Duqm Refinery ... a major ongoing industrial project.

Duqm Refinery ... a major ongoing industrial project.

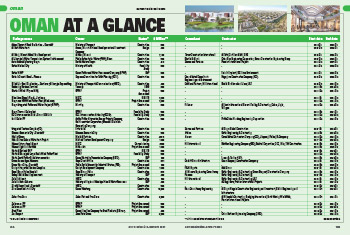

Diversification of its oil-reliant economy and driving in foreign investment are the primary goals of Oman as it battles the twin challenges posed by the coronavirus pandemic and the continued low oil prices. Central to these targets is boosting its infrastructure and expanding its industrial zones to attract investor interest and it is these areas that Oman has been focusing on over the past year.

After ascending to the throne early last year, Sultan Haitham bin Tariq Al Said pledged to address Oman’s economic challenges but the task has been confounded by the fact that he is faced with the need to further rationalise spending.

According to leading data and analytics company GlobalData’s report released in early December, Oman’s construction industry suffered severe setbacks last year, plummeting by 10.3 per cent, and this is expected to continue this year, with output contracting by 5.8 per cent.

|

|

Duqm Port ... a key project that will help drive investment into Sezad. |

Yasmine Ghozzi, Economist at GlobalData, comments: “Given the limited prospects for the government to boost investment in infrastructure and other investment projects, a recovery in the construction sector is expected to be very slow. Looking further ahead, GlobalData considers the prospects for capital expenditure projects in the tourism and manufacturing sectors as being key to the construction industry’s recovery. These sectors have been recognised as long-term drivers of revenue diversification and economic growth for the sultanate.”

Investment in the transport infrastructure sector will also be vital, with key projects planned including the $1-billion road connecting the towns of Dibba and Khassab in the northern Musandam governorate. There are also plans to build a mining rail in the country’s southern region to carry heavy freight from three locations in the Dhofar governorate to a central location, which will then connect to a separate rail line that runs to Duqm port, where the minerals will be exported to other markets by sea.

A key enabler in achieving its ambitions will be through adopting the public-private partnership (PPP) approach. As recently as at the end of last year, the sultanate opened up around 33 projects and initiatives on a PPP basis, involving investments worth over $2.5 billion, for local and international investment, according to an Oman Observer report.

These include an array of projects promoted by the sultanate’s solid waste management flagship company, be’ah, the biggest of which is a waste-to-energy independent power project (IPP) utilising municipal waste for power generation – a venture estimated to cost $700 million.

In addition, the promoter of Khazaen Economic City, the sultanate’s first integrated manufacturing and logistics hub, has invited international firms to consider a range of investment opportunities in the city at Barka, just north of Muscat, the report said.

|

|

Khazaen City ...96 per cent of Phase One infrastructural works completed. |

Apart from industrial development, tourism is another sector targeted for expansion, to introduce more revenue streams and reduce Oman’s reliance on its oil earnings. Driving this ambition is the country’s tourism development arm Omran, which recently became a subsidiary of Oman Investment Authority (OIA). Following this move, all tourism properties owned by OIA have now been transferred to Omran.

Omran is driving the vision for a number of tourism development projects in the sultanate, most notably the Madinat Irfan project, which hosts the Oman Convention and Exhibition Centre (OCEC) and the waterfront development project at Sultan Qaboos Port, which are being pursued with regional investors.

Meanwhile, Oman’s budget for this year envisages a public spending of RO10.88 billion ($28.18 billion) in 2021, a 14 per cent decline compared with the expected spending of RO12.66 billion in 2020. Aggregate public revenue is projected to increase to RO8.6 billion in 2021, based on an assumed oil price of $45 per barrel, up by two per cent as compared with the preliminary results achieved for 2020.

The government will continue building the infrastructure required to spur economic growth, and giving priority to the much-needed projects that serve economic and social objectives, in addition to expanding the participation of the private sector by enhancing its role in implementing and managing some projects and services, the Ministry of Finance said.

|

|

Madinat Sultan Qaboos Waterfront ... on the cards. |

The 2021 budget has been prepared in alignment with the priorities of Oman Vision 2040, and in tandem with the tenth Five-Year Plan (2021-2025), which was also unveiled last month. The five-year plan (2021-2025) seeks a qualitative leap in the development process in the sultanate and aims to achieve a real GDP growth rate of no less than 3.5 per cent on average.

The plan also seeks to increase the rate of investment to reach 27 per cent of GDP on average, and to raise the efficiency of investment and attract more foreign direct investment in oil and non-oil sectors to reach 10 per cent of GDP by the end of the plan.

