The GCC region is a key market for the UK’s construction goods and services industry, accounting for some £2.01 billion ($2.39 billion) of the total £2.27 billion worth of exports to the Middle East and Pakistan region in the year ending Q2 2022. Simon Penney, His Majesty’s Trade Commissioner for the Middle East, gives Gulf Construction an exclusive insight into the UK’s trade strategy.

The most important trade construction platform in the GCC exhibitions calendar, The Big 5 will see the UK’s Department for International Trade (DIT) bringing a strong mission of innovative UK companies to the event. In addition, dozens of UK companies, services and products from across the construction sector will be exhibited separately, or have a presence through GCC partners.

Simon Penney says: “We are facilitating direct engagement with our companies through opportunities for buyers to meet them in a 1:1 environment and at networking events that will encourage discussion and collaboration opportunities. We are delighted to work with the British Business Group and with Gulf Construction magazine in raising awareness of the presence of these companies at the show.”

Excerpts of the interview:

The construction sector is highly competitive; what makes the UK stand out in the sector?

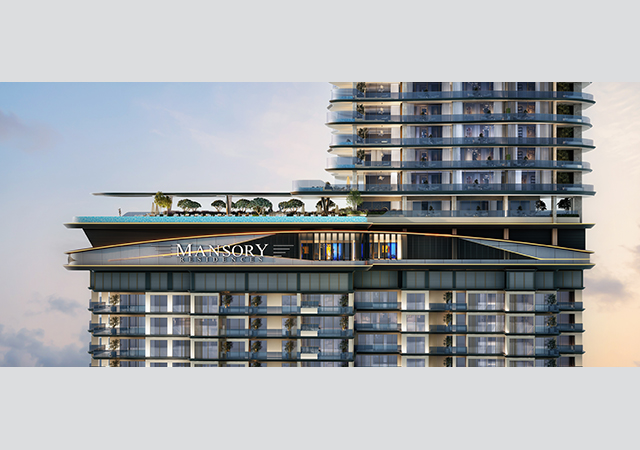

UK companies are global leaders in long-term planning, project design, engineering, project and cost management and finance for infrastructure and the built environment. The excellence and expertise of the UK’s construction sector is clearly visible in the skylines of every city in the Gulf.

The UK’s construction professionals, architects, civil and mechanical engineers, cost control and procurement specialists and systems integrators are leading the world in their ability to analyse, design and adapt to our changing environment to deliver exceptional sustainable, resilient, and tailored solutions to meet or exceed client expectations now and into the future.

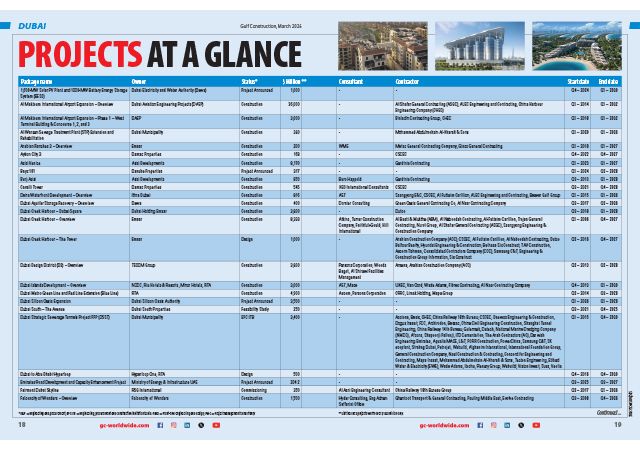

|

|

An artist’s perspective of the UK stand at The Big 5 2022. |

What is the UK export strategy post Brexit vis-a-vis the construction sector?

Exports are a critical part of the UK’s economy. Our export strategy aims to reach £1 trillion of exports annually by the mid-2030s.

DIT has identified construction as a ‘super sector’, offering extended support from Sector Specialist Advisers in the UK and Sector Leads in the Gulf to ensure that opportunities are identified and matched with the capabilities of UK companies.

Part of the export strategy includes encouraging the development of low carbon, carbon neutral and sustainable materials, as well as digitalisation in construction, with advice from DIT’s Clean Growth Specialists.

We work with UK Export Finance to ensure that no export will fail due to lack of finance or insurance. We work with partners to deliver this support for exporters’ internationalisation activities, including opportunities to access funding.

DIT is also responsible for the UK’s trade policy. Free trade agreements (FTAs) and other trade policy mechanisms can help provide greater certainty and protection for UK businesses, whilst also addressing existing barriers to clean growth investment and export.

