Qatar, which boasts the highest per capital income in the Middle East, is hitting headlines continuously with massive investment plans – many of them in the range of billions of dollars.

While the rest of the Gulf is seeing a boom in real estate development, Qatar is witnessing tremendous growth in every area of the construction sector – commercial, residential, tourism, industrial and infrastructure.

Last year marked the beginning of a rejuvenation in Qatar’s construction scene with the unveiling of many projects catering to the Asian Games which the country will host in 2006. And by the end of the year, Qatar’s planners were flaunting many giant projects to international investors.

Hosting the Games is part of Qatar’s vision to attract tourists and put the country on the world map as a major destination. It last year unveiled a new tourism masterplan that will guide a $15 billion investment into an array of prestigious projects and establish Qatar as a high quality destination for cultural tourism, beach resorts, shopping, lifestyle, business and sports events.

In line with this plan, the country launched probably its most ambitious project ever – the $5.5 billion New Doha International Airport (NDIA), which broke ground early this year. The project has been masterplanned to eventually accommodate as many as 50 million passengers a year.

Further indications of its interest in facilitating visitors from the region as well as worldwide are plans for two major causeways: one to Bahrain, which has just received the official go-ahead and the second to Abu Dhabi.

Besides tourism, Qatar has major plans to develop as a world leader in LNG sector as well as build a large industrial base that is fuelled by its abundant gas reserves. It has just flagged out the $12.8 billion Qatargas II LNG project and signed a deal for yet another venture – Qatargas IV, which will position it as the world’s LNG capital.

While, Qatar continues to tackle its objectives in these two sectors at a measured pace, it is also looking at developing the infrastructure to support the growth of the region’s centre for world-class education through its landmark Education City. It has just set in motion plans to set up the Qatar Financial Centre (QFC) in Doha by appointing an adviser.

The private sector too is fuelling a construction boom of sorts in the country, creating a real estate bonanza – the likes of which the country has not witnessed before. The $2.5 billion Qatar-Pearl project, which was launched last year and has already met with “overwhelming response”, looks likely to be the role model for a number of other such ventures to be launched soon. A massive project which is in the early master-planning sated is the 32 sq km North Beach Development, which will include 10 resort hotels, two golf courses, 3,000 lifestyle villas, 12,000 apartments, 300,000 sq m of retail shopping, and 6 million sq m of commercial space.

Airport

Construction work has got under way on the much-awaited NDIA project with dredging and reclamation now in progress. Nearly half the site will be reclaimed from the Gulf. The first phase of the greenfield airport is expected to be completed in 2009 and will be able to accommodate 12 million passengers a year (see page 112).

HMC/Asian Games

Among the largest projects in progress in Qatar is the $600 million Hamad Medical City complex, which will initially serve as the athletes’ village for the 2006 Doha Asian Games. J&P-Avax has won the $104 million deal for construction of a hospital and an underground car-park with a capacity for 556 vehicles while a $145 million finishing works contract awarded to Saudi Arabia’s El-Seif Engineering Contracting for married housing and nursing accommodation units (See page 117).

As part of the infrastructure required to host the Asian Games, construction of the Asian Games City is under way. Once completed, over 30 sports facilities will be in place. Existing buildings are being renovated as new ones are being built, including Al Sadd Stadium, Al Rayyan Sports Centre, Al Ilihad Sports Centre, Al Arabi Sports Centre, Swimming Centre (Aquatic) and Khalifa Stadium.

Education City

A series of projects is being launched at the Education City - a 10 million sq m multi-institutional campus. The promoter Qatar Foundation for Education, Science, & Community Development (QF) has awarded two contracts worth a total of $180 million, for the construction of a major accommodation complex at the City. Both contracts are scheduled to take about 16 months to complete. Other imminent projects include the construction of a 7,000- seat convention centre and the Texas A&M College of Engineering, with a gross area of 53,000 sq m.

Qatar Foundation also intends to build a new 350-bed medical care and research centre at Education City. The new digital care and research centre – known as the Specialty Teaching Hospital and being set up with the help of New York’s Cornell – will cost an estimated $900 million and be implemented on a fast-track basis, with completion scheduled for mid-2008.

