commitments to provide up to 40,000 affordable residential plots annually. These measures are supported by revisions to the White Land Tax Law, which discourages land speculation and encourages productive development, ensuring that the released land translates into actual housing supply rather than remaining undeveloped.

These regulatory frameworks operate in parallel with substantial government-backed initiatives supporting construction delivery. The newly-established Events Investment Fund has been mandated to develop permanent, world-class venues in partnership with global operators such as Legends Global, marking a strategic shift from temporary event structures to sustainable, long-term assets that anchor urban and economic development. This approach reflects recognition that infrastructure investments must serve multiple purposes beyond individual events, creating lasting value for residents, businesses, and visitors while strengthening Riyadh’s capabilities as a destination for international conferences, exhibitions, and cultural programming.

Despite these supportive policy frameworks, Riyadh’s construction sector operates in challenging market conditions characterised by elevated costs and resource constraints. Turner & Townsend’s Global Construction Market Intelligence report identifies Riyadh as one of the most expensive construction markets in the region, with building costs reaching $3,112 per sq m. These elevated costs reflect multiple factors including strong demand across concurrent projects, specialised material requirements for climate-appropriate construction, and competitive labour markets where skilled workers command premium wages.

Labour shortages represent a persistent challenge, particularly for specialised trades and technical roles where international expertise remains essential. The simultaneous advancement of numerous large-scale projects creates competition for qualified contractors, engineers, and construction management professionals, occasionally extending timelines and increasing costs. Material costs have similarly risen, influenced by global supply chain dynamics, regional demand patterns, and the specific requirements of projects designed to international standards with advanced sustainability features.

Nevertheless, investor confidence remains strong, supported by visible government commitment, clear project pipelines, and the integration of Riyadh’s development within broader Vision 2030 objectives. The $1.7-trillion national project pipeline provides long-term prospects for contractors, suppliers, and investors, while diversification across sectors including tourism, logistics, digital infrastructure, residential development, sports, leisure, and hospitality, reduces concentration risk and creates multiple pathways for market participation.

The approaching timeline for Expo 2030 and FIFA World Cup 2034 adds urgency and focus to delivery schedules, ensuring that projects advance according to defined milestones rather than remaining speculative.

Expo 2030 Riyadh ... to take shape over a 6-million-sq-m site.

Expo 2030 Riyadh: transformative catalyst

Expo 2030 Riyadh represents a transformative catalyst for construction activity, with delivery structures and early works now firmly established. The PIF-owned Expo 2030 Riyadh Company has appointed global giants Bechtel and Buro Happold, as the project management consultant and lead design consultant for public realm, landscape, infrastructure and legacy aspects, respectively, of the 6-million-sq-m site. In addition, it has made an early award of a critical infrastructure contract to Nesma & Partners.

Enabling works are being carried out by the Saudi Real Estate Company subsidiary Binyah, which secured a framework agreement to deliver early works including demolition, earthworks, and site logistics over a four-year period. These preparatory activities support the rollout of one of the largest World Expo sites globally, strategically located north of Riyadh near the future King Salman International Airport to leverage emerging transportation infrastructure (see Page 20).

New Murabba: New Downtown

Development of the New Murabba district – intended as a 14-million-sq-m mixed-use downtown destination in the capital – has reached a critical juncture. While the project remains a cornerstone of the capital’s urban transformation, questions have emerged over the delivery of its centrepiece, the Mukaab, a vast cube-shaped structure. A Reuters report said work on the landmark has been suspended as its financing and feasibility are reassessed.

In January, Parsons was appointed by the PIF-owned New Murabba Development Company as infrastructure lead design consultant under a five-year contract. The appointment covers design and construction technical support across infrastructure, public buildings, landscaping and the public realm, helping to establish the project’s delivery framework, which was conceived around the Mukaab (see Page 32).