To stimulate private investment, the plan aims to develop the necessary infrastructure, accelerate the pace of implementation of major strategic projects and partnership projects between the public and private sectors, and attract more foreign direct investment, while building on expectations for oil prices at an average of $48 per barrel during the years of the plan.

Airport

Oman last year unveiled the masterplan for its Muscat Airport City, a mega development that will consist of a hospitality, a logistics and a business zone.

The airport will have a 200,000-sq-m logistics portal, an area designated for air freight services and logistics, which includes an air freight building at Muscat Airport. The business district, a mixed-use project spread over a 1.1-million-sq-m area, will have spaces allocated for the office units of airlines and related economic sectors. The hospitality zone, which will cover an area of 192,000 sq m, will include hospitality facilities, duty-free shops, offices for travel agencies, and hotels for travellers or short-term visitors.

The airport city will also feature an aviation zone, which includes the passengers’ terminal area and the previous air freight buildings over an area of 166,000 sq m.

The project is being implemented as part of the National Aviation Strategy 2030.

Industrial cities

Work is well under way on Oman’s newest integrated development, Khazaen Economic City, with 96 per cent of Phase One infrastructural works completed. This includes a 9.2-km internal road network, a 22-km water supply system and 15 km of drain channels, with 5,000 cu m of water tanks and 3.3-km pipeline crossing ducts for future services along with installation of 200 streetlights.

With this development, 3.2 million sq m of leasable lands are opened up for various investors, according to Khazaen CEO Khalid Al Balushi.

Construction work has also begun on Oman’s first inland port facility at Khazaen Economic City. The ‘dry port’ is one of several anchor projects that will underpin the city’s development into a leading destination for logistics, light-industrial, food processing and distribution activities in the sultanate.

Khazaen has signed long lease agreements with local, regional and international investors to host their manufacturing facilities in the integrated economic city.

Phase One will host major projects such as the dry port, the central fruit and vegetables market, the auto market and other investment projects like the pre-built warehouses that will be offered to investors at different stages.

Another industrial zone planned is the Oman Nano City in Sur Industrial City to be jointly developed by Oman’s Public Establishment for Industrial Estates (Madayn) and its investment arm Shumookh Investment and Services with Advanced Universal Tech. The project aims at promoting nanotechnology in the sultanate.

Madayn also intends to set up a shipyard complex in Sur Industrial City and has invited the private sector to build, manage and operate it for a period of 30 years.

In addition, Madayn launched work last year on the masterplan for the Ibri Industrial City in the Al Dhahirah governorate over a 10-million-sq-m area. Work is currently under way to develop the masterplan for the industrial city through the appointed consultancy company.

Today, Madayn manages and operates eight industrial cities in Suhar, Raysut, Nizwa, Sur, Al Buraimi, Al Rusayl, Samail and Ibri in addition to the Knowledge Oasis Muscat and Al Mazunah Free Zone. It also offers a number of value adding initiatives.

The authority said it is witnessing increasing demand from business owners and investors in Samail Industrial City, where it is currently implementing a number of projects in cooperation with the private sector.

Industries

Among the largest developments under way in the country is a refinery project in Duqm. Work on the project being developed by Oman Oil Company and Kuwait Petroleum International is over 70 per cent complete.

It is being handled by three engineering, procurement and construction (EPC) contractors. These are a joint venture between Técnicas Reunidas-Daewoo Engineering & Construction Company for EPC Package One (process units); a Petrofac-Samsung Engineering JV for EPC Package Two (utilities and offsites) and a joint venture between Saipem and CB&I for EPC Package Three (offsite facilities).

The most significant industrial projects that came on stream last year was the Liwa Plastics Industries Complex (LPIC), a giant petrochemicals project set up at an investment of $6.7 billion. Located within Sohar Port, with an upstream natural gas extraction (NGL) facility around 300 km away in Fahud, Liwa Plastics is OQ’s signature investment. At full capacity, Liwa Plastics will boost OQ’s production of polyethylene and polypropylene to 1.4 million tonnes.

Also taking shape at Sohar Industrial Port is Oman’s first bitumen refinery, which is being set up at an investment of over $400 million. Sohar Asphalt has signed up China Chemical Hualu Engineering Company for the construction of the refinery, according to an Oman Observer report.

Expected to be fully operational by 2023, the project will go a long way in alleviating Oman’s longstanding dependence on bitumen imports for road paving and related applications.

Among other major industrial facilities is a seafood cannery plant at the new Duqm Fisheries Complex, a contract for which is expected to be awarded by mid-2021.

Power & Water

Among the major power projects launched last year was the Rabt Project, which aims to connect the national grid in the north with Petroleum Development of Oman’s (PDO) electricity transmission network and Tanweer network in Al Wusta region in addition to the Special Economic Zone at Duqm’s (Sezad) electricity network in the Wilayat of Duqm.