Commercial projects

Reclamation work is under way on the Pearl-Qatar, the country’s largest private real estate project, which is expected to provide housing for 30,000 residents when it is completed by 2009 (See page 120).

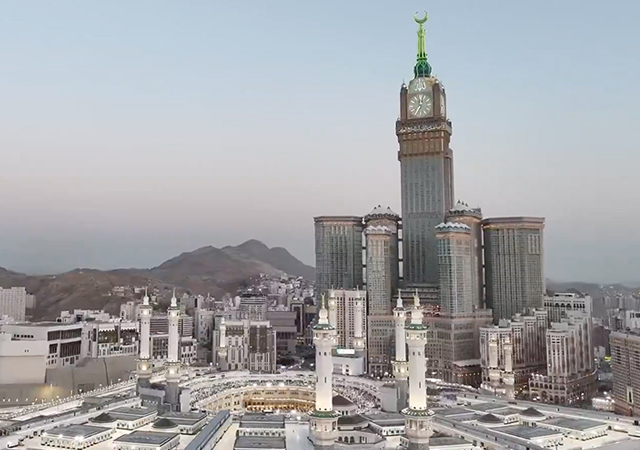

Besides this mega project, the West Bay area of the capital Doha has become a magnet for real estate developers, given the large number of high-rise buildings mushrooming in the area. Among the tallest buildings earmarked for the West Bay is a 52-storey office tower planned by Qatar Navigation Company. The project is currently being designed by the local MZ& Partners Architectural and Engineering Consultancy. Construction work is expected to start by end-2005 and for completion over a 30-month period.

Other major projects in the West Bay area include:

• A 44-storey 230 m cylindrical complex designed by the Paris-based Ateliers Jean Nouvel; the engineering consultant is Beirut-based Dar Al Handasah (Shair & Partners).

• A new $37.6 million office tower for Qatar’s Commercialbank. The 20-storey Commercialbank Plaza tower will be 148 m high and is expected to be ready in August 2006.

• The 36-storey Al-Jazeera Tower, which provides 500 full-serviced hotel apartments. Larsen & Toubro Qatar is building the tower under a 19-month contract due for completion in August 2006.

•The Alfardan Towers, designed by Arab Engineering Bureau and being developed by Alfardan Real Estate Company. Work on the project is now under way (see page 121).

In other developments, Thani Bin Abdullah Housing Group is building a $165 million residential tower complex in Al Dafna area of Doha. The residential complex is scheduled for completion in 2006. The group also plans to implement a number of other real estate projects in Doha including the $275 million Al Dafna Towers, which will comprise four blocks of 35-storey residential towers.

The Qatar Real Estate Investment Company (QREIC) is also spearheading a number of residential projects including a $10.9 million project in Al Khor, 57 km north of Doha. The 60-villa project is expected to be completed early next year. QREIC is also developing another $82.4 million residential project in Mesaieed Industrial City, which is designed to accommodate 10,000 employees within the industrial area.

Among the largest building construction projects under way is a $330 million expansion of the Doha City Centre, which calls for the construction of four towers ranging from 24 to 35 storeys housing retail units and four hotels. Hong Kong’s Shangri-La Hotels & Resorts will operate a 250-room, five- star hotel, while US-based Marriott International has signed up for the other three hotels: a 250-room Renaissance hotel; a 200-room Courtyard hotel; and a 120-unit executive apartments hotel. The fast-track project is due to be completed in the summer of 2006, in advance of the Doha Asian Games.

