Leading UK steel fabricator Cleveland Bridge, which is owned by Saudi-based Al Rushaid Group, has fallen into administration, reported the Construction Index.

The collapse of the top British engineering group came after Covid caused delays to several of its global infrastructure projects.

Joint Administrators Martyn Pullin, David Willis, and Iain Townsend of specialist business advisory firm FRP have been appointed to help save the steel fabricator, which has 221 staff at its Darlington headquarters and satellite office in Newport, opened in 2018. The business also has nearly 100 contracted workers on its books.

Over 200 jobs are at risk at Cleveland Bridge, which helped build the Shard skyscraper in London, the Wembley Stadium arch and the Sydney Harbour Bridge, reported Daily Mail.

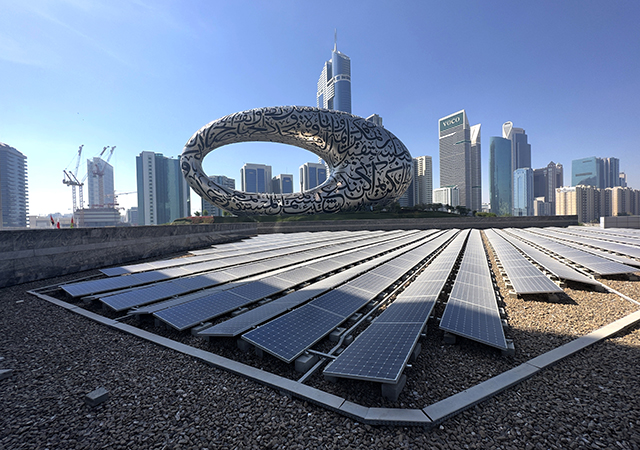

In addition to its Darlington base, the company has manufacturing facilities in Dubai and Saudi Arabia and can produce around 150,000 tonnes of steel annually.

Cleveland Bridge’s finances were hammered when a major bridge-building project in Sri Lanka was put on hold because of Covid, it stated, citing sources.

The business was acquired by Saudi firm Al Rushaid Petroleum Investment Company in 2000.

The British group held several rounds of talks with Al Rushaid Group for an extra £6 million ($8.24 million). However, the Saudi owner made it clear that it won’t put any more money into propping up the business.

With a full order book covering the next 18 months, in addition to its skilled workforce, expertise and prominent standing in the industry, there is optimism that a buyer for the firm can be found.

However, administrators from FRP Advisory have warned that the business will be wound up unless it receives significant investment.

“Cleveland Bridge UK, which was founded in 1877, has been a flag-bearer for cutting-edge British engineering for more than a century,” remarked Pullin, partner at FRP. “But no business is immune to the far-reaching impact of the pandemic, which has delayed major infrastructure projects around the world and put significant financial pressure on the teams behind them.”

.jpg)

.jpg)

.jpg)