The Chedi Hotel Wadi Safar, a luxury addition to the Diriyah development in Riyadh, which is scheduled to open in 2026.

The Chedi Hotel Wadi Safar, a luxury addition to the Diriyah development in Riyadh, which is scheduled to open in 2026.

The Middle East, and the GCC region in particular, is experiencing an unprecedented surge in hotel development, largely propelled by strategic government initiatives like Saudi Vision 2030 and a sustained focus on tourism diversification.

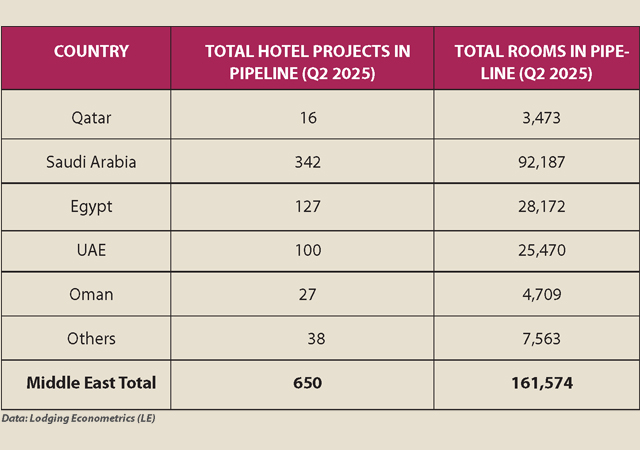

According to the Q2 2025 Hotel Construction Pipeline Trend Report for the Middle East from Lodging Econometrics (LE), the region’s total hotel construction pipeline has reached a new all-time high of 650 projects with 161,574 rooms. This marks a robust year-over-year (YoY) increase of seven per cent by projects and 10 per cent by rooms.

Complementing this, JLL’s latest hospitality insights, released ahead of the Future Hospitality Summit (FHS World) in Dubai at the end of last month, show the Middle East’s hotel construction activity remains robust, with strong momentum driven by giga-projects, investor confidence, and luxury-led development.

|

|

|

The report states that the value of MENA’s (Middle East and North Africa) hospitality market is set to grow from $310 billion in 2025 to more than $487 billion by 2032. The World Travel and Tourism Council (WTTC) projects that the Middle East’s travel and tourism sector will contribute $367 billion to the region’s economy this year, supporting 7.7 million jobs. International visitor spending is expected to reach $194 billion, nearly a quarter higher than pre-pandemic levels, while domestic spending is forecast to hit $113 billion.

Hotel projects currently under construction in the Middle East stand at 337 projects/86,447 rooms, up 12 per cent by projects and seven per cent by rooms YoY, says the LE report. Projects scheduled to start construction in the next 12 months stand at 147 projects/45,457 rooms, up 31 per cent by rooms YoY. Projects in the early planning stage stand at 166 projects/29,670 rooms, up two per cent by projects YoY.

New project announcements in the Middle East at the second quarter close stand at 48 projects/10,567 rooms, while new construction starts stand at 32 projects/8,587 rooms, up 23 per cent by projects and 38 per cent by rooms YoY. Additionally, combined hotel renovations and brand conversions reached record totals at Q1, with 67 projects/14,768 rooms.

SAUDI ARABIA DOMINATES CONSTRUCTION

LE analysts report that, at Q2, in the Middle East, Saudi Arabia has the lion’s share of projects, with a record 342 projects and 92,187 rooms. Egypt follows with 127 projects and a record-high room count of 28,172 rooms. Next is the UAE with 100 projects/25,470 rooms, Oman with 27 projects/4,709 rooms, and Qatar with 16 projects/3,473 rooms.

|

|

The Jumeirah Marsa Al Arab opened its doors in Dubai early this year. |

Data from STR further underlines Saudi Arabia’s dominance, reporting that the kingdom accounts for 67 per cent of the region’s 67,000 rooms currently under construction, with over 45,000 keys in the pipeline.

This massive development is a clear reflection of the looming deadlines for its ambitious Vision 2030 plans. The top five cities with the largest pipelines are led by Saudi hubs: Riyadh (88 projects/18,152 rooms), Jeddah (56 projects/12,627 rooms), and Makkah (29 projects/18,323 rooms), alongside Dubai (53 projects/13,726 rooms) and Cairo (48 projects/10,715 rooms).

The ambitious rollout of massive tourism projects across Saudi Arabia, central to its Vision 2030 economic diversification, includes extensive hotel development in key giga-projects. The Red Sea destination, a leading regenerative tourism project, is slated to feature 50 hotels with around 8,000 rooms upon final completion, with several resorts such as The Red Sea Edition just opened, to be soon followed by SLS The Red Sea and the InterContinental The Red Sea Resort before the year’s end (see separate article). Similarly, the nearby wellness-focused AMAALA will host up to 29 hotels with over 3,800 rooms, including brands like Rosewood and Six Senses, with its first phase centered on the Triple Bay masterplan.

Near Riyadh, Diriyah is transforming into a cultural and luxury destination that will boast 38 hotels, such as The Chedi Wadi Safar and Armani Hotel Diriyah, aiming to showcase Najdi heritage. Meanwhile, AlUla, home to UNESCO World Heritage sites, is focusing on immersive experiences with luxury boutique hotels like the Six Senses AlUla and an Autograph Collection property, while the entertainment city of Qiddiya is moving forward with projects like a 550-room five-star Aquarabia Park hotel at its Water Park resort, which is expected to open early next year.

LUXURY LEADS THE SUPPLY WAVE

The focus of this regional boom remains firmly on the high-end market. The luxury chain scale has achieved all-time high totals with 196 projects/43,942 rooms, while the upper upscale chain scale also hit a record high with 150 projects/38,357 rooms, according to Lodging Econometrics. Combined, these top two segments account for a dominant 55 per cent of projects and 56 per cent of the region’s entire pipeline, underscoring the GCC’s commitment to world-class, premium hospitality.

|

|

A number of hotels are set to open in Saudi Arabia shortly such as SLS The Red Sea. |

UAE SHIFTS FOCUS TO INVESTMENT AND LUXURY

While the construction pace is accelerating in Saudi Arabia, the UAE market is entering a new phase of maturity. According to Knight Frank’s UAE Hospitality Market Review, the Emirates remain a magnet for hospitality capital, with investor focus, particularly in Dubai, shifting from development-led expansion to strategic acquisitions and asset repositioning.

Dubai remains the sector’s powerhouse with 165,339 existing and upcoming keys, but markets like Abu Dhabi and Ras Al Khaimah are also emerging as leisure-driven investment destinations. The UAE’s existing room stock is already heavily weighted towards the high end, with 22 per cent classified as Luxury, 26 per cent Upscale, and 21 per cent Upper Upscale. Critically, future development in the UAE remains geared towards the highest tier, with 43 per cent of upcoming supply in the luxury segment.

STRONG CONSTRUCTION MOMENTUM

For the first half of the year, the Middle East opened 14 new hotels/4,327 rooms. LE forecasts 103 new hotels/23,596 rooms are expected to open by the year-end, followed by another 94 new hotels/19,019 rooms in 2026 and 91 hotels/22,631 rooms forecast for 2027.

(5).jpg)

.jpg)

(5).jpg)