Diriyah: Heritage-Led

Diriyah continues to anchor significant high-end construction activity through multiple residential, hospitality, cultural, and mixed-use projects advancing across masterplanned districts. Development momentum in Wadi Safar has accelerated with the unveiling of Trump International Golf Club, Wadi Safar, a 2.6-million-sq-m luxury destination comprising a championship golf course, branded hotel, and premium residences marking The Trump Organization’s first entry into the Diriyah project. The area has also launched Aman-branded ultra-luxury villas and estates alongside an 80-key Aman hotel, reinforcing Wadi Safar’s positioning as an exclusive lifestyle and hospitality enclave.

Diriyah ... massive projects under way.

Diriyah Company is expanding its residential and commercial pipeline through the Media and Innovation District, a key Phase Two component featuring office space, retail, hospitality, and new housing supply inspired by Najdi architecture. The launch of Manazel Al Hadawi marked the first home release within this district. Complementing this expansion, Diriyah Company secured a long-term lease of 552,000 sq m from King Saud University, enabling further development under a sustainable investment model aligned with Vision 2030 objectives (see Page 24).

In addition, Diriyah Company has announced a new joint development agreement with Midad Development and Real Estate Investment Company to build the Four Seasons Hotel and Private Residences Diriyah at a total investment of $827 million (see Saudi Focus).

Qiddiya City: Entertainment hub

Qiddiya City reached a major milestone with the official opening of Six Flags Qiddiya City on December 31, marking the first operational asset within the city’s entertainment ecosystem. This flagship theme park demonstrates the scale and pace at which Qiddiya is transitioning from construction into phased operation, establishing a benchmark for large-scale entertainment construction in the kingdom. The park integrates 28 rides including multiple record-breaking roller coasters, family attractions, retail, and food and beverage outlets within a setting that connects entertainment with landscape and identity.

The next major opening at Qiddiya, scheduled during the Eid Al Fitr holidays (March), will be Aquarabia Water Park Qiddiya, the Middle East’s largest water park spanning 25 hectares with 22 rides and experiences by WhiteWater. Highlights include the world’s first underwater theme park ride, Aquaticar: Legend of the Glowing Guardian, demonstrating Qiddiya’s commitment to offering unique, first-in-region experiences that attract domestic and international visitors.

Further investment continues with plans for the 45,000-sq-m Mercedes-AMG World of Performance, a multi-level experiential centre linked to motorsport and Formula One, positioned alongside Speed Park Track. These projects underscore Qiddiya’s role as a cornerstone of Saudi Arabia’s entertainment-led construction pipeline, combining complex engineering, experiential design, and phased delivery at unprecedented scale within the kingdom.

Misk Foundation HQ ... handed over last month.

Misk City

Mohammed Bin Salman Nonprofit City (Misk City), the world’s first nonprofit city of its kind – founded to host the ecosystem of Mohammed bin Salman Foundation (Misk) within a human-centric city focused on youth – has seen considerable progress with the Misk Foundation HQ handed over last month and the Misk Art Institute nearing completion.

Last year, the Riyadh Schools’ boys and girls campuses became operational and Misk Cultural Wadi was delivered.

King Salman International Airport ... work has started on a key runway.

Transportation infrastructure

King Salman International Airport represents one of Riyadh’s most significant infrastructure developments, with construction activity now under way with the commencement of works on a 4,200-m third runway. Being delivered by FCC Construcción in partnership with Al-Mabani General Contractors, the runway will increase hourly aircraft movements from 65 to 85 while enhancing operational resilience. The runway forms part of comprehensive transformation converting the existing King Khalid International Airport site into a world-class aviation hub designed to support long-term growth in passenger and cargo volumes (see Page 30).