Rabt project will link the national grid with PDO network thus enhancing the reliability of the latter as it is currently based on 132 kV voltage. It will also provide secure, stable and reliable electricity to the Special Economic Zone in Duqm.

In line with the government drive to switch to renewable energy, this project will play a key role in achieving the government ambitions of producing 15 per cent of the total energy from renewable energy sources by 2025 by connecting the future solar energy stations and wind farms in Al Wusta region, according to Oman Electricity Transmission Company (OETC).

OETC awarded agreements worth RO183 million ($474 million) for Phase One of the Rabt Project. Extending 660 km long, Phase One will see the setting up of 400-kV overhead lines and five main grid stations in Nuhaida, Barik, Suwaihat, Duqm and Mahout.

In the renewables segment, the country’s largest solar power plant, Ibri II – that can power up to 33,000 homes and remove 340,000 tonnes per annum of carbon dioxide emissions from the sultanate’s footprint – is slated to start operations by mid-2021. The 500 MW Ibri II power plant, coming up on a 1,300-hectare site in the country’s northwest region of Ibri.

Other solar IPPs planned by the country include the co-located Manah Solar I and Manah Solar II IPPs. OPWP issued requests for proposals to all prequalified bidders in July last year for the plants which will offer an aggregate capacity of 1GW, effectively making the combined scheme the largest renewable energy venture of its kind when it comes into operation during the summer of 2023, according to its developer.

The scope of each project covers the development, financing, design, engineering, construction, ownership, operation and maintenance of a 500 megawatts-peak (MWp) solar photovoltaic power plant and associated facilities.

Oman is targeting for renewables to contribute between 10 per cent and 16 per cent of the sultanate’s generating capacity in the main interconnected system (MIS) by 2025, which will total about 2,800 MW, it added.

In June last year, Oman began commercial operation of its independent power project located at Amin in the south of the Block 6 licence of PDO. Featuring 336,000 solar panels, the sultanate’s first utility-scale photovoltaic (PV) scheme, boasts a 105 MWac capacity.

PDO is also overseeing the implementation of a 1-GW Miraah project that harnesses solar energy to produce heavy oil from the Amal oilfield instead of natural gas for steam generation. The Amin solar farm came on stream last month after several weeks of performance testing and commissioning, stated the report citing a senior official.

In the water desalination sector, work has been launched on two mega projects Ghubrah 3 IWP and the Barka 5 IWP, with the award of EPC contracts worth a total of about $330 million last November to Fisia Italimpianti, a unit of the Webuild Group (formerly Salini Impregilo Group).

Located on the coast in the Gulf of Oman north of Muscat, these plants will serve residents living near the capital.

Ghubrah 3 IWP will have a production capacity of 300,000 cu m of water per day, while Barka 5 IWP, will produce 100,000 cu m per day.

Both projects are expected to take three years to complete, with Ghubrah becoming the biggest in the sultanate.

Fisia Italimpianti is also building the Salalah Independent Water Project.

|

|

Al Mouj, Muscat ... expanding. |

Roads & Bridges

Oman has several major road projects under construction including the Adam-Thamrait Road dualisation project, Alsharqiya Expressway Tunnels, and the expansion of the Batinah Expressway.

Adam-Thamrait Road is a principal carriageway linking north Oman with Dhofar governorate in the south. In July last year, Galfar Engineering and Construction was awarded a contract worth RO115 million for the fourth package of the project, which covers the dualisation of a 135-km road from Miqshin to Duka.

Work was also launched last year on expanding the 27-km Rusayl-Bidbid Road, which runs from Muscat Expressway to Sharqiyah, with the addition of two more lanes; and the construction of a series of internal roads that will connect the Batinah Highway, including a 14-km road linking the Khazaen Economic Zone.

The Alsharqiya Expressway Tunnels Project to improve connectivity between the north and eastern regions of the country is also under way. The project is co-financed by a $130-million Opec Fund for International Development public sector loan and the Omani government.

Real Estate

Al Mouj Muscat, Oman’s leading integrated tourism complex (ITC), continues to expand to meet the investor interest in the landmark development in the capital. A public-private venture between Omani government and Dubai-based Majid Al Futtaim Properties, it recently launched Murooj Lanes, a new residential neighbourhood located within the popular Ghadeer District.

Not much progress has been announced at Madinat Al Irfan, where work on a customer experience centre is under way. The new facility is set amid a range of premium commercial office buildings, central marketplace, healthcare district, hotel, residential and serviced apartment buildings and a central park forming part of the future central district.

.jpg)

.jpg)

.jpg)