The tight supply of commercial office space in Dubai is leading many clients to refurbish their existing premises rather than relocate to accommodate growth.

The tight supply of commercial office space in Dubai is leading many clients to refurbish their existing premises rather than relocate to accommodate growth.

The Middle East continues to be an attractive market for office fit-outs, yet the sector is experiencing escalating costs driven by fierce competition for talent and materials, according to recent reports from global professional services firm Turner & Townsend and leading real estate expert JLL.

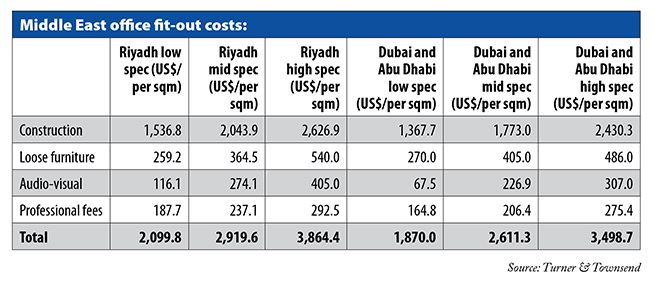

Despite being relatively more affordable than European capitals, the region’s fit-out expenses are on the rise. High-specification office fit-out costs in Riyadh average $3,864 per sq m, notably higher than Dubai and Abu Dhabi at $3,499 per sq m, as highlighted by Turner & Townsend’s Global Occupier Fit-Out Report 2025. This disparity is largely attributed to major giga-programmes in Saudi Arabia, which are intensifying competition for resources and attracting significant talent influx. The Global Occupier Fit-Out Report 2025 analyses fit-out costs across 50 global locations.

Both reports underscore robust demand across the Middle East, particularly in the Kingdom of Saudi Arabia and the UAE, with substantial investment in high-specification commercial office spaces. A strong emphasis is being placed on technologically integrated and sustainability-led fit-outs.

The increasing demand for skilled labour, especially in construction, project management, engineering, and IT/AV integration, is pushing up wages and preliminary costs for contractors. John Grant, Director, Occupier Lead, Middle East, at Turner & Townsend, notes: “We’re seeing a shift in the Middle East. Talent, across all levels, continues to relocate to KSA and the knock-on effect is that the UAE is now feeling the pinch.”

|

|

Saudi Arabia’s RHQ programme is fuelling demand for Grade A spaces. |

He adds that this, coupled with labour shortages, is driving up costs for skilled fit-out contractors.

Grant also points out the tight supply of commercial office space in Dubai is leading many clients to refurbish their existing premises rather than relocate to accommodate growth. Conversely, Saudi Arabia benefits from ample office stock, attracting new occupiers, including legal and technology firms.

JLL’s ‘EMEA Office Fit-Out Cost Guide 2025’ corroborates the trend of rising costs, identifying Saudi Arabia and the UAE among global leaders for the proportion of cost dedicated to high-quality finishes, averaging over $2,400 per sq m against a global average of $1,830 per sq m. This reflects the growing importance of workplace design in talent attraction and retention.

The report, which analyses data from 25 countries, also indicates a steady rise in overall office fit-out costs over the past 12 months, reflecting the growing trend of regional organisations (44 per cent) planning to increase office-based workdays in the next five years. Dubai’s position among the top 20 cities in the City Cost Index, alongside Saudi Arabia’s Regional Headquarters (RHQ) programme, further fuels demand for Grade A spaces.

Sustainability

Sustainability is emerging as a pivotal driver in office fit-out decisions. JLL found that 68 per cent of organisations globally, and a striking 78 per cent of corporate real estate leaders in the Middle East and Africa (particularly in Saudi Arabia and the UAE), plan to increase investment in sustainability performance to enhance value.

Maroun Deeb, Head of Project & Development Services, Saudi Arabia and Bahrain at JLL, states: “The general optimism towards investing in workspaces is likely to continue throughout 2025 as growth-oriented corporations invest in office fit-outs to support their hybrid workplace policies.”

|

|

Deeb ... optimism is likely to continue. |

He anticipates an increased focus on workplace design, innovative technology solutions, and refurbishments for healthier, energy-efficient spaces.

Supply chain disruptions in 2024 disproportionately impacted the Middle East and North Africa (Mena) region, tightening project timeframes and escalating prices. JLL’s analysis of fit-out costs reveals that builders’ works (partitions, flooring, finishes, joinery) account for the largest component, ranging from 26 per cent in Cairo to 36 per cent in the UAE and 40 per cent in Saudi Arabia.

These costs are among the most susceptible to raw material prices and supply chain risks, the report says. Mechanical and electrical (M&E) services now command a higher proportion of spend due to stricter environmental standards, with Cairo (39 per cent), Dubai (30 per cent), and Riyadh (29 per cent) aligning with or exceeding the global average of 29 per cent. Technology integration, particularly enhanced AV systems, is also crucial for hybrid work environments.

.jpg) |

|

Tracey ... demand is intensifying. |

Gary Tracey, Head of Project & Development Services UAE at JLL, emphasises: “The demand for high-performance office spaces is intensifying in the UAE as stakeholders increasingly prioritise environmental considerations to drive asset value.”

He notes that offices with innovative technologies, sustainable design, and higher green certifications command a premium, especially in Dubai.

Despite challenges like limited suitable stock and high costs of upgrading older buildings, the momentum for sustainable workplaces continues to surge. JLL advises early planning and integration of sustainability targets in relocation and fit-out projects.

Ahmed Hemmat, Head of Project & Development Services at JLL in Egypt, says: “In a climate of economic uncertainty, organisations that build flexibility and agility into planning will be better positioned to adapt their work settings to evolving workforce needs.”

|

|

Middle East office fit-out costs |

“This also supports leasing decisions, as flex spaces optimise costs for landlords and occupiers and create a more engaging and productive work environment to support the needs of today’s hybrid work model,” he adds.

The office construction sector in the region is expected to remain active. JLL concludes that greater collaboration and effective partnerships, from environmental and smart building systems to adaptive workspaces, are critical for managing costs and fostering innovation in future-focused office environments.

.jpg)

(1).jpg)

.jpg)