As an independent trading nation, the UK has embarked on a programme of negotiations with key trading partners to build relationships to break down trade barriers and support economic growth. We have already agreed trade deals with 71 countries plus the EU, accounting for £808 billion of UK bilateral trade in 2021.

These include signed FTAs with Australia and New Zealand, both of which were negotiated and delivered from scratch in less than two years, as well as a Digital Economy Agreement with Singapore, which is now in force.

So far this year, the UK has launched trade negotiations with India, Canada, Mexico and Israel, as well as the GCC.

Will a UK-GCC FTA impact the construction sector?

We are currently in negotiations towards a UK-GCC Free Trade Agreement.

A modern and ambitious FTA between the UK and the GCC will create new opportunities and, undoubtedly, have a positive impact on bilateral trade and investment, including in priority sectors like construction.

Taken as a bloc, the GCC is the UK’s seventh largest export market, and total trade was worth £44 billion in the four quarters until the end of Q2 this year.

Our analysis shows that a deal with the GCC is expected to increase trade by at least 16 per cent, and add at least £1.6 billion a year to the UK economy in the long run.

The UK-GCC FTA will boost the economy, create jobs, encourage bilateral trade and investment and support the levelling up agenda in the UK across all sectors, including in the construction sector.

The UK has a strong presence at The Big 5 2022 – Please comment.

The Big 5 is one of the most important exhibitions in the construction calendar. The business opportunities here in the GCC are vast, and that’s why we are bringing a strong mission of innovative UK companies to the exhibition. In addition, dozens of UK companies from across the construction sector are exhibiting separately, many in conjunction with their local partners. Our UK Pavilion offers a varied selection of products, systems, technology and services with many innovative designs that will appeal to The Big 5 audience.

We are also facilitating direct engagement with our companies, giving buyers the opportunity to meet them in a 1:1 environment, and hosting networking events that will encourage discussion and collaboration opportunities. We are delighted to work with the British Business Group and with Gulf Construction magazine in raising awareness of the presence of these companies at the show.

The DIT team in the UAE has been supporting this mission and will join colleagues from the UK on the stand to welcome visitors and make those important business introductions. We will also have colleagues from Saudi Arabia, Oman, Kuwait, Bahrain, Qatar, Jordan, Iran, Pakistan and Uzbekistan visiting The Big 5 to brief UK companies about opportunities in their markets.

What is the value of the total exports of construction products and services offered by British companies to the Middle East region, and the GCC specifically?

The total value of UK construction goods and services exports to the Middle East and Pakistan region that I cover was around £2.27 billion in the year ending Q2 2022. Of this amount, £2.01 billion was exported to the GCC in the same timeframe.

Energy efficiency, green buildings, sustainability and digitalisation are the trending themes in the construction sector, what is the expertise that UK can offer?

Clean Growth is at the heart of the UK offer, and our companies are at the forefront of designing and building for a sustainable future.

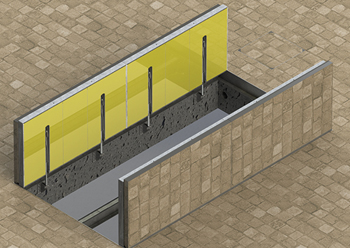

Digitalisation is making inroads into the traditionally conservative construction industry. Until now, most digital solutions were related to the design and planning process with 3D performance modelling, BIM design and information management systems.

Today, new technologies and software platforms are also arriving on site, making the work of completing a construction project easier and generating data that can be used for tracking targets, monitoring the construction process and informing decisions for improvements.

UK firms are at the leading edge of trends in sustainable building design. Our expertise has produced some remarkably impressive case studies highlighting the full potential of carbon-neutral buildings across the globe.

Much of the focus is on the Saudi giga-projects. Do you still see opportunities in the other GCC markets?

Saudi Arabia is now the UK’s largest export destination in the region, driven by significant growth in services exports.

This can be attributed to the massive agenda under Vision 2030 with UK companies playing an ever-growing role to deliver on Vision 2030.

While Saudi Arabia’s giga-projects will provide the region’s biggest opportunities, other markets in the GCC remain poised for growth which will continue to provide opportunities for UK expertise in many areas, including construction. New commercial and residential projects are planned, in addition to expansion and upgrades in the transport and energy sectors.

That said, Saudi Arabia and the UAE continue to represent the lion’s share of future planned construction and transport projects in the region.

According to the Economist Intelligence Unit (EIU), total contract awards for projects across the GCC reached over $100 billion in 2021. The GCC states awarded around $40 billion on contracts in the first half of this year and the project market outlook is expected to remain buoyant.