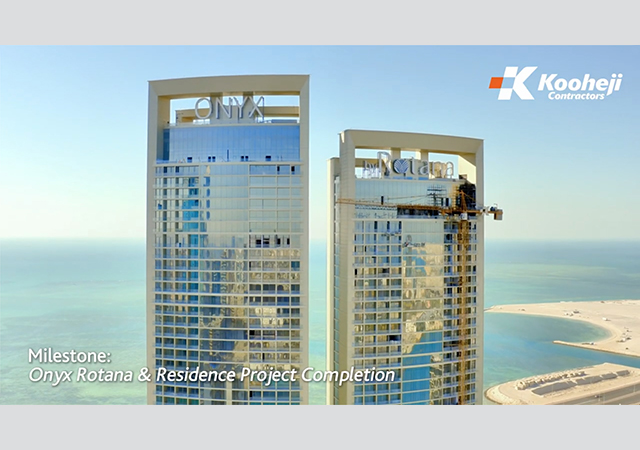

Hotels & tourism

At least nine luxury hotels are being built in Qatar by 2007, adding a further 1,967 rooms to its hotel capacity. Qatar’s hotel capacity stands at 3,705 rooms in 25 rated hotels. Some of the world’s most renowned hotel chains will manage the new properties, including Rotana (with 277 rooms), Hilton (277), Renaissance (250), Shangri-La (250), Regency (245), Four Seasons (232), Marriott Courtyard (200), Marriott Apartments (120) and Regency Apartments (116).

Another hotel being built is the $50 million La Cigale. The 180-room, five-star hotel in downtown Doha will be 100 m high and have a built-up area of 45,000 sq m. The consultant is Khatib & Alami.

The country’s leading hotel company the Qatar National Hotels Company has also launched work on a major resort in Doha’s Ras Abu Aboud area, known as the Al Sharq Village and Spa (see page 121).

In addition, a multi-million-dollar renovation is nearing completion on the main building of five-star Doha Marriott Gulf Hotel.

Doha Golf Club is also undergoing an expansion, which will include a new nine-hole course and buildings such as a new multi-purpose hall. The project is due to be completed in early 2006.

Port

A new port and free trade zone involving a total investment of $205 million is planned to be built over a 500-hectare reclaimed site near the existing port of Doha, east of the Doha International Airport. Port facilities will be able to handle three million shipping containers annually, compared to the current capacity of 100,000 containers annually at the existing Doha Port.

The port will be linked to the mainland via an 8.5 km long bridge. The entire new Doha port, as well as the airport area, is to be designated as a free trade zone.

Oil, gas & industry

The past few months have seen two massive projects, which will have far-reaching effects on Qatar’s economy and industry, getting the go-ahead. These include a $3 billion aluminium smelter and the Qatargas II expansion.

The smelter is being set up in a joint venture between Qatar Petroleum (QP) and Norsk Hydro of Norway, following the signing of an agreement last December. The move is a pioneering step by the Qatari company, which has spearheaded a large number of gas-based industrial projects in the country.

According to news reports, there are plans to expand the proposed 570,000-tonnes-per-year (tpy) aluminium smelter even beyond current plans, doubling the capacity later to 1.2 million tonnes – making it the largest in the world. Construction of the plant in the Messaied industrial area is expected to commence in June 2006 with commercial production to be launched by 2009.

Qatar Liquefied Gas Company (Qatargas) recently awarded a $4 billion engineering, procurement and construction (EPC) contract for the Qatargas II project setting in motion a massive expansion of its LNG facilities to meet increasing worldwide demand. The project – a joint venture between Qatar Petroleum and ExxonMobil – will see the construction of the world’s two largest LNG trains by a joint venture of Chiyoda Corporation and Technip France from Paris. Each train – train 4 and 5 – will produce 7.7 million tpy of LNG by 2008.

Meanwhile, QP and Shell Chemicals (Shell) signed a heads of agreement (HoA) at the end of last month for the development of Qatargas 4, a large-scale LNG project in Ras Laffan City. The Qatargas 4 project comprises the integrated development of upstream gas production facilities to produce 1.4 bcf/d of gas from Qatar’s North Field, a single LNG train, yielding about 7.8 tpy of LNG.

QP and Shell are also to develop a world-scale ethane-based cracker and derivatives complex and the Pearl GTL plant in Ras Laffan. The Pearl GTL project comprises the development of upstream gas production facilities as well as an onshore GTL plant that will produce 140,000 bpd. The project will be developed in two phases with the first phase operational in 2009.

Expansion work is also under way at Ras Laffan Gas Company. RasGas II, a Qatar Petroleum and Exxon Mobil joint venture also based in Ras Laffan is expected to go online in 2005.