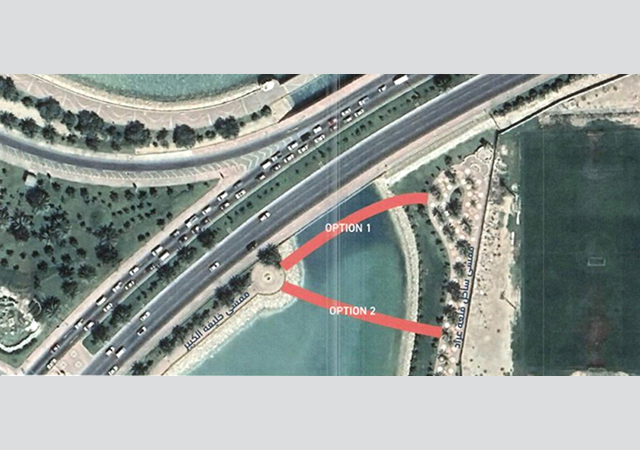

Meanwhile, Riyadh’s rail and metro network continues to expand as a central pillar of the capital’s mobility strategy. In January, the Royal Commission for Riyadh City awarded the contract for the 8.4-km extension of the Red Line (Line 2), extending services from King Saud University to Diriyah Gate Development. The project includes five new stations combining deep underground tunnels and elevated sections, designed to strengthen connectivity between major educational, cultural, and residential hubs with completion targeted within six years (see Saudi Focus).

Beyond urban transit, nationally significant freight infrastructure is set to advance through the Saudi Railway Company’s $7-billion Saudi Landbridge project, which is planned to be completed in phases by 2034. This freight-led network will strengthen east-west connectivity linking Jeddah with Riyadh and onward connections to the North-South Railway and Dammam. The Landbridge comprises six sections including upgrades to existing lines, a new Riyadh bypass, and a major Riyadh-Jeddah corridor extending to King Abdullah Port. The programme includes seven logistics centres, supporting industrial growth, port connectivity, and supply chain efficiency essential for economic diversification.

Plans have also been announced for the Qiddiya High-Speed Rail Project. The Royal Commission for Riyadh City (RCRC), in partnership with the National Center for Privatization & PPP and Qiddiya Investment Company, has requested expressions of interest (EOIs) for the project, which will be implemented under a public-private partnership (PPP) model. The line aims to connect King Salman International Airport, King Abdullah Financial District (KAFD), and Qiddiya City in just 30 minutes, via a high-speed rail line of 250 km/h. The project will be a core element of Riyadh’s transportation system, providing an integrated urban mobility experience that connects seamlessly with the city’s recently launched Riyadh Public Transport (RPT) network, said the RCRC.

Also on the cards is the proposed Riyadh-Doha railway. The 785-km network will serve Riyadh, Hofuf, Dammam, and Doha, with five stations in total.

King Salman International Stadium

Stadiums

Riyadh is witnessing substantial stadium construction and upgrades as Saudi Arabia prepares to host the 2034 FIFA World Cup.

Prince Faisal Bin Fahad Sports City

To host the World Cup, Riyadh will feature a total of eight stadiums. These venues are a mix of brand-new architectural marvels and major redevelopments of existing historic grounds. At the forefront, the planned King Salman Stadium has invited prequalification bids for main construction works. Designed by Populous, the 92,000-plus seat venue is set to become one of the world’s largest stadiums, featuring extensive premium hospitality, royal and VVIP facilities, and a distinctive roofscape incorporating gardens, walkways, and panoramic views. Strategically located in northern Riyadh near King Khalid International Airport, the stadium forms part of a wider sports, leisure, and commercial masterplan supporting year-round use beyond singular events.

King Fahad Sports City Stadium

The Ministry of Sports is advancing plans for the Prince Faisal bin Fahad Sports City through a public-private partnership model, with bids invited for a new 47,000-seat stadium under a long-term DBFOM contract. The project includes comprehensive masterplanning covering both new and existing facilities, expected to host matches during the 2034 World Cup. Existing assets are being upgraded, with Aecom appointed to provide site supervision consultancy for transformation of the iconic King Fahad Sport City to meet FIFA standards.

