Al Salam Tower ... set to be Sharjah's tallest tower at 210 m, when it reaches completion in 2006.

Al Salam Tower ... set to be Sharjah's tallest tower at 210 m, when it reaches completion in 2006.

THE sleepy Northern Emirates are being aroused by the Midas touch of Dubai. Skyscrapers, luxury hotels and resorts, new shopping malls and a host of commercial complexes are set to keep them abuzz over the next few years.

Following years of focusing on essential infrastructure development, the Northern Emirates – comprising Sharjah, Ras Al Khaimah, Ajman, Fujairah and Umm Al Quwain – are now gearing up to develop their tourism potential and gain the benefits of their close proximity to the booming construction market in Dubai.

Early this year, Ras Al Khaimah drew up a list of 10 major projects which are aimed at giving the emirate a facelift. It's no surprise that a large number of them were tourism related, namely, Al Hamra Village, Al Murjan Island, Khor Al Qarm (Jazerah Al Hamrah) resort development, Tower Links Golf Course, Hulaya island development and the Ras Al Khaimah airport master plan.

Work on some of these projects – including the Dh1 billion ($272.5 million) Al Hamra Village resort – is already under way. The resort – considered to be the largest of its kind in the Northern Emirates – will be a mini-township with a wide range of services and facilities (see separate report).

The project is among five mega real estate development projects worth a total of Dh6 billion and including 5,000 residential units which are expected to go ahead Ras Al Khaimah. According to Dr Khater Massad, industry and tourism affairs adviser to Sheikh Saud bin Saqr Al Qasimi, the Crown Prince of Ras Al Khaimah, foreigners will be allowed to buy residential units and other developments.

Other major tourism developments include the Khor Al Qarm project – which will involve developing a 13-km stretch overlooking the sea with 500 apartments and villas, 10 hotels, an entertainment city, harbour, and an aquarium – and a residential complex at Al Jebel, which will include 3,000 apartments and villas and entertainment facilities.

In addition, Egyptian developer of resorts, hotels and restaurants Orascom Projects and Touristic Development (OPTD) has announced plans to build a tourism resort in the emirate at an estimated cost of $30 million. The resort will cover an area of about 300,000 sq m and will comprise a five-star hotel and villas. The land for the project has already been bought and work is expected to start shortly.

With the real estate market booming in the emirates, significant investment is being made on commercial and residential developments. Sharjah will see its tallest skyscraper take shape by early 2006. The local Armada Group is building the 57-storey Al Salam Tower which will reach a height of 210 m. Construction work is already under way on the Dh168.9 million ($46 million) project in the Al Buhaira district of Sharjah, overlooking the Al Khan lagoon. At least two new shopping malls and six hotels are also reported to be in various stages of construction in Sharjah.

Airport development is another area that deserves attention as the Northern Emirates strive to boost their tourism infrastructure. While Ras Al Khaimah is focusing on developing the masterplan for its airport, Sharjah is most likely to push ahead with its plans for expansion of the Sharjah International Airport, at an estimated cost of over Dh100 million, which will enable it to handle five times more passengers than at present.

Shopping malls

In line with trends set by Dubai, many of these emirates are building or expanding their shopping malls.

For instance, Sharjah Mega Mall, located in Al Qasimiya Road, will undergo a three-phase expansion at a cost of Dh404 million ($110 million). The first two phases will be launched simultaneously in February 2005. Phase I includes 25 new shops and a 10,000-sq-ft anchor store. Phase II, set for completion by December 2005, will comprise the Mega Mall annex, including a four-level multi-storey car park with 600 additional parking spaces. Phase III, set to start in mid-2005 envisages the construction of a five-star residential building, which will include 330 fully-furnished and serviced apartments.

Meanwhile, the final phase expansion of the Ajman City Centre was completed recently with the addition of nine stores to the already extensive mix of leisure, entertainment and retail outlets. The complex now boasts a cinema, hypermarket, food court and over 60 family, fashion and electronic stores. Majid Al Futtaim Investments, the developer, had earlier spent Dh20 million on upgrading Sharjah City Centre.

Industry, electricity & gas

While, the Northern Emirates themselves have a small domestic market, the industries there are targeting Dubai and the wider Gulf market. The manufacturing sector is expanding and with reports that a steel plant and other heavy industries are to be launched there, the power generation capacity of these emirates will be considerably strained. Already, there have been significant outages, highlighting the need to press ahead with investment in this sector.

