KAFD ... the largest mixed-use financial centre in the world to secure the accreditation.

KAFD ... the largest mixed-use financial centre in the world to secure the accreditation.

Saudi-based King Abdullah Financial District (KAFD) has received the Leadership in Energy and Environmental Design (LEED) ND Stage 2 Platinum certification, thus becoming the largest mixed-use financial centre in the world to secure this accreditation from the leading global authority for green building.

LEED is a building certification process developed by the non-profit US Green Building Council (USGBC) that indicates a building or community was designed and built to be environmentally friendly in an aim to promote a higher quality of life.

This certification is an official recognition for projects that comply with the requirements prescribed within the LEED rating systems as created and maintained by the USGBC.

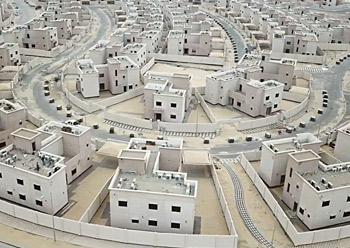

A state-of-the-art central business district in Riyadh, KAFD says this certification confirms it as a global centre for excellence in sustainability at every level – from its green building credentials to its robust public transport facilities and walkable infrastructure.

KAFD spreads over a 1.6-million-sq-m area in the north of Riyadh. It will include offices of several financial institutions such as the Capital Market Authority and the Saudi Stock Exchange.

It has sustainability built into the core of its infrastructure. Its energy-efficient building initiatives include: district cooling plants that help reduce energy consumption required for cooling; use of LED streetlights instead of conventional lighting; and installation of renewable energy sources such as solar panels in several of its towers.

The mixed-use project is also equipped with a site-wide automated waste collection system that collects and segregates recyclable waste, eliminating the use of garbage trucks on KAFD streets and thus reducing carbon dioxide emissions.

To encourage walkability, KAFD’s innovative design includes the Wadi, a shaded pedestrian walkway that sits 5.5 m below street level to provide a naturally cooler air flow.

Additionally, most of KAFD’s internal access roads are paved with concrete that has a high Solar Reflective Index (SRI) value, thus reducing the ‘heat island effect’ and supporting cooler temperatures throughout the development.

Meanwhile, Saudi Arabia’s sovereign wealth fund, Public Investment Fund (PIF), has awarded contracts worth more than SR8 billion ($2.1 billion) for construction works at King Abdullah Financial District, reported Arab News, citing a top official.

Most of the contracts were awarded to local companies, says Aiman Al-Mudaifer, PIF’s head of the Local Real Estate Division.

Several banks and companies started operations at KAFD, he says, with some tenants having received their units at the residential towers.

.jpg)

.jpg)

.jpg)