Given the high demand for cement and steel in the region, Qatar’s leading manufacturers have already launched expansion plans. Qatar Steel Company (Qasco) has launched an estimated $400 million expansion of its Messaied plant. It involves the construction of a new 1.2 million-tpy direct reduction iron (DRI) plant, a new 400,000-tpy rod mill and a 500,000-tpy expansion of the existing melt shop, taking Qasco’s steel production capacity to 1.5 million tpy from 1 million tpy and its DRI capacity to 2 million tpy from about 800,000 tpy.

Qatar National Cement Company (QNCC) has started construction works on its third cement plant at a cost of $160 million. The new plant, located in Umm Bab, will have a design daily capacity of 4,000 tonnes of clinker and is expected to reach its full capacity in the second half of 2006.

Other mega projects on the anvil include:

• A $6 billion gas-to-liquids (GTL) plant to be set up by Anglo-Dutch oil giant Shell. The 140,000 barrels per day plant, is due to start in two stages with the first to go onstream by 2009 and the second two years later.

• An estimated $400 million Ras Laffan condensate refinery project. The EPC contract for the 146,000-bpd refinery is expected to be awarded shortly, for completion in early 2007.

• An $800 million expansion of Qatar Fuel Additives Company’s (Qafac) facility at Mesaieed. Tenders for the plant – which will add 6,750 tonnes per day (tpd) of methanol capacity and 1,000 tpd of ammonia capacity – are due to be invited shortly with a contract award slated for the end of this year.

• A proposed natural gas pipeline from Qatar to Pakistan. A team of Qatari and Pakistani experts will review the technical aspects of the project and submit its report this month. The 1,200 km pipeline, more than half of which is expected to be subsea, is proposed to be built in five years at an estimated cost of $3.5 billion.

Roads & bridges

The largest project in this sector is the $4.77 billion Qatar-Bahrain causeway – known as the Friendship Causeway, which has just received the official go-ahead. The 40km double-lane causeway is expected to take four years and nine months to complete. It will start at end at Ras Ashiraj in Qatar and end at Askar village in Bahrain. The preliminary analysis and design of the project has been completed.

Qatar has recently accorded high priority to its long-awaited primary routes scheme and three major projects under the scheme are expected to get the green light shortly. These include the $350 million Dukhan highway upgrade project, the North Road project and the Doha Expressway.

Bids for the first construction package of the Dukhan project, covering the western section, were invited recently. The two-year contract calls for the construction of a 40-km, four-lane dual carriageway from Al-Shahanaya to Zekreet, with five grade-separated interchanges and seven camel underpasses.

A second package, covering the eastern section, is due to be tendered shortly and will be followed by the third package, the central section. WS Atkins is the consultant on the project.

Tenders have also been invited for the first package on the 140-km North Road project, which involves the construction a 4 km dual carriageway with a minimum of three lanes in a heavily urbanised area and an underpass close to the Landmark shopping mall.

The estimated $350 million North Road, which will connect Doha to Zubairah – the proposed landing point of the planned Qatar-Bahrain causeway, will take about five years to complete. The second package involves the construction of 35 km of four-lane dual carriageway.

The Doha expressway – on which the US’ Parsons International is the detailed design consultant – is expected to be the largest of the three developments.

Power & Water

Qatar General Electricity & Water Corporation (Kahramaa) is expected to launch work on phase 6 of the Qatar transmission programme soon. Bids were due to be submitted last month. Kahramaa has recently awarded more than $200 million worth of contracts on the phase 5 programme.

Kahramaa has also issued tenders for the EPC contracts for power supply to the Pearl-Qatar resort and for a water supervisory control and data acquisition (SCADA) system.

A major natural gas-fired plant – the Ras Laffan power and water plant ‘A’ with a capacity of 756 MW of electricity and 40 million gallons a day of desalinated water – opened last November. The plant has been set up by Ras Laffan Power Company Limited (RLPC), the first independent power operator in Qatar, which has a 25-year power and water purchase agreement with Kahramaa.

The plant, constructed by units of Enel and Impregilo at a cost of $726 million on a build-own-transfer basis, will cover the emirate’s growing utilities demand for the next three years.