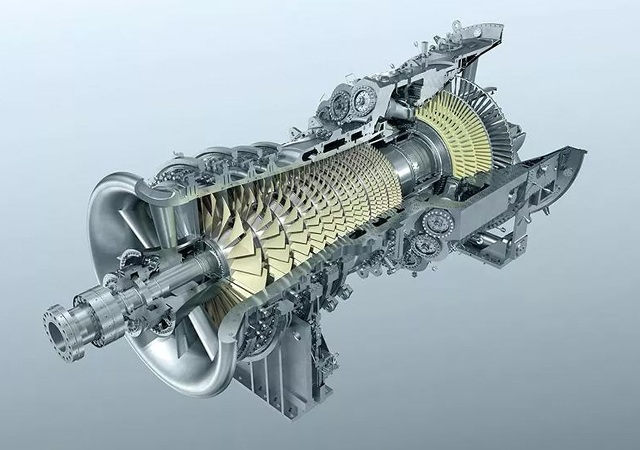

Demand for power in the Northern Emirates is expected to double from 1,140 MW in the next five years, power industry experts say. The existing demand is being met by Fujairah Electricity and Water Supply (Fewa) and Union Water and Electricity Company (Uwec).

Recently, UWEC completed the 68-km double circuit 400 kV overhead power transmission that connects Fujairah water and power plant and the Fewa network at Al Dhaid. With the completion of this transmission line, the Fewa network can use the entire power generation capacity of Fujairah water and power plant (FWPP). The FWPP and the 400 kV transmission line are part of the investments being made by UAE Offsets Group through Uwec to strengthen the power infrastructure in the Northern Emirates and to meet the growing demand for water in Abu Dhabi.

The new transmission line is the early part of the Emirates National Grid (ENG) and will interconnect the various power grids in the UAE. The $220 million ENG project will connect Fewa with Uwec, Sharjah Electricity and Water Authority (Sewa), Dubai Electricity and Water Authority (Dewa) and Abu Dhabi Electricity and Water Authority (Adwea) through a 400-kV transmission backbone in late 2005.

Meanwhile, Uwec has started preparations to convert the second phase of the power generation and water desalination and transmission project at Qidfa in Fujairah into an independent water and power project (IWPP). UWEC intends to select an experienced power and water developer to invest in its existing project, and become a strategic partner in the planned expansion. Construction work on the second phase development is expected to start shortly.

Among other developments, Fewa is expected to go ahead with a proposed plan to build a greenfield power and desalination facility in Ajman. The facility will have between 750 and 900 MW of installed power and up to 30 million gallons per day (gpd) of desalination capacity. Funding for the estimated $500 million facility – which is to be located adjacent to the existing 1 million-gpd Al-Zawra desalination plant between Ajman and Hamriya – is expected to come from the federal budget.

In line with these efforts to boost power generation capacity, Fewa is purchasing gas to fuel the power generation plants from two offshore gas fields being developed by Umm Al Quwain, Sharjah and Ajman. The two gas fields – Umm Al Quwain and Zora – will jointly produce 150 million cu ft per day (cf/d) in the first phase and up to 300 million cf/d at a later stage. The concession for the first field, which belongs to Ras Al Khaimah, is held by a partnership of Atlantis Holdings Norway (now part of Sinochem of China) and the Abu Dhabi-based UAE Offset Group (UOG), under an agreement with the emirate signed in December 1999. Zora is being developed for Sharjah and Ajman by a partnership of Atlantis and Crescent Petroleum (CPC), under a PSA signed in mid-2002 with the two emirates.

Average gas demand from Fewa, Uwec and Ras Al Khaimah – which stands at 207 million cf/d and rises to 286 million cf/d during the peak summer months, is expected to increase by 6 per cent over the next five years.

Ports

The Northern Emirates enjoy a competitive edge because of their position at the north of the Arabian Gulf and to further exploit the benefits of that strategic location, these emirates are not losing time in developing their shipping infrastructure.

Sharjah is expanding its Khor Fakkan container terminal. The main construction package for the project has been awarded to Greece’s Athena, which was the low bidder at Dh185 million ($50 million). The contract calls for the construction of 400-m quay and two new deepwater berths. The project is scheduled for completion by 2006.

Ras Al Khaimah has awarded Kuwait and Gulf Link Transport Company (KGL) a Dh165.2 million ($45 million) contract to build, operate and manage the container terminal at Saqr port for 21 years. KGL will be investing $15 million to build berths 8 and 9, $4 million to reconstruct berths 1, 2 and 3 and $3 million to build facilities for the port. $23 million will be spent on the equipment.

Dredging work has recently been completed at Fujairah port, which is expected to boost its traffic.

BIG.jpg)

.jpg)

.jpg)