Residential Development & Housing Supply

Riyadh’s housing pipeline continues to accelerate through large-scale developments led by National Housing Company (NHC), private developers, and PIF-backed ROSHN Group. In November last year, Retal Urban Development signed a SAR5.2 billion agreement with NHC to deliver a major mixed-use residential scheme in Al Fursan. Spanning more than 1 million sq m, the four-year project comprises 4,839 villas and apartments alongside commercial components and full infrastructure, with Retal responsible for end-to-end delivery from design through handover.

Meanwhile, last year ROSHN Group awarded SAR1.5 billion new contracts for its flagship SEDRA development, covering the construction of more than 1,900 residential units, sports facilities, infrastructure works, and Sedra’s first district retail mall. This approach reflects a shift toward fully integrated communities where housing, commercial services, recreational facilities, and infrastructure are delivered comprehensively rather than incrementally.

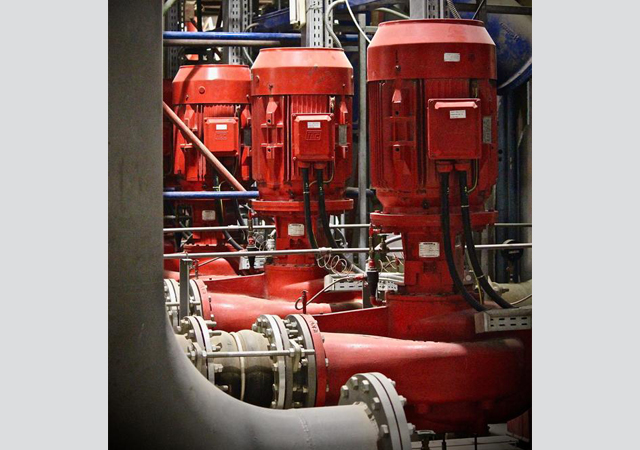

Power Generation & Industrial Infrastructure

Power infrastructure continues to be expanded with projects reinforcing Vision 2030’s focus on sustainable energy diversification and grid expansion. A consortium led by Acwa Power, Korea Electric Power Corporation, and Saudi Electricity Company has been awarded the contract for the development of 1,800 MW Rumah 1 combined-cycle power plant, while Siemens Energy has secured a contract to equip the 1,800 MW gas-fired Rumah 2 with advanced gas and steam turbine technologies.

Industrial development is expanding through partnerships supporting manufacturing localisation and logistics capacity. PIF company Alat has partnered with Lenovo to establish a SAR7.5 billion electronics manufacturing facility covering 200,000 sq m in the Special Integrated Logistics Zone in Riyadh, to produce Saudi-made laptops, desktops, and servers while hosting Lenovo’s new regional headquarters.

In logistics, SAL Saudi Logistics Services Company and Sela Company signed a SAR4 billion agreement to develop a state-of-the-art logistics zone within Falcons City, spanning 1.5 million sq m with Grade-A warehousing strategically located near King Khalid International Airport and national transport corridors.

Other projects

Other landmark initiatives include the $23-billion King Salman Park, set to be the world’s largest urban park, and the Sports Boulevard, a 135-km linear park where the first phase is already open. Among new project launches is The Pulse Wadi cybersecurity hub, designed by Hong Kong’s LWK + Partners, which will add a $3.2 billion innovation-focused district with 60 per cent of its footprint reserved for green space.

Plans on the anvil for the capital include a 2-km-tall tower as an anchor project for the ambitious North Pole development, though not many details have emerged in the public domain.

In the retail and commercial sector, The Avenues – Riyadh is one of the region’s most significant active developments, with Mabanee having recently awarded SAR1.13 billion in contracts for the construction of five towers during Phase Two. This phase includes a residential tower, offices, and three Hilton-branded luxury hotels.

Among other developments, the Royal Commission for Riyadh City has reached an agreement to house the first phase of the Riyadh Creative District within the King Abdullah Financial District (KAFD) to support the local media and content economy. KAFD recently achieved a Guinness World Record for the world’s largest continuous pedestrian skyway network, totalling 15.46 km.