THE Muharraq sewage treatment plant (STP) and sewer trunk main project – the first wastewater treatment PPP (public-private partnership) in Bahrain – is expected to reach financial closure shortly.

Ashurst has advised Samsung Engineering, Invest AD and United Utilities – the stakeholders in the project – in connection with the development and financing of the development.

Samsung, Invest AD and United Utilities are committing 45 per cent, 35 per cent and 20 per cent of the equity respectively. The $285-million debt package comprises a direct loan from the Export-Import Bank of Korea (K-EXIM). CA-CIB, Natixis and SMBC are the commercial banks participating in the covered and uncovered facilities.

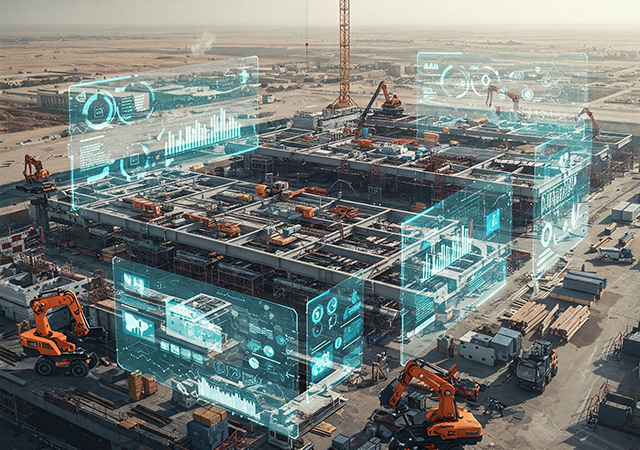

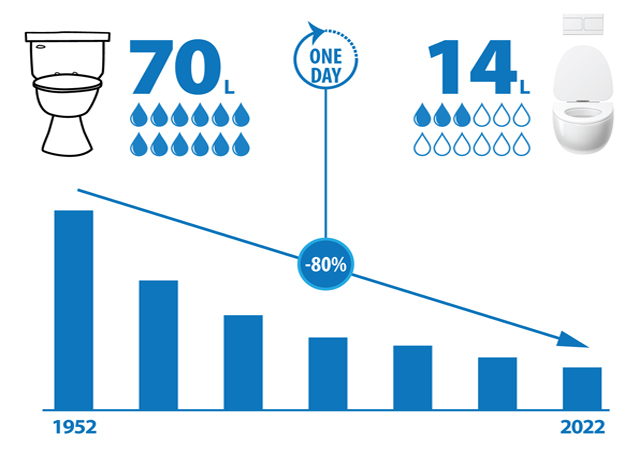

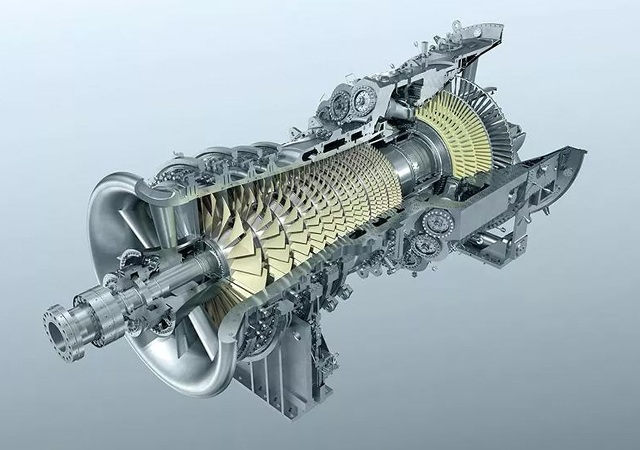

The project is being constructed by Samsung Engineering as engineering, procurement and construction (EPC) contractor and will comprise a treatment plant capable of processing 100,000 cu m of influent per day and a deep gravity sewer trunk main and associated waste water collection network.

The plant is scheduled to achieve completion in the fourth quarter of 2013. A joint venture between Samsung Engineering and United Utilities will operate and maintain the facility.

Ashurst’s role involved advising the consortium on all legal aspects of the project, including its negotiation of the concession arrangements with the government of Bahrain, as well as negotiating all finance and security documentation with the lender group.

Partner David Wadham, who led the Ashurst team, said: “While the concession model follows in some respects the prior Bahraini power deals, this is the first wastewater PPP in the country and the different nature of the plant gave rise to some interesting issues.”

BIG.jpg)

.jpg)

.jpg)